Omega Healthcare Investors, Inc. (NYSE:OHI) displayed a mixed financial performance in Q3 2023, marked by a slight decrease in net income, attributed to increased expenses and reduced income from unconsolidated joint ventures. The company’s Nareit Funds From Operations (FFO) and Funds Available for Distribution (FAD) showed a marginal increase, signaling a stable operating performance. This article analyzes Omega Healthcare’s financial results from Q3 2023 earnings alongside a technical analysis of stock price to determine future price trends and potential investment opportunities. It is noted that the stock displays robust bullish price movements, indicating potential for upward momentum.

Omega Healthcare’s Q3 2023 Earnings

The company reported a net income of $93.9 million, or $0.37 per common share, a slight decrease from $105 million, or $0.43 per common share, in Q3 2022. This decline in net income is attributed primarily to increased expenses and a decrease in income from unconsolidated joint ventures, despite a rise in other income and total revenue.

The company’s Nareit FFO stood at $161 million or $0.63 per common share, compared to $159 million, or $0.65 per common share, in Q3 2022. Despite a higher share count, the marginal increase in Nareit FFO suggests a stable operating performance. Similarly, FAD slightly increased to $174 million, or $0.68 per common share, compared to $173 million, or $0.71 per common share, in Q3 2022. This growth in FAD indicates the company’s ability to generate cash flow, although the increased share count impacted the per-share figures.

During the quarter, Omega Healthcare Investors made significant new investments totaling $106 million, including real estate acquisitions, loans, and capital projects. The sale of 15 facilities for $99 million and the repayment of a $105 million seller note, resulting in a $44 million gain, highlights the company’s strategic asset management. Additionally, selling 29 facilities leased to LaVie for $305.2 million post-quarter end underscores the active portfolio management strategy.

The company strengthened its balance sheet by entering into a $429 million unsecured term loan and issuing 4 million common shares for $126 million in gross proceeds. This financial maneuvering, along with over $600 million in cash and $1.4 billion available under its line of credit, positions Omega Healthcare well for future investments and debt obligations.

However, CEO Taylor Pickett noted potential headwinds, including smaller restructurings, many tenants still on a cash basis, and depleting security deposits, which might impact FAD in Q4 2023 and early 2024. Despite these challenges, Pickett remains optimistic about long-term opportunities in the skilled nursing industry, buoyed by improving operating conditions and demographic tailwinds.

Moreover, Omega Healthcare demonstrated active management of its portfolio, navigating challenges and capitalizing on opportunities. The divestment of LaVie facilities for a substantial amount showcased a strategic shift, balancing immediate cash influx with mortgage pay-offs. However, Omega Healthcare faced rent payment issues with Maplewood and Guardian, prompting the use of security deposits to mitigate revenue shortfalls. These challenges were partly offset by new investments, including the acquisition of care homes in the U.K. and a skilled nursing facility in Virginia, as well as significant new investments in the fourth quarter. These acquisitions, alongside strategic real estate loans, highlight Omega’s commitment to growth and diversification. The varying yields and escalators attached to these investments reflect a nuanced approach to portfolio management, aiming to secure long-term profitability amidst a dynamic healthcare real estate landscape.

Overall, Omega Healthcare Investors has demonstrated a resilient and strategic approach to navigating the complexities of the healthcare real estate market. While facing headwinds such as tenant payment issues and potential future challenges, the company has effectively balanced risk and opportunity, as evidenced by its active portfolio management and strategic investments. These actions, combined with a strengthened balance sheet and a focus on long-term growth prospects in the skilled nursing sector, position Omega Healthcare well to navigate the evolving landscape and capitalize on demographic and market trends.

Decoding Historical Technical Trends

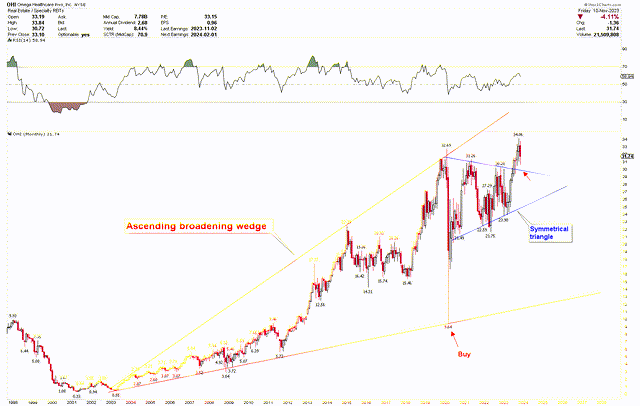

The technical analysis of Omega Healthcare over the long term, as evident from the monthly chart below, presents a robustly bullish trend. This chart reveals a steady upward trajectory in the stock’s value, beginning from its 2001 low point of $0.33.

This upward trajectory was primarily due to its strong position in the long-term healthcare sector, particularly in skilled nursing and assisted living facilities. This sector saw robust growth driven by an aging population in the United States, increasing the demand for long-term care services. Omega, as a REIT specializing in these types of properties, benefited from this demographic trend. The company’s strategic acquisitions and effective management of its property portfolio further strengthened its financial performance, leading to a consistent increase in dividends, which attracted income-focused investors. Additionally, the low-interest-rate environment for much of this period made Omega Healthcare more attractive for its higher yields, thereby driving up stock prices. This combination of favorable demographics, strategic growth, and a conducive economic environment underpinned Omega Healthcare’s stock price appreciation until 2019.

OHI Monthly Chart (stockcharts.com)

However, Omega Healthcare Investors experienced a significant drop in its stock price, primarily due to the outbreak of the COVID-19 pandemic. The pandemic posed unprecedented challenges to the healthcare sector, especially facilities like those Omega Healthcare invests in, such as skilled nursing and assisted living facilities. Investors were concerned about increased operational costs, potential disruptions in rent collections, and the broader impact of the pandemic on the healthcare system. These fears were reflected in a sharp decline in Omega Healthcare’s stock price. However, the stock quickly reversed to higher levels as the company demonstrated resilience. Omega Healthcare’s focused business model, which includes long-term leases, a diversified tenant base, and governmental support measures for healthcare facilities, helped stabilize its financial position. Additionally, the roll-out of COVID-19 vaccines and an increased focus on healthcare infrastructure contributed to investor confidence in the sector’s recovery, aiding in the stock price rebound.

After hitting a low in 2020, the market recovered strongly, developing an ascending broadening wedge pattern, highlighting significant volatility. Moreover, the market uncertainty during 2021 and 2022 resulted in the development of a symmetrical triangle. This triangle was conclusively broken on the upside in July 2023, triggering a surge of optimistic momentum in the market. Presently, prices are settling at higher levels, suggesting the possibility of continued upward trends.

Key Action for Investors

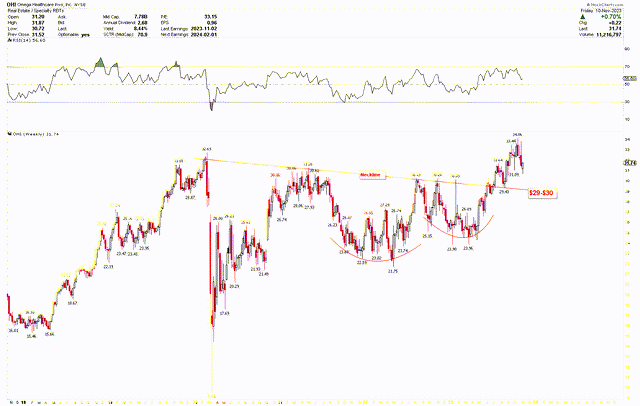

To gain a deeper insight into the market trends following 2020, the weekly chart depicted below illustrates the distinctly bullish price movements. This robust price resurgence post-COVID-19 is characterized by rounding bottom patterns, with a neckline around $29-$30. The price has notably surpassed this threshold, indicating an upward trajectory. The market correction observed in October 2023 is consistent with this bullish trend and represents a compelling investment prospect.

OHI Weekly Chart (stockcharts.com)

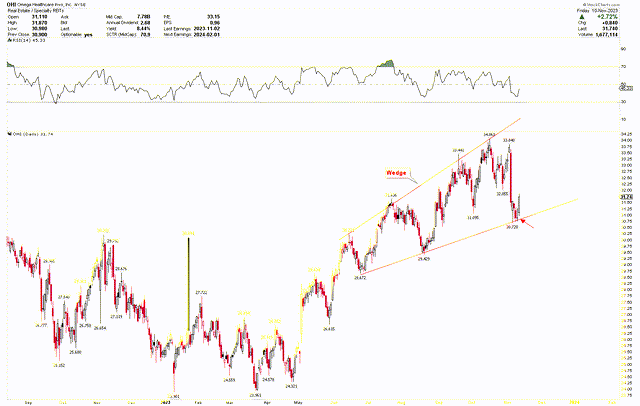

The short-term daily chart also showcases a wedge formation, underscoring the significant market volatility. The price’s sharp recovery from a low of $30.72 at the edge of this broadening wedge is a testament to the strong market momentum.

OHI Daily Chart (stockcharts.com)

From the above discussion, it’s evident that Omega Healthcare’s long-term outlook is decidedly positive. The price adjustment experienced in October 2023 presents an attractive entry point for long-term investors expecting future price increases. Investors may consider buying the stock at its present value if it trades over the $22 mark.

Risks

The increase in expenses and reduced income from unconsolidated joint ventures indicate operational challenges. These factors may signal inefficiencies or problems in joint venture partnerships, which could continue to impact profitability. Moreover, persistent expenses relative to income can strain the company’s financial health, potentially affecting its investment capabilities and dividend payouts. Additionally, Omega Healthcare is sensitive to interest rate changes. Rising interest rates can increase borrowing costs and negatively impact valuation. The healthcare sector is subject to regulatory changes, shifts in healthcare policy, and technological disruptions, all of which could impact Omega Healthcare’s operations and profitability.

From a technical perspective, notable volatility leads to potential short-term price swings. This is particularly relevant for investors with a shorter investment horizon. Should the stock close below $22 in a month, it could signify a continued downward trend before any potential upswing.

Bottom Line

In conclusion, Omega Healthcare Investors exhibited a complex financial picture in Q3 2023, characterized by a modest decline in net income due to increased expenses and diminished returns from unconsolidated joint ventures. However, the company’s Nareit FFO and FAD showed slight improvements, indicating a stable operational performance amidst challenging conditions. Moreover, the company’s proactive portfolio management, demonstrated through significant new investments and strategic divestments, reflects a strong commitment to growth and adaptability in the dynamic healthcare real estate market. Despite facing tenant payment challenges and potential short-term headwinds, Omega Healthcare’s long-term outlook remains optimistic, supported by demographic trends and a focus on the skilled nursing sector.

From a technical analysis standpoint, Omega Healthcare’s stock has shown a strong bullish trend over the long term. The recent breakout from a symmetrical triangle pattern in July 2023 and the subsequent price stabilization suggest a potential continuation of this upward trajectory. The temporary price adjustment in October 2023 has driven the price down to the robust support level indicated by the monthly, weekly, and daily charts. This consolidation of the price at this support level suggests underlying strength in the price. Investors may consider purchasing Omega Healthcare at the current prices and increasing holdings if the price declines further, provided it stays above $22.

Read the full article here