Dear Partners and Friends,

Desert Lion Capital Fund returned approximately -1.9% net for the month of June and +9.1% for Q2, compared with +12.6% for the JSE All Share Index (J203) during the quarter. This lag is largely explained by the heavy weightings and stellar performance of gold producers and Naspers/Prosus in the index – positions to which we have no exposure.

Our core holdings continue to compound intrinsic value per share at above-average rates, yet many still trade at deeply depressed valuations. The portfolio contains several names with significant embedded upside, and we believe Fund performance will converge with the compelling fundamentals of the companies we own.

Continuing our recent theme of reporting on portfolio earnings, this month’s letter focuses on Argent Industrial, a holding in the Fund since inception. In June, Argent released another set of strong results for the fiscal year ended March 2025.

Argent Industrial [JSE:ART](OTCPK:AILTF)

Argent is a vertically integrated industrial conglomerate operating across South Africa, the UK, and the US. The group comprises more than 20 subsidiaries in sectors ranging from steel fabrication to the manufacture of security barriers, specialty equipment, branded consumer and industrial goods, and fuel-storage and refueling systems. The market tends to dismiss Argent as a “SA Inc.” cyclical, but under the hood, the story is far more compelling.

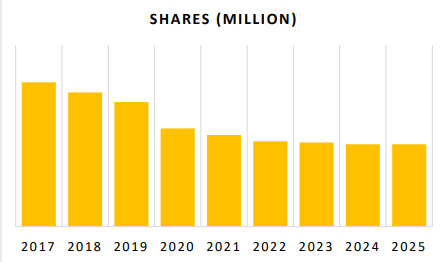

Since the arrival of a new strategic shareholder and capital allocator in 2019, Argent has undergone a transformation. Low-return assets were jettisoned, working capital was tightened, cash conversion prioritized, and capital was recycled into higher-return growth avenues and significant share buybacks at deep discounts.

Although its origins and listing domicile are South African, Argent is anything but a domestic- only story: in fiscal 2025, just 22% of earnings were generated in South Africa, while 78% came from developed markets such as the UK and US.

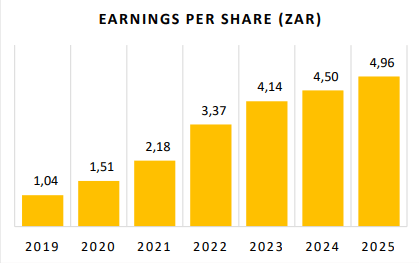

EPS was up 12.5% and does not yet fully reflect the first full-year contribution from the Mersey Containers modular spaces acquisition. Over the past six years, EPS has compounded at 30% per annum. We see another year of strong EPS growth ahead, driven by organic expansion on the back of robust order books, disposal of a low-return non-core division, resumed share buybacks, and the full-year inclusion of recent acquisitions.

The company remains an example of astute, shareholder-oriented capital allocation. Over the past nine years, Argent has repurchased about 43% of its shares at deep discounts. Buybacks were paused last year to accommodate acquisitions, but thanks to strong cash generation and an ungeared balance sheet with surplus cash, management has indicated that repurchases will resume.

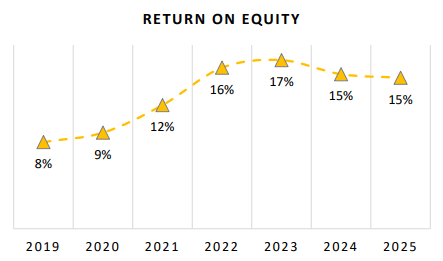

With Argent trading on an ex-cash P/E of below 4×, such buybacks are hugely accretive to shareholders. Management is incentivized and remains focused on improving returns on capital. ROE is trending up and to the right (the flattening in 2024 and 2025 is a result of surplus cash in the denominator; adjusted for cash, ROE is higher and still rising).

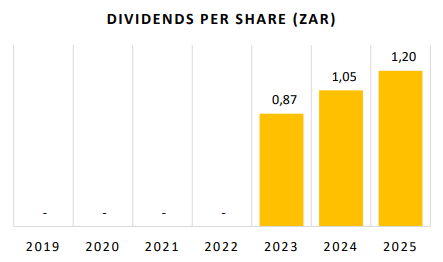

Cash conversion exceeds 100%, so the company is not only returning profits to shareholders via buybacks – it has also reinstated a dividend after several years without one. We expect dividends to grow sustainably from the current base, which should place Argent on the radar of additional market participants.

Argent is one of the largest holdings in the Desert Lion Capital Fund. We have high conviction that a long runway of significant growth lies ahead. Efficient execution and smart capital allocation have already delivered impressive outcomes: EPS has compounded at over 30% per year, the business is debt-free with surplus cash, and return on equity continues to trend upward. Yet the market assigns it a P/E of under 6×. This is a textbook mispricing of a high-quality, globally diversified, cash-generating company with excellent capital allocation driving returns – a classic case of a global business trading at South African discounts. We believe the discount won’t last forever, and until it closes, we are content to collect outsized earnings yields.

In Closing

Required returns on South African equities remain high, and our opportunity set is richer than our capital base. Deploying incremental capital at today’s valuations – against a backdrop of declining SA bond yields, potentially lower inflation targets, and the possibility of liquidity flows into emerging markets – tilts the odds in our favor.

To our limited partners: as always, thank you for entrusting Desert Lion with your hard-earned capital. The majority of my personal wealth remains invested in the Fund, right alongside yours.

All the best,

Rudi van Niekerk

Read the full article here