The Federal Reserve on Wednesday cut its benchmark interest rate by 25 basis points in its first cut of the year, marking a move that could ease monthly payments on mortgages, credit cards and other loans.

The Fed’s benchmark rate helps set the prime rate, which banks use to determine how much to charge on many loans. That means Americans with credit card debt or adjustable-rate mortgages (ARMs) could experience some relief, while savers may feel the pinch as banks reduce interest payouts, according to Investopedia.

Credit Cards:

The 25-basis-point cut is expected to save credit card users $1.92 billion in interest over the next year, according to Wallethub.

FED CUTS INTEREST RATES FOR FIRST TIME THIS YEAR AMID WEAKENING LABOR MARKET

The impact of a Fed rate cut on credit cards depends on the type of card you have. For fixed-rate cards, the interest usually will not change right away. Most variable-rate cards are tied to the prime rate, so when the Fed cuts rates, interest charges typically decrease a bit. However, credit card companies can still raise rates on fixed-rate cards if they provide notice, according to Investopedia.

Mortgages:

The rate cut can also make borrowing for a home cheaper. However, how much you save depends on the type of mortgage you have, according to Investopedia.

For those with fixed-rate mortgages, your monthly payment will not change, and the only way to take advantage of lower rates is by refinancing into a new loan. For homeowners with ARMs, your payment may go down as these loans reset based on market rates that move with the Fed. Home equity loans and home-equity lines of credit (HELOCs) also track short-term rates, so borrowers here may also see some relief, according to Investopedia.

EXPERTS WARN FEDERAL RESERVE HAS ‘FROZEN UP’ THE AMERICAN DREAM WITH ‘INCOMPETENCE’

Realtor.com Chief Economist Danielle Hale told FOX Business that much of the benefit from lower mortgage rates has already come through in recent weeks.

“I don’t know that we’re going to see a lot of additional momentum lower right now following today’s decision,” Hale told FOX Business.

Hale explained that mortgage rates will continue to respond to economic data. If inflation eases or the job market weakens, that would increase the chances of more Fed cuts and likely push mortgage rates lower. She also added that with rates moving lower, many homeowners are beginning to consider refinancing.

“You’re looking at potentially $150 a month in savings for buying the typical home and then, if you’re refinancing, you may see more or less depending on the cost of [refinancing],” Hale told FOX Business. “We’re at the point now where there are real savings on the line, so people who have been thinking about it, it’s worth getting serious and taking the next step and contacting a lender or an agent.”

SENATE BANKING CHAIRMAN SAYS 50 BASIS POINT RATE CUT IS A POSSIBILITY, BACKS TRUMP’S NEW FED GOVERNOR

Savings accounts:

When the Fed cuts rates, banks usually pay less interest for savings accounts. When interest rates are up, high yield savings accounts and certificates of deposit (CDs) are a great investment, as the return is higher. Lower interest rates comes with lower return rates for those savings accounts, CDs and money market accounts.

The federal funds rate now stands in a new range of 4% to 4.25%, after the Fed held steady through its first five meetings of the year amid ongoing economic uncertainty.

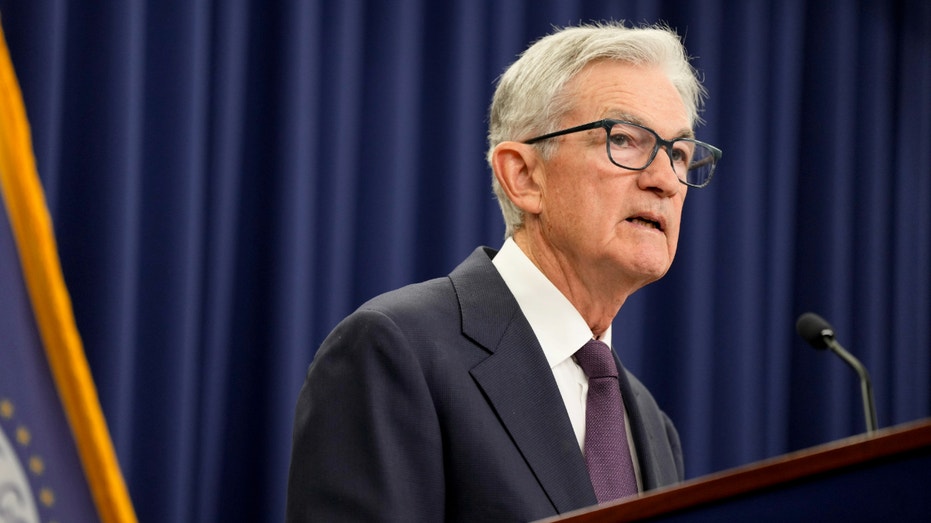

The Fed has faced pressure from the Trump administration to lower rates, with the president previously threatening to fire Powell. Those threats have since eased, and Powell’s term as chair is set to end in May 2026.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Powell was asked Wednesday if he plans to step down entirely when his term as Fed chair ends, rather than stay on as a Fed governor through 2028. He declined to answer.

FOX Business’ Eric Revell contributed to this report.

Read the full article here