Ram 2500 Heavy Duty on the street

By now, most sophisticated investors in automotive stocks are at least minimally conversant with the imperatives, mysteries, tradeoffs and opportunities – financial and otherwise – inherent in the growing battery-electric business. They understand that battery electric vehicles (BEVs) are destined to become mainstream personal transportation worldwide.

What no one can know for sure is how soon and comprehensively difficulties such as range anxiety, charging times and lack of infrastructure will be resolved, or how quickly massive new investments will yield financial return, especially in the key North American market, the world’s most profitable.

Two for one

Along comes Stellantis N.V. (NYSE:STLA), the Dutch-based agglomeration of such automotive brands as Chrysler, Dodge, Ram, Peugeot, Fiat and others with a clever solution for battery-hesitant buyers, especially those wondering about a full-size electric pickup truck. For this group, Stellantis offers the new 1500 Ramcharger, a BEV with an on-board generator in the form of 3.6-liter gasoline engine with a range of 690 miles.

Much of the company’s financial strength rides on full-size Ram gasoline and diesel pickups whose future is beclouded by looming regulations limiting CO2 emissions. (Likewise with General Motors Company (GM) and Ford Motor Company (F) – Detroit is very much a pickup truck town).

The company has another big moneymaker, its Jeep franchise. Jeep is a hot global brand that appeals to mainstream buyers and is doing a decent job of fighting off rivals like Ford’s Bronco lineup. In 2021, Jeep produced $42 billion of revenue worldwide, which means it likely accounts for more than 40% of the company’s revenue.

Early concept of Ram BEV (Stellantis)

Stellantis’ response to the e-pickup trend is a full-size pickup that addresses emissions and battery-range problems. The 1500 Ramcharger arrives as part of a series of new Ram pickup models: A pure BEV, called REV, features battery only, a conventional model comes with a new 3.0-liter six-cylinder gasoline engine, and the third introduces the new set-up containing an on-board charger, which some may think of as a gas-electric hybrid. (Stellantis rejects the hybrid appellation, insisting it’s a genuine BEV with an on-board gasoline charger.)

Among the changes to Ram’s pickup truck lineup will be discontinuation of the fire-breathing V8 Hemi gasoline engine, which is bound to upset traditionalists.

Power aplenty

According to Stellantis, Ramcharger generates 663 horsepower and 615 foot-pounds of torque and can achieve 0 to 60 miles per hour in 4.4 seconds. The new model will be capable of bidirectional charging, wherein the vehicle acts as a generator to power appliances or even an entire house.

Stephanie Brinley of S&P Global Mobility told CNBC: Ramcharger “works to address the fact that right now the industry and the pickup truck segment in particular is not ready to just flip to EVs 100%.”

“The new model addresses some of those performance and range anxiety concerns, and it’s strong.- But the difficult part is going to be getting consumers to really understand what it does,” she said.

Ramcharger can travel about 145 miles on pure electric charge. For longer trips, the system senses when the battery is getting low and then activates the engine, which via a generator, recharges the battery. The battery also can be recharged like any other automotive battery at a charging station or via a home-based Level Two charger. On its face, Stellantis’s solution seems smart. Will pickup truck buyers agree? What kind of price will Ramcharger command?

If pickup truck buyers do respond to Ramcharger, how soon before GM and Ford offer a similar propulsion system? GM and Ford’s pure electric pickups don’t appear to have as much demand as originally projected.

For the motor geeks among us, Ramcharger’s system is termed by Stellantis engineers as a “series hybrid,” in contrast to parallel hybrid systems like that in Toyota Prius. In the Prius’ set-up, the battery-driven motor and gas engine both drive the wheels – and don’t accommodate external charging. Fisker Karma, BMW i3 and Chevrolet Volt are series hybrids – though the Volt’s battery-driven electric motor provides slight power to the wheels.

Leapmotor C01 (Leapmotor)

Notwithstanding Ramcharger’s introduction, Stellantis has fallen behind in developing electrified know-how and expertise, especially in China, the world’s largest automotive market. In late October, Stellantis announced a $1.6 billion purchase of a 20% stake in Leapmotor, a China-based EV startup.

“As consolidation unfolds among the capable electric vehicles start-ups in China, it becomes increasingly apparent that a handful of efficient and agile new generation EV players, like Leapmotor, will come to dominate the mainstream segments in China,” said Stellantis CEO Carlos Tavares.

Whether the relationship bears fruit of course remains to be determined.

The automaker, whose hourly workers are represented by the UAW in the U.S. and by Unifor in Canada, recently reached tentative contracts with both unions following a six-week strike. The company said the labor stoppage cost $3.2 billion in lost revenue and $800 million in lost profit. The agreements surely will increase the automaker’s labor costs significantly, though the extent probably won’t be clear for a few quarters.

Growing sums

For the six months ended in June, Stellantis NV reported a record $12.1 billion (10.9 billion euro) net profit, up 37% year-over-year for the first six months, on a best-ever $109 billion revenue (98.4 billion euro), a 12% increase from higher shipments. An 11% increase in adjusted operating income to a record $15.6 billion (14.1 billion euro) represented a 14.4% group-wide margin compared to 14.5% a year ago. Worldwide, inventory was at 1.37 million vehicles, up from 845,000 a year ago.

A potential investor may legitimately question whether it’s wise to own the shares of an automaker whose workforce periodically strikes, causing major financial loss – particularly in a competitive industry filled with rival producers whose workforces are non-union.

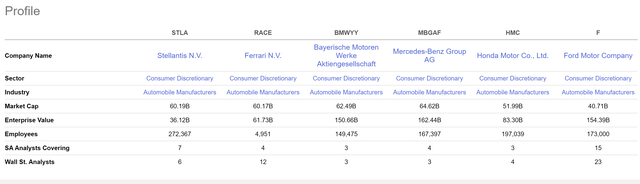

Comparative chart (Seeking Alpha)

From a dividend standpoint, Stellantis’ policy has been generous and inconsistent. The latest dividend was paid last May and at current valuation indicates a yield of 7.5% – assuming the same or larger dividend will be paid again this May. According to Seeking Alpha’s methodology, Stellantis earns an A- grade for dividend growth, an A+ for dividend yield, a D- for consistency and an F for safety.

The stock price has been trending upward since July and remains short of its all-time peak of just under $25.

Generally speaking, I’m a long-term investor. In this case, understanding the economic risk as well as the inherent cyclicality of automotive sales and profit on top of the union liability, STLA shares look like a decent bet as a Buy and hold through May, when – assuming the annual dividend is paid – shareholders may wish to reassess.

Read the full article here