TDW and offshore industry recap

I shared my take on Tidewater (NYSE:TDW) a week ago and why I am bullish on the offshore industry. It is time to analyze the 3Q23 results published last Monday. Before I proceed, let`s recap my view on TDW and the offshore industry.

We have rising demand and constrained supply. Combined, they widen the offshore vessel deficit, thus reflecting the day rates. The rates have been on a constant rise for the last year.

The supply side is affected by record-low order books and limited shipyard capacity. Offshore vessels’ order book has been recording low at 2.5%. The figure is the lowest among all types of vessels. On the other hand, shipyard capacity has declined by 65% over the last 15 years. The demand is driven by deep water exploration revival. The deep-water projects have solid economics: $40/barrel breakeven cost, 31% IRR at $70/barrel, and the lowest average CO2 intensity among the various fields.

To bet on offshore revival, we have multiple options. However, not all are equal. TDW is one of the best companies in the business. The company has an extensive and quality fleet operating across the globe. TDW owns 69 PSV >900m2 or 17% of the global fleet. After acquiring Solstad vessels, the company will cement its leading position as the top OSV operator globally.

TDW acquired 37 PSVs from Solstad in the third quarter for $594 million. The company uses $250 million in unsecured Nordic bonds, a new $325 million senior bank term loan, and $18.5 million of its cash reserves to finance the deal. With Solstad vessels, the company has a well-diversified fleet of 220 ships.

TDW expects to improve its G&A profile after the Solstad vessel’s acquisition. Company management expects the incremental annualized G&A for the new fleet to be about $3.5 million compared to the initial assumptions of $5 million. The implied G&A synergies will drop to $14.3 million, resulting in an incremental G&A cost per vessel of $260 daily.

In my report on TDW, I stated the price is overextended and recommended waiting for a dip. The last two weeks were harsh to all energy stocks, and TDW was not spared. Even the impressive 3Q23 results did not save the company`s stocks from significantly dropping across the sector. Nevertheless, the dip offers an excellent opportunity to start building a position. This is what I did.

I would not be surprised if the correction extends further due to sector rotations. US treasuries rebounded for the last two weeks, and the yields declined. The broad equity indexes led by MAG7 recovered their losses from October. So, the market participants started to rotate from energy and materials to tech stocks and treasury bonds.

3Q23 results

Tidewater continued to benefit from growing day rates, driven by the increasing demand for vessels and tight vessel supply. Since the recovery began, this is the most significant absolute and relative QoQ day rate increase. Every region and vessel class experienced modest to substantial day-rate increases during the third quarter.

In the last quarter, two foremost divers pushed the company’s fleet day rates. The first are older contracts rolling off and contracting at prevailing market rates. The second factor is improved term contracts continue to move meaningfully higher. During 3Q23, 27 term contracts with an average rate of approximately $28,600 per day were signed.

TDW composite fleet day rates had increased to $23,500 per day, or 22% growth compared to previous quarters. The growing rates motivate the company to change the duration of the contracts. In 3Q23, the company signed new contracts with an average duration of ten months, compared to 2Q23, 6.5 months. It is always a trade-off between contract duration and daily rates. With improving rates, OSV companies can take advantage and sign more extended-duration contracts.

Revenue, day rates, and utilization

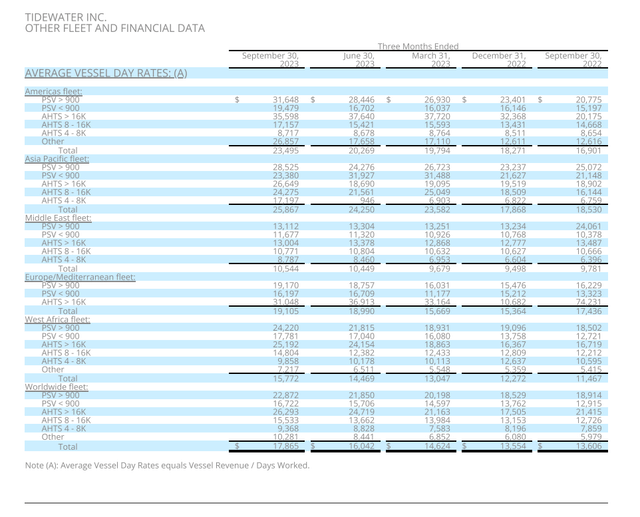

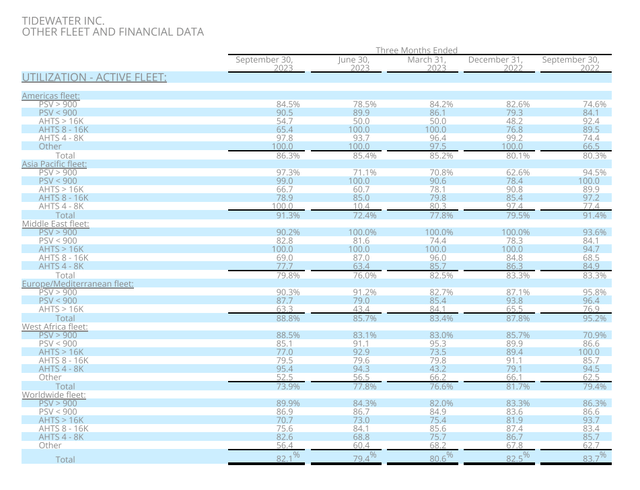

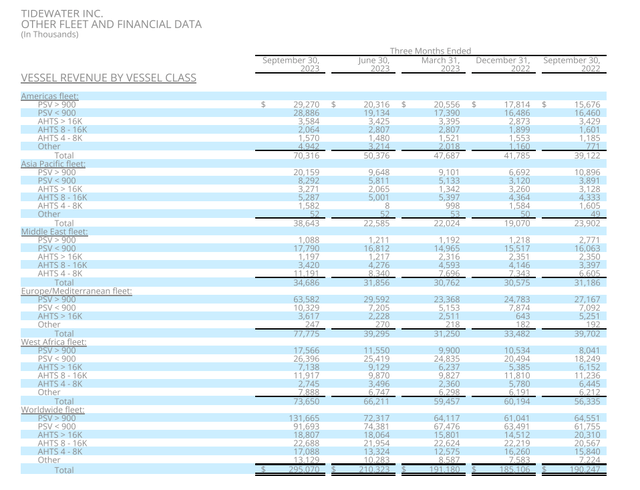

Let’s see how day rates, utilization, vessel class, and regional revenues have changed. I will use three charts from the last company`s report to argue my thesis: average vessel day rates, utilization active fleet, and vessel revenue by vessel class.

TDW results report 3Q23 TDW results report 3Q23 TDW results report 3Q23

The most significant growth is in the Americas region. The composite day rate has increased from $20,269 in 2Q23 to $23,495 in 3Q23, with 45% YoY. Americas operations generated $70.7 million in revenue in 3Q2 against $50.4 million in 2Q23. The primary drive in the segment was the growth of PSV day rates. The utilization rate has been stable for the last three quarters at 85-86%.

Asia Pacific fleet generated higher revenue in 3Q23 than in 2Q23, $39 million and $22.6 million, respectively. AHTS rates across all sizes had moved up significantly. For example, AHTS>16K grew from $18,690 in 2Q23 to $26,649 in 3Q23. Another reason for improved results was the utilization rate. It moved from 72.4% in 2Q23 to 91.3% in 3Q23. TDW has 18 vessels dispatched to the Asia Pacific region.

The European/Mediterranean fleet realized significant revenue growth, too, from $39,225 in 2Q23 to $77,775 in 3Q23. The major growth contributor was PSV>900, doubling revenue QoQ. The company operates 51 vessels in Europe and the Mediterranean Sea. The utilization rates had increased from 85.7% in 2Q23 to 88.8% in 3Q23.

West African operations delivered strong results despite declining utilization rate (77.8% in 2Q23 vs 73.9% in 3Q23). A significant contributor to the revenue growth was PSV>900, with rising day rates and revenues. The composite day rate for the region changed from $14,469 in 2Q23 to $15,772 in 3Q23. The revenue increased from $66.2 million to $73.6 million QoQ.

The laggard in the fleet is the Middle East operations despite growing deepwater exploration in the region. Composite day rates QoQ increased from $10,449 to $10,554. Utilization moved up to 79.8% in 3Q23 from 76% in 2Q23. The Middle East division generated $34.6 million in 3Q23 compared to $31.8 million in 2Q23.

Let’s look at the big picture. TDW composite fleet day rates YoY increased from $13,600 to $17,865. The revenue for the same period grew from $190 million to $295 million. The active fleet utilization rate fluctuated between 79.3% to 83.7%.

Vessel operating profit and margins

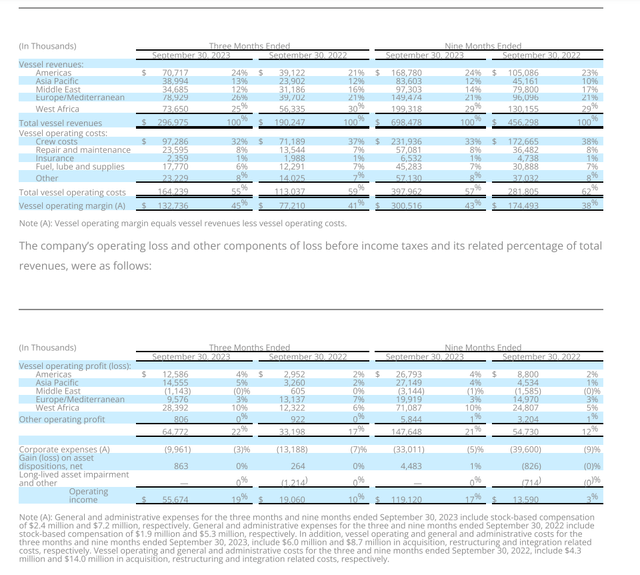

Let’s move down in the TDW income statement and analyze income changes.

TDW results report 3Q23

The best-performing segment based on revenue for 2Q23 is Europe/Mediterranean. However, American and Asia Pacific operations realize the most robust growth based on operating profit. The reason for such a discrepancy is due to the total operational costs.

The European/Med segment vessel operating costs for the European division increased QoQ from $21 million to $42 million. The American division’s total costs, QoQ, changed from $29.5 million to $43.2 million, and Asia Pacific from $11.9 million to $18.8 million. Going deeper in detail, the primary driver for increased total vessel operating costs is the crew costs, doubling QoQ. Despite the high costs, the European segment remains the third most profitable for the company based on a vessel operating margin of 46.7%. The leader is the West Africa division, with 55.1 %, and the second is the Asia Pacific division, with 51.7%. The Middle East operations did not deliver surprises, and the costs and revenues did not change much QoQ, resulting in a 22.0 % vessel operating margin for 3Q23.

Looking at TDW`s bottom line, the company achieved impressive figures. Net income attributed to TDW for 1Q23 was $10.7 million, while 3Q23 was $26.1 million, or 143% net income increase. The day rates grew for the same period from $14,624 to $17,865, or 21% day rates growth. Those figures affirm TDW management`s ability to generate value for its shareholders.

Investor takeaway

I expect the demand for oil rigs to grow further, resulting in higher demand for OSV. Global political and economic fragmentation will change the oil industry landscape. The Middle East will hold its prime portion as a leading oil producer. However, the oil business will seek viable alternatives.

A few regions I believe will benefit significantly: South America and particularly Guyana and Suriname shelf; West Africa with Namibia a new kid from the block; North Sea deep water exploration revival. A large part of TDW’s revenue derives from those regions.

TDW has another strong quarter with a growing fleet and operating region revenue. The top performing divisions based on vessel operating profit margin are West Africa, Asia Pacific, and Europe. However, I consider West Africa, the North Sea, and Brazil regions with great potential for growth in the coming year. They deliver 74.6% (for 3Q23) of the company`s revenue.

I expect sector rotation to continue and TDW stock might fall further. I will take a further decline as an opportunity to add more exposure to TDW. In my previous article, I gave a buy rating. Given the better stock price, I provide a strong buy rating.

Read the full article here