Datadog (NASDAQ:DDOG) has soared ever since I moved to the sidelines. While macro continues to impact the near-term growth rates, the company appears to be seeing a quick recovery relative to tech peers. DDOG is one of the few tech companies generating high-secular revenue growth while producing robust cash flow margins. DDOG appears well positioned to benefit from ongoing adoption of generative AI and AI in general. In spite of the promising long-term outlook, I continue to caution on the stock due to valuation – I reiterate my neutral rating.

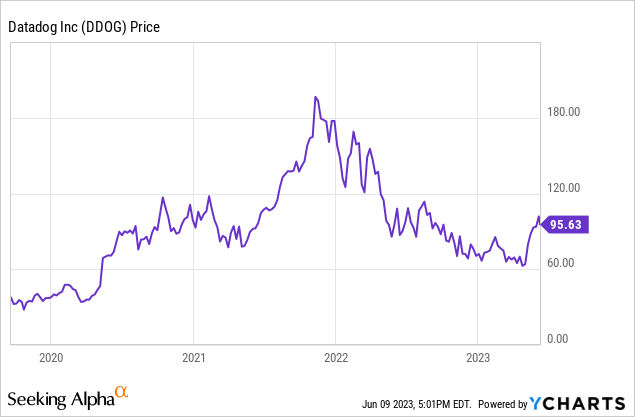

DDOG Stock Price

DDOG stock finds itself around 50% below all-time highs and 50% above recent lows.

I last covered DDOG in April where I downgraded the stock due to the deteriorating growth outlook. The stock has since returned 36% as the company’s growth rates proved more resilient than expected.

DDOG Stock Key Metrics

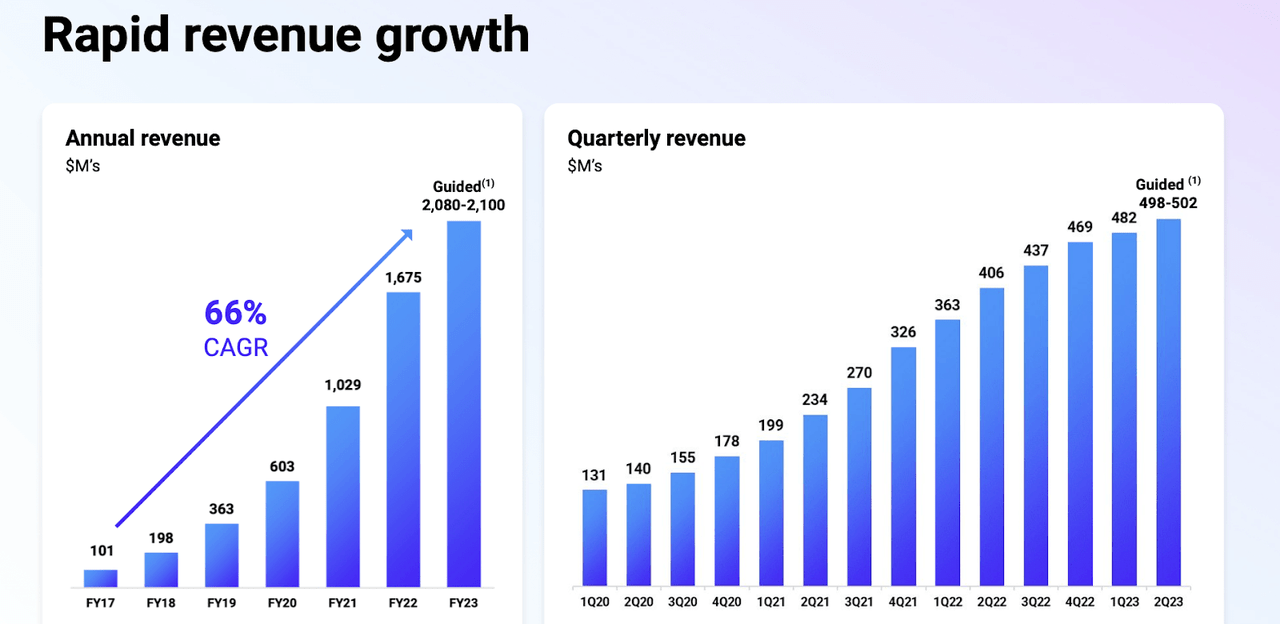

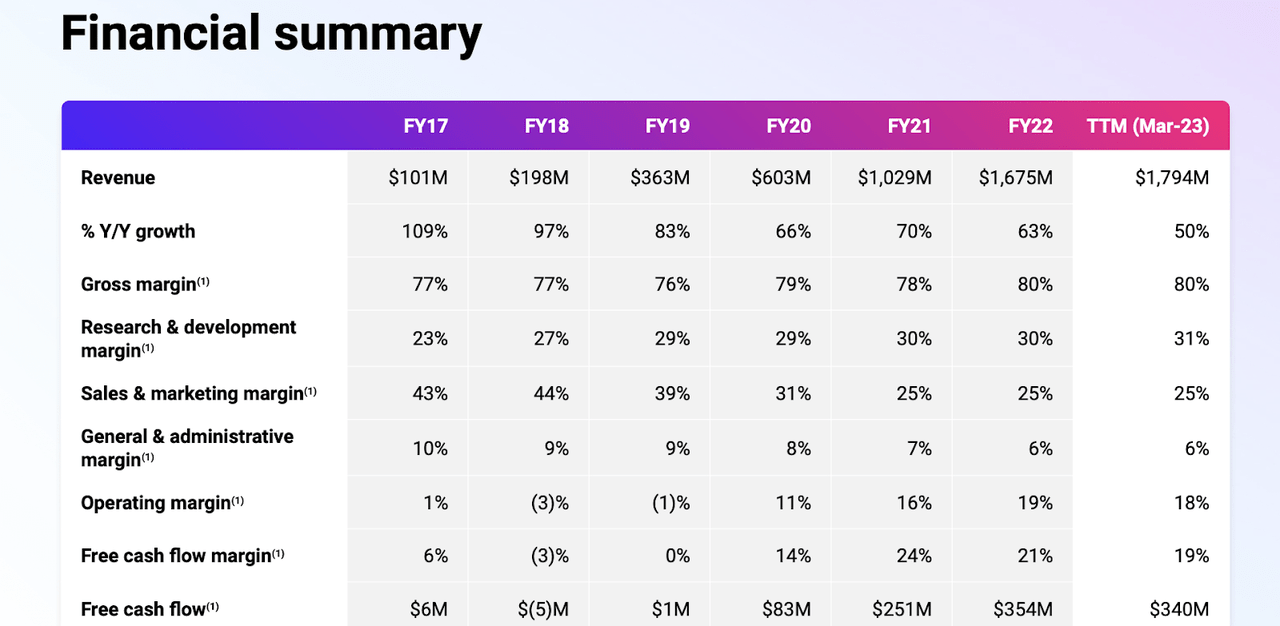

In its most recent quarter, DDOG generated 33% YOY revenue growth to $481.7 million, comfortably ahead of guidance for $70 million.

2023 Q1 Presentation

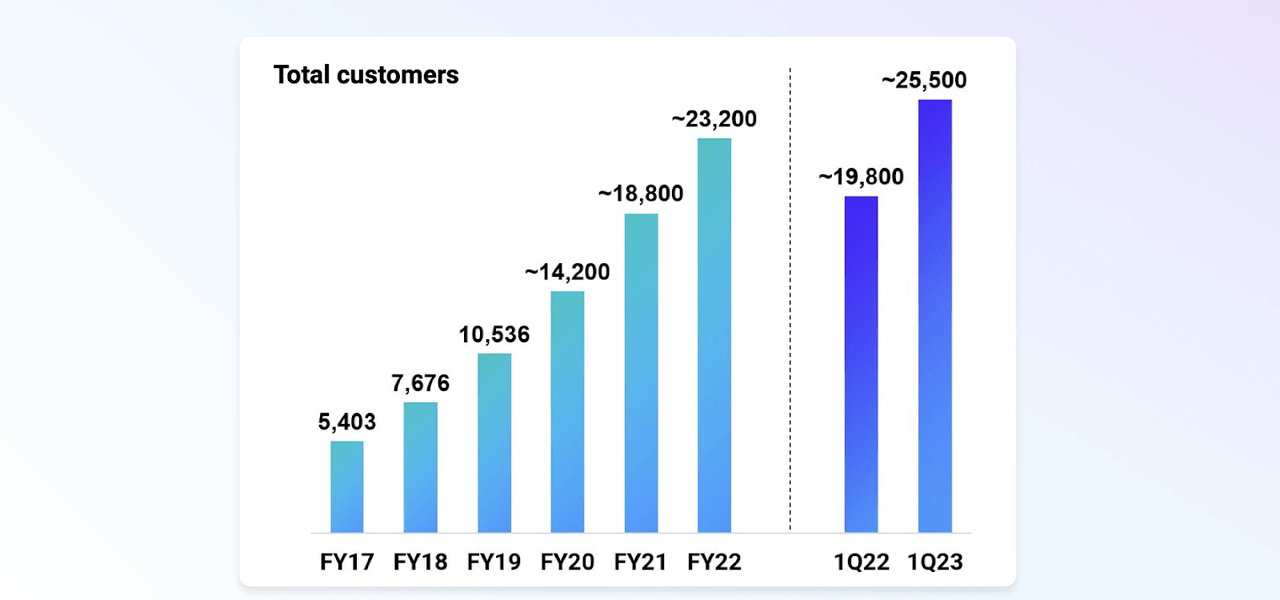

DDOG continued to grow its customer count at a rapid pace – this is no longer such an easy accomplishment given tough pandemic comps as well as the tough macro environment.

2023 Q1 Presentation

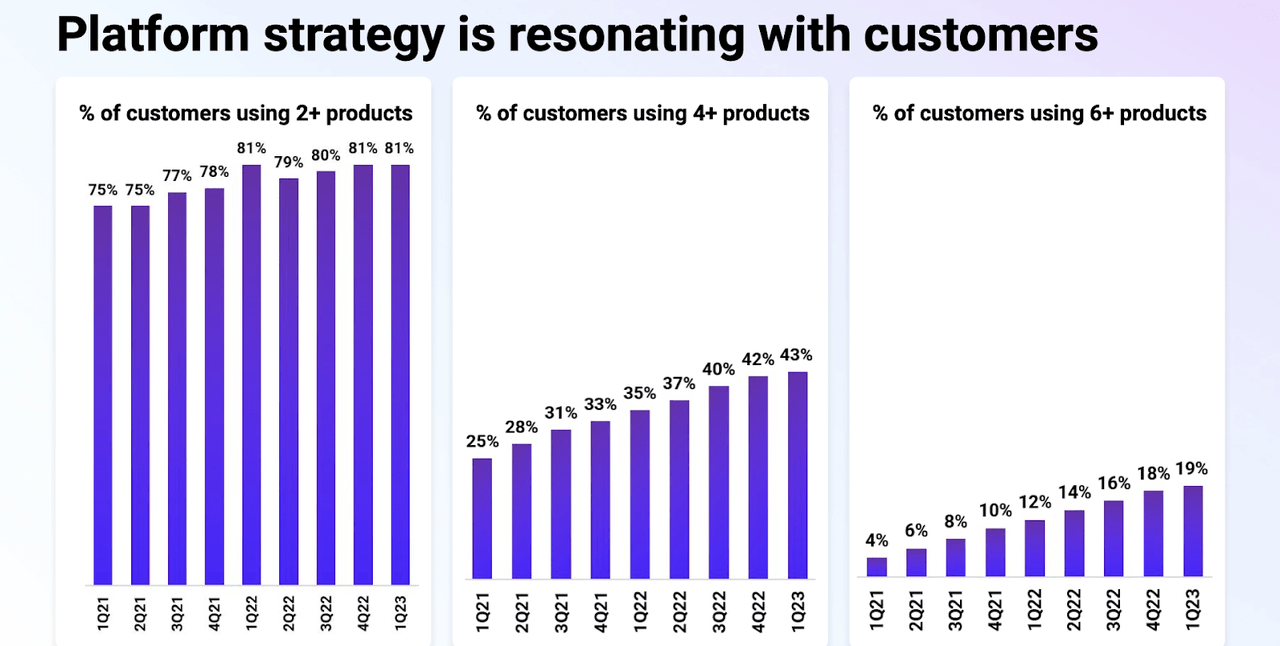

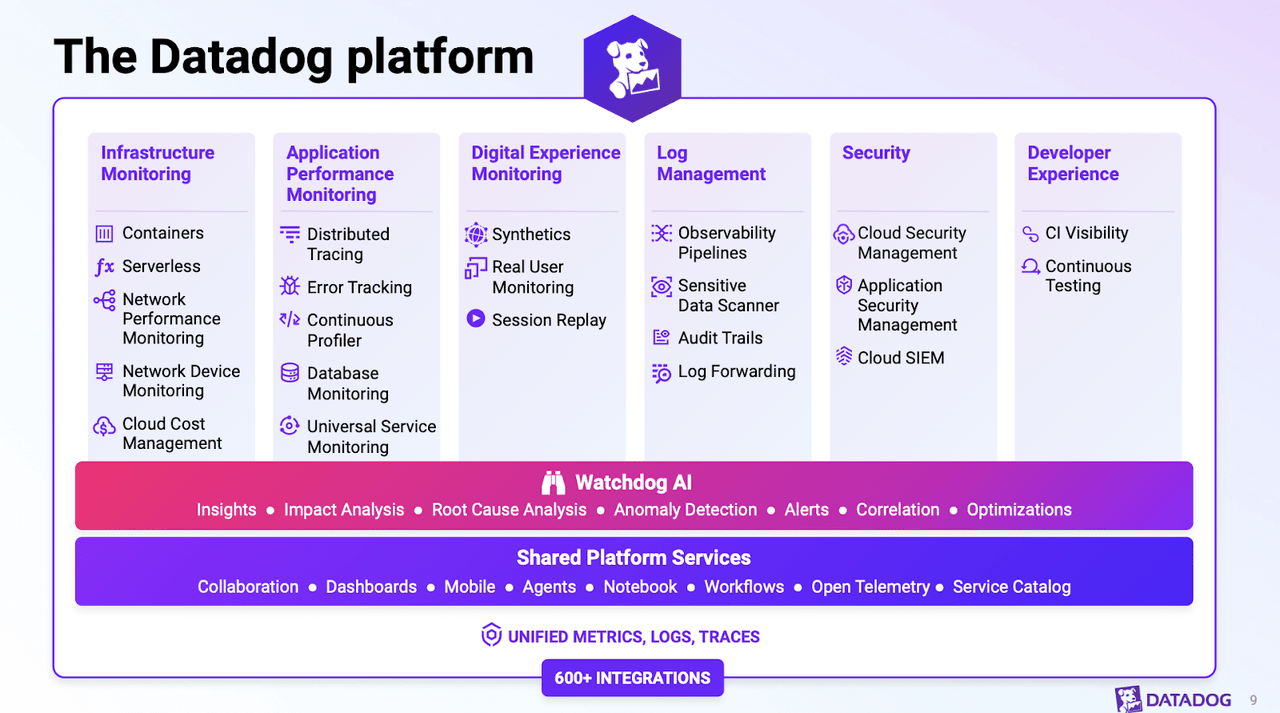

Even without that strong customer growth, DDOG is strongly positioned with its complete product portfolio. This kind of positioning has proven crucial during these times given as the company is able to generate revenue growth by upselling existing customers. Again – DDOG does not appear to have issues growing its customer count so it is quite impressive to see it excel in both these areas

2023 Q1 Presentation

As seen above, DDOG has a large number of customers using at least 2 products but still has a large number of customers not yet using more than 4 products. Increased adoption of DDOG’s products likely helps to reduce churn, explaining the mid-high 90% dollar-based gross retention rate, and the latter point helps to explain the TTM 130% dollar-based net retention rate.

DDOG generated $86 million in operating income in the quarter, representing an 18% margin. That was flat sequentially but down from 23% YOY. The prior year benefitted from the lack of in-person work during the pandemic. DDOG has already been generating positive operating and free cash flow margins for several years at this point.

2023 Q1 Presentation

DDOG ended the quarter with $2 billion of cash versus $740 million of convertible notes. Together with the positive cash flow generation, the company has a strong balance sheet.

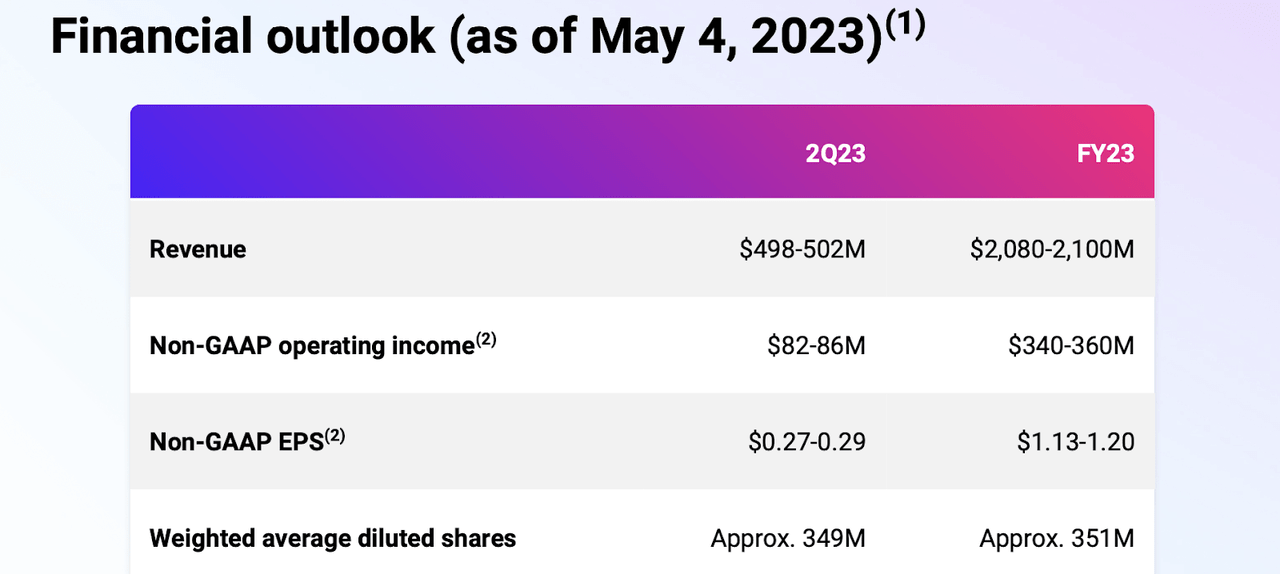

Looking ahead, management is guiding for up to 24% YOY revenue growth in the second quarter to $502 million. For the full-year, management now expects up to 25% YOY revenue growth to $2.1 billion, up slightly from prior guidance for $2.09 billion. That forecast should be considered very strong considering that many tech peers are having to walk back guidance due to the tough macro environment.

2023 Q1 Presentation

Management expects their TTM NRR to decline below 130% in the second quarter. On the conference call, management also noted that customer usage growth improved sequentially despite still being below prior levels. The company continues to see its larger customers undergo cloud optimization initiatives, though it appears to be rounding the corner on these headwinds. Management thoroughly discussed the company’s positioning amidst the AI boom, stating their belief that AI will “further shift value from writing code to observing, managing, fixing and securing live applications.” The idea is that AI may help to increase developer productivity and accelerate the digital transformation, leading to long term growth in data. It is worth noting that DDOG is one of the few tech companies that has not engaged in significant headcount reductions – many tech peers have sought to offset decelerating top-line growth with headcount reductions and associated margin expansion. DDOG has instead sought to continue investing in long term growth – and thus far Wall Street appears to be fine with that.

Is DDOG Stock A Buy, Sell, or Hold?

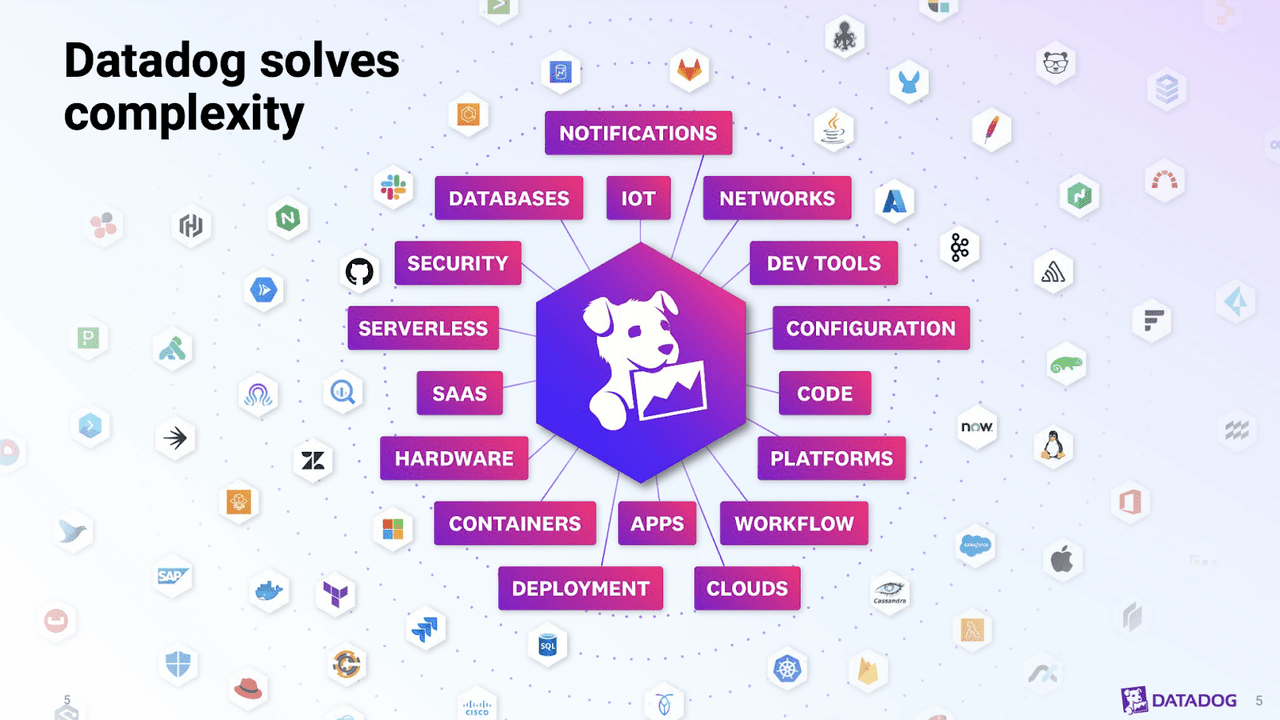

DDOG seeks to address the complexity of managing data.

2023 Q1 Presentation

DDOG has a wide product portfolio highlighted by their infrastructure and performance monitoring product lines.

2023 Q1 Presentation

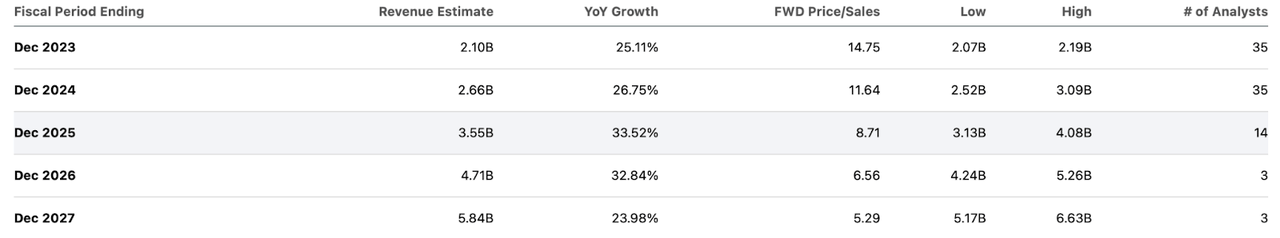

The company’s resilient top-line growth rates, robust profit margins, and exposure to the growth of AI have helped the stock earn premium valuations. As of recent prices, the stock was trading just around 15x this year’s sales. That is a very rich multiple given that consensus growth rates are in the 25% to 30% range moving forward.

Seeking Alpha

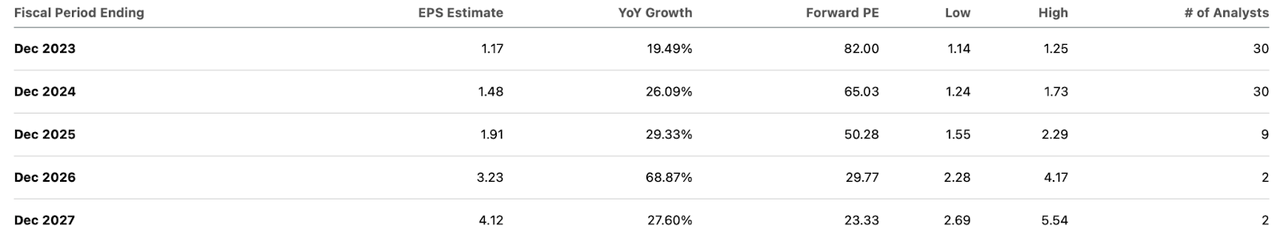

DDOG does not appear cheap until the year 2027 as the stock is pricing in many years of growth.

Seeking Alpha

Based on 30% long term net margins, 30% revenue growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at around 13.5x sales, implying some upside assuming the company can sustain that hefty growth rate for many years. But that’s the problem, I expect the company to show decelerating growth rates with or without a macro recovery – I am basing that projection on what I am seeing elsewhere in the sector. I wouldn’t rule out management having to walk back their optimism as companies who have recently reported have essentially all indicated a worsening macro environment. It is curious that DDOG stock seems to behave as if it is immune to such headwinds, maybe Wall Street believes that AI can allow the stock to move away from the pack. But I caution against such thinking as names like Snowflake (SNOW) have shown some serious weakness. While DDOG continues to generate solid fundamental results, I reiterate my neutral rating as the valuation is pricing in much optimism and not leaving in much room for disappointment.

Read the full article here