Investing Thesis

On Wednesday, Penske Automotive Group (NYSE:PAG) released a superficially encouraging Q1 revenue report in which the firm celebrated a record quarterly revenue increase of 5% to $7.34 billion. That number represents a 5.3% increase year over year and beat Wall Street expectations by $320 million. Among other highlights in the report, Penske announced that Q1 GAAP earnings per share of $4.31 beat Wall Street expectations by $0.20, retail and commercial truck same-store revenue increased by 10%, and retail automotive same-store revenue climbed 2%.

Those positive numbers, however, cannot make up for some concerning trends elsewhere in the report, which is likely why the stock price stumbled a bit as investors digested the news. Among the more disappointing details is the fact that Penske reported that net income attributable to common stockholders decreased 19% to $298.3 million from $367.9 million while related earnings per share decreased 9% to $4.31 from $4.76 year-over-year. A sharp decline in revenue generated by the company’s used vehicle operations is particularly eye-opening as the revenue from used vehicles in both retail automotive sales and retail commercial truck sales dropped substantially in Q1, with the former reporting a 23% decline and the latter reporting a 51% plummet.

Given the mixed bag of results, I decided to take a closer look at the company to see whether it presents a buying opportunity for investors or if, on the other hand, it would be better to look elsewhere. In this article, I will discuss some of the pros and a few of the risks of investing in Penske from the perspective of a dividend growth investor.

Company Overview

Founded in 1990 by Roger Penske, the eponymous company is headquartered in Bloomfield Hills, Michigan and has grown into one of the largest automotive retailers in the world. As Seeking Alpha’s Gary Gambino has discussed in his own coverage of Penske, the company “differ[s] from its peers due to its luxury brand focus, truck sales and leasing business, and foreign exposure, particularly the UK,” which provides it with a degree of diversification uncommon in its industry. Penske’s primary operations fall into the following five segments:

New and used vehicle sales: Penske owns and operates a large network of dealerships that sell both new and used cars, trucks, and SUVs from a variety of different automotive manufacturers. This broad range of offerings enables Penske to cater to a range of customer preferences and budgets, from shoestring to those drawn to the company’s aforementioned emphasis on luxury brands.

Service and parts: In addition to automotive sales, Penske also offers a range of automotive services, from maintenance and repair services to parts and accessories sales as well as collision and repair services. This segment has enabled the company to generate additional income from customers who purchase or lease vehicles from Penske.

Finance and insurance: Penske also offers a number of finance and insurance services for its customers. These services enable the company to offer financing and insurance operations in-house, which both generates additional income and strengthens customer loyalty. Who doesn’t like a one-stop shop?

Commercial Truck Sales: The large yellow box trucks emblazoned with Penske’s name and logo are arguably the most immediately recognizable part of the company’s business and the company’s commercial truck dealerships remain a major part of Penske’s overall revenue generation. In addition to sales, the dealerships offer truck rentals as well as servicing and replacement parts for commercial vehicles.

International Operations: In addition to a strong presence in the United States, Penske also maintains a significant international presence in multiple countries, including the United Kingdom, Germany, and Italy. This international presence enables Penske to benefit from a more diverse customer base than its less internationally-focused peers and to leverage the different market conditions of these nations to its advantage.

A few pros of buying Penske Automotive Group:

Diversified Revenue Streams: As I discuss above, one of Penske’s strengths is its diverse range of operations, which can help the company continue to generate cash when one or two of those segments encounter unfavorable market conditions. For instance, while automotive sales have declined in 2022, the sales of aftermarket auto parts increased during the same time. In Penske’s case, while used vehicle sales dropped by 7% in Q1 and revenue from the finance and insurance branches of the company dropped by 7%, the company nevertheless reported a 2% increase in retail automotive same store revenue on the strength of a 9% increase in new vehicle sales and a 10% increase in revenue from service and parts.

A strong history of financial performance:

While the company is currently facing a number of concerning headwinds ranging from younger buyers dropping out of the new and used vehicle market due to high interest rates to continued supply chain disruptions and the impact of inflationary pressure on superconductors and other technologies vital to the automotive industry, Penske does offer a long history of strong financial performance.

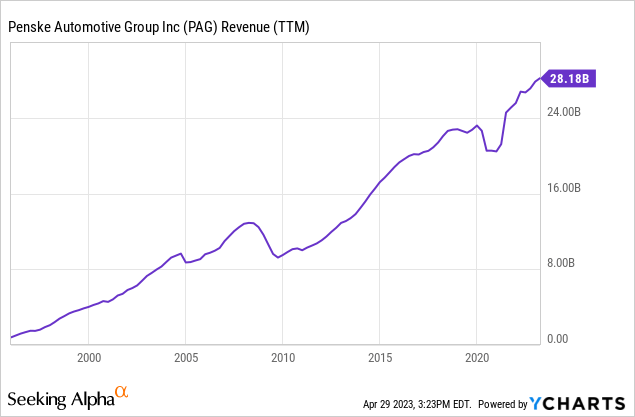

Starting with Penske’s revenue, we can see steady growth over the company’s entire existence and particular strength over the past decade:

In the decade leading up to the 2020 market crash the subsequent market spike, Penske’s revenue more than doubled from $11.8 billion in 2011 to just under 25 billion in 2020, which represents a compound annual growth rate of more than 8%. In the three years since, Penske’s revenue has continued to climb to its present position just north of $28 billion.

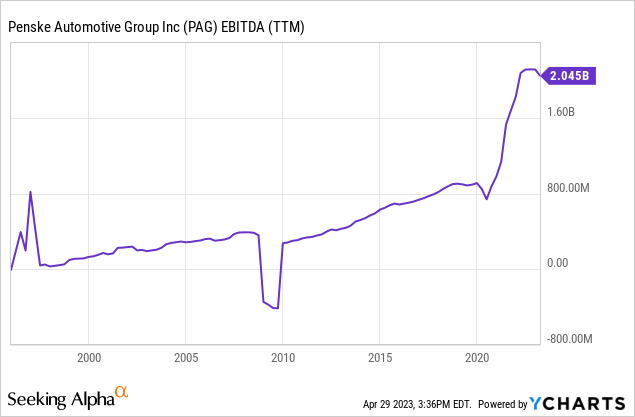

Similarly, Penske’s earnings have consistently performed well. Over the same time span, the company’s EBITDA climbed from $343 million in 2011 to $1.615 billion in 2022. It currently sits above $2 billion today:

Despite some struggles during the bear market following the bursting of the subprime mortgage bubble, Penske’s earnings show a steady growth trajectory that may continue to climb moving forward.

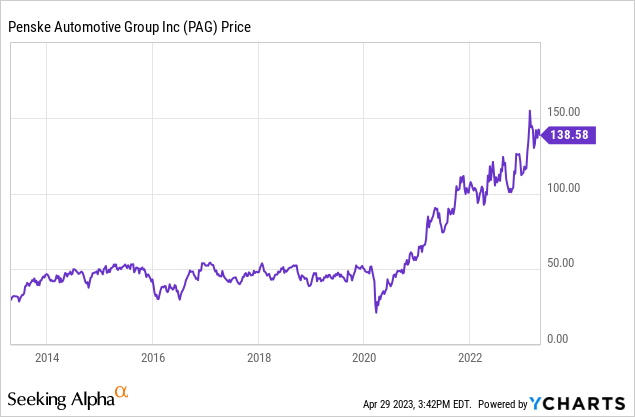

Lastly, while Penske’s share price chart shows a generally flat return for much of the past decade, the share price has performed exceptionally well over the past three years:

To put that growth into perspective, it might be useful to consider what an investment in Penske a decade ago would be worth today. Excluding dividends, if one were to have purchased $1000 of Penske in April of 2013, that investment would be worth more than $4,800.00 today, representing an impressive gain of just under 390%, more than doubling the S&P’s 167.48% gain over that same time span. Not too shabby!

A few potential risks of buying Penske Automotive Group

Dependence on the automotive industry: Given that the automotive industry is a cyclical one, Penske may be headed towards a particularly bumpy path if and when the much-anticipated recession hits us later this year or next. As many armchair economists will happily tell you, the automotive industry generally fares poorly during recessionary periods because consumers frequently cut back on or delay discretionary spending, especially big-ticket purchases such as cars or trucks. As a recession lingers on, consumer confidence softens and the demand for cars often drops along with it. Moreover, lines of credit may be more difficult for buyers to find, which can make it challenging to finance the purchase of a new or used car or truck, a trend that can reduce demand even further.

Of course, Penske does offer some financing options in-house, so it may be possible for the company to facilitate the purchase of a car for some consumers who might otherwise struggle to finance a purchase. However, since Penske seems less focused on the average car buyer than some of its peers, it faces another potential problem: competition from companies that do not focus on higher-end brands. Since consumers tend to prioritize affordability and reliability over luxury, Penske may lose customers to competitors selling lower-priced vehicles with an emphasis on practicality and reliability.

Geographic concentration: While Penske does operate in more countries than many of its peers, it nevertheless derives a significant portion of its revenue from the United States and the United Kingdom. With the Federal Reserve’s tight monetary policies in response to inflation driving interest rates to generational highs, for instance, American consumers are much more hesitant to spend money on expensive items such as cars. Should this stubborn inflationary environment persist, Americans may continue holding off on the sorts of expenditures Penske relies upon. Similarly, The Guardian reports similar levels of reluctance to spend in the United Kingdom.

Operating in a competitive industry: Penske Automotive Group, while an industry leader, nevertheless faces significant competition from peers across each of its primary operating areas. Between tech-savvy used car dealers such as Carvana (CVNA) and CarMax (KMX), Penske’s may feel the pinch of competition despite its position as the third largest used car dealer in the U.S. Similarly, companies like AutoZone (AZO) and O’Reilly’s (ORLY) will ensure that Penske faces stiff competition in the parts and services space. With so many competitors vying for customer dollars, Penske’s margins could feel significant pressure.

Evaluating the Dividend

As a dividend investor, I generally avoid stocks that do not pay shareholders. Since Penske does offer a 1.76% yield at the moment, it would be a company I would consider adding to my portfolio, if I felt strongly about the firm’s ability to continue paying and, perhaps more importantly, growing the dividend. At first glance, Penske’s dividend does appear to be attractive on a few fronts. For instance, the company’s payout ratio currently sits at 9.47%, which suggests that the dividend is both sustainable and has room to grow. Likewise, the company’s five-year growth rate is an inflation-topping 11.20%. On the other hand, Penske did suspend its dividend for two quarters in 2020. In general, when a company suspends its dividend, I avoid its stock since I do not consider it to be a reliable source of income. That said, I do believe that the decision to suspend a dividend in response to the pandemic’s impact on the world economy is such an exceptional circumstance that I do not see Penske’s suspension as particularly suspect. If anything, the fact that the company resumed payments in December 2020 and announced a dividend hike in January 2021 suggests to me that Penske is both willing to make hard decisions to maintain the strength of the company and conscious of shareholder concerns.

However, Penske’s pandemic dividend suspension was its third dividend suspension since the inception of the dividend in 2003, which works out to a dividend suspension once every seven or so years, on average. While the company does appear willing to resume payments and to increase them regularly over time, Penske’s behavior also suggests that maintaining the dividend is as much of a priority for the company as I prefer when deciding whether or not to purchase a stake in a business. I want a long history of regular dividend hikes, a clear plan for future dividend growth, and a commitment to maintaining the payouts during lean years. While the company may make sense for growth-minded investors less interested in dividends than me, for this investor Penske falls short of what I want from a company in my portfolio.

Parting Thoughts

Penske Automotive Group is a solid company with an admirably diversified business portfolio within an extremely competitive industry. It has a long history of solid economic performance and has rewarded long-term shareholders with market-beating returns over the past decade. The company’s leadership has shown a dedication to shareholder returns through a share repurchase program as well as a regular cash dividend. At the same time, Penske’s rapid growth over the past three years is not likely to continue at such a scorching rate. While I do not expect the company to flounder, I do believe that the likelihood of a recession makes Penske a hold at the present time. Unless we enter a new bull market, I expect Penske’s shares to trundle along at or even somewhat below current levels. Furthermore, given the company’s history of suspending its dividend during economic downturns, I do not feel comfortable buying shares when a recession in the next year seems not only possible but likely. That said, I do think that Penske is a good company with a shareholder-friendly philosophy and one that will likely resume a steady growth trajectory once the present cloudy economic skies clear up.

Read the full article here