Introduction

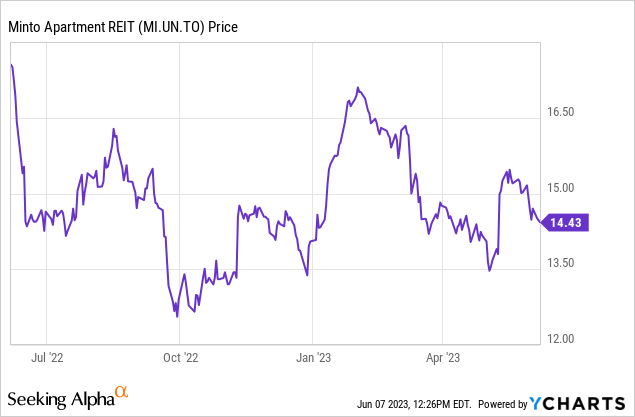

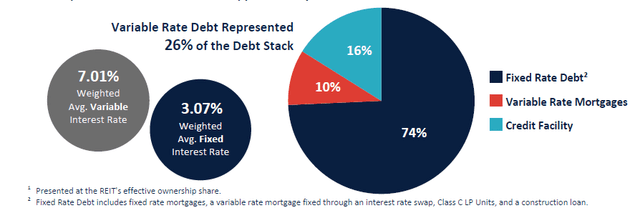

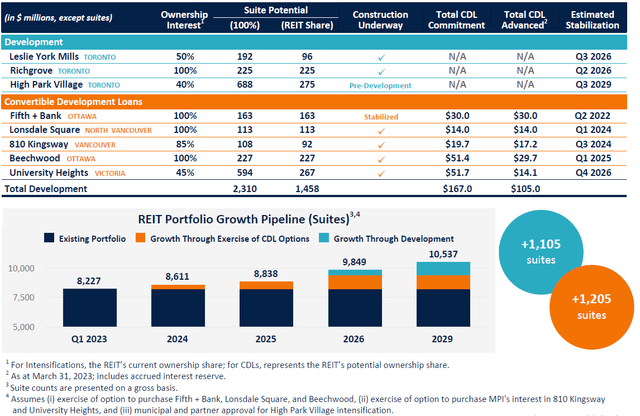

Minto Apartment REIT (TSX:MI.UN:CA) is a Canadian residential REIT with just over 6,700 suites in its portfolio. All suites are in five Canadian cities: Ottawa, Toronto, Montréal, Calgary and Edmonton. The REIT has been hit hard by the increasing interest rates as about a quarter of its debt has a variable interest rate to service. Although the average interest rate on the fixed rate debt is very manageable at 3%, the 7% cost of debt of the variable rate loans has been suffocating the REIT. In the first quarter of this year, in excess of 50% of the NOI had to be spent on interest expenses.

In this article, I wanted to have a closer look at the REIT’s performance and how applying a higher capitalization rate to value the assets would have an impact on the debt ratio.

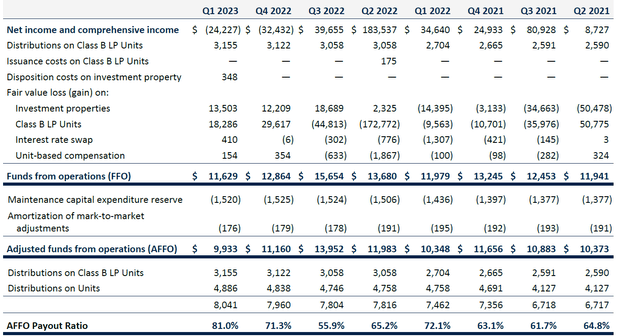

A somewhat okay FFO and AFFO performance – but higher interest expenses are hurting

Before having a closer look at how the recent changes on the financial markets have had and will have an impact on the balance sheet and valuation of the properties.

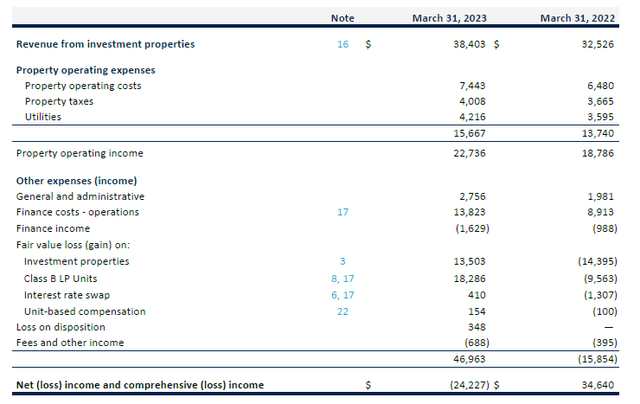

The finance expenses are already increasing pretty sharply. Although the FFO and AFFO calculation are the most important metrics to value a REIT, I think the income statement offers an interesting look under the hood as it shows how the net finance expenses are evolving as well.

And I have to say I was pretty negatively surprised when I saw the sudden increase of the interest expenses. I can’t say it was unexpected as everyone knows the interest rates on the financial markets have gone up, but as you can see below, the REIT’s net finance expenses increased by approximately 50% compared to a year ago.

Minto Investor Relations

Or to put things into perspective: in excess of 50% of the net operating income was spent on finance expenses in the first quarter of this year. About 74% of the debt is currently classified as fixed rate debt while 26% of the debt has a variable interest rate. And the average cost of the variable debt increased to a stunning 7%.

Minto Investor Relations

Minto Apartment REIT is taking action as the REIT has signed several refinancings. In April, a C$46M variable rate mortgage with a 7.70% cost of debt was refinanced with a C$61M insured mortgage at 3.87% for a 10-year term. Although the borrowed amount increased by C$15M, the REIT will save about C$1.2M per year in interest expenses. Additionally, another C$62M variable mortgage with a 7.44% interest rate will be refinanced at about 4%. That will save the REIT another C$2M per year in interest expenses.

A good move, but I’m surprised it took Minto this long to actually take action. The interest rates have been increasing for a while and I can’t help but feeling management should have taken action sooner. The book value of the assets was determined based on a capitalization rate of 3.84% so if you see your cost of debt increasing to a level way beyond your capitalization rate I would hope there would be a bigger sense of urgency.

Despite the strong Net Operating Income performance (an increase of approximately 15% on a same property portfolio basis and an increase of in excess of 20% on a total portfolio basis), the FFO and AFFO decreased, mainly due to the substantial increase of the interest expenses. As you can see in the image below, the FFO and AFFO haven’t been this low for a very long time.

Minto Investor Relations

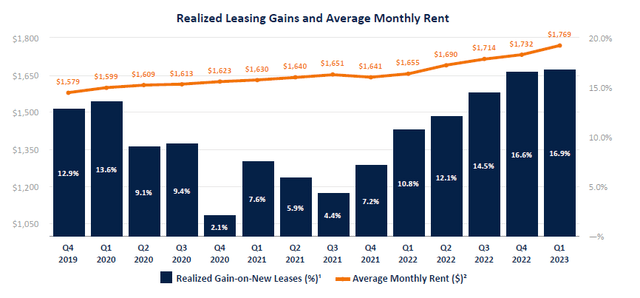

In the first quarter of this year, the FFO of C$11.6M and the AFFO of C$9.9M represented a per-share result of C$0.178 and C$0.151 respectively. This means that on an annualized basis, the full-year AFFO is trending at just over C$0.60 per share. So even after the recent share price decrease to C$14.40, the stock is still trading at almost 25 times the annualized result of Q1. Fortunately the recently announced debt refinancings will add about C$0.05 per share per year to the AFFO. This, in combination with the strong and hopefully continuously increasing NOI should help the AFFO per share to move up towards C$0.70 next year (and perhaps even exceed that if the lease spreads hold up). But even if Minto would be able to report such a result, the stock is still trading at about 20 times the AFFO which still doesn’t make it cheap. The recent lease spreads have been very encouraging with double digit increases in the past few quarters so that will likely help the performance as well.

Minto Investor Relations

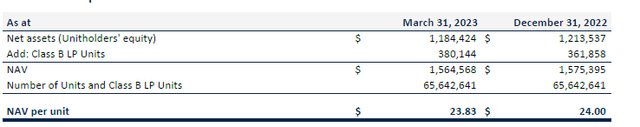

Fundamental investors may point at the NAV of C$23.83 per share to justify an investment. While it is true the stock is currently trading at a discount of almost 40% versus the NAV, it is important to make sure the NAV calculation is realistic.

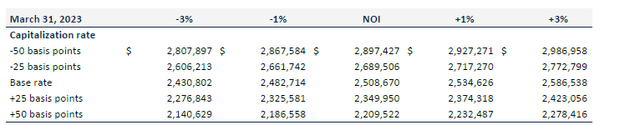

In the footnotes of the financing, we find a sensitivity analysis. Assuming a 50 bp increase in the capitalization rate (which would represent an increase from 3.84% to 4.34% which definitely still isn’t outrageous), the value of the assets would decrease by C$230M even if you would include a 3% NOI increase.

Minto Investor Relations

If you would use a capitalization rate of 4.84%, an increase of 100 bp versus the current base case scenario, you’d lose about C$400-450M in fair value, even if the NOI would increase by 5-6%.

If we would subsequently deduct C$425M from the C$1.56B in NAV and divide it by the 65.6M units that are currently outstanding (including the impact of the Class B LP units), the NAV per unit would decrease from C$23.83 to C$17.35.

Minto Investor Relations

That indeed means there would still be a margin of about 15% based on the current share price but that’s indeed already quite a bit lower than the margin based on the official book value. Fortunately, the debt to gross book value currently is just 41.2% and even in the scenario I painted above, the debt ratio will remain just below 49%. That’s not low, but still manageable in my ‘abrupt’ scenario.

Fortunately, the payout ratio remains below 100%. Based on the Q1 AFFO performance, Minto retains about C$7.6M per year in AFFO which it can use to further advance its development portfolio.

Minto Investor Relations

The main issue is that the average cost of debt was just around 4% in the first quarter of the year, and some of the cheap debt is maturing over the next few years. An increase of the average cost of debt by 50 bp to 4.50% or by 100 bp to 5.00% would reduce the AFFO per share by an additional C$0.08-C$0.17 per share per year. This means the interest expenses will gradually increase again as existing fixed rate debt matures, and this means the AFFO per share may continue to come in around C$0.70 per share for the next few years as the anticipated higher NOI will be needed to cover the higher interest expenses.

Investment thesis

The increasing interest expenses are definitely having a very negative impact on the performance of Minto Apartment REIT. Fortunately the residential REIT has been able to hike rents and the higher NOI was already very helpful in helping to mitigate the impact of the sharp increase of the interest expense.

Looking at the current situation, Minto is a ‘hold’ at best. But taking the recent refinancings into consideration and seeing how strong the leasing spreads are, Minto may actually be a speculative buy down here. The stock is trading at a 15% discount to my stress-tested NAV where I used a capitalization rate of closer to 5% while the AFFO per share will likely bottom in the first half of this year as further rent hikes and the refinancing of in excess of C$100M in variable rate debt should have a noticeable impact from Q3 on. I’m not counting on an AFFO of C$0.70 per share for this year, but it should be a target for 2024.

I currently have no position, as I don’t expect the AFFO per share to suddenly increase again until we have gone through the refinancing cycle. But the stock is getting increasingly attractive due to the discount to the NAV, even if I increase the capitalization rate by 25%.

Read the full article here