Introduction

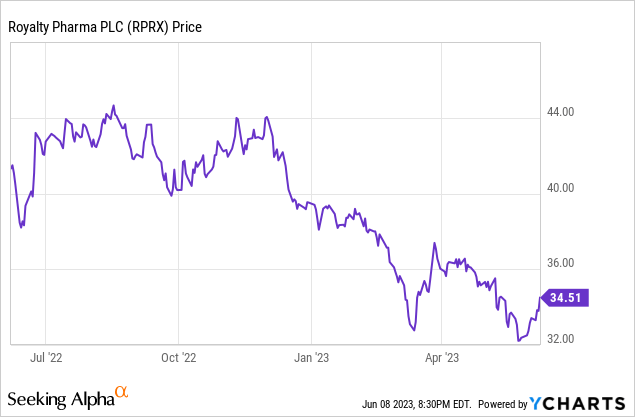

I am keen on investing in royalty companies focusing on acquiring and raking in the cash from pharmaceutical royalties. My position in DRI Healthcare (DHT.UN:CA) in Canada has served me well and I recently had a closer look at Royalty Pharma (NASDAQ:RPRX) in the USA as I was attracted to its cash flows and very clear capital allocation plans and policy.

A closer look at the 2023 guidance and capital allocation strategy

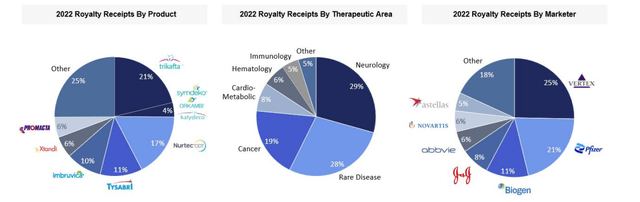

The business model of Royalty Pharma is very straightforward. The company acquires royalties on pharmaceutical products and, in return for an upfront payment, RPRX receives a cut of the revenue.

Royalty Pharma Investor Relations

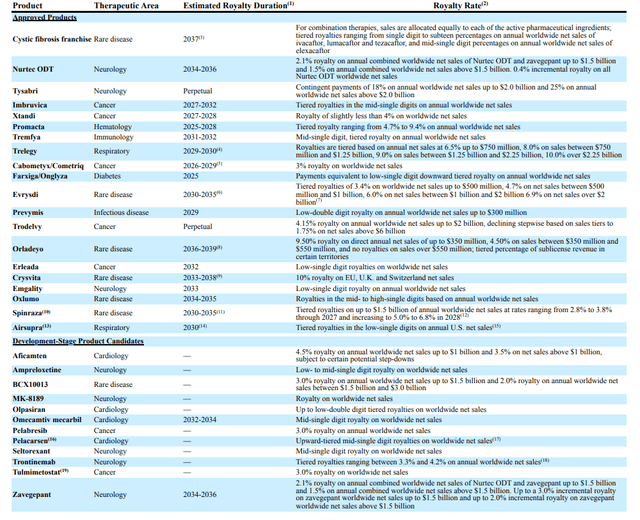

Most of the drugs it currently has a royalty on will last for at least another decade, and although you can expect a decrease in the cash receipts once a drug sees generic variants entering the scene, Royalty Pharma already has its hands on candidates in the development stage.

Royalty Pharma Investor Relations

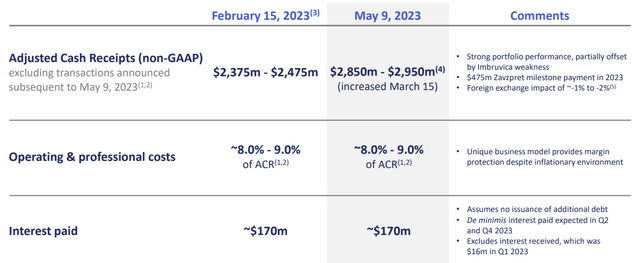

Royalty Pharma has upgraded its full-year cash receipts guidance by in excess of 20%. While that sounds very impressive, let’s not forget the updated cash receipts guidance of $2.9B (the midpoint of the $2.85-2.95B guidance) includes a one-time milestone payment of almost $500M. So on an adjusted basis (in this case adjusted for the milestone payment), Royalty Pharma is just on track to meet the previous guidance. Of course, the impact of the $475M milestone payment will for sure be positive but investors should realize this is a non-recurring item.

The operating costs will be just 8-9% of the adjusted cash receipts (so on an adjusted basis this will be around $200M) while the interest expenses (and payments) will come in at around $170M). This means the pre-tax incoming cash flow will likely be around $2.05B excluding the milestone payment and about $2.5B including the milestone payment.

Royalty Pharma Investor Relations

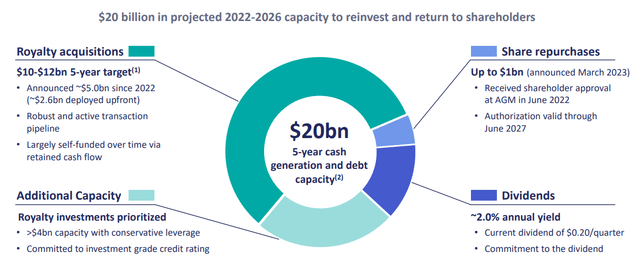

It’s also interesting to see Royalty Pharma is sticking with its forecast to have access to $20B in funding capacity in a mix of debt availability and self-generated cash flow (the latter should contribute the majority of the $20B in investment capacity).

Royalty Pharma Investor Relations

I like it when businesses are able to start compounding. And as most pharmaceutical royalty acquisitions happen at a double digit ROI, I’m definitely on board with spending the majority of the available cash on the acquisition of new royalties.

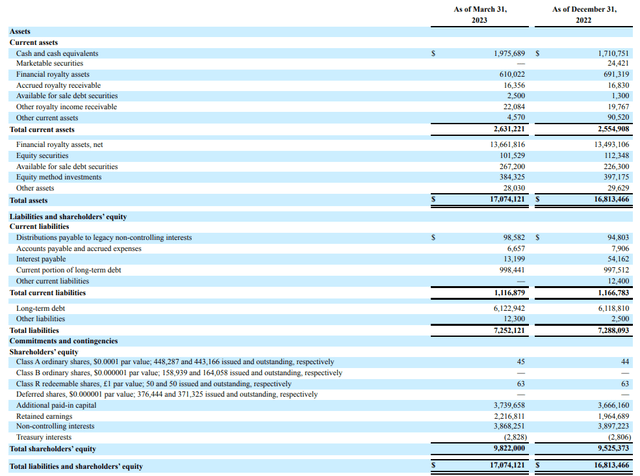

It’s good to see the company is also committed to its current quarterly dividend of $0.20 per share on a quarterly basis. The annualized dividend of $0.80 per share requires Royalty Pharma to fork over about $360M per year on dividends paid on the Class A shares (the company also has Class B shares which also have one vote per share but the dividend rights of the B-shares are different. The A-shares are the share class that’s listed on the exchange and that’s also where my focus is. There currently are just under 450M A-shares outstanding. There also are about 158M B-shares which are convertible into A-shares using a simple 1 for 1 conversion.

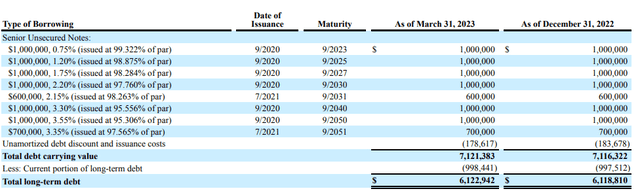

I’m pleased to see the strong cash flow guidance as that increases the potential of the debt securities that are currently outstanding. Royalty Pharma took advantage of the low interest rates on the financial markets and most of its senior notes have very low coupons which means the bonds are currently trading at a discount to their principal value.

Royalty Pharma Investor Relations

The September 2025 note for instance has a coupon of just 1.2% and currently trades at just under 90.5 cents on the dollar. This means the yield to maturity of that security is approximately 5.85% which definitely isn’t bad for a debt security with a 2 years and 1 quarter term left. The September 2031 note with a 2.15 coupon is currently trading at less than 80 cents on the dollar for a yield to maturity of approximately 5.40%.

As of the end of Q1, Royalty Pharma had about $2B in cash and a net gross debt position of approximately $7.1B for a net debt level of $5.2B. While that sounds high, keep in mind the company is currently collecting about $2B per year in after-tax normalized cash receipts from the existing royalty portfolio. If Royalty Pharma would stop buying new royalties and halt all dividends and share buybacks, its net debt would evaporate to zero within three years.

Royalty Pharma Investor Relations

And considering $2.7B of the debt (almost 40%) matures beyond 2031 you could play the ‘seniority by maturity’ game here. Given the strong cash flows, I have little doubt Royalty Pharma will be able to refinance the existing debt and I don’t mind having a closer look at any of the bonds maturing between now and 2031.

Investment thesis

I currently have no position yet in Royalty Pharma as I haven’t fully decided yet how I want to approach this company. The equity appears to be pretty appealing given the company’s strong cash earnings guidance for the 2022-2026 era, but the current dividend yield of just under 2.4% (the company pays a quarterly dividend of $0.20) is a bit on the lower end of the spectrum. I obviously like the decision to spend billions of dollars on the acquisition of new royalties, but if I wanted an income-focused idea, I may have to consider the bonds issued by Royalty Pharma.

I’m leaning towards writing put options on the common shares of Royalty Pharma in an attempt to get my hands on some stock at a bargain price. The P32.5 expiring in October could likely be written for an option premium of in excess of $1 (or at least that’s what I will aim for) while I could buy the senior notes for a YTM of in excess of 5%.

Read the full article here