Inter & Co (NASDAQ:INTR) is a Latin American fintech bank that has been showing enormous growth in the number of clients in the Brazilian market.

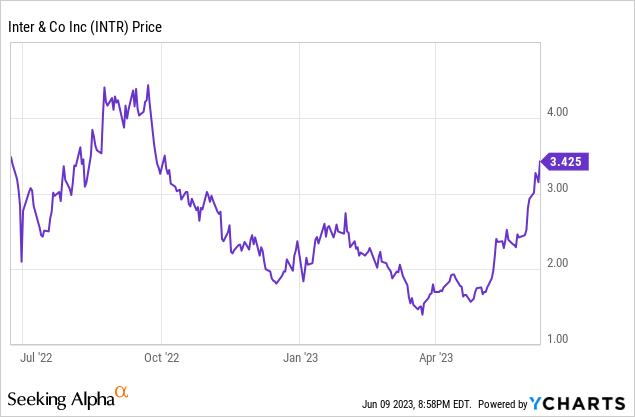

Since the company started trading on the Nasdaq, shares have fallen more than 50% until March of this year, being punished by a series of factors involving the unfavourable macro scenario for technology companies, lower liquidity, large shareholders selling their positions, as well as the broad market’s scepticism regarding Inter & Co’s ability to monetize its vast customer base.

The digital bank is still trading at much lower multiples compared to its peak two years ago, when it was not actively trading on the American stock exchange. The recent appreciation of the bank in recent months partially corrects the poor trading performance of the last two years, while still leaving room for more upside, in my belief.

Bold growth predictions

Earlier this year, João Vitor Menin, CEO of Inter & Co, shared with the financial sector an ambitious proposal for the digital bank, “60-30-30”. The plan involves reaching 60 million customers by 2027, achieving a 30% cost-to-income ratio (efficiency) and a 30% return on equity (ROE).

This level of growth could put Inter & Co. within five years on the same level as Brazil’s so-called “big banks”, such as the traditional Itau, Bradesco, and Santander – characterized by a robust credit portfolio.

Inter & Co is still 34 million customers short of its target for the next five years. The bank’s current 62% efficiency still needs to be halved. Also, ROE, which is currently negative, needs to grow by about 30%.

However, since Inter & Co decided to migrate from the Brazilian stock market (Ibovespa) to Nasdaq, shares had lost half their value to some extent from June last year to mid-March this year when they reached their all-time lows trading nearly penny stock levels.

But apparently, the American dream is reviving. Since its all-time lows trading on Nasdaq, shares of Inter & Co have soared as much as 133% breaking the $3 level.

Recession fears in Brazil calming down was one of the reasons for unlocking Inter’s shares value. As inflation shows signs of cooling in Brazil, internal pressure exists to lower the interest rate, currently at 13.75%.

But also, in its most recent quarter, Inter & Co reported earnings results that pleased the market. The fintech company increased the number of total clients by 41.5% and grew Q1 revenues by 22% YoY.

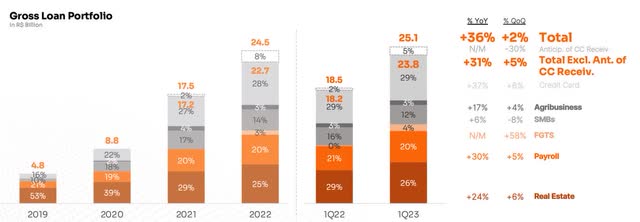

In addition, it reported for the second quarter in a row a net profit of $24.2 million. The big jump that pleased investors was regarding fintech’s credit portfolio, as its gross loan portfolio grew 36% YoY with revenues well distributed between credit cards, real estate, and payroll.

Inter & Co Investor Relations

The significant growth in the credit portfolio is an excellent sign for the bank as it needs to find methods to monetize its vast customer base and a good omen to proceed with your bold growth plans.

Valuations

Inter & Co is another case of a financial technology company that has experienced significant growth in recent years. For example, since its IPO in 2018, when it was still called Banco Inter, its customer base has grown from 1.4 million to 26 million. This substantial and quick increase in the customer base has caused the bank’s share price to rise more than 1000% between the IPO and mid-2021.

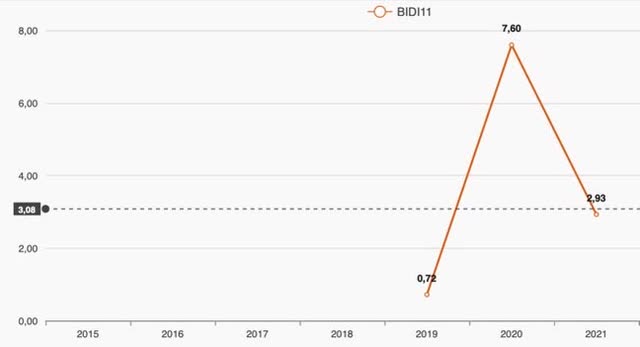

Although this accelerated growth has not resulted in losses for the bank, it has not resulted in profits. The comparison with the big traditional Brazilian banks had brought about considerable dissatisfaction in the company’s valuation, trading around seven times its price-to-book at its peak when it was still trading on the Brazilian stock exchange (Ibovespa) under the ticker BIDI11.

Banco Inter’s price-to-book value (Status Invest)

After the bank issued a follow-on, raising about R$5.5 billion in gross proceeds to beat the historical high, shares plummeted by an incredible 92% from June 2021 to the end of 2022.

However, Inter fundamentals have not necessarily worsened in this period. On the contrary, the bank increased its client base by 77% and maintained acquisition costs (CAC) close to R$30 on average. Amid this, Inter bought back 1.2 billion shares at R$19.35 in June 2022.

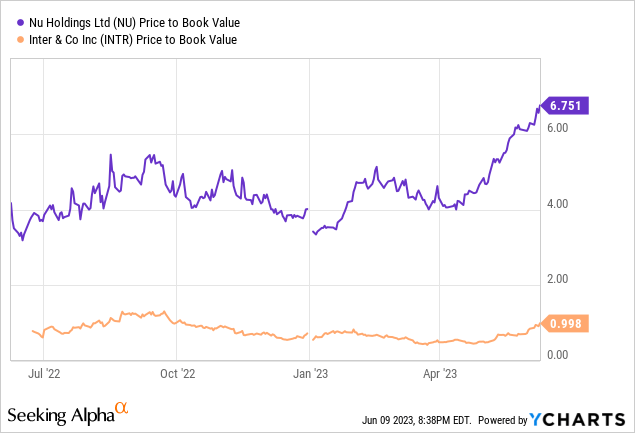

This steep drop had caused Inter & Co to trade at an extraordinarily discounted valuation relative to its historic peak when it debuted on the Nasdaq last year, selling at around one time its equity value and a price-to-book value of just 0.53 times.

Currently, with the rebound after Q1 earnings, valuation is less discounted than earlier this year, but still, it continues to trade at a price-to-book value of 0.91. Compared with its Brazilian fintech peer that trades in the U.S., Nubank (NU), Inter & Co trades at a price-to-book discount about six times lower, considering it has a customer base about three times smaller than Warren Buffett’s-backed fintech.

Assuming that Inter & Co manages to execute its 60-30-30 strategy, the bank projects to reach R$5 billion in profits over the next five years. This projection would imply that Inter & Co could reach a market capitalization of nearly $75 billion by 2027 – approximately $15 billion converted to USD, considering 1 USD = 0.20 BRL. Based on the current market cap of $1.3 billion, the bank would have roughly a 10-fold appreciation for the next five years with management’s plan well executed.

Considering the robust outlook for Inter & Co’s profitability growth for the foreseeable future, the consensus estimates for the next three years, until 2025, indicate Inter & Co’s earnings per share (EPS) of 0.41. This significant increase in EPS would imply a growth of about, 2150% compared to the reported EPS in 2022. As a result, the price-to-earnings (P/E) multiple for the end of 2025 would be at a modest 7.76 times.

Risks

Inter & Co has overgrown in recent years, and expanding its customer base will take more work. Because Inter & Co bases its growth strategy on fee waivers, it is relatively easy to attract customers by offering free services. However, monetizing them is a more complex matter.

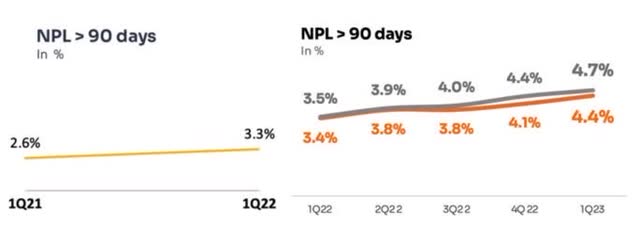

In their most recent quarter, Inter & Co witnessed the Non-Performing Loan (NPL) trend more than doubled in the last two years, increasing from 2.6% in Q1 2021 to the current rate of 4.3%. This increase implies a deterioration of Inter & Co’s creditworthiness, particularly concerning as the company is pursuing initiatives to expand its credit portfolio.

Inter & Co Investor Relations

Moreover, with the global economy entering a period of economic slowdown, growth is likely to be further hampered, and there is a greater likelihood of defaults on commercial loans.

The Brazilian economy’s high-interest rate scenario should continue for a while at high levels – the Brazilian Central Bank’s projection is 9% by 2025 – this could raise defaults to much more dangerous levels. On the other hand, high-interest rates also constitute a relatively favourable scenario for Inter & Co, since the bank can raise funds at lower speeds and lend at higher rates.

The Bottom Line

Inter & Co presents a strong growth potential from now on, guided by a bold growth strategy by the bank’s management.

Although the forecast that Inter & Co will reach 60 million clients and R$ 5 billion in profits over the next five years is quite challenging, the bank has been taking significant steps, mainly due to the growth of its credit portfolio. And recent advances in its share price have confirmed an implied turnaround in the confidence of foreign investors.

On the other hand, the global economic slowdown scenario should impose extra challenges for Inter & Co to expand and monetize its clientele more efficiently.

Still, I see the bank’s current trading valuation at a price-to-book value almost 30 times below its historical peak, which is attractive, especially considering its predicted growth potential.

Read the full article here