Introduction

Intellia Therapeutics (NASDAQ:NTLA) is a foremost clinical-stage company specializing in genome editing via CRISPR/Cas9 technology to create potential cures. Their robust platform enables them to develop in vivo therapies for genetic diseases and ex vivo therapies for immune and autoimmune disorders. Possessing a rich scientific, technical, and clinical background along with a strong IP portfolio, Intellia exploits the potential of CRISPR/Cas9 to create novel genetic medicine classes.

In recent news, Intellia has shared encouraging Phase 1 data for NTLA-2002, demonstrating its potential as a treatment for Hereditary Angioedema (HAE).

In this article, we will analyze Intellia’s Q1 financial report, examine the HAE data, discuss the upcoming Phase 2, and offer an investment analysis along with a recommendation.

Q1 2023 Financials

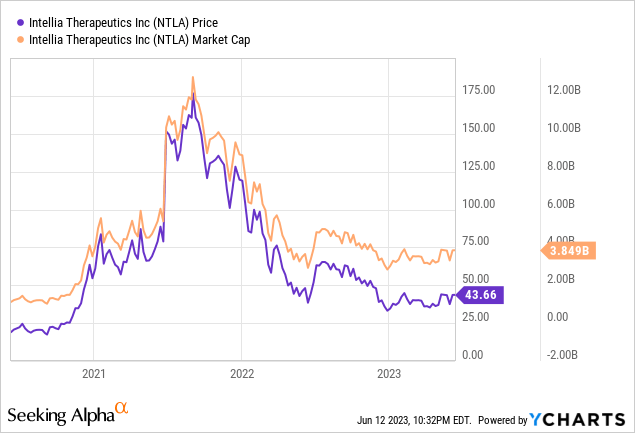

Let’s first review the company’s most recent financial report. As of March 2023, Intellia Therapeutics had a cash position of $1.2 billion, a decrease from $1.3 billion in December 2022, primarily due to operational expenses. This was partly offset by interest income, reimbursements, net equity proceeds from the ATM program, and employee stock plan proceeds.

Collaboration revenue rose by $1.3 million to $12.6 million in Q1 2023. R&D expenses fell to $97.1 million, mainly due to a $56.0 million cost associated with the acquisition of Rewrite Therapeutics in 2022, counterbalanced by an increased expense of $20.0 million for lead programs and staff expansion. R&D also included $16.9 million of stock-based compensation.

G&A expenses rose by $5.0 million to $27.4 million in Q1 2023, largely due to a $2.1 million increase in stock-based compensation, which totaled $10.3 million.

The net loss for Q1 2023 was $103.1 million, a reduction from $146.9 million in Q1 2022.

NTLA-2002: Promising HAE Treatment with CRISPR Technology

NTLA-2002 is an exclusive investigational therapeutic candidate from Intellia, employing CRISPR technology to inactivate the KLKB1 gene responsible for producing the prekallikrein protein. As Intellia’s second investigational systemic CRISPR therapeutic, it edits disease-causing genes within the body with a single intravenous infusion. Intellia uses a non-viral platform using lipid nanoparticles to deliver a two-component genome editing system to the liver. This system comprises guide RNA targeted at the disease-causing gene and messenger RNA encoding the Cas9 enzyme, executing the precise editing.

The Phase 1 study for NTLA-2002 demonstrated a significant reduction in HAE attack rates and plasma kallikrein protein levels. The treatment showed an average 95% reduction in monthly attack rates across all patients, which was long-lasting with patients having attack-free durations of about a year or more.

Patients who achieved over a 60% reduction in plasma kallikrein levels remained completely attack-free, suggesting the treatment’s effectiveness. One patient who did not reach this reduction target experienced a mild HAE attack, indicating lower effectiveness below this target.

Significantly, six patients on long-term HAE prophylaxis medication discontinued their treatment after receiving NTLA-2002 without experiencing subsequent attacks. Furthermore, plasma kallikrein reductions were robust and persistent, indicating the treatment’s long-term effectiveness.

NTLA-2002 was well-tolerated at all doses with no serious adverse events, indicating a good safety profile.

In conclusion, these results highlight NTLA-2002’s promising efficacy and safety in HAE treatment. The treatment demonstrates potential for sustained attack prevention and significant symptom reduction, even in severe cases. Its good tolerability suggests a high safety level, possibly revolutionizing HAE management. Further insights will be provided by the ongoing Phase 2 trial.

NTLA-2002 Phase 2: Advancing HAE Treatment and Gene Editing Therapies

The completion of enrollment for the Phase 2 trial of NTLA-2002 later this year is a crucial milestone in its development, as anticipated by the management. In this phase, researchers aim to validate the observed effectiveness from the Phase 1 trial by including a larger patient population. They will also closely monitor safety and potential side effects. Furthermore, the dosage will be fine-tuned to optimize the drug’s efficacy while minimizing any potential adverse effects. This phase will yield more precise data on the effectiveness, potential benefits, and risks of NTLA-2002, which are essential for its further development and eventual regulatory approval.

The potential market opportunity for NTLA-2002 is substantial if it successfully navigates the clinical trial process and receives approval. HAE is a rare and life-threatening genetic disorder that is currently managed through long-term prophylaxis and acute attack medication. It affects 1 in 10,000 to 1 in 50,000 individuals globally. A curative treatment like NTLA-2002 could transform the HAE treatment landscape, offering potential benefits over current therapies, including reduced treatment frequency and potential attack prevention.

Moreover, as a CRISPR-based therapy, the success of NTLA-2002 could further validate the broader field of gene-editing therapies. This could open up opportunities for treating other genetic diseases, thus expanding the market potential beyond just HAE.

My Analysis & Recommendation

In conclusion, there are several important elements to weigh when considering an investment in Intellia Therapeutics. Their approach to leveraging CRISPR/Cas9 technology for gene-editing treatments is undeniably pioneering. The encouraging clinical trial results of their experimental treatment, NTLA-2002, signal a significant milestone in the management of HAE.

The substantial reduction in HAE attack rates coupled with the persistence of plasma kallikrein reductions represent a strong proof of concept for NTLA-2002. The fact that these effects are achieved via a single intravenous infusion adds to the treatment’s potential value proposition by enhancing patient convenience and adherence to the therapy.

Moreover, the drug’s positive safety profile thus far further builds its case for potential approval and eventual commercialization. Still, investors should stay attuned to the Phase 2 trial’s results, which will be instrumental in securing regulatory approval and determining the therapy’s broader market applicability.

From a financial perspective, Intellia’s current cash position of $1.2 billion should support continued research and development efforts. However, given the decrease from the previous quarter, vigilant monitoring of their financial health is warranted. Notably, Intellia’s diversified pipeline and their robust intellectual property portfolio could help mitigate risk and potentially unlock additional revenue streams.

Regarding the potential market opportunity, if NTLA-2002 successfully navigates the remaining clinical trials and receives approval, the HAE market presents a sizeable niche. This therapy’s innovative approach could radically disrupt the current management of HAE, supplanting long-term prophylaxis and acute attack medication with a potentially curative treatment.

Simultaneously, a successful outcome could validate the broader applicability of CRISPR-based therapies, potentially expanding the company’s market reach to other genetic disorders. Nevertheless, investors should balance this growth potential against the inherent risks and uncertainties of drug development.

In conclusion, taking into account the promising data, the robust cash position, and the significant potential market opportunity, I believe this is a “buy signal” for investors. The substantial evidence of NTLA-2002’s effectiveness and the overall financial health of the company indicate that Intellia Therapeutics represents an attractive investment opportunity. That said, it’s crucial to continuously monitor the progress of clinical trials and financial metrics to adjust the investment strategy as necessary. Remember, investment in biotechnology is a long-term game that requires patience and a keen understanding of scientific advancements.

Risks to Thesis

When the facts change, I change my mind.

There are several key risks that investors should consider while evaluating the ‘Strong Buy’ recommendation for Intellia Therapeutics stock:

-

Clinical and Regulatory Risk: The successful commercialization of NTLA-2002 and other drug candidates depends on the outcomes of clinical trials, and subsequently, regulatory approval. There is always a risk that the drug may not perform as expected in later stages of trials or may not gain approval from regulatory bodies like the FDA or EMA.

-

Market Adoption: Even with successful regulatory approval, there’s a risk that the drug might not gain acceptance in the medical community or among patients due to factors such as cost, perceived efficacy, or safety concerns.

-

Financial Health: While Intellia has a strong cash position, its increasing R&D and G&A expenses could strain its financial health if revenues or additional funding do not materialize as expected.

-

Competition: The gene-editing field is rapidly evolving with many players. If a competitor develops a superior or more cost-effective treatment, it could hamper Intellia’s market share and profitability.

-

IP Litigation: CRISPR technology has been the subject of numerous intellectual property disputes. There’s a risk that Intellia could become embroiled in such disputes, which could impact its ability to commercialize its treatments.

-

Ethical and Public Perception Issues: CRISPR gene-editing technology has faced ethical concerns, and public perception can impact the acceptance and regulation of such treatments.

-

Management Execution: Like all companies, Intellia’s success will also depend on its management’s ability to execute its strategy, manage its resources effectively, and navigate the complex biotech landscape.

Read the full article here