Introduction

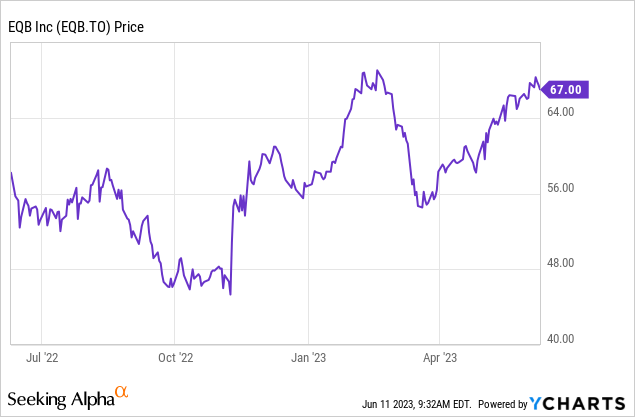

EQB (TSX:EQB:CA) (OTCPK:EQGPF) is the (relatively) new name of the Equitable Group which was the owner of the EQ Bank. This bank should be seen as one of the largest ‘challenger’ banks in Canada, but with a total balance sheet size of just C$52B after completing the recent acquisition of Concentra, it still is a fairly small player. Thanks to its online presence, EQB is able to keep its operating costs relatively low and that obviously helps to support the net income.

The first quarter of the year was very strong

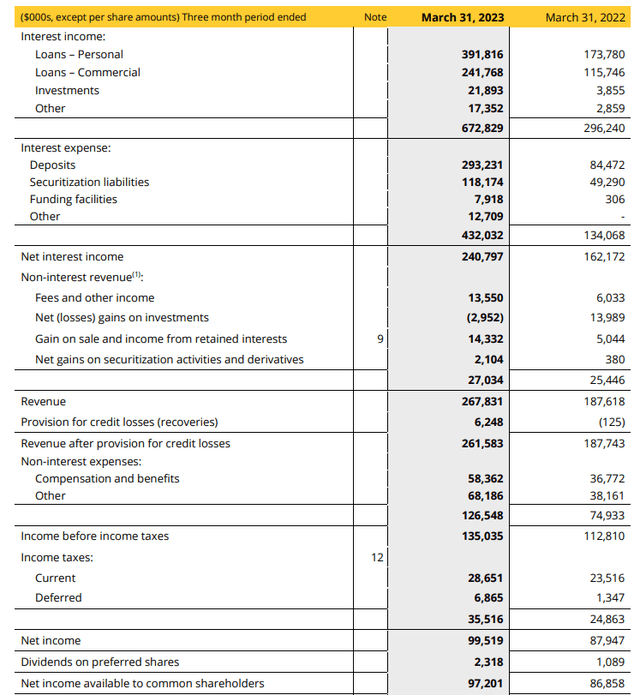

In the first quarter of this year, the total interest income more than doubled from C$296M to C$673M. This was partly due to the higher interest rates but obviously also due to adding in excess of C$10B in assets as part of the Concentra acquisition. This means it makes very little sense to compare the Q1 results of the current financial year with the Q1 results of 2022.

While the interest income increased, the interest expenses obviously increased as well, by quite a bit: the total interest expenses more than tripled to C$432M.

EQB Investor Relations

Despite that sharp increase in the interest expenses, the net interest income increased by almost 50% to just under C$241M.

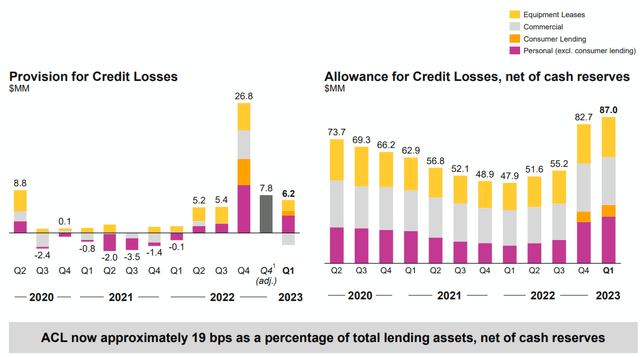

The bank also reported a non-interest revenue of C$27M and a non-interest expense of about C$126.5M resulting in a net non-interest expense of approximately C$100M. After also deducting the (very low amount of) C$6.2M in loan loss provisions, the pre-tax income of the bank was C$135M in the first quarter of this year. EQB owed about C$35.5M in taxes, resulting in a net income of C$99.5M and about C$97.5M of that result was attributable to the common shareholders of EQB as the total cost of the preferred shares was approximately C$2.3M.

The total EPS was C$2.58, which means that on an annualized basis, EQB is getting closer to reporting a double-digit EPS result. Perhaps that won’t be the case yet for the current financial year, but I wouldn’t be surprised to see an EPS north of C$10 in 2024.

What about the balance sheet after the recent acquisition?

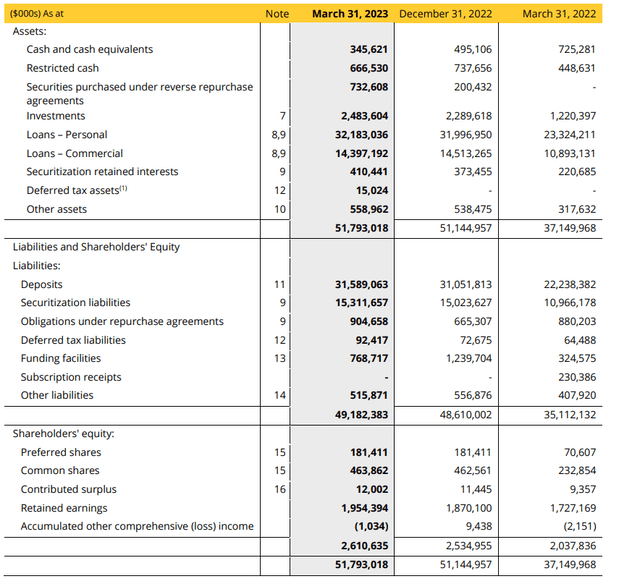

EQB should not be impacted by the same issues some of the smaller banks in the USA are dealing with. As you can see below, less than 6.5% of the assets are invested in securities (including the securities with reverse purchase agreements), and the vast majority of the assets is invested in personal loans and commercial loans.

EQB Investor Relations

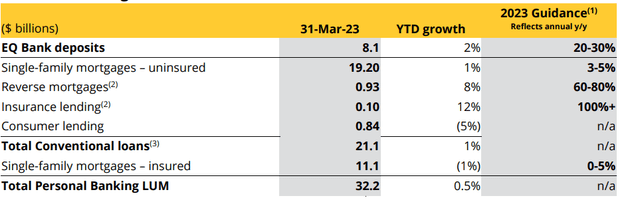

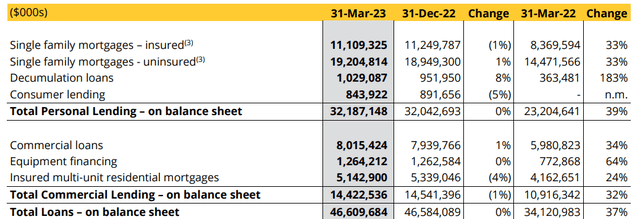

Let’s look at the personal loan book first. The vast majority of those loans are mortgages. As you can see below, the total amount of mortgages on the balance sheet is about C$30.3B of the C$32.2B loan book. A large chunk of those mortgages are insured which means the risk element is very low on that portion of the loan book.

EQB Investor Relations

So, all things considered, I am not too worried about the ‘personal loans’. The C$14.4B in commercial loans also contain a substantial amount of insured mortgages, as well as about C$1.3B in equipment financing. As you can see below, the total amount of ‘real’ and uninsured commercial loans is just C$8B, that’s less than 16% of the total assets of the bank.

EQB Investor Relations

It’s important to emphasize EQB has virtually no exposure to offices. Less than 1% of the assets are related to lending for offices, and the LTV ratio in that segment is less than 60% (note: this is not the LTV at origination but based on the most recent appraisal value – EQB appraises commercial buildings once per year). The LTV ratio of the uninsured residential real estate is about 65%, which should be fine as well: even if there’s a sudden economic shock with a 30% reduction in real estate prices across the board, EQB will still be able to keep its losses very limited (but it would create headaches, that’s for sure).

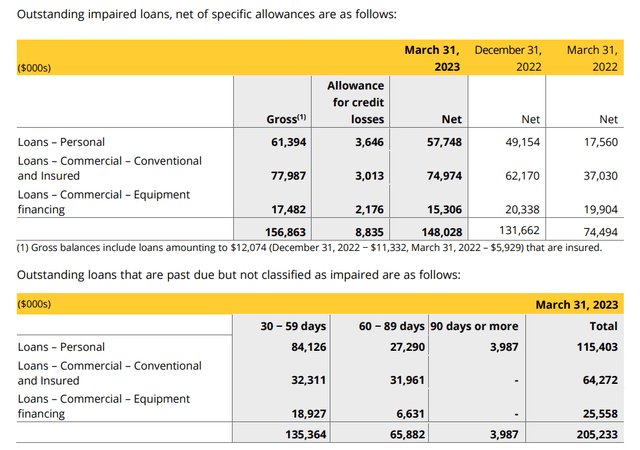

As of the end of March, the bank had about C$148M in impaired loans on the balance sheet while an additional C$205M in loans were more than 30 days overdue. Only C$70M of those overdue loans have been overdue for more than 60 days.

EQB Investor Relations

On its conference call, EQB made it clear it expects its provisions for loan losses to remain stable (and increase along with the size of the loan book). And surprisingly, the bank was also able to record a C$2.3M recovery on a previously impaired commercial loan. That’s good news as it could indicate the bank is applying a rather conservative stance when it comes to dealing with riskier loans.

EQB Investor Relations

I also think the liquidity risk is pretty low for EQB. About half of the deposits consists of term deposits – which improves the visibility as it’s not easy for customers to withdraw funds from term deposits – while a substantial portion of the deposits at EQ Bank are insured: the bank actually limits the deposit sizes to C$200,000 to avoid concentration risk and to ensure the majority of its customers fall under the current protection scheme. This greatly reduces a run on the bank and allows the bank to ‘match’ deposits and loans versus banks that rely more on savings accounts. Additionally, the bank is the largest securitizer of insured multi-residential assets so the risks related to a portion of the loans are transferred to the buyer of those securities. This does however mean that a larger portion of the uninsured loans remains on the books of EQB.

Investment thesis

As of the end of March, EQB had about C$2.2B in tangible book value attributable to its common shareholders (this excludes the intangible assets and goodwill but includes the fair value of derivative instruments) and divided over 37.7M shares outstanding, the tangible book value is about C$59/share. As the bank will generate close to C$10/share in earnings and as it will pay out less than C$1.5/share in dividends (based on the recently hiked dividend), we can be sure about C$8/share will be retained on the balance sheet. Which means the TBVPS will likely increase to north of C$70/share by the end of next year (barren any unforeseen circumstances).

The low dividend payout ratio also means EQB can shift gears pretty fast in case the economy takes a turn for the worse: the normalized pre-tax and pre-loan loss provision income of in excess of C$140M per quarter (excluding future synergy benefits from the Concentra acquisition) could immediately be used to cover substantial provisions and losses without needing an emergency capital raise. With a CET1 ratio of 14.0% at the end of Q1, the bank is well-capitalized.

I currently have no position in EQB’s common shares or preferred shares, but I am keeping an eye on the 5-year resettable preferred shares which are currently yielding approximately 6.5%. These shares will see a reset in the interest rate in the second semester of next year, and based on the current 5-year Canada government bond yield, the preferred shares would start yielding north of 9%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here