Paychex Inc. (NASDAQ:PAYX) provides integrated human capital management solutions for human resources (HR), payroll, benefits, and insurance services for small to medium-sized businesses in the United States, Europe, and India.

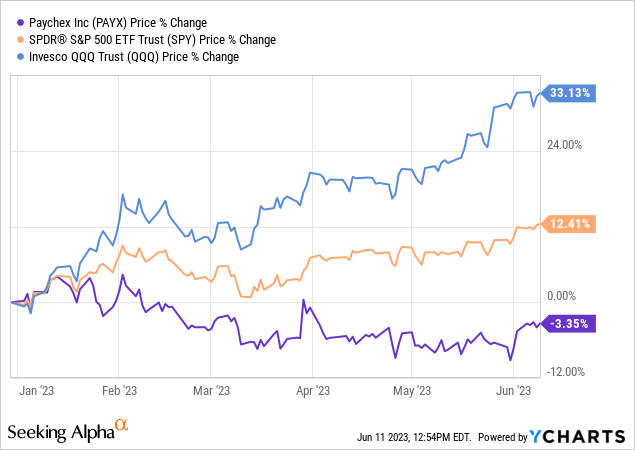

Year to date, the stock has underperformed the overall market by declining more than 3%, while the SPY has gained 12% and the QQQ has gone up by more than 33%.

Despite the underperformance, we believe that PAYX’s business may look attractive to many investors, mainly due to its profitability measures, its efficiency and its dividend history.

In today’s article, we will be elaborating exactly on these three points to try to determine, whether an investment now in PAYX could be a good idea or not.

Net profit margin

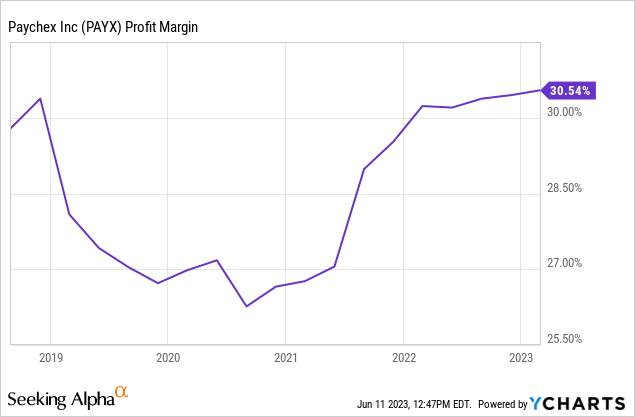

Let us start our discussion with profitability. To assess the firm’s profitability, we will be looking at the net profit margin, which is the ratio between the net income and the revenue. The following graph shows PAYX’s net profit margin over the past 5 years.

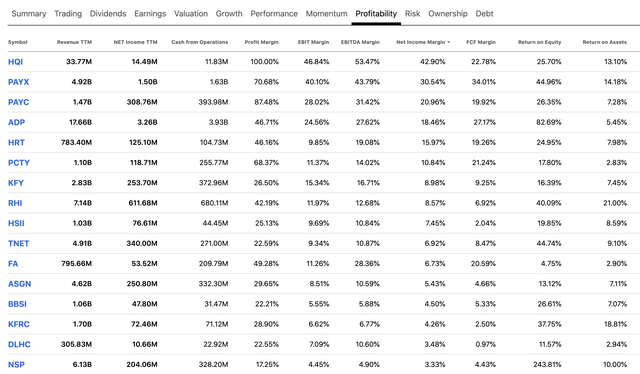

Since mid-2020, PAYX’s profitability has been gradually increasing, reaching above 30% in 2022. Comparing PAYX to its peers and rivals in the human resources and employment services industry, the firm appears to be quite attractive. According to most of the profitability metrics, including the net profit margin, return on equity, return on assets, EBITDA margin, Paychex’s metrics compare favourably to those of the others.

Comparison (Seeking Alpha)

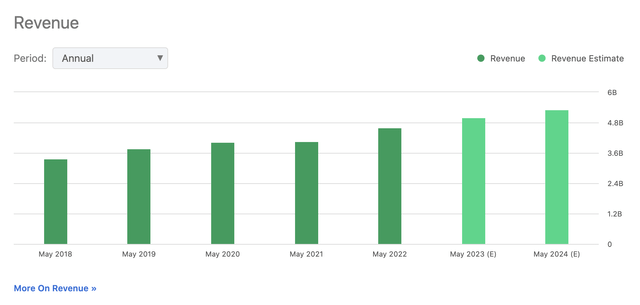

Looking forward, analysts are expecting both revenue and net income to keep increasing in the coming years, and the net profit margin to keep expanding.

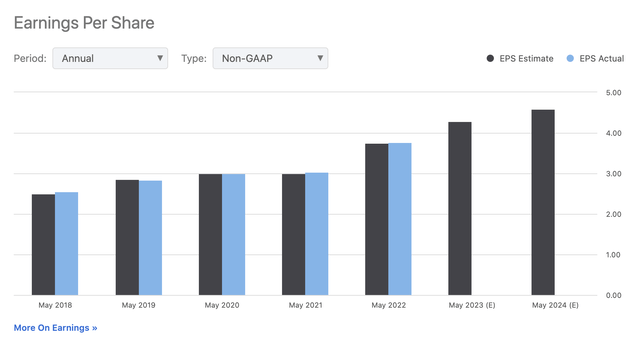

Revenue forecast (Seeking Alpha) EPS forecast (Seeking Alpha)

At this point, however, we have to understand the uncertainties with regards to these forecasts.

The products and services offered by PAYX are employment and HR related. Meaning that the health of the job market and the overall economy can have a substantial impact on the financial performance of the company, and therefore also on its net profit margin.

As of now, the status of the job market looks stable, but the possibility of a recession in the near term is not off the table. We will present here some economic indicators that show the current condition of the job market, but we cannot forget that these indicators are likely to be lagging the overall economy.

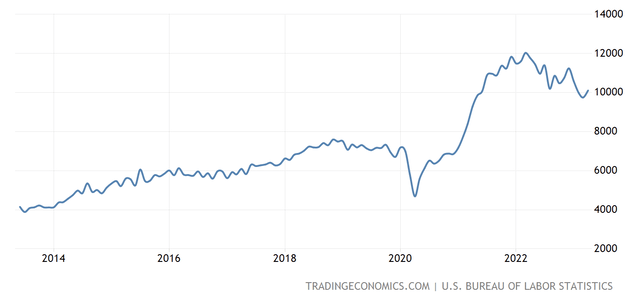

1. Job openings

U.S. Job openings (tradingeconomics.com)

The number of job openings in the United States remain substantially higher than pre-pandemic.

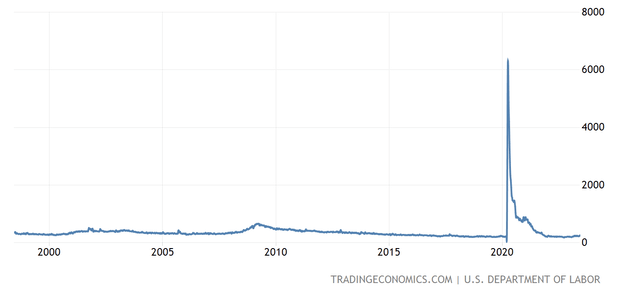

2. Initial jobless claims

Initial jobless claims (Tradingeconomics.com)

The number of initial jobless claims have been slightly increasing in the past year, but the figure is still far away from 2008 levels.

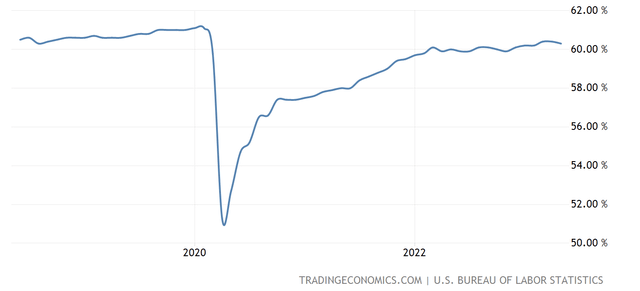

3. Employment rate

Employment rate (Tradingeconomics.com)

Employment rate has also not been showing any signs of deterioration so far, and has been hovering just above 60% in the past months.

We also have to mention that PAYX is not only operating in the United States, but also in Europe and India, making the firm less reliant on the U.S. economy overall, which is definitely a plus. Most of PAYX’s peers operate in the United States only, including TriNet Group (TNET), Paycom Software (PAYC) or Paylocity Holding (PCTY). In our view, this is an important differentiator.

Also, the decline of the USD index from its peak in 2022 can have a positive impact on PAYX’s margins on a YoY basis, as we do not expect the FX environment to worsen in the near future.

USD index (Investing.com)

Overall, we believe that the firm could be an attractive candidate from a profitability point of view.

Asset turnover

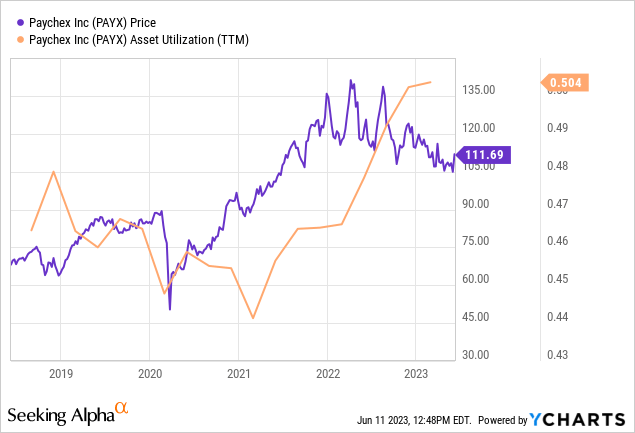

Asset turnover or asset utilisation is a measure of efficiency. It measures, how effectively a firm can use its assets to generate revenue. This ratio has been gradually increasing since the beginning of 2021, indicating that the company has been becoming more and more efficient.

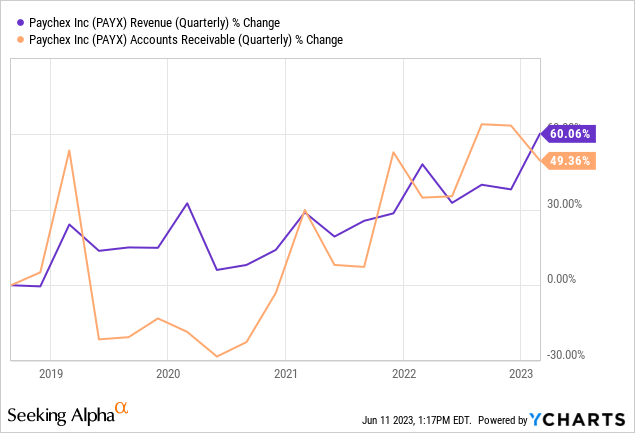

At this point, important to check, whether the firm has been trying to maybe manipulate its financial figures to exaggerate the sales. A simple way of checking this is by comparing the change in accounts receivable to the change in revenue. If accounts receivable increase at a much faster rate than the revenue, it could be a warning sign. Fortunately, it is not the case for PAYX.

This metric has also been an important contributor to the overall improvement of the firm’s return on equity.

Equity multiplier

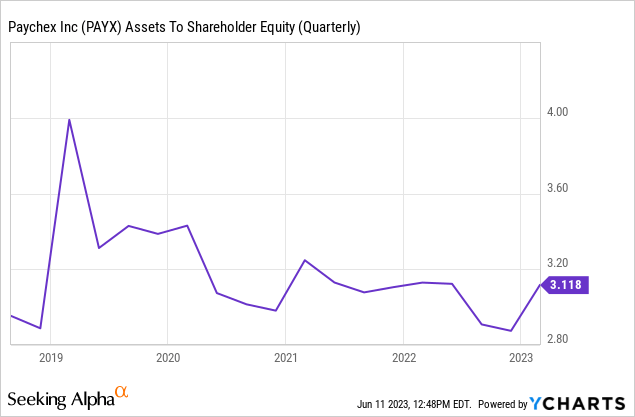

Last, but not least, we will take a look at the firm’s capital structure and its change over time. The chart below shows the equity multiplier, which indicates how much of the total assets are supported by equity. Since mid-2020, this figure has been relatively stable. In our view, this is a positive indication that the firm has not been financing its growth by taking on more debt.

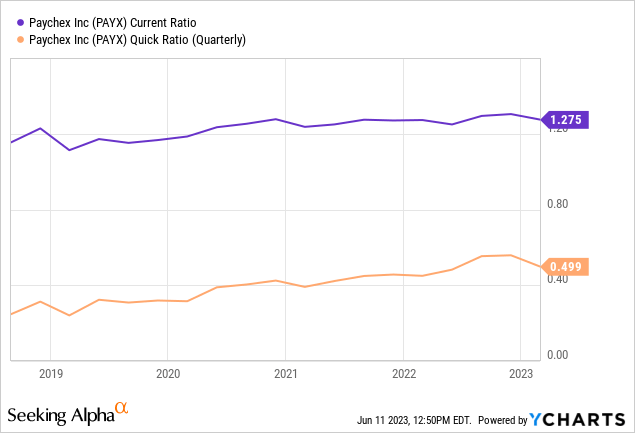

Also, when looking at the firm’s liquidity, primarily the current- and quick ratio, it has been also improving gradually.

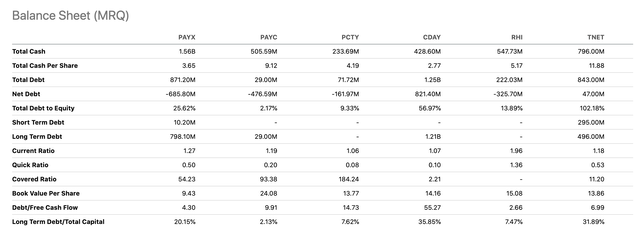

While the quick ratio appears quite low (in general we like both the current- and the quick ratio to be above 1), it does not compare unfavourably to that of its peers.

Comparison (Seeking Alpha)

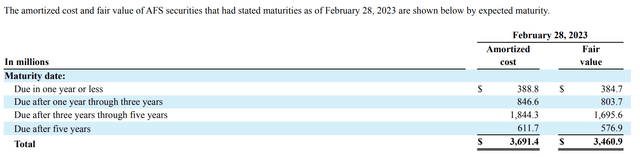

Further, we need to note that one of the primary risks listed in the firm’s Q1 earnings report is related to debt and the level of interest rates. The following table summarises PAYX’s debt maturities.

Maturities (PAYX)

We can see that a large portion, about 50%, will mature in 3 – 5 years. If the interest rates were to remain elevated until then, it could have a significant impact on the company’s cost of capital, and therefore on the required rate of return. We, however, believe that based on the current state of the economy and the slowing pace of the rate hikes by the Fed, in 3 – 5 years interest rates are likely to be somewhat lower than today.

Return to shareholders

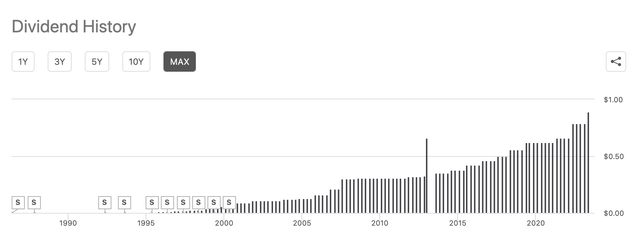

Now that we have discussed profitability and efficiency, let us move on to a different topic, namely the dividends and the share buybacks. PAYX has a relatively long history of dividend payments, and they have also managed to increase these payments in most years.

Dividend history (Seeking Alpha)

Recently, they have hiked their dividends by as much as 13%. The current annual dividend is $3.56 per share, equivalent to a yield of 3.2%.

While the firm’s payout ratio is relatively high, about 79%, we believe that the recent dividend hike shows the firm’s confidence in being able to cover the payouts in the coming quarters. Also, it is not uncommon for PAYX to pay out a large chunk of its earnings in dividends. For these reasons, we do not believe that the dividend is in danger in the coming quarters. Further, the firm also did not cut or pause its dividends in 2007 – 2008 during the financial crisis, which also shows the company’s commitment to returning value to the shareholders.

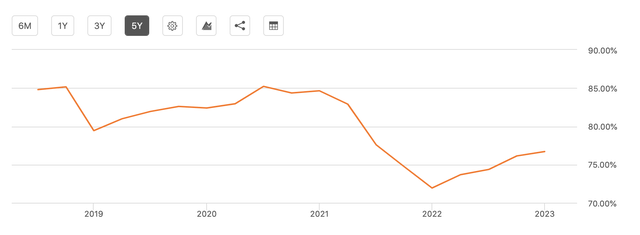

Dividend payout (Seeking Alpha)

Another component of return to shareholders is the share buyback. In PAYX’s case, however, it is negligible. The number of shares has decreased by only about 1.5% over the past decade, which definitely cannot be described as a significant source of return.

Number of shares outstanding (Seeking Alpha)

Valuation

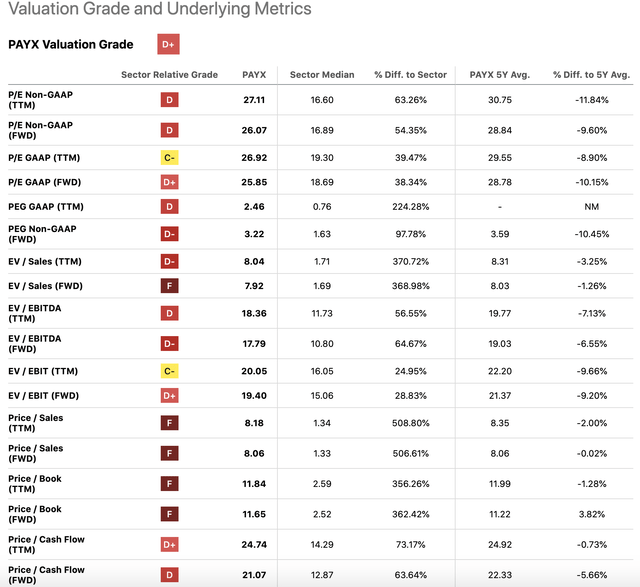

To conclude our writing, we will take a brief look at a set of traditional price multiples to gauge whether PAYX’s are valued fairly at the current price or not.

Valuation metrics (Seeking Alpha)

According to most of the metrics, PAYX’s stock appears to be trading at a significant premium to the industrials sector’s median. On the other hand, compared to its own 5Y averages, PAYX is trading at a discount. We believe that in this case, the comparison to the sector median may be somewhat misleading, therefore we will compare the firm to some of its closer peers.

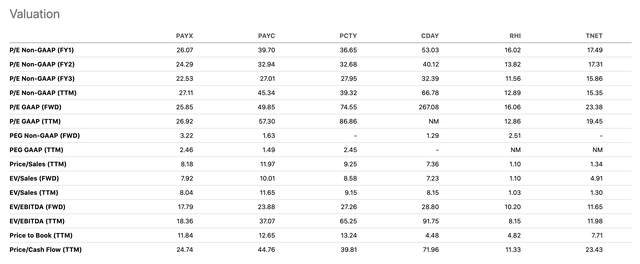

Comparison (Seeking Alpha)

According to this narrower peer group, the valuation already looks much better, and we cannot see a more than 50% deviation from the medians. In our opinion, this is a more representative and fairer comparison. The comparison to the industrial sectors as a whole may be distorted as the sector contains industries such as airlines, construction machinery and heavy transportation equipment, and electrical components and equipment, which are unrelated to the products and services provided by PAYX. Their valuations also tend to be different historically and for these reasons, in our opinion, the comparison to a narrower peer group is more representative and fairer.

All in all, we believe that PAYX could be an attractive “buy” at the current market price. While it is not a cheap stock by any means, it has outstanding profitability and efficiency measures as well as sufficient financial flexibility and liquidity, which justify the current price, in our opinion. The company also has a long history of increasing dividend payments, which can also make the stock attractive for dividend and dividend growth investors.

Read the full article here