It seems like every day, there are reasons for the market to hit a higher high. Much of this is driven by the tech sector, whose rich valuations and market-cap weightings hold an outsized influence over the rest of the stock index.

However, it remains a market for stocks, as a number of income stocks remain in value territory and trade well-off their 52-week highs. While it may be tempting to layer into office REITs for their high yields and cheap valuations at present, more risk averse investors may want to consider higher quality Apartment REITs that carry less headline risk.

This brings me to Essex Property Trust (NYSE:ESS), which remains reasonably attractive with a solid yield that’s well above the market average. I last covered the stock here in February, detailing its margin expansion, and in this article, I will discuss recent events and why the stock remains a quality yield in today’s volatile market.

Why ESS?

Essex Property Trust is a member of the S&P 500 (SPY) and owns high quality apartment buildings in high barrier to entry markets along the West Coast of the U.S. This includes 251 apartment communities comprising 62K apartment homes.

It’s also one of the oldest REITs on the market today, having been established in 1971 and perhaps unbeknownst to some investors, it’s a dividend aristocrat that’s raised its dividend for 29 consecutive years.

What makes ESS stand out is its presence in supply-constrained markets in California, with new supply of multifamily and for-sale housing historically increasing by less than 1% of existing stock on an annual basis. This is due to limited space and high cost of land, and the recent rise in interest rate only exacerbates this dynamic, giving established players like ESS more pricing power.

It appears that ESS is benefiting from its strong positioning, as its occupancy was 96.7% during the first quarter, up 70 basis points since the end of last year. ESS also grew Core FFO per share by a respectable 8.3% YoY during the first quarter. This was driven by same property revenue growth of 7.6% YoY and ESS continues to see margin growth due to lower expenses, with same-property NOI growing at a faster rate of 9.2% YoY.

This enabled ESS to raise its dividend by 5%, resulting in its 29th consecutive annual increase. The dividend is also well-protected by a 63% payout ratio. This is based on the midpoint of management’s Core FFO/share guidance, which was recently raised by $0.03 to $14.78.

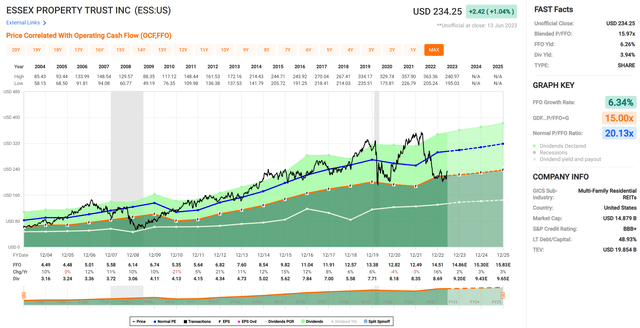

Headwinds to ESS include its higher valuation, which makes cost of capital less attractive. At the current price of $234, this equates to a 6.3% cost of equity, based on price-to-Core FFO/share of 15.8. Even if ESS were to issue debt at a ~4% interest rate, its weighted average cost of capital would be higher than the 4% market cap rate that management is seeing on new properties.

Nonetheless, management has the potential to unlock value through property dispositions at lower cap rates, and recycling capital into higher cap rates, should opportunities arise as they have in the past. Also, the existing property base should fare well, as the West Coast economies have produced solid job growth of 2.7% so far this year and tech layoffs have impacted only 16% of ESS’s markets.

Meanwhile, ESS maintains a strong BBB+ rated balance sheet with $1.5 billion liquidity. It also has no funding needs over the next 12 months and carries only limited variable rate debt exposure.

As such, investors may simply want to stay the course with this quality name, as the market should eventually pick up on the quality of this enterprise. At its forward P/Core FFO of 15.8, the valuation sits materially below the 20.1 historical level.

Even management thinks the stock price is too low, as it recently used the proceeds of a sale of a non-core property to repurchase shares on a leverage neutral basis. With the material undervaluation and solid portfolio NOI growth, ESS could deliver potential double-digit total returns for investors over the next 12-18 months.

FAST Graphs

Investor Takeaway

Essex Property Trust is a premium-quality REIT with an attractive 4% yield that’s supported by solid fundamentals and great dividend coverage. While there are some headwinds, such as higher cost of capital, I believe it may just be a matter of time before the market revalues the stock to its historical price, especially considering its strong NOI growth and margin expansion. As such, ESS stock could potentially deliver double-digit total returns over the next 12-18 months while paying investors a meaningful and growing dividend in the meantime.

Read the full article here