NIO (NYSE:NIO) may be Tesla’s (TSLA) nearest premium, pure-EV competitor. NIO is a unique vehicle manufacturer that has demonstrated its ability to build high-quality, luxury, pure EVs on a mass scale. The company delivered more than 31,000 vehicles in Q1. Moreover, NIO has the home-field advantage in China, the world’s most significant and by far most lucrative EV market globally.

NIO’s electric car sales increased by 31% YoY in April as the company’s sales continued to advance rapidly. Furthermore, NIO recently introduced its premium ET5 vehicle, which is already amongst China’s most popular selling premium sedans. The ET5 competes directly with the Model 3 in China and globally. NIO vehicles are available in Europe as the company gradually expands its international infrastructure and increases its market share outside China.

Why has the price dropped so much, people may ask? NIO is not a mature company. On the contrary, it is a start-up that successfully learned to design, build, and manufacture some of the best premium pure EVs on a mass scale. NIO has one of the most impressive EV lineups, supported by some of the industry’s most innovative technology and best infrastructure.

Despite its current lack of profitability, NIO has remarkable production potential, significant revenue growth prospects, and immense profitability potential. The company’s shares appear cheap, as the consensus analysts’ depressed estimates could be too low now. Furthermore, NIO’s stock is dirt cheap relative to its intermediate and long-term prospects. Therefore, NIO’s stock price should advance as the company continues expanding sales and improving profitability in the coming years.

NIO’s Stock Price – From Epic Drop to Recovery

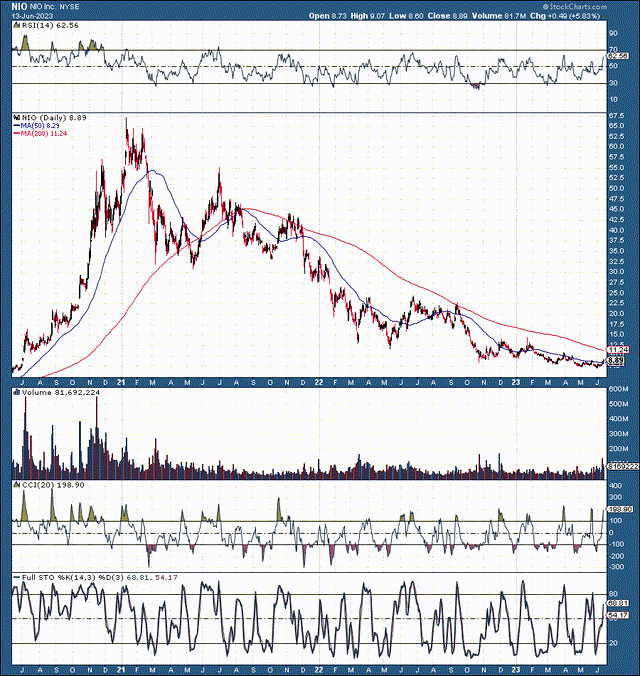

NIO (StockCharts.com)

Can I ask you a simple question? Would you have rather bought NIO’s stock at $30, $50, or $65, as it crashed over the last two years? Or buy NIO now, below $10 a share, as the stock is likely in the early stages of a long-term recovery. I want to own this stock now for several reasons.

NIO became highly overvalued and significantly overbought in late 2020 and early 2021. The Chinese bubble burst around the same time, and NIO’s stock declined by a staggering 90% (from peak to trough) in about two and a half years. With NIO’s stock bouncing around rock bottom, it is an excellent time to initiate a position or add more shares.

Technically, NIO’s long-term trend is improving. The stock likely bottomed, as we’ve seen the RSI making higher lows, and the 50-day MA will probably cross above the 200-day MA soon. This dynamic implies that NIO’s stock is stabilizing, momentum is improving, and the stock could be in the opening stages of another significant move in the coming years.

Robust Earnings Despite the Transitory Slowdown

Most of NIO’s sales still come from China, and the country faced significant issues with COVID-19. Harsh government lockdowns and significant restrictions caused NIO to decrease sales projections in previous quarters. While COVID-19-related concerns linger, China has relaxed its draconian zero-COVID policy.

However, this too shall pass, as it has in the West, for the most part. I don’t worry about catching COVID-19 because I am vaccinated, and I’ve had the virus. Also, this likely applies to most people, as COVID-19 is about as common as the seasonal flu or cold now. Therefore, China will get over COVID-19, and its economic slowdown should pass, leading to improved sales growth and profitability potential for NIO.

In NIO’s recent earnings report, the company announced Non-GAAP EPADS of -$0.36 in Q1, beating the consensus analysts’ estimate by $0.05. Revenue came in at $1.55B, slightly below estimates ($80 million), increasing by roughly 8% YoY. NIO delivered approximately 31,000 vehicles in the quarter, consisting of roughly 10,400 smart electric SUVs and 20,600 smart electric sedans, representing a 20.5% YoY increase. If we do the math here, we arrive at an ASP of approximately $50K per NIO vehicle. While the Q2 outlook is still cloudy, as the company expects to deliver about 25,000 cars, NIO’s situation should continue improving in the coming months.

Record Breaking Sales Approaching

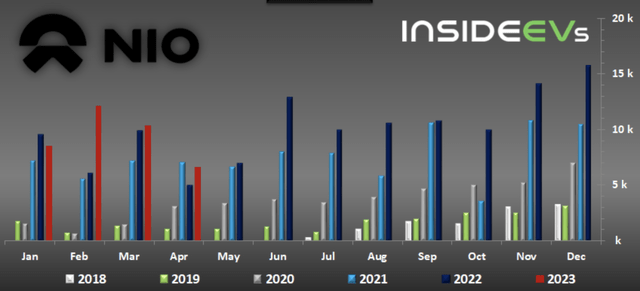

NIO sales (insideevs.com)

NIO’s sales have exploded in recent years. NIO sold minimal vehicles from 2018-2020. Yet, the company’s sales have surged since 2021. Moreover, NIO’s sales and profitability have been negatively impacted due to the transitory COVID-19-related problems in China and the temporary slowdown effect. As China stabilizes, NIO’s sales growth and profitability prospects should improve notably, leading to record-setting sales and substantially higher revenues in the coming years.

Here’s What the Analysts Think

Revenue estimates (Seekingalpha.com)

The average estimate on the street is around $9.3B in revenues this year. However, NIO should have a big H2 and could sell around 200,000 vehicles this year. Therefore, the company’s revenues could come in at $10B or more for the year, placing NIO’s price-to-sales valuation at a meager 1.5. NIO’s revenue growth could be 30-50% for several years, and the stock deserves a much higher P/S multiple. Lucid (LCID) has yet to prove it can effectively mass produce its premium pure EVs, yet it trades at five times forward revenue estimates vs. NIO’s one X.

NIO likely won’t become profitable for several years. Still, the stock deserves a higher P/S multiple as NIO has the potential to grow sales at double digits for several years, and it should begin showing profitability in 2025-2026. However, NIO’s valuation will not stay this depressed for long, and its stock will likely experience a multiple soon. Furthermore, higher-than-expected revenues, improving profitability, and multiple expansions should drive NIO’s stock price much higher in the coming years.

Here’s where NIO’s stock price could be in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue | $10B | $15B | $20B | $26B | $33B | $40B |

| Revenue growth | 40% | 50% | 33% | 30% | 25% | 22% |

| Forward P/S ratio | 1 | 2 | 3 | 3.2 | 3.3 | 3.2 |

| Market cap | $15B | $40B | $78B | $105B | $132B | $160B |

| Stock price | $9 | $24 | $47 | $63 | $80 | $96 |

Source: The Financial Prophet

Risks to NIO

Despite my bullish outlook, there are various risks to my thesis. Delisting concerns, geopolitical factors, and other detrimental elements related to China could continue to pressure NIO’s stock price. Also, the company could run into various production issues and may not reach the production capacity I envision in time. Moreover, NIO’s vehicles may experience a drop-off in demand, in which case the company’s share price would suffer. NIO remains an elevated-risk investment, but there is substantial reward potential if everything goes right.

Read the full article here