Toyota bZ4X on a road

The accusation by environmental groups and left-leaning media that Toyota Motor Corporation (NYSE:TM) has been shirking its environmental duties by dragging its feet toward an all-battery, all-electric future never had much credibility.

To the contrary, Toyota has proven itself to be on the forefront of sustainability, lately evidenced by the unveiling of its battery strategy in Susono, Japan, on June 12. Notable in Toyota’s strategy will be the rollout of batteries employing other than today’s standard lithium-ion chemistry, including a solid-state battery that promises to deliver about 900 miles of range on a single charge – which would be about three or more times what most batteries promise today.

Assuming Toyota’s solid-state battery performs as the automaker says it will – and rival automakers would be wise not to dismiss the claim as hyperbole – the industry may be forced very soon to rethink and switch its present reliance on the lithium-ion chemistry used today by Tesla (TSLA), General Motors (GM), Ford (F) and others. Naturally, rival automakers also are working on solid-state battery designs, mostly via investment in start-ups – though little information on their progress has been released.

No coincidence

The timing of Toyota’s announcement, just days before the company’s annual meeting of shareholders, was anything but random. On Wednesday, Automotive News reported:

“Toyota Motor Corp. shareholders backed the board and voted down the first resolution proposed in 18 years at an annual general meeting, an endorsement of the automaker after it laid out an extensive electric-vehicle strategy.

The resolution from three European asset managers called for greater disclosure on climate lobbying activity but was widely expected to fail given the strength of support for management.”

Shareholders also backed the Toyota’s 18 director nominees, even though two shareholder advisory firms had opposed the nomination of former-CEO Akio Toyoda as chairman on the grounds that he lacked independence. The advisory firms advocate for non-employees to serve on corporate boards in the interest of what they believe to be better governance.

Cynics will credit environmental activists with forcing Toyota to speed up its electrification program. As a regular attendee at Toyota press conferences, I can testify that the company has been holding clinics for years on its research and the need, in terms of business practicality, for multiple approaches to reducing carbon emissions.

More MPGs

Back in the day, carbon reduction was another name for improving fuel efficiency. When Toyota first unveiled the phenomenal Prius gas-electric hybrid in the late 1990s, environmentalists cheered its efficient gas mileage while rival car companies scoffed – yet Toyota stuck to its guns, spread gas-electric tech to most of its models and plans to keep using it.

Toyota will explain to anyone who cares to listen that the finite amount of minerals now available for battery manufacture can be used (1) to build a greater number of gas-electric hybrids with small batteries – or (2) a lesser number zero-emission vehicles with huge batteries. The amount of CO2 conserved by hybrids will be greater than that saved by fewer pure electrics. Another big plus for gas-electrics: no range limitation or need for recharging.

Executives at Toyota point out that they sell internal combustion vehicles in parts of the world such as Asia and Africa where no charging infrastructure exists. These include markets where automakers such as GM have exited.

While relying on its current technologies to generate cash flow and earnings, Toyota’s electrification strategy is to double the current battery range while halving the amounts currently being invested. The automaker’s first dedicated EV platform will debut in 2026 as a Lexus; by 2030 about 1.7 million vehicles will be built on this architecture.

More range, less cost

A next-gen lithium battery will arrive in 2026, Toyota said, with a range of 621 miles, said Kaiji Kaita, Toyota’s chief battery guru. The cost will be down 20% from current batteries and will charge from 10% to 80% charge in 20 minutes. That compares with the battery in Toyota’s bZ4X, now on sales, that offers 382 miles of range and a charging time from 10% to 80% of 30 minutes.

A lithium iron phosphate battery arrives in 2006-7 that will be 40% less costly; an advanced version arrives two years later with a further 10% increase in range. The first solid-state battery should begin service in 2027-28 with another 20% increase in range. Finally, an advanced solid-state battery “after 2028” with 50% more range or about 900 miles.

Toyota Motor

“We are determined to be the world leader in batteries,” Chief Technology Officer Hiroki Nakajima said. “We will need various options for batteries, just like we have different variations of engines. It is important to make these batteries compatible with any kind of model.”

Additionally, Toyota said it plans to radically alter its manufacturing protocol, stamping larger and fewer parts that can be assembled more efficiently, quickly and at less cost – similar to an initiative that Tesla announced in April at its investor day.

Unquestionably, Toyota would have preferred to keep the latest details and timetable regarding batteries and future electrification closer to the vest. The hostility from environmental groups and the shareholder initiative against Akio Toyoda, the former CEO and grandson of the founder, resulted in the company’s decision to show its cards. Toyota throughout its history has proven itself acutely responsive to criticism, even when such disapproval is seen by the company’s management as unjustified.

Sharper focus

Now that Toyota’s incremental strategy has been clarified as deliberate and certainly not an attempt to avoid electrification, investors may feel more confident the automaker is on the right track toward steady carbon reduction toward the goal of carbon neutrality by 2050 – in a manner that maintains financial growth and stability.

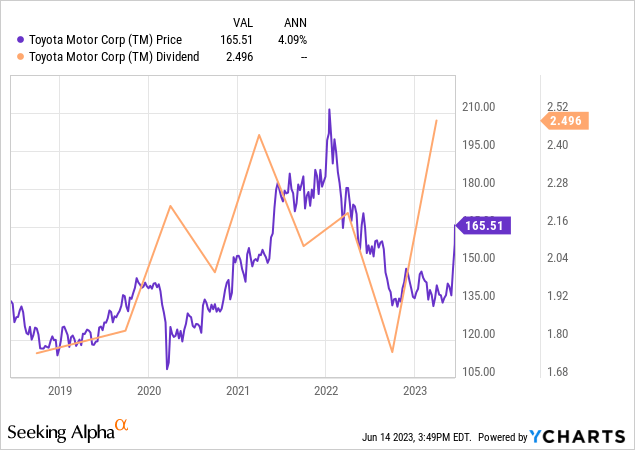

News from Toyota’s battery briefing followed by strong affirmation for management by Toyota shareholders helped push the company’s ADRs 10% higher in the space of two days. With the shares still well off their early January 2022 peak of about $201, TM still has room to run and remains an attractive holding for the long term.

Dividend yield currently stands at a shade under 3%.

SeekingAlpha’s Quant rating of 4.77 suggests it to be a strong buy – a consensus of Wall Street analysts rate it a buy as well. I own it and will buy more opportunistically.

Read the full article here