By Okan Akin, Markus Schneider

The Latin American crisis of the 1980s, the Mexican crisis of 1994–95 and the Asian Crisis of the late 1990s shared several underlying causes. In each case, economic stresses manifested in the financial sector, leading to fully fledged banking crises and investor panic. Mindful of those lessons, investors need to keep a weather eye open for new stresses, and to monitor a range of metrics to detect signs of possible trouble across the EM financial sector.

Measuring Risks for EM Financial Systems

Typically, these risk metrics fall into two categories. Macro/leverage metrics aim to identify macroeconomic pressure points and potentially excessive leverage within a country’s financial system. Financial metrics help monitor the balance sheet risks of the financial system, which determine its ability to withstand unexpected losses without causing systemic crises.

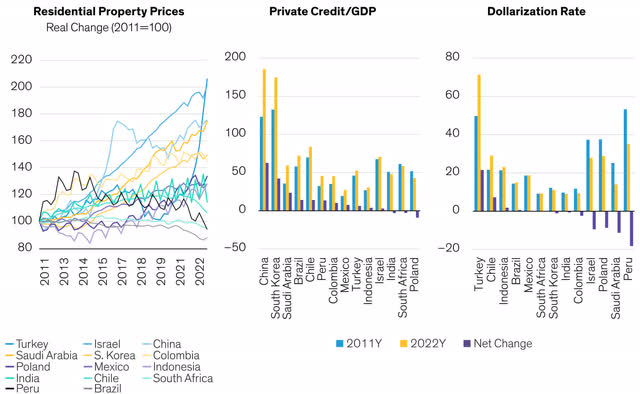

We find three macro/leverage metrics are particularly effective indicators across the full range of EM countries; these measures help highlight excessive borrowing, asset-price bubbles (especially in the real estate sector) and dollarization. Specifically:

Comparing movements in property prices (adjusted for inflation) helps assess the risk of possible asset bubbles developing.

Monitoring changes in private credit/GDP can show if the level of private sector borrowing is becoming disproportionately high.

Tracking the dollarization rate quantifies how much a country’s population has lost confidence in the local currency and has substituted hard currencies such as the US dollar instead (Display).

Macro Trend Changes Can Highlight Possible Dangers

Key Macro/Leverage Risk Factors for EM

As of September 30, 2022Source: BIS, International Monetary Fund, SNL, WB and AllianceBernstein (AB)

Financial metrics can also apply consistently across EM financial companies. For instance, key measures normally include the nonperforming loan, wholesale funding to total liabilities and gross loan to deposit ratios. But investors need to adjust for data inconsistencies. For instance, the definitions of nonperforming loans, liquid assets and net profits can vary across EM countries because of differing levels of regulatory forbearance measures and accounting systems.

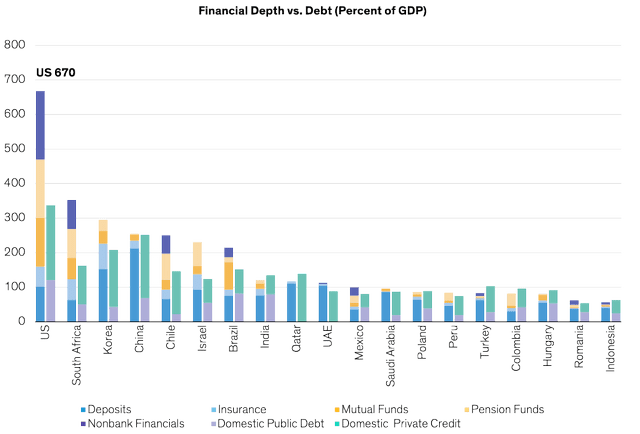

Financial Depth Is an Important Differentiating Factor

We believe that these metrics alone do not reflect the full picture, and that EM countries’ risk scores need adjusting for financial depth—the size of the financial sector relative to a country’s economy (Display).

Financial Depth Is an Important Factor

Depth Varies Considerably Across EM Countries

As of December 31, 2021Source: BIS, International Monetary Fund, SNL, WB and AB

Greater financial depth can increase a country’s ratio of local savings to gross domestic product and so improve liquidity for local assets—a potentially significant factor in averting contagion from economic events that impact global portfolio flows. Countries with greater financial depth may also be able to sustain larger public and private debt, have lower dollarization rates, and run lower risks of default on their sovereign debt.

By creating risk profiles based on macro/leverage and financial metrics, adjusting for financial depth, and comparing EM risk scores on a cross-country basis, investors can assess the extent to which countries’ securities prices and currency values reflect the prevailing risk levels of systemic financial crisis.

How the EM Countries Compare

In Europe, the Middle East and Africa, Turkey stands out as the highest-risk country. Notable risks include: a potential asset bubble from a significant rise in real estate prices; increased dollarization; and a relatively small financial system. By contrast, the South African financial system is the strongest in the region—a major positive for the country’s sovereign debt. South Africa benefits from significant financial depth, a banking system that has been deleveraging over the last decade and an absence of signs of any asset bubbles. Israel (high real estate prices) and Saudi Arabia (high private credit growth) both shows signs of overheating, but from a strong base.

In Latin America, Mexico and Brazil have strong and stable financial sectors, while Peru’s declining macro risks and long-term credible monetary policy are reflected in reduced dollarization.

Across Asian countries, China, India, Indonesia and Korea all seem to have stable financial systems. Although private credit levels are rising in China and Korea, we believe this is offset by the greater financial depth of their banking systems. India and Indonesia overall have stable systems, with no signs of overheating.

Emerging markets have come a long way since the 1990s, with many countries now benefiting from independent regulation and more proactive risk management. Although economic conditions can change quickly, for now financial sector risks across EM countries seem largely manageable. But as events in the US and Europe have shown, in an environment of tighter global liquidity conditions, investors need to stay alert for future signs of fragility.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Original Post

Read the full article here