The iBuying Investment Thesis Looks Speculatively Attractive Here

We have previously covered Opendoor Technologies (NASDAQ:OPEN) in November 2022. The property market’s highly cyclical nature and rising interest rates have not helped the iBuying company prove its AI/deep learning platform’s capabilities, with inventories building up then.

Since then, OPEN has already recorded an impressive recovery to $2.98 at the time of writing, up from the previous November 2022 price of $1.69 and the 52-week low of $0.92 in December 2022. While the stock may have been overly moderated then, it appears that the recovery is mostly attributed to its somewhat optimistic FQ1’23 results.

The iBuying company has reported revenues of $3.12B (+9.4% QoQ/-39.4% YoY), with improving gross margins of 5.4% (+2.9 points QoQ/-5% YoY), with the latter drastically expanded from the FQ3’22 levels of -12.6%.

This is on top of the intentional restraint visible in OPEN’s operating expenses of $292M (+11% QoQ/-30% YoY), naturally triggering the moderation in its net losses margins to -3.2% (+10.8 points QoQ/-3.7 YoY), in response to the uncertain macroeconomic outlook.

The same cadence is also witnessed in the moderating inventory of $2.11B (-52.6% QoQ/-54.7% YoY). This development is important since the management has made great efforts to improve the spread between its offers and expected listed prices, potentially improving its margins ahead.

Nonetheless, OPEN investors must also note that the company has reported up to $752M in inventory valuation adjustments over the last twelve months (+1,928% sequentially). This naturally highlights the widening demand/supply gap between the cooling property market thanks to the elevated interest rate environment and the red-hot prices during the hyper-pandemic period.

Then again, we are not certain how things may improve for the iBuying company in the short term, with the May 2023 CPI still showing rising inflationary pressure at +8% YoY for shelter prices.

While the Fed may have refrained from another rate hike in the recent FOMC meeting, Jerome Powell has guided the possibility of two more rate hikes in 2023, suggesting a terminal rate of between 5.5% and 5.75%.

30Y Fixed Rate Mortgage Average in the United States

Freddie Mac

This cadence implies a rising cost in mortgages, with the 30Y national average at 6.69% and average home equity loan rate of 8.48%, compared to the hyper-pandemic levels of 2.65% and 2019 levels of 4.1%.

The combination of sky-high property prices and elevated mortgage rates do not bode well for OPEN, in our view, due to the drastic increase in the median mortgage payment from $1.69K between 2017 and 2021, compared to $2.01K by October 2022 and up to $3.04K by early January 2023.

Depending on when the Fed pivots, likely only by 2024, we may see the iBuying company’s prospects remaining mixed, with its balance sheet likely to be further impacted. By the latest quarter, it recorded only $1.25B in cash/short-term investments (inline QoQ/-54.8% YoY), though with stable long-term debts of $3.59B (-9.5% QoQ/+17.3% YoY).

Then again, with $10.7B of asset-backed credit facilities at a time of tightened lending environment post-banking meltdown, OPEN is unlikely to run out of dry powder, potentially supporting its execution for the near term.

Maybe that is why the management has guided narrowing the next quarter’s adj. EBITDA losses of -$190M (+44.2% QoQ/-187.1% YoY), despite the impacted revenues of $1.8B (-42.3% QoQ/-57% YoY) at the midpoint, with the quarter likely to be the “last quarter of negative contribution margin.”

So, Is OPEN Stock A Buy, Sell, Or Hold?

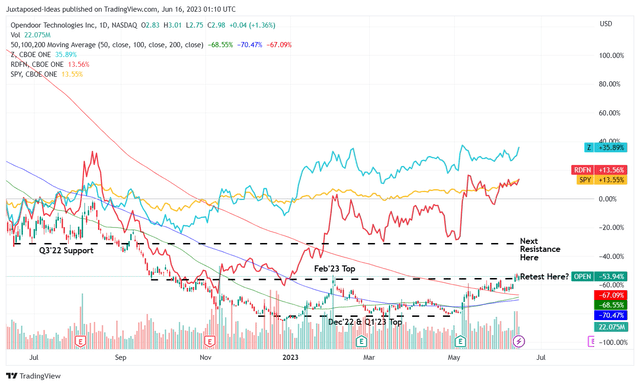

OPEN 1Y Stock Price

TradingView

As evidenced from the price chart above, OPEN has charted an impressive recovery since early May 2023, as similarly observed with other home-buying stocks, such as Zillow (Z) and Redfin (RDFN), at the same time. This cadence is impressive indeed, likely boosted by the sustained recovery of the SPY since October 2022, given the nascency of the former’s AI iBuying platform and the peak recessionary fears.

However, here is where we want to exercise caution, since the rising tide that lifts all boats may be deceptively buoyant due to external market forces, instead of OPEN’s growth prospects. Even if the stock market bull run has commenced, it remains to be seen when the property market may recover to normalized levels.

For now, the optimistic forward guidance suggests the management’s confidence in surviving a few more difficult quarters, significantly aided by the prudence in its inventory management and operating efficiency thus far.

Therefore, we are cautiously rating OPEN as a buy here. Nonetheless, it must also be highlighted that the stock remains a speculative play, since market analysts expect the company to only turn adj EBITDA positive by FY2025 and adj EPS positive by FY2027.

Therefore, investors that add here must be comfortable with moderate volatility while keeping the portfolio sized appropriately, due to the elevated short interest of 13.88% at the time of writing.

Read the full article here