DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Bear-Defying Tech Stock That Everyone Forgot To Pile Into

What was the best way to beat the 2022 bear? Be long energy? Sure. Short the Nasdaq? Absolutely. But what if you were a long-only tech-focused investor, and you didn’t like to abandon your happy place – you were toast, right? Well, that depends on whether you had the foresight to rotate your money into the lowest beta high beta stock on the Street, being Palo Alto Networks (NASDAQ:PANW).

We wrote up the company’s Q1 of FY7/23 back in November and rated the name at Accumulate (or ‘Buy’ if you prefer the one-and-done method!) – the stock was at $156 at the time. You can open that note at this link.

Cestrian Nov-22 PANW Note (Seeking Alpha)

This was a righteous call, as it turned out.

With the stock very close to our $250 price target, we now revisit the fundamentals and the technical story.

Numbers

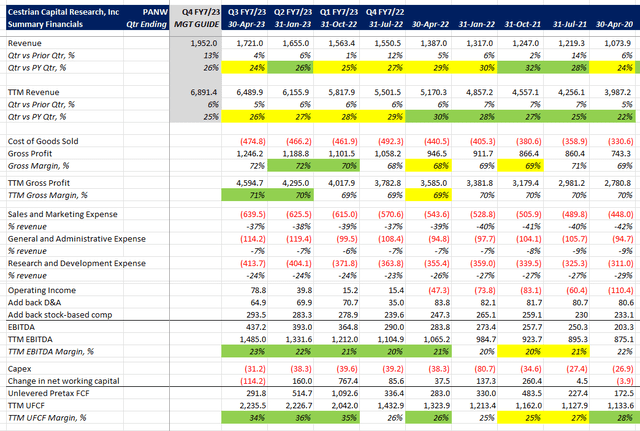

This company should be taught in business school as What Great Looks Like. Just look at the combination of these factors:

- TTM revenue growth of 26% on a revenue base of $6.5bn.

- Quarterly YoY revenue growth dropped only a little through 2022 – compare that to almost any other Big Tech name, all of which slowed dramatically.

- TTM EBITDA margins of 23%, and more impressively.

- TTM unlevered pretax free cash flow margins of 34%. (If you’re wondering how come cashflow exceeds EBITDA, itself an aggressive, management-friendly measure of profit? It’s because the capex is nothing and the working capital management is exceptionally good, driven by prepaid upfront customer contract terms).

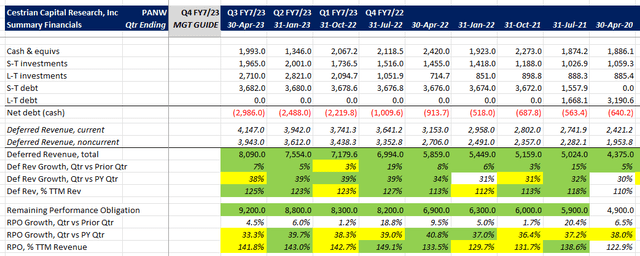

- Close to $3bn net cash on the balance sheet.

- Deferred revenue (= prepaid customer contracts, yet to be recognized as revenue of … $8bn! – being 1.25x TTM revenue).

- Remaining performance obligation (a superset of deferred revenue, it includes orders which have been placed but not yet invoiced or paid for) of $9.2bn, being 1.4x TTM revenue.

In short – rock solid growth, high cashflow margins, and revenue visibility from here to the event horizon.

PANW Fundamentals I (Company SEC Filings, YCharts.com, Cestrian Analysis) PANW Fundamentals II (Company SEC Filings, YCharts.com, Cestrian Analysis)

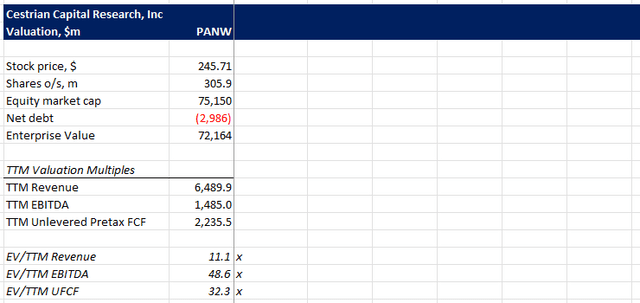

Valuation? It looks punchy as a revenue multiple – 11.1x TTM revenue for 26% TTM revenue growth. And nearly 50x TTM EBITDA, which is obviously nuts.

But 32x unlevered pretax free cashflow for this thing? You’ll pay 27x for a decent quality defense contractor like Northrop Grumman (NOC). So is 32x really a lot? We think not.

PANW Valuation (Company SEC Filings, YCharts.com, Cestrian Analysis)

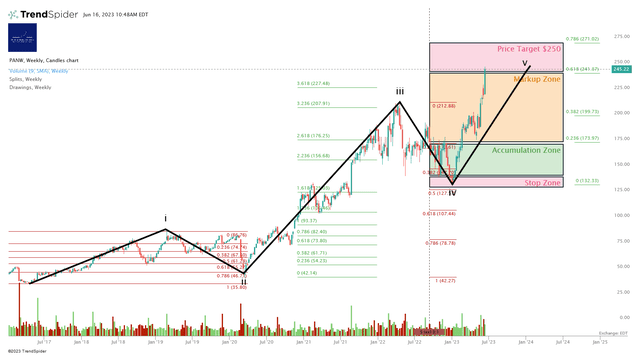

Technically, though, the stock has run, a lot. We rate the stock at Distribute (we use the Wyckoff Cycle motif – we explain all in this video). Our ‘Distribution Zone’ is defined by the lower and upper bounds of the .618 and .786 Fibonacci extensions of the prior Waves 1-3 combined, which for those who don’t speak hexadecimal is in essence just a common termination zone for the final move up in an impulsive 5-wave trend. Or in other words, a potentially meaningful high. You can open a full page chart, here.

PANW Chart (TrendSpider, Cestrian Analysis)

The Distribution Zone is where late buyers come to provide exit liquidity to the institutions that were accumulating at the lows. So don’t be surprised to see PANW crop up all over the financial media as a Killer Hot Tech Stock. You will make your own decision as always!

Cestrian Capital Research, Inc – 16 June 2023.

Read the full article here