This is my second Eiger BioPharmaceuticals (NASDAQ:EIGR) article following 02/2023’s “Eiger BioPharmaceuticals: The Results Are In – The CEO And The CFO Are Out” (“Results”). Since the publication of Results, in which I characterized Eiger as a “trader’s delight”, Eiger shares have dropped >50% from $2.22 to <$1.00.

In this article I discuss its prospects going forward.

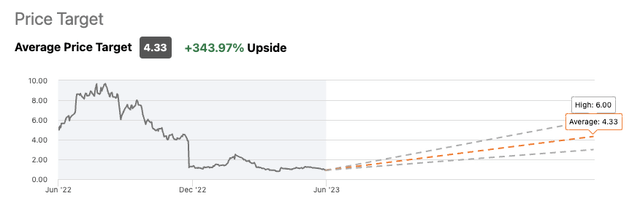

Wall Street Analysts have pegged Eiger as having >300% upside.

The three Seeking Alpha Wall Street Analysts covering Eiger have lined up with strong positive expectations for it. As shown below they have average price targets of $4.33 for a +343.97% Upside:

seekingalpha.com

This bullish perspective has held consistent for the entire three year period tracked on Seeking Alpha:

seekingalpha.com

The Wall Street Journal’s and Barron’s tracking of Eiger analysts is similar, albeit slightly more nuanced.

Counterbalancing this bullish perspective consider Seeking Alpha’s 06/15/2023 quant rating of strong sell. This has been holding steady for the entire year of 2023 ever since its 12/08/2022 70% drubbing following announcement of topline data from its Phase 3 D-LIVR study for lonafarnib.

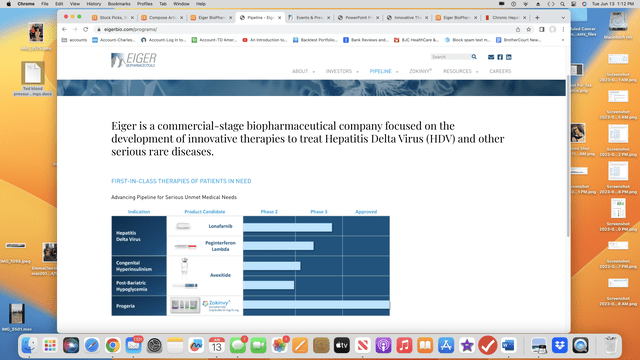

Eiger’s pipeline of marketed (1) and clinical (3) therapies is unremarkable.

General

Eiger’s pipeline graphic from its website lists a single marketed therapy and three clinical stage assets that it is developing:

eigerbio.com

Marketed therapy — Zokinvy

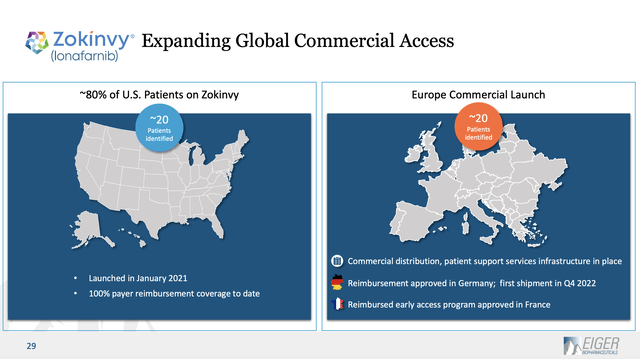

As discussed in Results, Zokinvy® (lonafarnib) is decidedly small beer. Likely because of management upheaval discussed in Results, Eiger issued no earnings call for Q4, 2022 or for Q1, 2023 as had been its previous practice.

For both quarters it issued earnings and business update press releases (for Q1, 2023, the “Release”). The release advised that Zokinvy had marketing approval in the EU and UK in treatment of Progeria and Processing-Deficient Progeroid Laminopathies. It achieved net revenue of $4.1 million in Q1 2023.

It also advised:

Product revenue, net was $4.1 million for the first quarter of 2023, as compared to $2.7 million for the same period in 2022. The increase in product revenue was primarily due to higher sales in Germany, France ATU, and U.S during the quarter.

Beyond this revenues advice, the Release offers nothing else on Zokinvy. Eiger’s latest presentation from its website is its 04/2023 slide deck the (“Deck”). The Deck includes a slide providing helpful Zokinvy information. Slide 29 describes the extent of Zokinvy’s identified patients as 20 in the US (the FDA approved it in 11/2020) and 20 in Europe:

eigerbio.com

Eiger does not help us to understand the prospects for expanding beyond these 40 identified patients. One article suggests that the market may include as many as 600 patients.

I have been unable to discover any company advice on the likely peak revenues for Zokinvy. Certainly it has issued nothing to suggest that there are hundreds of potential patients.

Clinical therapy — Lonafarnib/Ritonavir

Eiger’s lead pipeline therapy is its lonafarnib/ritonavir combination therapy in treatment of hepatitis delta virus [HDV]. Slide 8 describes key attributes for this as follows:

- Only oral agent in development;

- Orphan Designation in U.S. and EU;

- FDA Breakthrough Therapy Designation;

- patent protection through late-2030s.

Clinicaltrialls.gov lists two phase 3 trials evaluating Lonafarnib/Ritonavirin treatment of HDV. One of these, NCT03719313, is complete with no results posted. The second, NCT05229991, is still recruiting. Its brief summary describes it as:

Open label, single arm, multi-center clinical trial of lonafarnib 50 mg QD plus ritonavir 200 mg QD, administered orally, over a 48-week treatment period, with a 24-week post-treatment follow-up period, in patients with chronic Hepatitis D Virus infection.

Objectives: To evaluate the safety and tolerability of once daily dosing of lonafarnib 50 mg with ritonavir 200 mg over a 48-week treatment period.

To evaluate the effect of once daily dosing of lonafarnib 50 mg with ritonavir 200 mg over a 48-week treatment period with a 24-week post-treatment follow-up on HDV viral levels.

Trial population: Up to 30 patients with chronic HDV infection with detectable HDV RNA and compensated liver disease.

Clinical therapy — Peginterferon lamda

Eiger’s second lead therapy is also directed at HDV. There are two clinicaltrialls.gov listed trials evaluating peginterferon lamda in treatment of HDV. One of these, NCT02765802, is complete with results. The second, NCT05070364, is still recruiting. Its brief summary describes it as a:

…Phase 3 LIMT-2 study will evaluate the safety and efficacy of Peginterferon Lambda treatment for 48 weeks with 24 weeks follow-up compared to no treatment for 12 weeks in patients chronically infected with HDV. The primary analysis will compare the proportion of patients with HDV RNA < LLOQ at the 24-week post-treatment visit in the Peginterferon Lambda treatment group vs the proportion of patients with HDV RNA < LLOQ at the Week 12 visit in the no-treatment comparator group.

Its estimated primary completion date is 06/15/2024 with an estimated study completion date of 01/15/2024.

Clinical therapy —Avexitide

Avexitide is Eiger’s third and last pipeline clinical therapy. Clinicaltrialls.gov lists three completed phase 2 trials with results evaluating avexitide. One, NCT04652479, evaluates it in treatment of acquired hyperinsulinemic hypoglycemia [HI]. The other two, NCT02771574 and NCT03373435 in treatment of postbariatric hypoglycemia [PBH].

The PBH trials were both completed several years back. The HI trial was completed on 06/2022. For a reason unknown, Eiger seems to be slow-walking avexitide in the PBH indication.

The release indicates that it is planning to reaccelerate HI advising “phase 3 readiness activities initiated in HI program”. This rather cryptic advice falls well short of providing a timeline. It does provide comfort that avexitide in treatment of HI has not been totally forgotten. The same can’t be said for its PBH indication.

Conclusion

Eiger’s financial situation as disclosed by the Release is dismal. It has its paltry Zokinvy revenues matched up against Q1, 2023 R&D expenses of $16.7 million and SG&A expenses of $9.5 million. It reported:

Cash, cash equivalents, and short-term debt securities as of March 31, 2023 totaled $75.3 million compared to $98.9 million as of December 31, 2022.

In order for Eiger to regain the >$2.00 price point that prevailed when I wrote Results, management is going to have wake up. There are questions that demand answers:

- does Zokinvy have potential to multiply its revenues to the point that they can contribute meaningfully to its hefty quarterly expense nut;

- was the market’s 12/2022 70% selloff in response to topline data from its Phase 3 D-LIVR study for lonafarnib in treatment of HDV an overreaction;

- if so, why;

The Deck advises that Eiger plans several upcoming data points and a pre-NDA FDA meeting by end of Q2. As I write on 06/15/2023, the end of Q2 is only two weeks away. Expect big price moves on the near horizon.

Positive price moves will result from positive news, particularly if it is well delivered. Bad news, or silence will likely see Eiger exploring new lows. Speculators line up. Make your bets. I can offer no handicap advice on this one.

One thing is for sure. Investors in Eiger should only invest money that they are prepared to lose. Don’t think for a minute that Wall Street Analysts’ consensus price target is any kind of magnet. No matter how long you are prepared to hold Eiger, it may never hit anything close to $4.00 or even the $2.00 it was when I wrote Results.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here