BUD Has Fallen To The Cancel Culture

We have previously covered Anheuser-Busch InBev SA/NV (BUD) in April 2023, suggesting that the controversy after the collaboration with Dylan Mulvaney may work both ways. It may either boost the brewer’s brand awareness or impact its sales, depending on how the backlash develops.

It appears that the bears may have won after all, attributed to the disastrous decline in Bud Light sales. It is no longer the top-selling beer domestically, with its market share declining to 7.3%, compared to its competitor, Modelo, at 8.4%, by the four weeks ended June 03, 2023.

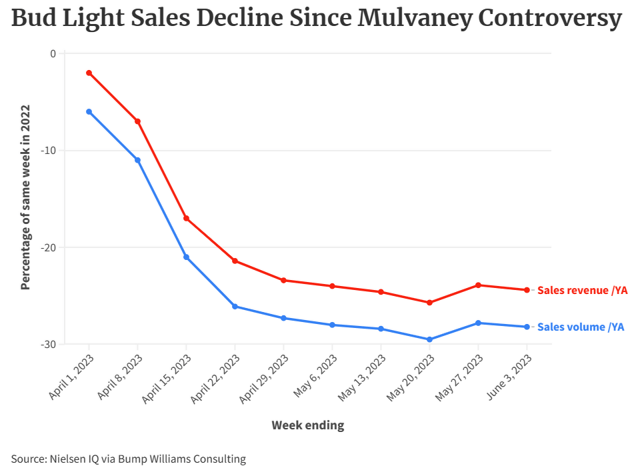

The Sustained Decline in Bud Light Sales Since April 2023

Newsweek & Nielsen IQ via Bump Williams Consulting

The same cadence was reported a week ago, with Modelo sales hitting $333M (+15.6% YoY) as Bud Light’s plunge to $297M (-22.8% YoY). Despite our earlier optimism, there appears to be little reprieve from the backlash, with competitor brands already absorbing the departing consumer volume. While the rate of decline appears to have tapered at current levels, with the last two weeks somewhat recovering, it remains to be seen when normalization may occur.

In addition, it seems that most of the backlash has fallen on BUD instead, since Dylan Mulvaney continued to receive endorsements and appearances over the past few weeks, as witnessed on Instagram. These partner brands have yet to be “canceled,” suggesting that the brewer has gravely misunderstood its own consumer base.

Given the supposed alienation of its target audience, it seems that sales may continue to suffer moving forward, potentially making the damage permanent, similarly impacting its stock prices. The same pessimistic sentiments have been echoed by many beer distributors, with 65% expecting the backlash to persist through 2023 and 32% expecting the market losses to be permanent.

While the BUD management has commented that the impacted US sales only represent 1% of the company’s global volume in the recent earnings call, it remains to be seen what the actual impact is on its top and bottom lines. This is because North America comprises 16.9% of its volumes (-0.3 points YoY) and $3.97B (+5.1% YoY) / 27.9% of its revenues (-0.8 points YoY) by the latest quarter.

As highlighted by an astute analyst from Jefferies, Edward Mundy, Bud Light may comprise approximately $5B of the brewer’s annual revenues and $500M of its EBITDA, suggesting that the backlash may not be that painful after all.

Based on BUD’s last quarter revenues of $14.21B (+13.2% YoY), EBITDA of $4.75B (+13.6% YoY), and an approximate decline in sales of -25% in the US, we may see a top-line impact of -$312.5M and a bottom-line impact of -$31.25M every quarterly.

This cadence may translate to an annual top-line impact of up to -2.1% and a bottom-line impact of -0.6%, respectively. Assuming that the brewer is able to ramp up sales for other brands and products, we may see the backlash absorbed by the projected expansion in its FY2023 revenues by +7.4% YoY and EBITDA by +4.9% YoY. Only time may tell.

So, Is BUD Stock A Buy, Sell, or Hold?

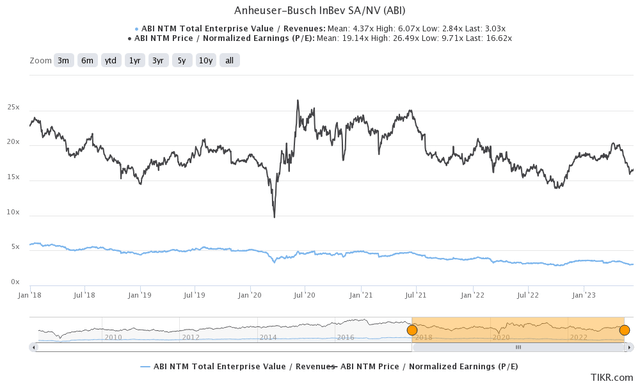

BUD 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

The pessimism is also embedded in BUD’s NTM EV/ Revenues of 3.03x and NTM P/E of 16.62x, compared to its 5Y mean of 4.37x and 19.14x, respectively. The decline has been dramatic indeed, compared to the pre-controversy levels of 3.46x and 20.27x, respectively.

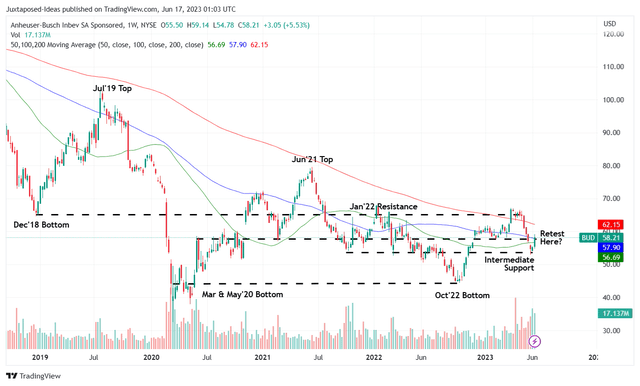

BUD 5Y Stock Price

Trading View

BUD has also retraced, though remaining well supported at the mid $50s for now. Then again, depending on how the FQ2’23 earnings report turns out in August 2023, we may see the stock remaining volatile in the near term. Therefore, we prefer to cautiously rate it as a Hold (Neutral) for now.

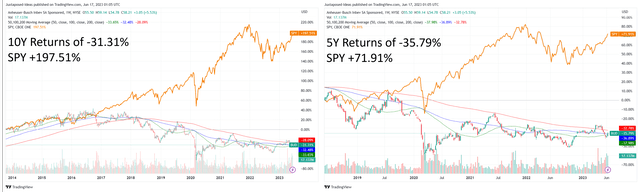

BUD’s Underwhelming Total Returns, Including Dividends

Trading View

Then again, with BUD underperforming for the past five years with total returns (including dividends) of -35.79% and ten years at -31.31%, against the SPY at +71.91% and +197.51%, respectively, we believe that the stock may be a value-trap at current levels.

This is especially given the declining forward dividend yields of 1.41%, against the 4Y average of 1.62% and sector median of 2.42%, suggesting that it is neither a viable income stock nor a high-growth stock.

As a result, investors who have yet to add the BUD stock may want to look elsewhere, especially given the start of the bull market.

Read the full article here