The gross national debt of the United States crossed the $32 trillion level on Friday. And all comments on the future indicate that the national debt is not only increasing, but its pace of increase is accelerating.

I have been writing about this problem earlier. The problem is a very difficult one and is becoming an even bigger one with the passage of time.

We need to get some idea of the scope.

Jeffrey Frankel, Professor of Capital Formation and Growth at Harvard University who previously served as a member of President Bill Clinton’s Council of Economic Advisers, writes about America’s Mythical Fiscal Conservatives.

America used to be known for its “conservative” leanings when it came to budgetary matters.

Mr. Frankel gives us a picture of what this “fiscal world” looks like now.

In this piece, Mr. Frankel lays out a picture of the composition of spending the federal budget.

Roughly speaking, Mr. Frankel divides things up in this way.

Entitlement spending, that is Social Security, Medicare, and certain health-care programs, accounts for 49 percent of the federal spending in 2022 and if you include farm-price support and other income support programs, the number reaches 63 percent.

The combination of interest expenses and defense expenditures accounts for another 20 percent.

“Non-defense discretionary spending accounts for only 16 percent of total government spending.”

In a recent post, I attempted to lay out some other factors that will be putting additional pressure on the spending picture.

For example, pressure to increase expenditures will be coming from the health area as the population ages and further pressure will be coming from the education side in terms of growth in the knowledge industry.

That is, the composition of the economy is changing.

Second, the interest rates on government debt have been increasing and as the government refinances its outstanding debt, interest costs are going to continue to rise.

“Long-term projections suggest that the debt ratio will continue to increase as the rapid aging of the U.S. population drives up mandatory spending.”

A report by the Congressional Budget Office shows that the debt-to-GDP ratio will break its 1946 record within a decade, climbing from 98 percent of GDP in 2023 to 118 percent in 2033.

Rising interest costs and rising mandatory spending will take the federal debt up to 195 percent of GDP by 2053. Also, the projections show that interest costs will consume nearly 40 percent of all federal revenues by 2053.

A balanced budget cannot be attained by cutting all of the non-defense discretionary spending. In 2023, the projected deficit is $1.4 trillion. Non-defense discretionary spending is projected to be $0.9 trillion.

And, cutting non-defense discretionary spending includes cutting air traffic control, law enforcement, immigration control, national parks, and the weather service.

Mr. Frankel builds a narrative that shows that there is little that can be done to the budget in the short run to resolve the debt situation.

What Do We Do?

So, the issue is that we need to do something about government deficits and about the government debt, but, the picture Mr. Frankel draws for us is pretty dim. There doesn’t seem to be much room to make major changes without upsetting the whole structure.

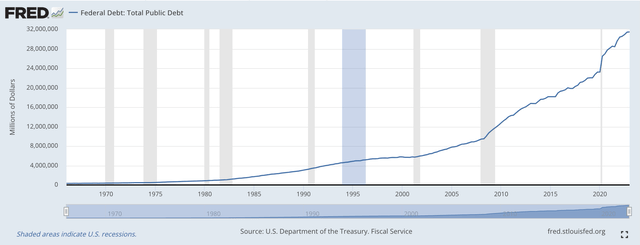

It has taken us a long time to get to this point.

It may take us a long time to get out of this fiscal condition. We cannot just reverse ourselves and get out of the problem overnight. Just look….

Total Federal Debt (Federal Reserve)

However, it seems to be the case that we are going to have to do something to get us out of this debt situation. We cannot let it go on and on.

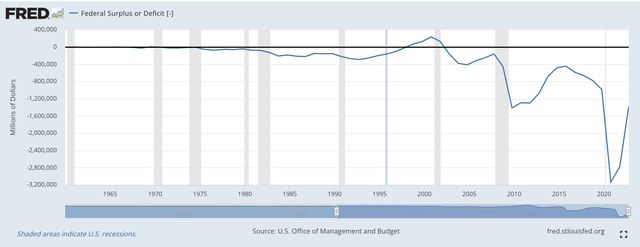

The deficit problem grew and grew and grew. It really started to be a very difficult problem in the 1980s. The deficits really began to grow just after the Federal Reserve busted the back of inflation in the early part of that decade.

As can be seen from the following chart, under President Ronald Reagan, the deficits really grew. This was a period of time when, what I have called “credit inflation,” really became the overriding economic program of the government.

Rather than the consumer price inflation of the 1960s and 1970s, which was just defeated in the early eighties by Paul Volcker and the Federal Reserve, we got another kink of inflation…the inflation of asset prices, like housing prices, commodity prices, and stock market prices.

Government stimulus went flowed into the financial sector of the economy and not into the real sector of the economy.

And, “credit inflation” was fully supported and underwritten by the federal government.

Everything went well for an extended period of time, even though the debt was building up through the credit inflation of the government.

Then the Great Recession hit and the government’s deficit exploded.

Following that, after the recovery from this disruption, the Fed’s quantitative easing came into play, with quite large deficits following.

Federal Surplus or Deficit (Federal Reserve)

Then the Covid-19 pandemic hit and everything seemed to break loose. The federal budget deficits reached enormous levels. And, the recent deficits have even exceeded the previous size of the budget deficits that were associated with the Great Recession.

And, now, the fiscal situation of the federal government is in “no man’s land.” We have never experienced a debt situation like the one we are now in and are unlikely to see anything like it in the near future.

But, the government has to do something about the debt and where the level of the debt is going.

The Future

It is easy to see that climbing to achieve a budget surplus is not going to be easy, given the picture that Mr. Frankel gave in his paper. Consequently, reducing the size of the government debt outstanding any time soon looks really unthinkable.

The events following the Great Recession placed the U.S. government in dire straits. Something must be done. The American future depends upon it.

This is why some analysts, like Daniel Henninger in the Wall Street Journal, put this issue on such a pedestal: “Government Spending Is The Central Issue Of Our Time.”

This issue, realistically speaking, must be addressed. It cannot be pushed out further down the road without really having something done about it.

Mr. Frankel has a very simple suggestion. He suggests that the government move to “slow” the growth of entitlement spending, especially that of Social Security. Some taxes need to be raised, and some reforms need to be made to the tax system to make it more efficient and equitable. “That will require providing the Internal Revenue Service with the funding it needs to fulfill its mandate.”

In Mr. Frankel’s picture, there is very little room to resolve the debt problem of the U.S. government. Very little will be accomplished in the near term.

Resolving the debt problem in the United States is going to take time, it is going to be relatively complicated, so it will take a lot of advance planning, and it is going to require commitment to bring the discipline to government policymaking that is often so lacking in governmental administrations.

Resolving the debt problem is going to take a focus that is rarely seen in governmental circles.

Read the full article here