The market has benefited from the AI hype over the past few months as investors piled into the technology sector (XLK), rotating to one of the most “un-loved sectors” in 2022. The consumer discretionary (XLY) sector has also outperformed the S&P 500 (SPX) (SPY) since bottoming out in January 2023, as investors rotated back into cyclical stocks.

In addition, Meta Platforms (META) and Google (GOOGL) (GOOG) have led the outperformance in the communications sector (XLC), as investors chased alpha in these companies’ ability to be the most prominent leaders in generative AI over the next decade.

I highlighted in two early December 2022 articles (here and here) why the XLK and the XLY were on the verge of bottoming out, even though investors didn’t show “love” to them then. However, I gleaned that pessimism over their performances reached extreme levels as risk/reward opportunities for high-conviction investors became increasingly attractive.

That thesis has played out accordingly, as the XLK was “inches” away from re-testing its November 2021 highs last week. Our members have also benefited, as I alerted them in October 2022 that the broad market bottomed out. As such, we reloaded our bets at the market’s lows, even as Wall Street strategists were caught out in their forecasts, as they entered 2023 with the most pessimistic prognostications in more than twenty years.

“Perma-bears” still hanging on to their bear-market rally thesis are urged to reassess whether their thesis is still valid. I’m not a perma-bull or perma-bear. As a price-action investor, I listen to what the market tells me and adjust my thesis accordingly. As a reminder, I highlighted my concerns to my members in November 2021, suggesting that “long-term bearish signals intensified.” While the SPX topped out only in early January, the trouble had already been brewing in tech and growth stocks before that, as I assessed in November 2021.

But why should investors pay attention to the sectors I highlighted above?

| Sector | Weighting (%) |

|---|---|

| Technology | 51.20% |

| Communication | 16.76% |

| Consumer Discretionary | 15.08% |

| Total | 83.04% |

Nasdaq (QQQ) (NDX) top three holdings. Data source: Seeking Alpha

| Sector | Weighting (%) |

|---|---|

| Technology | 28.86% |

| Health Care (XLV) | 13.46% |

| Financials (XLF) | 12.03% |

| Consumer Discretionary | 10.67% |

| Communication | 8.61% |

| Total | 73.63% |

SPY top five holdings. Data source: Seeking Alpha

As seen above, these sectors account for more than 80% of QQQ’s holdings, which significantly lifted its outperformance against SPY. In contrast, while they are also within the top five sectors in SPY, they have a much lower relative weighting than in QQQ.

Moreover, SPY has been impacted by the relative underperformance in XLV and the significant damage done to XLF in the past few months. Therefore, the critical question facing investors is whether the underlying market rotation could occur as investors look to cut exposure in big tech that drove the recent rally?

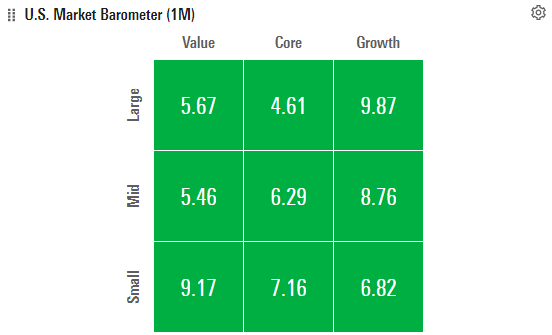

US Market Factor Ratings (Morningstar)

There were initial concerns about the recent rally being concentrated mainly on Large-cap Growth. The concerns make sense, as the top ten holdings in QQQ comprised nearly 60% of its total weightings.

However, as seen above, the rally has broadened across the market to small and mid-caps, including core and value factors. Hence, the worries about a narrow-breadth bull market rally are likely overstated.

Also, I gleaned that market strategists are still sufficiently pessimistic, as they focus on the Fed’s “hawkish” communication. However, they may have failed to glean that the Fed’s next move will likely depend on incoming inflation data, which “has been gradually decelerating, although it remains above the Fed’s target,” as strategist Edward Yardeni reminded us in a June 15 brief.

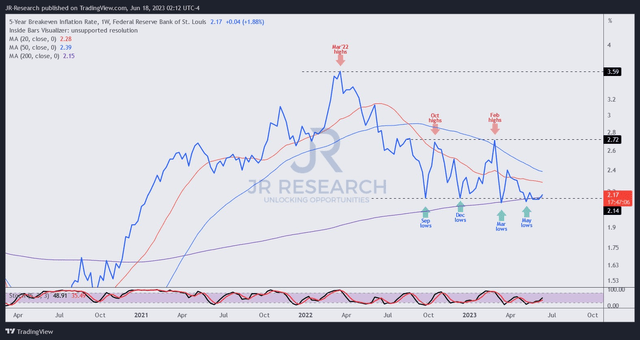

5Y inflation expectations (TradingView)

Also, I think market operators reduced their 5Y inflation expectations much lower compared to the highs in March 2022. It’s clear that the 5Y outlook is on a medium-term downtrend, even though I think it should bottom out at the current levels, as the Fed highlighted in its recent FOMC statement that “inflation remains elevated.”

As such, I assessed that tailwinds from lower inflation expectations have likely been baked in as investors lower the implied discount rates in their valuation assumptions. With that in mind, it’s appropriate to assess whether the price action and valuations in the leading stocks of SPX and Nasdaq are still constructive.

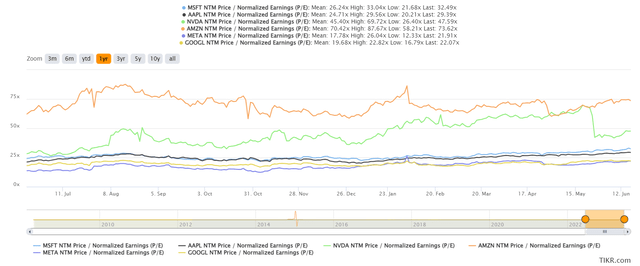

SPY and QQQ top holdings forward adjusted P/E (TIKR)

As seen above, the forward adjusted P/E of the leading holdings in QQQ and SPY are no longer attractive. Other than META and Amazon (AMZN) stock, the stock of Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) are trading well above their 10Y highs.

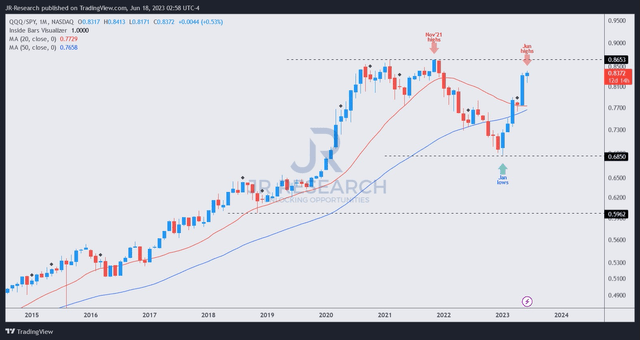

QQQ/SPY price chart (monthly) (TradingView)

QQQ has outperformed SPY significantly since QQQ/SPY bottomed out in January, taking value investors by surprise. Growth and tech have demonstrated incredible resilience as investors piled into them, further bolstered by the AI hype.

However, astute investors also know that after such a remarkable comeback, a pullback is anticipated and more than welcome. We need to deflate some of the recent AI hype for the market to resume its recovery more sustainably.

If you didn’t manage to load up your bets at the lows last year or earlier this year, it’s time to be cautious. Wait patiently for the pullback, which could improve your risk/reward markedly than joining the momentum spike now.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here