Beware of hidden shark risks

Thesis

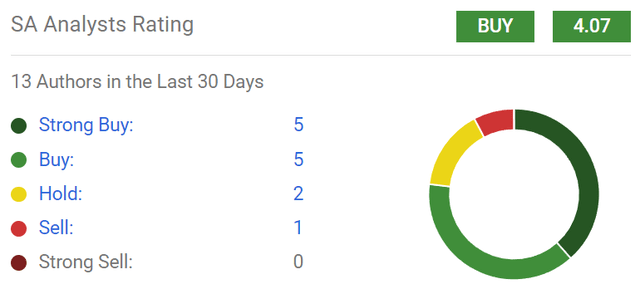

Seeking Alpha analysts’ sentiment seems to be strongly bullish on the whole for Medical Properties Trust (NYSE:MPW):

Seeking Alpha Analysts’ Sentiment on Medical Properties Trust (Seeking Alpha)

I struggle to garner the same optimistic enthusiasm due to these 3 key thesis points:

- I have lower confidence in asset quality

- Leverage and operators’ rent coverage metrics are worsening

- The portfolio is struggling even if Prospect rebounds

The main thing that prevents me from going so far as to issue a ‘sell’ rating is the low valuation multiple and high short interest at current prices. Hence, I rate the REIT a tactical ‘neutral/hold’ for now.

I have lower confidence in asset quality

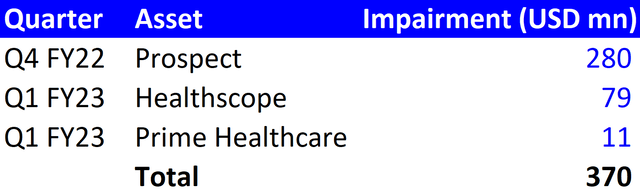

Over the last 2 quarters, MPW has incurred some large impairments of its assets:

Recent Impairments (Company Filings, Author’s Analysis)

This $370 million impairment is 152% of the typical quarterly AFFO and 45% of the typical annual AFFO. I have taken FY22 figures for the AFFO calculations since Q1 FY23 has been impacted by a loss of rent revenues from Prospect; a key operator which used to contribute 11-12% of revenues.

Management has had to extend support to some of its struggling operators. This is of course acceptable given the business circumstances. It is normal to help your tenants to try make the best out of a tough situation. However, what I find less reliable is management’s communication:

In the Q4 FY22 earnings call, an analyst asked management:

…do you expect to have to [provide financial support to operators] in the coming quarters outside of Prospect?

– John Pawlowski from Green Street Advisors in the Q4 FY22 earnings call

MPW’s CEO Edward Aldag gave a direct reply:

“Aside from Prospect. No we don’t.”

– CEO Edward Aldag in response to Pawlowski’s question

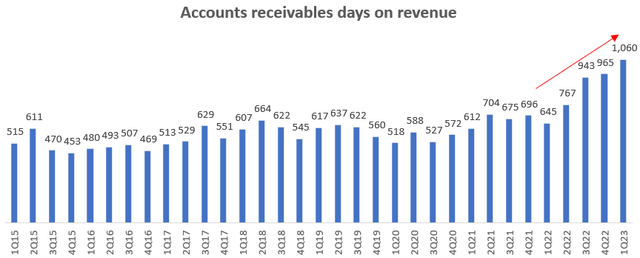

However, in the Q1 FY23 earnings call, management admitted that they provided an additional $28 million in financial support to Steward. In addition, I believe the recent sharp increases in accounts receivables days from the longer-term historical average of 500-700 days give further reasons to be very wary of future impairment risks. This is because questions pop up about the quality and health of the receivables. Increasing receivables days is generally a leading indicator of tenants’ rent payment issues and it is a slippery slope that can lead to more scenarios such as the Prospect account, wherein the tenant is unable to pay rent and even needs financial support, thus undermining the balance sheet of the lessor.

Accounts receivables days on revenue (Company Filings, Author’s Analysis)

Thus, I struggle to gain confidence in the asset quality of MPW’s portfolio as the evidence leads me to have 2 key doubts:

- What if there are more struggling assets underneath the hood that have not surfaced yet?

- Management’s commentary may not be as reliable

Leverage and operators’ rent coverage metrics are worsening

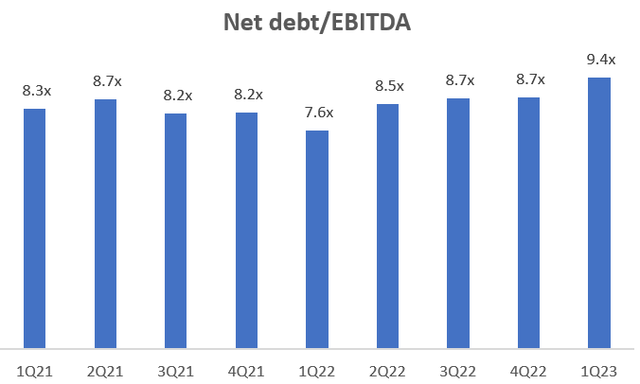

Fueling further doubts on asset quality are the leverage and operators’ rent coverage metric trends:

Net debt/EBITDA (Company Filings, Author’s Analysis)

Net debt/EBITDA has crept up to 9.4x. I recognize that the company has about $900 million of cash coming in from asset sales. This will bring the debt coverage ratio down to 8.6x. Nevertheless, this would still be above the longer term average (over 8 years) of 8.0x.

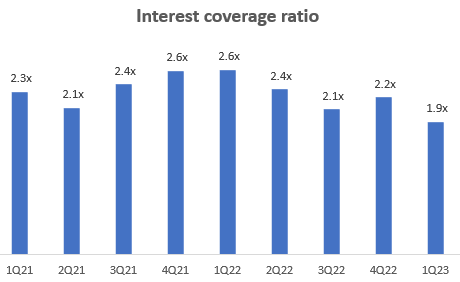

The interest coverage ratio is also falling and I think it is likely that it will remain below 2.0x as rent from Prospect won’t be coming back until September 2023, leading to a continued subdued earnings:

Interest coverage ratio (Company Filings, Author’s Analysis)

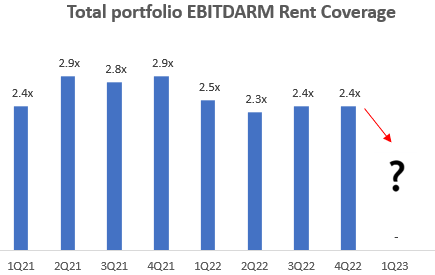

Lastly, I note that the MPW lease operators’ rent coverage ratios as measured by EBITDARM/Rent have been gradually falling. I think the Q1 FY23 figures would show a sharp drop from Q4 FY22 levels due to the issues with the Prospect operator’s operating health (the company reports this statistic with a 1Q lag):

Total Portfolio EBITDARM Rent Coverage (Company Filings, Author’s Analysis)

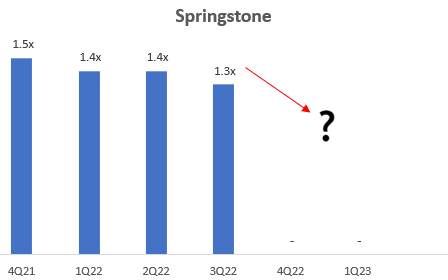

The Springstone operator makes up 5.8% of overall revenues. In Q3 FY22, its EBITDARM rent coverage ratio was at low 1.3x. But the company stopped disclosing this figure separately in Q4 FY22:

Springstone EBITDARM Rent Coverage (Company Filings, Author’s Analysis)

Why did the disclosure stop? Is this number now below 1.0x? Is further asset weakness being concealed? These are the questions that pop up in my mind.

The portfolio is struggling even if Prospect rebounds

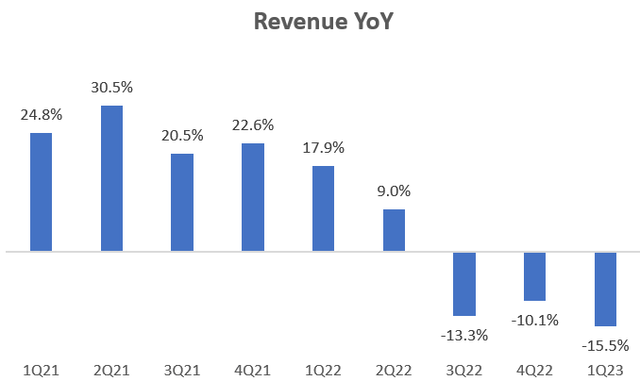

Revenue YoY (Company Filings, Author’s Analysis)

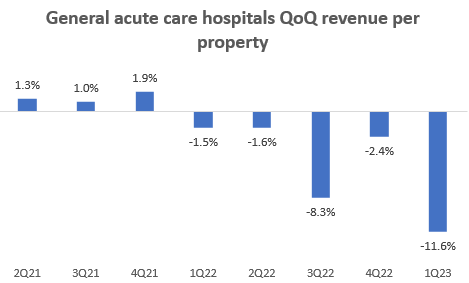

MPW is seeing consistent revenue declines in its portfolio for the past 3 quarters. Even if I add back the ~$44-45 million loss of revenues due to Prospect rebound, Q1 FY23 would still see a revenue decline of 3.5-3.8%. This indicates that the portfolio is struggling beyond Prospect as well. For example, in the general acute care hospitals segment, which currently makes up 72% of revenues and 45% of properties (before the operator-specific issues, it used to make up a low-mid 80s% of revenues), the QoQ decline trend has been persistent for multiple quarters now:

General acute care hospitals QoQ revenue per property (Company Filings, Author’s Analysis)

Valuation and Positioning

I think there may be further issues under the hood for Medical Properties Trust. I have doubts about whether there may be further impairments of assets. These doubts are fueled by multiple pieces of evidence such as sharply increasing receivable days, unreliability of management’s communication, worsening debt and interest coverage metrics and degrading rent coverage metrics by operators with a risk of further impairment issues in the Springstone operator. From an operational perspective, my analysis shows that revenues are declining even if one assumes the Prospect rent problem does not exist.

I rate this REIT a tactical ‘neutral/hold’. I would it a ‘sell’ if not for 2 saving graces:

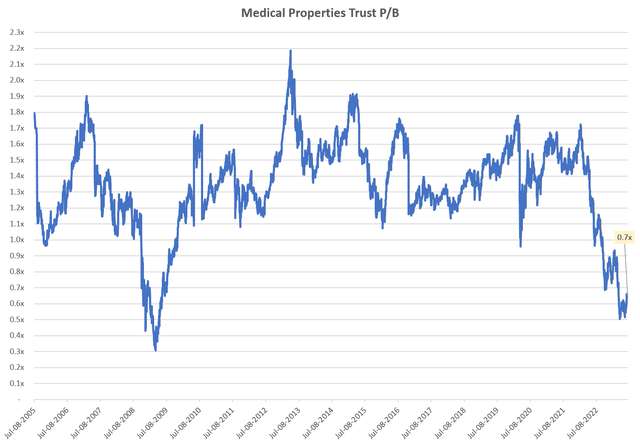

Medical Properties Trust P/B (Capital IQ, Author’s Analysis)

Firstly, MPW is trading at a P/B of 0.7x. This corresponds to decadal lows. Secondly, the short interest is high at 20.35%, which I believe elevates the chances of a short squeeze.

I hope this analysis makes the bulls more aware of some non-obvious risks in Medical Properties Trust.

Read the full article here