The JXN Investment Thesis May Remain Volatile A Little Longer

The March 2023 banking crisis had naturally impacted the sentiments surrounding Jackson Financial Inc. (NYSE:JXN), as witnessed in the plunge in its stock prices then.

Its prospects were made even more uncertain after the recent FQ1’23 earnings call, when the annuity company reported a bottom-line miss with an adj EPS of $3.15 (-44.3% QoQ/-20% YoY).

Naturally, much of the pessimism was attributed to JXN’s available-for-sale debt securities of $43.77B (+3% QoQ/+155.6% YoY), comprising 85.1% of its total securities of $51.38B by the latest quarter (inline QoQ/+2.5% YoY).

With growing gross unrealized losses of $5.39B (-15.7% QoQ/+138.4% YoY), mimicking those of the troubled banks, it was unsurprising that some investors might be wary of its forward execution.

However, here is where we are cautiously optimistic.

Since JXN is not a bank, it need not realize losses to shore up its balance sheet, one that we have witnessed with Silicon Valley Bank and the First Republic given the panic-driven deposit run then. The same has been reflected in its recent financial report, with the annuity company not intending to sell these debt securities.

The peak recessionary fears have naturally affected the company’s total retail annuity sales to $3.14B (-3% QoQ/-34.4% YoY) by the latest quarter, with the decline attributed to the procyclical industry trend as capital pivoted toward higher return money market funds, among others.

For now, the impact on its fee income/premiums of $1.91B (inline QoQ/-6.3% YoY) has fortunately been minimal, with its total net investment income still stable at $722M (-2.3% QoQ/+4.6% YoY).

Nonetheless, while JXN has enjoyed massive net gains on derivatives and investments of $3.85B in FY2022 (+255.4% YoY), thanks to the Fed’s sustained hike then, it appears that the trend may be reversing after all.

By the latest quarter, it reported staggering net losses on derivatives and investments of -$3.39B (-14.4% QoQ/-531.7% YoY), notably impacting its total revenues to -$749M (-97.1% QoQ/-133.7% YoY).

Then again, JXN investors must also note that its derivatives and investments are generally geared toward medium and long-term returns, with the hedging instruments not structured to match GAAP accounting standards. This cadence may then cause the net losses or gains to appear inflated on a quarter-to-quarter basis. This is on top of its annuity “fair value calculation” and “volatility assumptions,” which are based on the available market data for durations up to 10 years.

Therefore, investors should not be overly concerned about the short-term health of the annuity company’s business operations, while allowing the fluctuation in its hedging to play out for the next few quarters. Meanwhile, with the Fed still guiding two rate hikes in 2023 and is only likely to pivot by 2024, likely elongating the uncertain macroeconomic outlook, one should be ready for more volatility ahead.

In the long term, we suppose the demand for annuities may return once the uncertain macroeconomic outlook lifts and the elevated interest rate environment normalizes. While JXN may only have a short track record since the demerger in September 2021, we are willing to observe the developing story a little longer.

So, Is JXN Stock A Buy, Sell, or Hold?

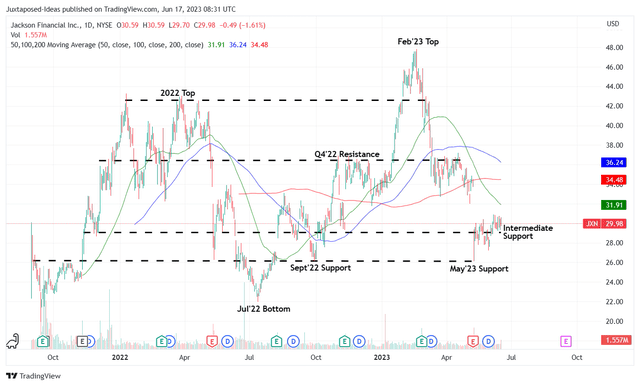

JXN 2Y Stock Price

TradingView

As a result of the market uncertainties, it is unsurprising that JXN has already plunged post-banking meltdown and FQ1’23 misses, with the stock still held up by the current support levels.

However, we are not overly concerned, since the annuity company expects to generate a cash flow of $800M at the midpoint once things normalize, sustaining its capital return program in the long term.

Meanwhile, JXN continues to boast excellent liquidity with cash/short-term investments of $1.77B (-58.7% QoQ/-33.7% YoY) by the latest quarter, significantly aided by the proceeds of preferred stock issuance at $533M.

This cadence suggests that the annuity company has more than sufficient capital to meet the fiscal year’s capital return target of $500M at the midpoint and the retirement of its Senior Notes due 2023 of $598M. With zero debt maturities through 2027, it appears that investors need not be concerned about another dilutive capital raise for the next few years.

Furthermore, the JXN management also took the chance to repurchase shares at these depressed levels, retiring $251M equivalent of shares over the last twelve months, with approximately $24M worth already repurchased in FQ2’23.

This cadence may encourage investors, due to the sustained share retirement to 86.08M (+2.8% QoQ/-4.3% YoY), on top of the expansion in its quarterly dividends to $0.62 (inline QoQ/+12.7% YoY). Combined with it trading well below the FQ1’23 book value of $100.01 (-1.8% QoQ/-10.9% YoY), the stock offers a very attractive risk-reward ratio at current levels, in our view.

These depressed levels allow long-term JXN investors to dollar cost average as well, while offering new investors attractive entry points for forward dividend yields of 8.27%, compared to its 2022 average of 4.39% and sector median of 3.15%.

As a result, we are rating the JXN stock as a cautious Buy here. Do not miss this deep correction.

Read the full article here