Aerospace stocks have been volatile in the past couple of years, but since last fall, they’ve been roaring higher. The group entered a consolidation period earlier this year, but by all indications, that consolidation phase appears to be ending soon. If that’s the case, constituents in the group stand to do quite well.

Perhaps the best known of those is flying machine legend Boeing (NYSE:BA), which has had a bunch of problems of its own in recent years. The stock has mostly recovered, but after a consolidation of its own, looks ready to set new recent highs.

The problem is that while I like the chart, I still think Boeing has a tough road ahead from a fundamental perspective. Let’s dig in.

Consolidation phase over?

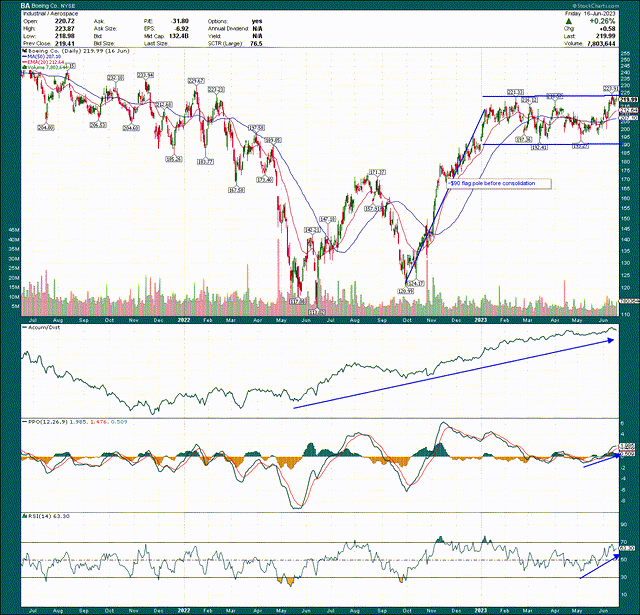

We’ll start with the price chart, and I see a lot of reasons to be bullish here. I notified subscribers of this pattern a few weeks ago, and it looks like the bullishness we were looking for is coming to fruition. The stock made a double bottom at roughly $120 last October and hasn’t looked back. That ~$90 rally, according to what I’m seeing, is the pole in the flag formation.

StockCharts

You can see the flag that has occurred in the ensuing months, and if we make a measured move target off of that, we get a target of just over $300 on a potential breakout. Now, we’re obviously needing to see the breakout before we can get into targets, but that’s the opportunity here.

The stock actually broke out intraday in early June but fell back into the consolidation. However, since then, we’ve seen all dips bought, and the momentum indicators continue to improve. All of that suggests a breakout is likely “when”, not “if”.

The moving averages are pointed skyward, as are the accumulation/distribution line, 14-day RSI, and PPO. We have all boxes being checked here, and if we get a close at $225+ or better, look out above.

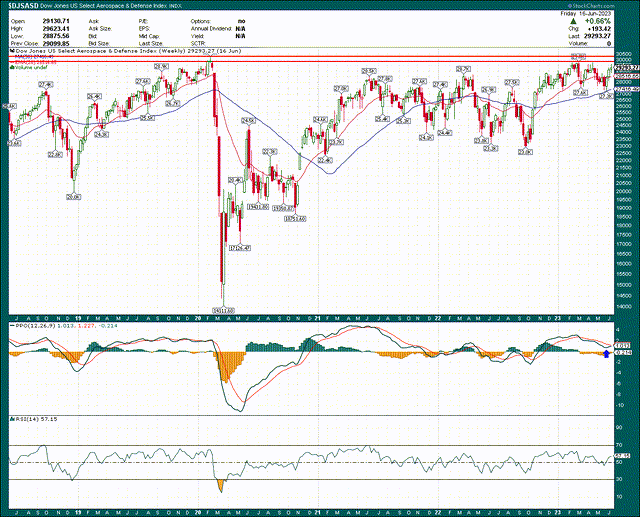

I mentioned the sector’s strength, which we can see below, and adds to the bull case for Boeing.

StockCharts

This is a weekly chart back to 2018, and we can see here improving momentum, as well as the all-time highs set back in 2020. Just like Boeing’s chart, this one appears to be a matter of time before we get the breakout. That would be the ultimate buy signal for Boeing, but I suspect Boeing will break out of its consolidation before the group does. Either way, the point is that there’s a lot of money flowing into this sector, and I see Boeing as a primary beneficiary of that.

Here’s the problem

Boeing’s fundamentals still haven’t recovered from its self-inflicted wounds from a variety of things, including the MCAS scandal that resulted in two airliners crashing and taking hundreds of people from the world. In addition, chronic production delays on marquee products like 737 MAX, the Starliner, the 787, and more have made it seem like the company simply cannot get it together on the blocking and tackling of aircraft production. None of that is a source of confidence for me.

Despite all of this, Boeing has literally thousands of unfilled orders on its books. The overwhelming majority are for 737 MAX, but production delays are plaguing top line growth as the company simply cannot catch up to demand.

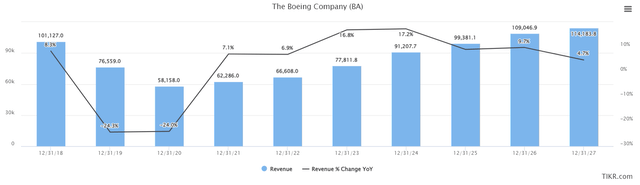

That’s making the road back to $100 billion in revenue – which was the pre-COVID peak – take quite some time.

TIKR

We can see revenue hit ~$67 billion last year, and analysts are looking for mid-teens growth rates this year and next. That sounds great, except analysts have years of history in terms of overestimating the company’s ability to deliver top line growth. Is this time different? We don’t know yet, but history usually either repeats or at least rhymes, so I’m skeptical until proven otherwise. Even with these lofty targets, we’re looking at 2026 before the company can hit its 2018 revenue level again.

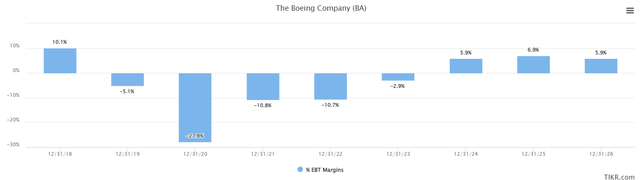

That’s had numerous negative impacts, not least of which is on margins. Boeing is facing supply chain messes like just about everyone else in the world, but the fact is that even if/when Boeing hits $100 billion in revenue again, its margins will be nowhere close to where they used to be.

TIKR

This is a look at earnings before taxes margin, or EBT, and the story isn’t good. In 2018, before the malaise, EBT margin was 10% of revenue. The problem is that the road back has been tough, and it’s nowhere near having recovered yet. Not until 2024 is EBT margin expected to be positive again, and even at that, analysts expect no better than 6.9% of revenue in EBT margin through 2026. The thing is that by that time, we’re supposed to see higher revenue than 2018, so we should theoretically see leveraging of costs down. That’s obviously not happening, and Boeing’s margins are still awful.

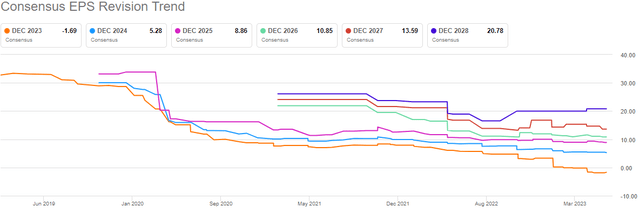

Small wonder then that EPS revisions look awful as well.

Seeking Alpha

This is about as rough as it gets in terms of revenue revisions, so I won’t try to sugarcoat this. We’re here for facts, and the facts are that analysts have very consistently overestimated Boeing’s ability to generate profits. Again, is this time different? Maybe. But that’s not something I’m willing to bet on given the history the company has produced.

Is it at least cheap?

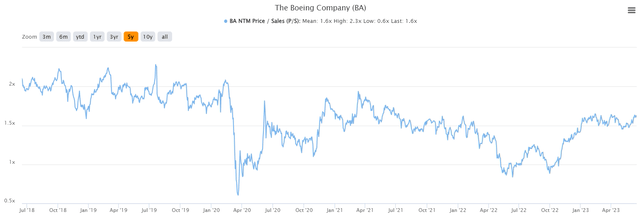

In short, no, no it isn’t. Earnings have been all over the place in recent years (to say the least), so let’s instead try revenue and EBIT as a means to value the stock. We’ll start with price-to-sales.

TIKR

Shares are at 1.6X forward sales today, which is exactly in line with the mean over the past five years. However, part of this period was back when Boeing sported ~10% operating margins, and would therefore command a higher P/S ratio. Those days are gone, so in light of that, I’d argue the stock is leaning towards overpriced on this measure when considering lower profitability.

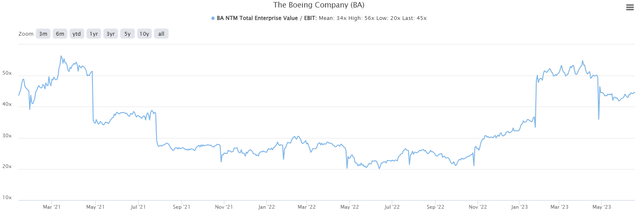

When we look at EV/EBIT, the story is worse, in my view, and highlights the lower margin situation.

TIKR

We see the stock at 45X EBIT on an enterprise value basis, and however you feel about that number, the fact is it’s very expensive relative to the past couple of years. Given the company is still struggling to rebuild its top line, and margins are nowhere close to prior levels, is that a stock you want to pay a premium for?

The bottom line here is that I’m torn. The chart is showing a clear bullish bias, and despite my misgivings about the company’s ability to execute, I respect price action above all else. Given that, here’s my current stance. I think this stock is too expensive and to be completely honest, I don’t think Boeing has earned the right to the benefit of the doubt, for the reasons I mentioned above. However, I’m also willing to look past that if we get a breakout over $225/$230.

Money is rotating into the sector, and into Boeing, and that’s a valid enough long strategy for me. So, if we get the breakout I’m looking for, I’m willing to look past all of the issues this company has. I’m neutral overall on the stock right now, until we get a breakout or breakdown of the consolidation pattern. I firmly believe we are going to see up as the next directional move, but since I am struggling with the fundamental case, I cannot slap a buy rating on it just yet.

Read the full article here