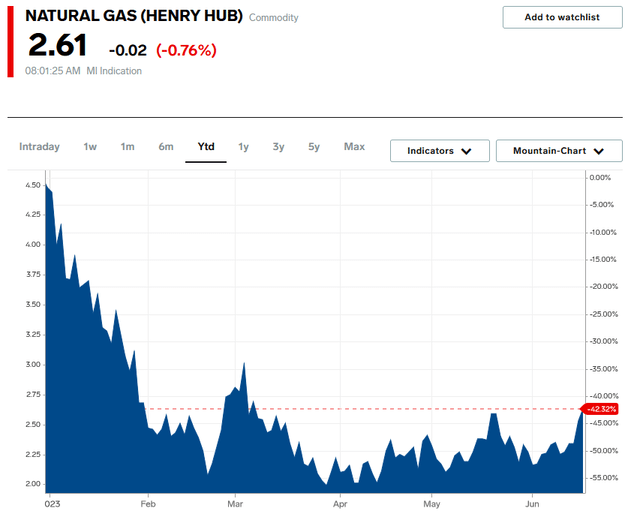

CNX Resources Corporation (NYSE:CNX) is an American producer of natural gas that primarily operates in the incredibly wealthy Appalachian region. This has unfortunately not been a particularly attractive business to be in this year, as natural gas prices have fallen by 42.32% year-to-date:

Business Insider

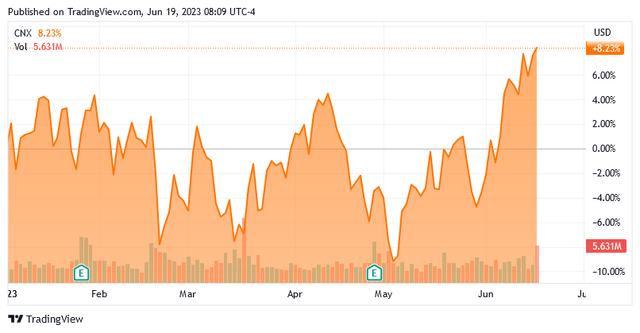

This is due to a variety of reasons, most of which are completely out of CNX Resources’ control. However, the stock price has reacted much more favorably as it is actually up 8.23% over the same period, with most of the gains coming in the past week:

Seeking Alpha

While this could be due to the potential sale of the company’s Appalachian assets, that was only announced on Friday so it could not have been a major contributor. As I mentioned in my last article on CNX Resources, this company does enjoy a certain amount of protection against low natural gas prices due to its hedging program and the company’s first-quarter earnings results were quite decent so some of this performance may be attributed to these two factors. Unfortunately, the rapid increase in price that we have seen has made the company very expensive relative to its peer group. It therefore might be best to wait until the mania passes and then buy in once the stock has fallen back to a reasonable valuation.

About CNX Resources

As mentioned in the introduction, CNX Resources Corporation is an American independent exploration and production company that operates primarily in the Appalachian Basin in Pennsylvania, Ohio, West Virginia, and Virginia:

CNX Resources.png)

The company is headquartered in Pittsburgh, Pennsylvania, which happens to be one of the best areas in the region for natural gas production. As of the end of 2022, CNX Resources controlled 530,800 net acres in this region. Most of the company’s acreage is in Pennsylvania, as might be expected:

| Location | YE 2022 | YE 2021 |

| Southwest PA | 135,100 | 125,100 |

| Central PA | 298,900 | 303,200 |

| Ohio | 10,100 | 10,900 |

| West Virginia | 86,700 | 86,800 |

As we can see, 434,000 of the company’s total 530,800 net acres at the end of 2022 were located in Pennsylvania. This is unsurprising considering the company’s Pittsburgh headquarters and the fact that Southwestern PA and parts of northern West Virginia are among the best areas of the Marcellus Shale for the production of natural gas. I discussed this in a few previous articles on Range Resources (RRC), which operates in the same area.

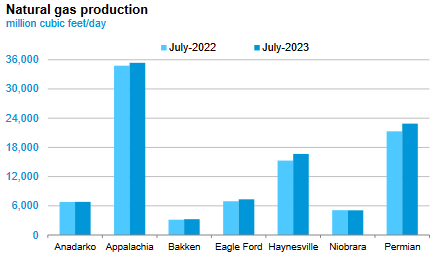

For its part, the Marcellus Shale is perhaps the best place in the country for a natural gas producer to operate due to its resource wealth. According to the U.S. Energy Information Administration, the Marcellus Shale boasts total proven reserves of 148.7 trillion cubic feet of natural gas. That makes it by far the wealthiest basin in the country in terms of natural gas reserves. It is also the largest in terms of total production:

U.S. Energy Information Administration

This positions CNX Resources quite well for both reserves and production. As of December 31, 2023, CNX Resources had total proven reserves of 9.8 trillion cubic feet of natural gas equivalent. Unfortunately, we do not have a more current figure than this as most exploration and production companies only release reserve estimates annually. As I have noted in the past, most investors tend to overlook the company’s reserve figures and indeed one has to search through the 10-K filing to find this information. However, the size of the company’s reserves is critically important due to the fact that CNX Resources operates in an extractive industry. The company literally obtains the products that it sells by pulling them out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, the company must continually discover or otherwise acquire new sources of resources or it will eventually run out of products to sell. As a company’s success at accomplishing this is by no means guaranteed, the company’s reserves are what ensure its longevity. In the first quarter of 2023, CNX Resources produced an average of 1.5096 billion cubic feet of natural gas equivalent per day. Thus, its reported reserves are sufficient to allow the company to continue to produce at its present level for 6,941 days, which is roughly 17.7 years. That is a significantly larger reserve life than most of the company’s peers as well as most of the energy supermajors. This is a good sign as it indicates that CNX Resources has a substantial amount of resource wealth and should be able to continue operating in its current state for quite some time.

Unfortunately, it appears that CNX Resources’ reserves may decline in the near future. On Thursday, June 15, 2023, the company announced the sale of some of its Appalachian assets for approximately $125 million. The company did not provide any details regarding the buyer, nor the amount of resources located on the land. In fact, the company did not even state how much land is included in this sale. As such, we have no way of determining the impact that this will have on the company’s reserves but we do know that it will be negative. As such, the company’s reserve life is not going to be 17.7 years following the sale, but it is uncertain exactly what it will be. Most of the company’s peers have ten to twelve-year reserve lives though, so unless the company is selling off a substantial portion of its reserves with this sale, it will remain better positioned than most of its peers.

The company’s asset sale will also reduce its production by approximately nine billion cubic feet of natural gas equivalent. The guidance that was provided at the end of the first quarter was for 555 billion to 575 billion cubic feet of natural gas equivalent over the course of the year, so this sale will only reduce the company’s expected full-year production by 1.59%. That is hardly worth worrying about and so should not have any significant impact on the company’s near-term revenues and profits. The only real impact will be the reduction of the company’s reserve life, which is very much a negative. However, the $125 million that it obtains from the sale will improve its financial position and possibly give it an opportunity to buy similar acreage at a future date. There is an old financial maxim that “a dollar today is worth more than a dollar in the future” that would seem to apply here.

In a recent blog post, I pointed out that American natural gas producers have been actively reducing their production. This is due to the incredibly low current price for natural gas, which is caused by high natural gas supplies. In short, we currently have a supply glut in the market that is suppressing prices. In the first quarter of 2023, CNX Resources did see its average daily production decline. However, this has been going on for a while now:

| Q1 2023 | Q4 2022 | Q3 2022 | Q2 2022 | |

| Average Daily Production (mmcfe/d) | 1,509.6 | 1,528.4 | 1,590.9 | 1,564.1 |

The company has not made any public statements that it is actively making production cuts. However, the fact that it is selling producing assets could indicate that it is certainly willing to consider that option. Thus, we might see its production drop in the second quarter. That will almost certainly have an adverse impact on the company’s revenues. The key though will be its guidance. If the company reduces its guidance by more than the nine billion cubic feet of natural gas equivalents that it will be losing in the aforementioned asset sale, then it is a clear sign that the company is reducing its production. It may not be a bad thing for it to take that move, as it will allow it to save its reserves until such time as it can sell at a higher price. The $125 million that it receives from the asset sale will help it cover its expenses in the interim.

Financial Considerations

It is always important to investigate the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is normally accomplished by issuing new debt to repay the maturing debt since few companies have the ability to completely pay off their debt with cash as it comes due. This can cause a company’s interest expenses to increase following the rollover in certain market conditions. As of the time of writing, American interest rates are at the highest level that they have been since 2007 so it is almost certain that any debt rollover will result in a company’s interest costs going up. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. As CNX Resources’ revenues are affected by sometimes volatile commodity prices, this is a risk that we should not ignore.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2023, CNX Resources had a net debt of $2.3771 billion compared to a shareholders’ equity of $3.5673 billion. This gives the company a net debt-to-equity ratio of 0.67 today. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| CNX Resources | 0.67 |

| Range Resources | 0.49 |

| EQT Corporation (EQT) | 0.28 |

| Antero Resources (AR) | 0.66 |

| Comstock Resources (CRK) | 0.93 |

As we can see here, CNX Resources appears to be running a reasonable financial structure compared to other independent natural gas producers. The company is not the most heavily indebted of this group, but it is also not the least. It is also important to note that CNX Resources will almost certainly see its net debt-to-equity ratio improve once it receives the $125 million in cash from the Appalachian asset sale that was already discussed. Thus, it does not appear that we need to be especially worried about the company’s debt level.

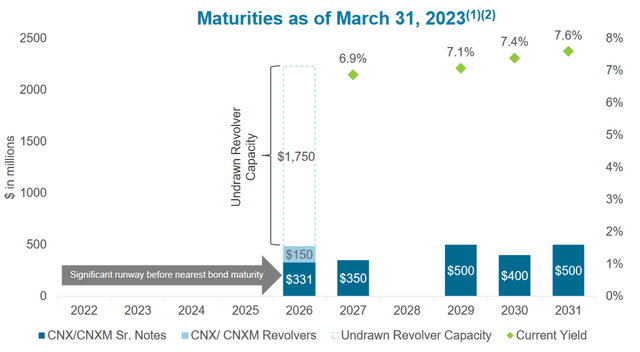

We can gain even more confidence in the company’s financial structure by looking at the company’s debt maturity schedule. Here it is:

CNX Resources

As we can see, CNX Resources does not have any debt maturities prior to 2026. This is something that is very nice to see as it tells us that the company has a great deal of time before it needs to do anything about its debt. This gives it some options. For example, CNX Resources had a levered free cash flow of $41.5 million in the trailing twelve-month period. It could very easily use some of its free cash flow to begin buying back the debt. This will reduce the amount that it needs to roll over in 2026 when the maturity hits. It is also very uncertain what level interest rates will be at in 2026. The Federal Reserve is apparently committed to a very hawkish monetary policy, but at some point, that will also result in the U.S. Federal Government having difficulty affording the interest payments on the national debt so an interest rate cut at some point is almost certain. The fact that CNX Resources does not have to worry about its debt until 2026 means that there is a chance that interest rates will be lower by the time it needs to roll over the debt. The company’s back is not up against the wall here with respect to its debt.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an independent exploration and production company like CNX Resources, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, as I discussed in a previous report, just about everything in the traditional energy segment looks undervalued relative to its earnings growth. As such, the best way to use this ratio is to compare CNX Resources’ price-to-earnings growth ratio against its peers in order to determine which company offers the most attractive relative valuation.

According to Zacks Investment Research, CNX Resources will grow its earnings per share at a 6.34% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 1.59 at the current price. Here is how that compares to the company’s peer group:

| Company | PEG Ratio |

| CNX Resources | 1.59 |

| Range Resources | 0.45 |

| EQT Corporation | 0.80 |

| Antero Resources | NA |

| Comstock Resources | NA |

As we can clearly see, CNX Resources appears to be incredibly expensive relative to its peers. This is almost certainly due to the run-up that we have seen in the share price so far this month as the company looked to be incredibly undervalued back in April. I discussed that in my last article on the company. Thus, it might be best to wait for the stock to retreat back to a reasonable valuation before buying shares.

Conclusion

In conclusion, CNX Resources is a solid independent natural gas producer that operates in the Appalachian region. The company boasts a very strong balance sheet and reserves that should allow it to sustain itself over the long term. It is uncertain what impact the pending asset sale will have on the firm’s reserve base, but the $125 million that it will receive from the sale will go a long way towards improving its balance sheet further and insulating it somewhat against the low price environment. Unfortunately, the stock appears to be significantly overvalued right now so investors might want to wait until a more reasonable price can be obtained before buying shares.

Read the full article here