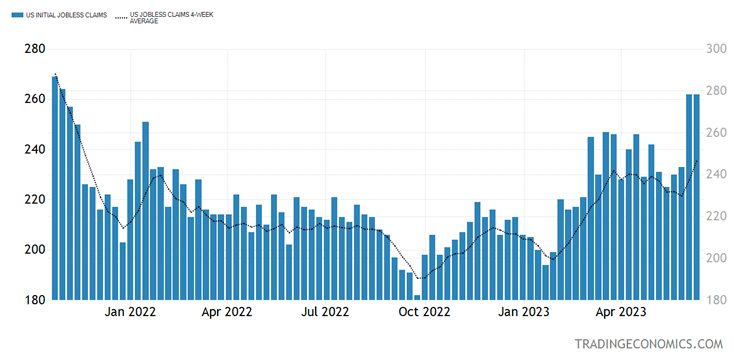

Two weeks in a row, jobless claims have been elevated, affecting the four-week moving average. These indicators have not been as high since late 2021 and early 2022 (see chart). Jobless claims are real-time, as best as they can be, and are not as prone to seasonal adjustments, as the job report is posted monthly.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What these and other economic indicators forecast about an impending recession – or the stock market, which made a fresh 52-week high last week – is open to interpretation.

Economic indicators geared towards manufacturing show a recession in that part of the economy. Economic indicators geared towards services show growth. As to the stock market, it may have forgotten its ability to forecast recessions.

It has to be stressed that two months before the 2007-09 recession started, the stock market made an all-time high, with parts of the mortgage market collapsing, cratering many banks’ balance sheets.

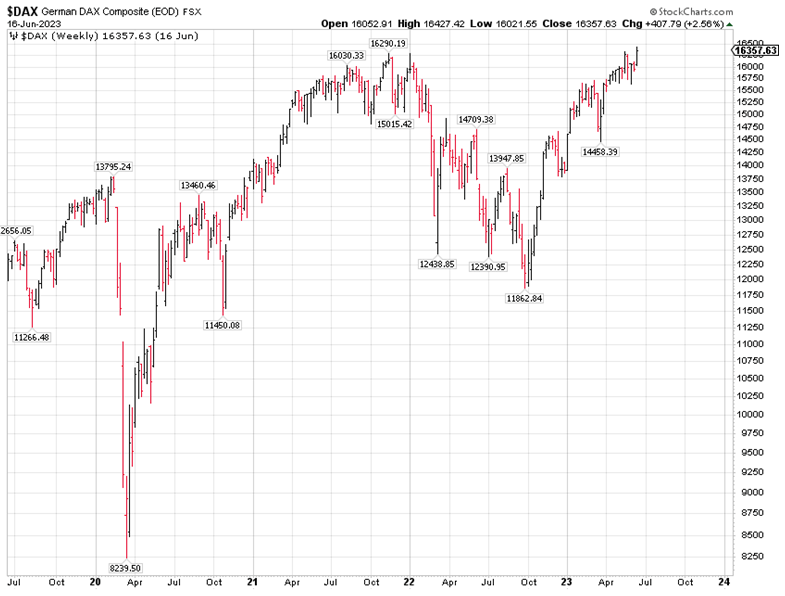

I wouldn’t say the stock market in 2007 forecast any recession, but fast forward to 2023 and look at Germany and you will see the German DAX making an all-time high last week, while Germany is in a recession now.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I am not rooting for a recession, and I would definitely prefer to see that elusive soft landing, but waiting on the stock market to forecast a recession is not advisable.

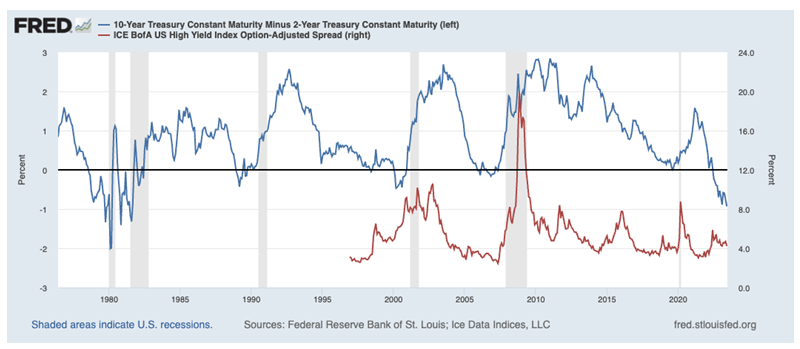

If one were to look at the bond market, however, one sees a mixed picture. The Treasury yield curve, as measured by the 2-10 spread, is as inverted as it was prior to the two nasty Paul Volcker recessions of 1979-80 and 1981-82.

The Treasury rates clearly think we are headed for trouble, but junk bond spreads are not elevated and are actually contracting, so they are not behaving like they did before the 2000-01 or 2008-09 recessions.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Ukrainian Counteroffensive (So Far) Underwhelms

The Ukrainian counteroffensive has started and, so far, it has been repelled rather violently on several instances with the help of the Russian air force, which is far superior to Ukraine’s.

The Russians were not prepared to fight a long war in Ukraine, based on the faulty intelligence that Ukraine would fall quickly, but it sure looks like they are prepared to repel the latest counteroffensive.

It would help if this conflict could be resolved this summer, as it would remove a great unknown from the investing world before it spirals out of control. I suppose we will know more in the coming month, but it looks like the Russians have dug themselves in pretty well on the other side of Dnipro, and they have no intention of leaving.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

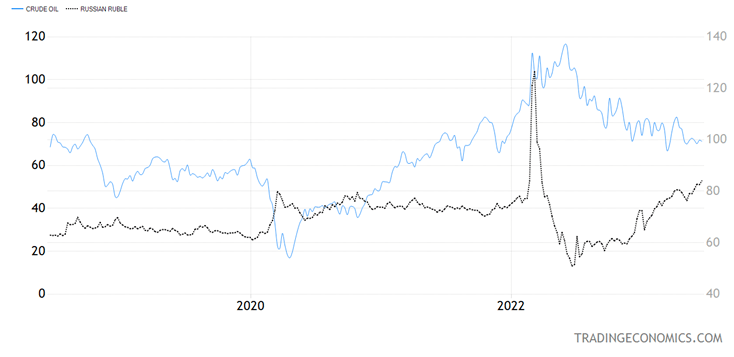

The Russian ruble has held up very well, and other than the volatility at the start of the war, it has kept its inverse relationship to the price of oil, where a stronger oil price means stronger ruble and vice versa. It would appear that sanctions achieved very little, and the Russian economy is holding up, all considered.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here