Introduction

PDD Holdings (Pinduoduo) (NASDAQ:PDD) is a Chinese e-commerce company that was founded in 2015. They have been on the uptrend over the last few years, and are well positioned for future growth. Following the pandemic, the e-commerce industry saw a lot of growth, though particularly in China, which is seeing widespread increases in GDP to supplement the expansion of the e-commerce industry in China. While there are risks associated with industry regulation and competition, Pinduoduo’s unique business model, strong fundamentals and expansion efforts make it a compelling investment option for investors looking to diversify their e-commerce portfolio.

Company Overview

Pinduoduo prides itself in its differences from its competitors. They have a unique business model which surrounds the idea of “group buying,” allowing consumers to team up with other consumers to place orders on a wide range of products in bulk, taking advantage of wholesale prices and incentivizing high volume orders. Their platform isn’t “search dominant,” where users know what they’re looking for, but instead markets the cheapest deals of the day. They also have a grocery vertical, called Duoduo Grocery, which provides wholesale grocery delivery to some of their key market areas. Most recently, they have taken initiatives to expand their operations and delivery capabilities to new regions, which include areas of Southeast Asia and North America via their subsidiary app, Temu. It is currently trading at ~$79 per share with a market cap of $106 billion.

Industry Overview

The Southeast Asian e-commerce market has experienced rapid growth in recent years, driven by the expansion of internet access and increasing consumer purchasing power. The Chinese e-commerce market alone is expected to reach a value of $3.3 trillion in 2025 with only a few major companies that dominate the industry. Pinduoduo is one of the leading players in this market, with a market share of 24%.

Competitive Analysis

Pinduoduo’s main competitors are Alibaba (BABA) and JD.com (JD). Alibaba leads with a GMV of $8.7 billion in 2022, which was driven by similar factors as the rest of the Chinese e-commerce industry. Pinduoduo’s investment in user interface consumer marketing over a search dominant platform, along with their online grocery vertical, gives them an edge in growing their consumer base and driving revenue compared to their competition.

Financials

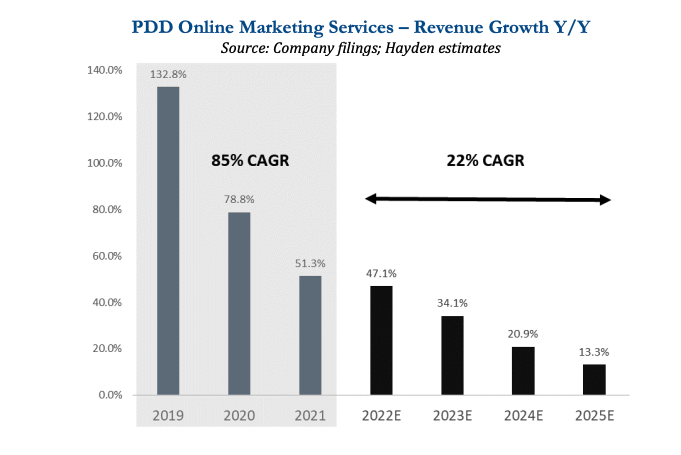

Pinduoduo’s financials have been strong in recent years. Their revenue has grown 58%+ YoY, and CAGR over the last year has been ~27%, which exceeds the industry CAGR of 20%. Their net income has grown 211% in the last year as well, currently at $8.1 billion. This is coupled with a growing take rate for PDD compared to the rest of the industry, providing ease of marketing for their suppliers on products that are often facing high supply.

Hayden Capital

Key Catalyst

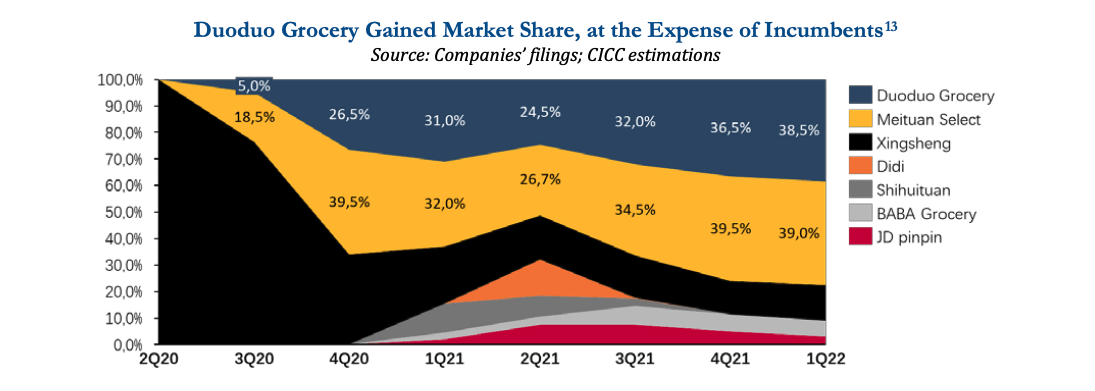

Pinduoduo main catalysts for continued high growth will revolve around their expansionary efforts in product availability, geographic presence, and the success of their other verticals like Duoduo Grocery and Temu. Relying on their group buying platform will continue to be successful as they expand into new product offerings and into the long-term, when the Chinese e-commerce industry sees more stable and normalized growth YoY. This will be coupled with an increased access to mobile phones and the internet to source products, granting an innate bias to Pinduoduo’s platform, which is designed for ease of use. Furthermore, Duoduo Grocery could easily become a main revenue driver for PDD, which is currently overlooked but has become the most widely used online grocery retailer in the region and could become profitable as soon as this year. Even in the grocery delivery industry, their model of group buying has a much higher utilization rate due to the structural compatibility of China’s dense population and the cheaper rates associated with wholesale ordering. Investing into this vertical will be key for PDD over the coming years.

Hayden Capital

Valuation

Adjusted for reduced industry CAGR, PDD is still expected to double its revenue over the next 3 years as Duoduo Grocery sees increasing success. PDD’s price to earnings ratio (P/E) is 21.31x, which is consistent with their competitors at 23.15 (BABA) and 22.46 (JD). Their price to sales ratio (P/S) is 5.503 compared to BABA’s 1.91, indicating that investors may believe in the high growth of PDD in comparison and are willing to pay a premium for the company’s revenue. This is most likely due to the company’s younger age and the potential for their grocery vertical to drive higher revenue over the next few years. This is demonstrated through their forward P/E of 20.62x, which is higher than the forward P/E ratio for their competitors and industry as a whole. BABA’s forward P/E is 10.08x and JD’s forward P/E is 14.37x in comparison. PDD’s stock price has been volatile over the past year, most recently reaching a high of $106.38 in January of this year. With high forward metrics, the reduced price of $79 per share could serve as a good investment opportunity considering that the company is still relatively young and is expected to drive record profits from its other investments.

ESG

Pinduoduo has a strong ESG record, pledging carbon neutrality by 2030, similar to other industry giants like Alibaba. They also have initiatives concerned with improving its supply chain and promoting diversity. PDD’s operations and structure are regulated by the Chinese government, though there has been no indication that this has affected the company’s revenue or structure.

Risks

Pinduoduo faces a few risks when attempting to forecast the stock’s future performance, specifically in terms of their ability to reinvest and capitalize in a more mature market, as well as potential restrictions from U.S. regulators for a lack of transparency from Chinese-owned companies that are listed on the U.S. stock exchange. The fear of restriction has been mostly calmed as US inspectors have been granted full access to the companies’ audit work papers as of last fall, but has not eliminated the risk of delisting entirely. Further regulation from US lawmakers could incentivize more Chinese companies to dual list on the Hong Kong exchange, boosting access to investors and potentially increasing their valuation while facing lower exchange costs.

Conclusion

Pinduoduo is a high-growth e-commerce company with a strong position and history. The company is well positioned to grow as they reinvest profits into new verticals and expansionary efforts, as well as the Chinese e-commerce industry continues to mature. While they face some risk with regulation and competition, they remain poised for growth and an overall good growth stock for investors.

Analyst Recommendation By: Caden-Alexander Fernando

Read the full article here