The electric car revolution has been underway for over a decade now, with all major players developing and touting at least one full electric model. While only representing 7% of new sales in the US in 2022, the projection is half of new car sales worldwide will be electric by 2035. One company that shows promise as a beneficiary from the demand for increased, clean electrical output to help power these electric vehicles is Centrus Energy (NYSE:LEU). From the company’s strategic position in the nuclear fuel industry to its recent growth prospects, we will delve into why LEU has the potential to generate long-term growth for investors and has a set-up for a shorter term swing trade.

Centrus Energy is a leading provider of enriched uranium for the nuclear power industry. As a trusted supplier, the company plays a vital role in supporting global nuclear energy programs, especially in the United States, Japan, and Belgium. The increasing demand for clean and sustainable energy solutions has positioned Centrus Energy at the forefront of the nuclear fuel industry. With an established customer base and long-term contracts, the company benefits from stable revenue streams and consistent demand.

Centrus Energy operates through two primary segments: the LEU segment and the Contract Services segment. The LEU segment focuses on the production, sale, and delivery of low-enriched uranium (LEU), primarily used in nuclear reactors. The Contract Services segment provides a range of technical, consulting, and management services to government and commercial customers. This diversification mitigates risks associated with dependence on a single revenue stream and enhances the company’s resilience. For instance, the company has a long-term contract with the U.S. Department of Energy (DOE) for the supply of uranium. Such contracts and partnerships underscore the trust and confidence placed in Centrus Energy’s capabilities, ensuring a steady flow of business opportunities.

The global push for clean energy and reducing carbon emissions has revitalized interest in nuclear power. With its low carbon footprint and ability to provide reliable base load power, nuclear energy is expected to play a significant role in the energy transition. As governments worldwide seek to decarbonize their economies, Centrus Energy stands to benefit from increased demand for its products and services. This favorable industry outlook creates a conducive environment for LEU’s growth and profitability.

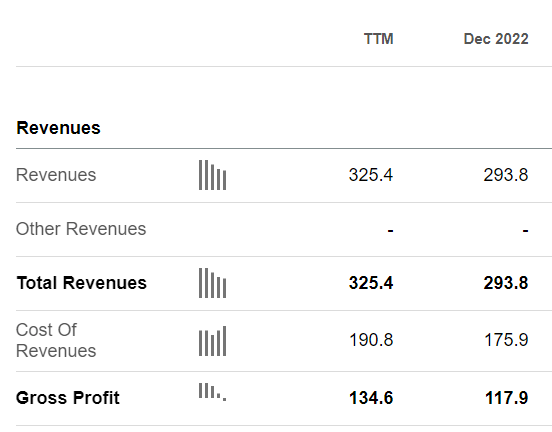

Examining Centrus Energy’s financial performance reveals positive trends that signal growth potential. The company has reported consistent revenue growth over the past few years, with trailing twelve months already exceeding 2022’s revenue by over 10%, highlighting its ability to capitalize on market opportunities. Foreign sales have also doubled since 2021 giving it strong diversification from regulation risk from one government which is always a worry in the nuclear energy sector. Additionally, Centrus Energy has successfully reduced its debt burden, enhancing its financial stability and providing more room for investment and expansion, as the company currently has more cash than debt on hand. These factors, coupled with a robust industry outlook, suggest promising long-term growth prospects for the company and with a current price to earnings ratio of 9, an attractive valuation as well.

Seeking Alpha Seeking Alpha

It is important to address the Russian Uranium import ban, as it may have implications for Centrus Energy. Last month, Congress passed legislation imposing restrictions on the import of uranium from Russia. The ban is aimed to protect national security interests and domestic uranium production. While this ban affects the import of uranium, it also creates potential opportunities for domestic uranium producers like Centrus Energy. By reducing competition from Russian imports, Centrus Energy can potentially benefit from increased demand for domestically produced uranium, supporting its growth prospects.

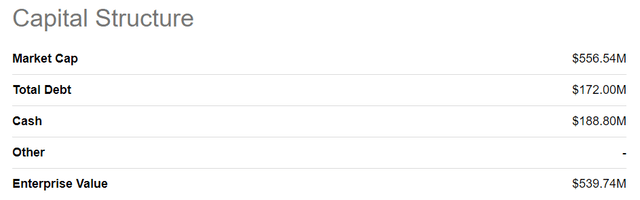

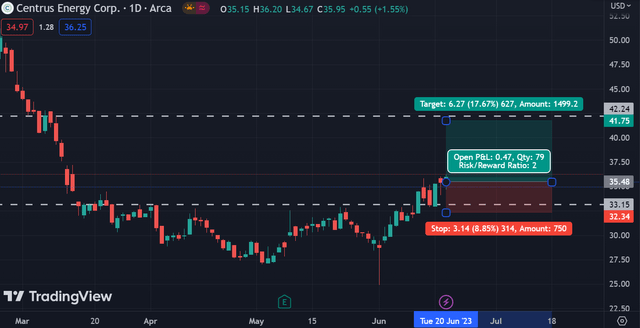

Studying LEU’s chart from a technical standpoint shows it coming out of a rounding bottom, with the highlighted date (June 1st) being the news announcement about the Russian uranium import ban. That day saw a nice bullish rejection of lower lows, sending the stock higher. While I normally like options trades, Centrus unfortunately has incredibly low volume with wide bid ask spreads. If I were to make an options play, though, I would use a double bullish put credit spread with call debit spread that would look something like this:

BUY TO OPEN: $30 PUT and $40 CALL October Expiration

SELL TO OPEN: $35 PUT and $45 CALL October Expiration

Option Strat

But with options volumes being so low and bid ask spreads being wide, I will stay out of the options and go with normal shares purchase. With current prices at ~$35 and a strong support level, I am targeting a 2:1 risk to reward ratio with profit target just below previous resistance and a stop loss protected by previous support.

Trading View Tradingview

Centrus Energy (LEU) is well-positioned to benefit from the increasing demand for clean electrical output to power electric vehicles and the broader push for clean energy solutions. As a leading provider of enriched uranium for the nuclear power industry, Centrus Energy plays a vital role in supporting global nuclear energy programs. Its strategic position, diversified revenue streams, and long-term contracts provide stability and growth opportunities. Additionally, the company’s financial performance, with consistent revenue growth, reduced debt burden, and strong diversification, points to promising long-term prospects. Furthermore, the recent Russian uranium import ban creates potential opportunities for Centrus Energy as it reduces competition and increases demand for domestically produced uranium. From a technical standpoint, LEU’s chart shows signs of a bullish reversal, further supporting the potential for a shorter-term swing trade. With an attractive valuation and a favorable industry outlook, Centrus Energy presents an enticing investment opportunity for both long-term growth and shorter-term trades.

Read the full article here