Bloomberg reported on January 5, 2023 that Kioxia and Western Digital (NASDAQ:WDC) had restarted merger talks that could create a force in the NAND industry to rival Samsung.

As late as June 2, 2023, an article in Nippon.com reported that “Japanese chipmaker Kioxia Holdings Corp. and its U.S. peer Western Digital Corp. are in detailed talks about merging their operations.” (Note I bolded the date as important for the discussion below).

As a background, Western Digital is a global leader in data storage solutions, specializing in hard disk drives (HDDs) and solid-state drives (SSDs). The company has a strong track record of technological innovation and a robust product portfolio, catering to a diverse range of customer needs.

I discussed the company in my April 3, 2023 seeking Alpha article entitled Western Digital Should Benefit From Samsung’s Production Cuts, But Macro Headwinds Could Dampen Memory Recovery.

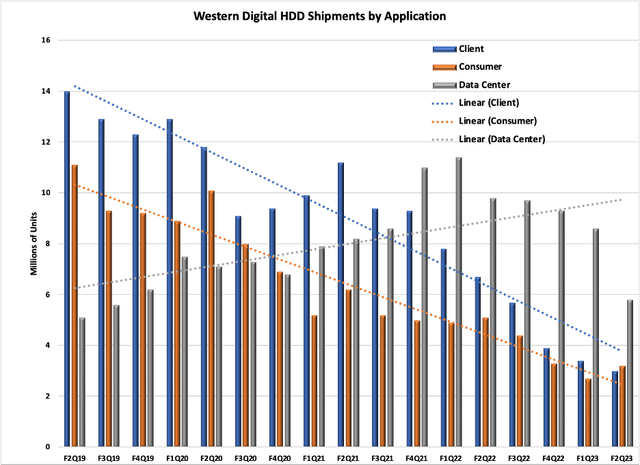

Chart 1 illustrates the problem with WDC and its HDD business. HDDs are segmented by application, and the Client, Consumer, and Data Center, according to The Information Network’s report entitled The Hard Disk Drive (“HDD+) and Solid State Drive (“SSD”) Industries: Market Analysis And Processing Trends.

In the fiscal Q3 2023 earnings call, WDC reported Client represented 35% of total revenue at $1 billion, down 10% QoQ and 44% YoY. Consumer represented 22% of total revenue at 0.6 billion, down 22% QoQ, and 29% YoY. Cloud (data center) represented 43% of total revenue at 1.2 billion, down 2% QoQ. Within the Cloud segment, “Nearline” bit shipments were 79 exabytes, up 31% QoQ. “Client” represented 35% of total revenue at $1 billion, down 10% QoQ and 44% YoY.

Chart 1

The Information Network

Kioxia, formerly known as Toshiba Memory Corporation, is a leading provider of flash memory and SSD solutions. Renowned for its expertise in NAND flash memory technology, Kioxia has established itself as a key player in the storage industry, with a strong focus on advancing memory solutions.

The merger between Western Digital and Kioxia holds significant strategic advantages. The combined entity would have a comprehensive product portfolio, integrating Western Digital’s HDD expertise with Kioxia’s leadership in NAND flash memory and SSD solutions. This broad range of storage offerings will position the merged company as a leading provider of both traditional and advanced storage technologies.

The reported merger between Western Digital and Kioxia marks a significant milestone in the storage solutions industry. By combining Western Digital’s HDD expertise with Kioxia’s leadership in NAND flash memory and SSD solutions, the merged entity has the potential to reshape the storage landscape.

Is the Merger Off?

In my “thinking outside the box” to my Seeking Alpha analyses, today I came across a June 13, 2023 press release from Intevac entitled Intevac Announces Appointment of Houlihan Lokey to Evaluate Strategic Options. (Note I bolded the date as important for the discussion below).

Intevac (IVAC) is a leading supplier of thin-film processing systems to the HDD industry. In the last 20 years IVAC has delivered over 180 of its industry-leading 200 Lean systems, which currently represent the majority of the world’s capacity for HDD disk media production. The system deposits the magnetic coating on top of the glass or aluminum platen.

The press release noted two important issues:

- IVAC has retained investment banking firm Houlihan Lokey Capital, Inc. to advise management and the board of directors on strategic alternatives. Additionally, the board has formed a strategic committee comprised of independent directors David Dury and Kevin Barber to work with management and Houlihan Lokey in evaluating options to increase stockholder value.

- “The ongoing challenges within the hard disk drive (HDD) industry resulted in the unprecedented cancellation of $54 million in 200 Lean® system orders late last month,” commented Nigel Hunton, president and chief executive officer. “In our nearly 20 years of supplying these industry-leading media processing tools, this is the very first time one of our customers has elected to cancel an order.”

The $54 million order was first reported by Intevac in an April 4, 2022 press release, titled “Intevac Announces $54 Million Order For 200 Lean Systems,” which was supposed to be delivered largest 200 Lean order in over 12 years.

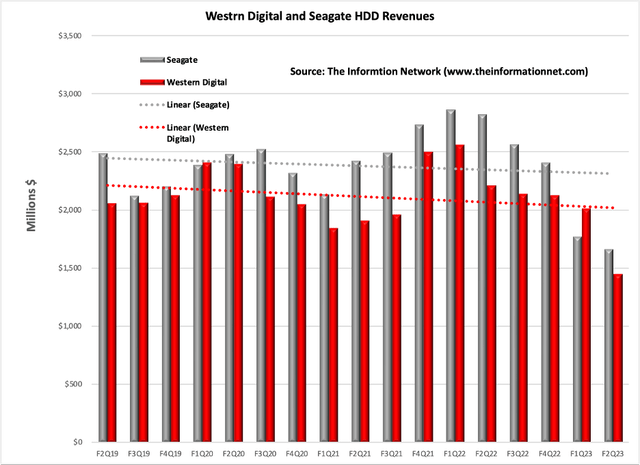

As I noted above in my analysis, HDDs are being replaced at client (PCs, e.g.) and consumer products by SSDs. But Nearline in the data centers is still strong. In fact, both WDC and competitor Seagate (STX) are experiencing similar HDD sales results, as shown in Chart 2, which illustrates total revenues for both companies between F2Q19 and F2Q23.

Chart 2

The Information Network

It is important to note that besides WDC and STX, the only other company making HDDs is Toshiba, which has a lower market share. So the $54 million in canceled 200 Lean sales is most likely coming from either WDC or STX.

Its particularly noteworthy that the Intevac press release noted that 180 200 Lean systems were sold in a 20 year period, meaning an average of just nine systems per year. This order for $54 million was for eight expanded-module systems, each of which are configured with 28 process chambers for the production of advanced hard disk drive (HDD) media.

The large cancellation is significant. IVAC reported in today’s press release new guidance for CY 2023 will include just one, 200 Lean system.

Importantly, this is called a “cancellation” not a “push-out”, so to me this indicates that the expansionary efforts by WDC with its merger with Kioxia is now off.

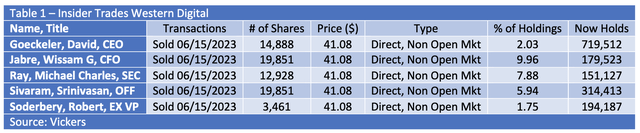

Insider Trading at WDC

While this article is my conjecture based on this Intevac announcement, Table 1 shows Insider Trading at Western Digital on 6/15/2023. It shows that all four executives of WDC sold a considerable number of shares, albeit a small percentage of their holdings.

The “type” of sales are “Direct, Non Open Market.” According to Investopedia, Non-open market describes an agreement to purchase or sell shares made directly with the company. Non-open market transactions do not take place on a market exchange like most purchase and sale transactions. These are private transactions and can include insider buying.

These WDC stock sales came two days after the Intevac Press Release as discussed above. This raises the question why would they Sell shares if a merger was imminent just two days after the equipment cancellations and just two weeks after the June 2, 2023 article I quoted above that the companies were in “detailed talks?”

Vickers

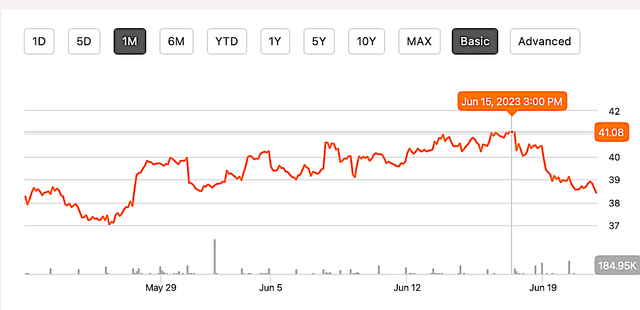

Importantly, these WDC share prices were rising at the time since May 25, 2023 and On June 15 at 3:00PM, the shares were sold and have been dropping since, as shown in Chart 3.

Chart 3

Seeking Alpha

Pomerantz Law Firm Investigates Claims On Behalf of Investors of Intevac, Inc. – IVAC

On June 19, 2023, Pomerantz Law Firm issued a press release that it was opening an investigation on behalf of investors of Intevac. The investigation concerns whether Intevac and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

I contacted the firm and asked for the filing, but was told there was no filing yet. I forwarded my Marketplace Semiconductor Deep Dive newsletter detailing my thesis to the firm and hope to get back a filing. With my e-mail I stated:

“Your activity has opened up new possibilities. I have looked into insider trading and I also attached an Intevac note that shows this, and I couldn’t discern the connection for your disclosure.”

This note covered insider trading by Vickers Stock Research Corporation.

Investor Takeaway

I fully suspect that the Western Digital-Kioxia merger is canceled. With the possible exception of sinister activity at Intevac, I can’t think of another plausible explanation for the cancellation of 54 deposition systems and the insider trading by WDC executives.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here