Investment Summary

Over the last 6 years, Kinder Morgan Inc (NYSE:KMI) has increased its dividend and prioritized its shareholders. It’s not often you have the opportunity to buy a company like KMI on a pullback with a strong yield of 6.63% where it’s actually supported and realistic. For 2023 KMI sees $4.8 billion available as distributable cash flows. That is over 10% of the entire market cap of the company. Used solely for buybacks and you would have your stake in the company appreciate more than most index funds.

While many companies in the tech sector have seen their share prices increase drastically this year so far, many of the value companies like KMI have instead gone down. I think this opens up a solid opportunity to scoop up some quality business for a decent price. KMI sees its dividend increasing by at least 2% in 2023 compared to the year prior. The commitment they have towards their shareholders makes this a buy right now.

A Dividend King Supported By FCF

As one of the largest energy midstream companies in North America, KMI has managed to establish itself very well and right now holds 15% of the entire natural gas storage capacity in the US. That sort of position is quite leveraged and has helped KMI become the dividend giant that they are today.

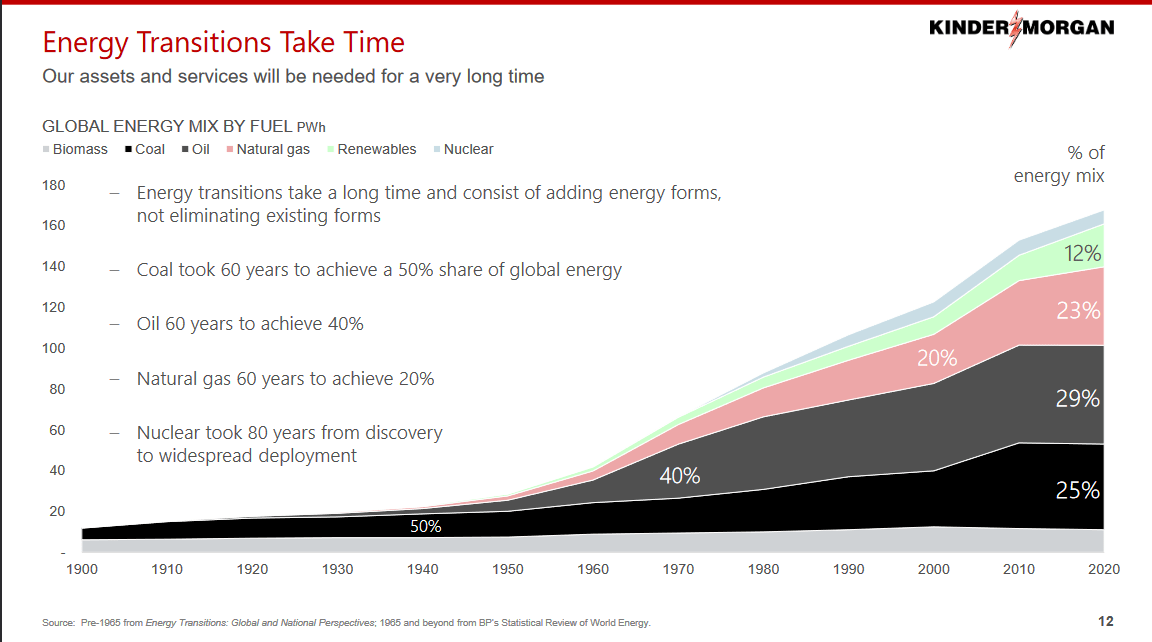

In recent years, the lobbying towards more renewables has strongly increased and the sentiment towards energy sources like gas and oil has strongly decreased. The younger generations are loud about wanting renewable energy sources and that creates hurdles and challenges even for companies as large as KMI. But the fact of the matter is that we are far far away from ever getting rid of natural gas and oil completely. Even with the goals set to reach by 2050, it’s likely natural gas and oil will still hold a significant portion as energy sources.

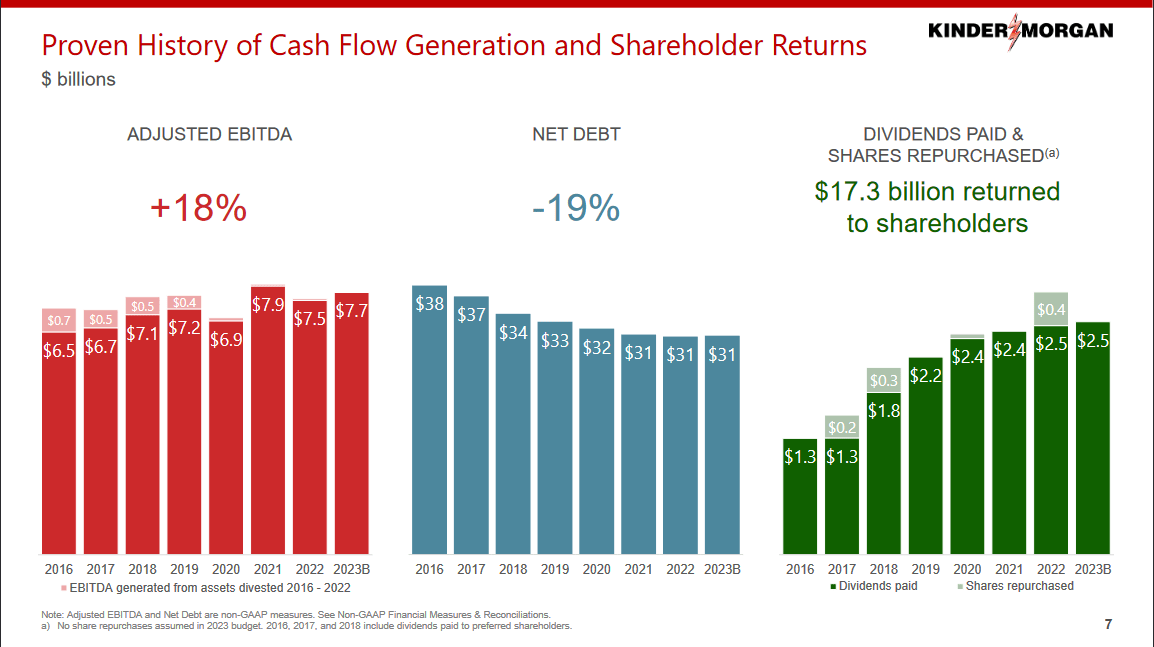

Cash Flow Generation (Investor Presentation)

Where KMI can in the meantime provide value to investors is by maintaining strong margins even through down parts of the cycle. Over time investors will be rewarded with dividends and buybacks, but also share appreciation. In the case of KMI, they have solid FCF margins of 8.63% right now. The outlook for 2023 is that KMI will have $4.8 billion in distributable cash flows, down 3% YoY. Normally that might be slightly worrying, but we have to remember that the natural gas market has seen a decline from its previous highs, which of course affected revenues. The short-term outlook however looks promising with prices rebounding in 2024, which would help KMI net another solid year of FCF.

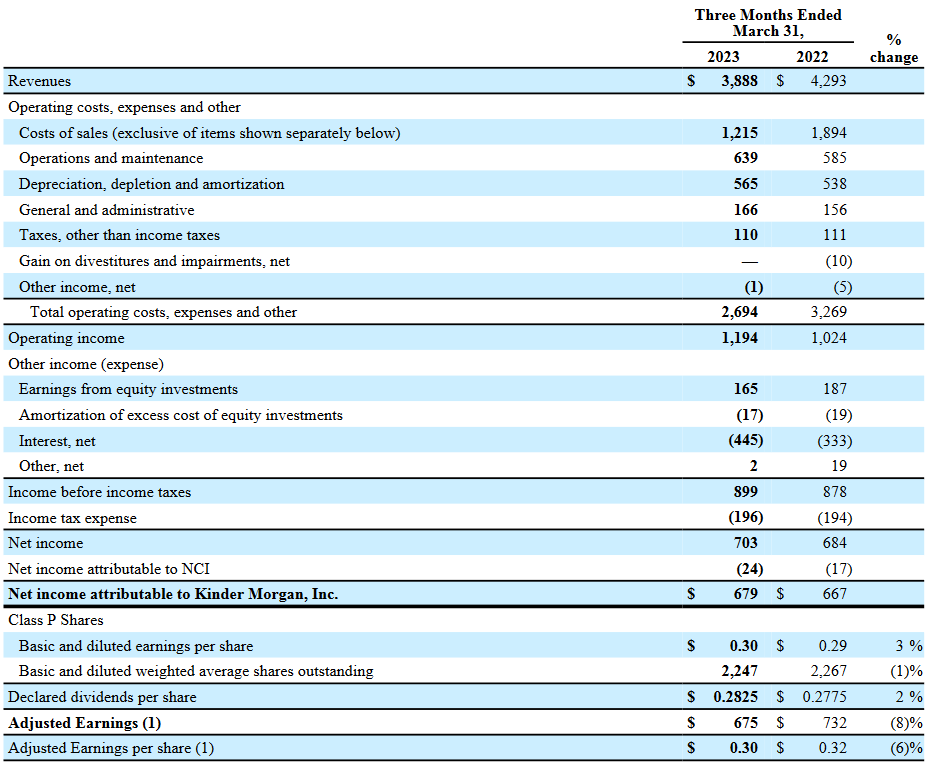

Quarterly Result

Looking at the last report by the company, it is impressive to see the top line decreasing but KMI is still able to grow its EPS by 3% YoY. The revenues decreasing around 10% is not that bad given the change decrease in the natural gas prices over the last months.

Where KMI sees some struggles is the continuous debate regarding natural gas pipelines in the country. The CEO said the following, “While the U.S. Congress debates much-needed infrastructure permitting reform, the system we operate under today makes it difficult to permit new natural gas pipelines in much of the country. That, in turn, increases the value of our existing natural gas pipeline systems, which results in a favorable re-contracting environment”. I think these are some good points, as the need to expand our pipeline infrastructure seems to need improvements, with KMI already being so established they can leverage what they already have to a certain extent.

Income Statement (Q1 Report)

Right now KMI has committed $3.7 billion in growth capital projects and expects 53% of this to be in service in 2023, and the remaining to be used up in 2024 and beyond. A majority is going towards natural gas which tells me KMI still sees there to be strong potential for growth in the current climate. They are however lowering their annual growth spending to $1 – 2 billion compared to $2 – 3 billion which they have had historically.

Energy Outlook (Investor Presentation)

As I mentioned earlier here, the transition towards renewables will take a very very long time. The only one seeing a noticeable decrease on the chart above is coal, whereas natural gas is still climbing and likely to continue doing so too I think. With renewables making up 12% of the global energy mix already I think they are clearly starting to take over, but will likely grow in unison with natural gas. With the Q2 report coming up I think the spotlight will be on whether KMI is able to maintain margins once again even in a soft market environment. So far the solid performance of the overall business of KMI has helped offset the projected prices they had for both oil and natural gas for 2023, which were $85 and $5.5 respectively. A bullish uptrend in both these commodities will be a catalyst for KMI and could result in the share price climbing back toward the $19 mark.

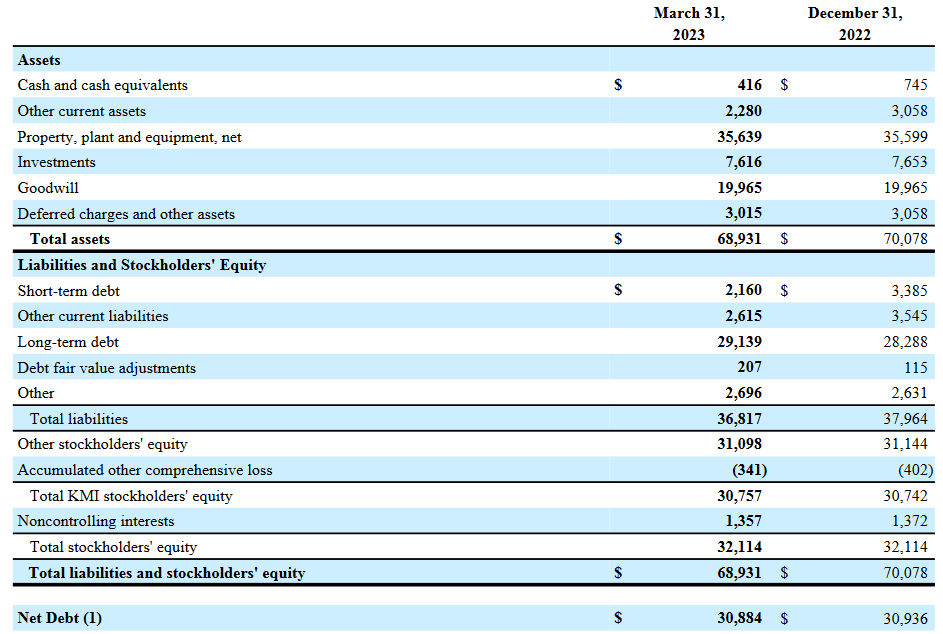

Financials

So far I think KMI has done a solid job at handling and growing their balance sheet. The long-term debts for the company are under $30 billion which is a solid improvement compared to the highs of $42 billion back in 2015. With the management prioritizing to build up a strong and healthy balance sheet that won’t pose a threat to the dividend and buybacks I think investors should be pleased.

Balance Sheet (Q1 Report)

The cash has seen a slight decline on a QoQ basis. Comparing just the cash to the debts would be unfair, as KMI still generates strong EBITDA even if the market is softer. For 2023 the guidance is $7.7 billion which makes KMI have a net debt/EBITDA of 3.7 on a forward basis. Perhaps a little higher than my preferred threshold of three.

As for me, I think the further reduction of debt will be a nice sign to look out for in the Q2 report. That would help reassure my thesis at least that investing in KMI right now is a sound decision.

Valuation & Wrap Up

Kinder Morgan Inc is one of the largest natural gas companies in North America. Holding 15% of the total storage capacity of natural gas they play a major role in supporting the region with gas. Where they spot some challenges is the continued discussions in Congress that are delaying much-needed infrastructure upgrades and pipeline projects. But that however makes the assets that KMI has ever so more valuable.

Stock Chart (Seeking Alpha)

With a strong projection of FCF distributable to shareholders I think the over 6% dividend yield right now looks reliable and I don’t expect KMI to hold off on increasing it or even lowering it. They have a 6-year streak of increasing it and I think that will continue. Because of the quality of the business and the commitment the management team has to their shareholders, I am rating KMI a buy at these prices.

Read the full article here