June 22, 2023, proved to be a really fantastic day for shareholders of Overstock.com (NASDAQ:OSTK). After news broke that the company had agreed to acquire certain assets from now defunct retailer Bed Bath & Beyond (OTCPK:BBBYQ), shares of the company spiked, closing up 17.3% for the day. While I agree that this maneuver will likely be value accretive for the business, I also think that investors should not get too excited right now. Fundamentally, the picture for the company has worsened over the past several quarters and it is unclear whether it can return to the kind of profitability it experienced in 2020 and 2021.

An interesting but opaque opportunity

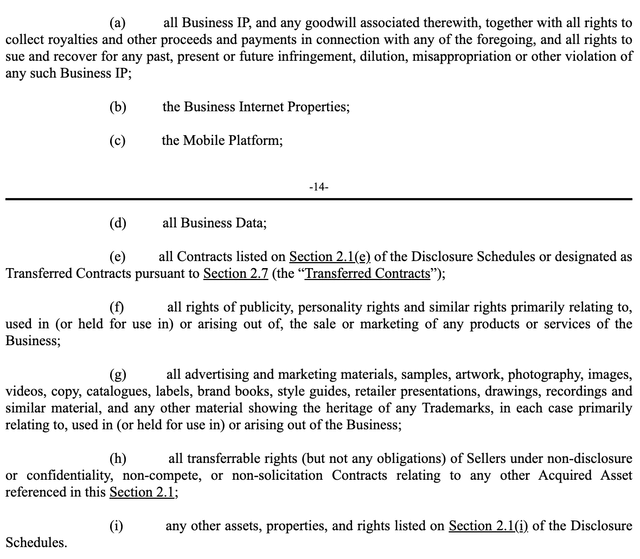

On June 22, news broke that Overstock’s bid to acquire certain assets associated with bankrupt retailer Bed Bath & Beyond had been accepted. In exchange for a cash payment of $21.5 million, Overstock.com will receive all of the business IP (intellectual property), combined with all rights to collect royalties and other proceeds and payments in connection with said IP, that has previously been owned by Bed Bath & Beyond. This means all intellectual property that has been owned or licensed exclusively to the bankrupt retailer.

Overstock.com

With few minor exceptions, the transaction also includes all of the Internet properties owned by Bed Bath & Beyond, its mobile platform, business data, certain contracts, advertising and marketing materials, and more. You can see a comprehensive listing of what’s included in this arrangement in the image above. It is worth mentioning that there are some assets that will not transfer over. These are referenced as ‘excluded assets’ in the agreement. But specific details have not been made publicly available as of this writing. Most likely, it will include some software, trademarks, and some select Internet properties.

Unfortunately, the collection of assets being acquired is something of a black box at this time. However, some of the most important assets could include customer data and contact information. That alone could be incredibly valuable for Overstock.com in its marketing efforts moving forward. It should be mentioned that the sale does not include ownership over the Buybuy Baby brand that will be sold off separate from this arrangement. That particular set of properties is likely worth billions of dollars, but only time will tell how that shakes out.

There has been some speculation as to what the financial impact could be for Overstock.com resulting from this asset purchase. Curtis Nagle, an analyst from Bank of America (BAC), for instance, estimated that for each 1% of Bed Bath & Beyond revenue, the company could see its revenue grow by 3% and its adjusted EBITDA climb by $10 million. Investors would be wise to keep in mind that any such estimates to this effect are highly speculative at this point, especially because we have no idea how Overstock.com will utilize the assets it’s acquiring.

My own opinion on the matter is that the company likely will benefit from this transaction. The market definitely thinks so. The market capitalization of Overstock.com shot up $164.9 million in response to this maneuver. Considering that Bed Bath & Beyond generated revenue of $5.34 billion during its latest completed fiscal year, it’s not difficult to imagine Overstock.com being able to capture at least that much value as time goes on. Those who are bearish regarding the transaction, however, can make the case that there is little true value in anything associated with the defunct retailer. In the last three fiscal years that it operated, it saw revenue cut by nearly half from $9.23 billion to $5.34 billion.

There are certain brand names associated with Bed Bath & Beyond that are likely to transfer over to Overstock.com as part of this arrangement. These include the private label brands that Bed Bath & Beyond owned up to this point. But when you consider that, starting in late 2022, the retailer began slashing away at its private label business, cutting the number of labels that it had by a third, it’s unlikely that there is a great deal of value on that front. That alone is shocking since private label brands should, by definition, have higher profit margins than name brands that a retailer can sell. That also tells me that the real value from this purchase would be in the data as opposed to anything brand related.

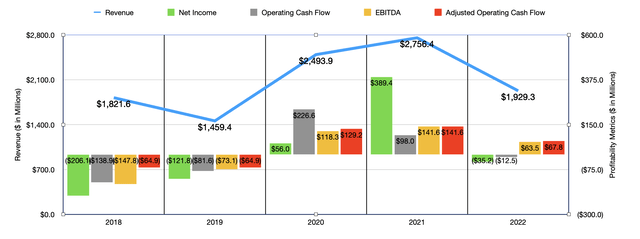

Author – SEC EDGAR Data

While some positive reaction from the market was justified as a result of this development, I don’t believe that this changes the picture regarding Overstock.com one iota. As you can see in the chart above, sales of the company plunged in 2022 compared to what they were in 2021. This caused profits for the company to collapse, with the company turning from a net profit of $389.4 million in 2021 to a net loss of $35.2 million last year. Other profitability metrics also took a beating during this time.

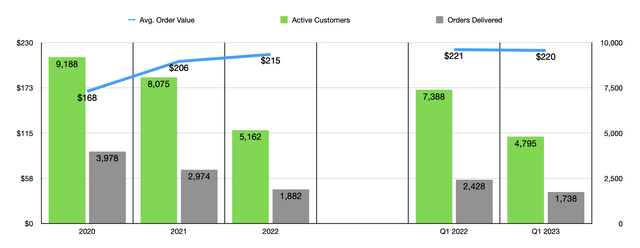

Author – SEC EDGAR Data

There was one primary driver behind this sales decline. And this was a substantial decrease in the number of active customers that the company had. The number dropped from 8.08 million in 2021 to 5.16 million last year. Even though the average value of an order grew during this time from $206 to $215, the drop in active customers resulted in a plunge in the number of orders received from 2.97 million to 1.88 million.

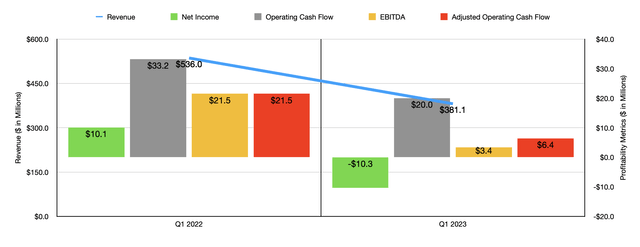

Author – SEC EDGAR Data

To make matters worse, this downward trend continues. During the first quarter of 2023, revenue for the company totaled $381.8 million. That’s a meaningful difference compared to the $536 million reported the same quarter last year. The firm went from generating a net profit of $10.1 million to generating a net loss of $10.3 million. And just as was the case with 2022 relative to 2021, the other profitability metrics for the company collapsed as well. This was driven by a further decline in the number of active customers from 7.39 million to 4.80 million, while the number of orders received fell from 2.43 million to 1.74 million. In this case, the average value of an order did drop modestly, while the number of orders per active customer declined.

To some extent, this fundamental worsening can be chalked up to current economic conditions. However, management has been very direct about what they think some of the issues are. One of the primary issues is the fact that, during the COVID-19 pandemic, the company exploded in popularity because of social distancing policies and government stimulus. Now that the pandemic is long since over, the company is returning to more normalized conditions. This is rather problematic because, if you look at data from both 2018 and 2019, revenue, profits, and cash flows for the company are all significantly in the negative. If we are returning back to that as the new normal, then it will likely be a bad recipe for shareholders.

Author – SEC EDGAR Data

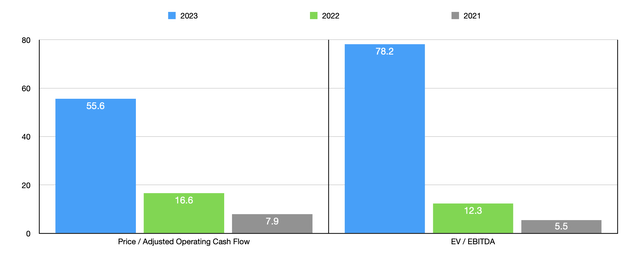

Even in the event that the company can stabilize at levels similar to what it is seeing today, shares look very expensive. By annualizing financial results seen in the first quarter of this year, for instance, we would expect adjusted operating cash flow for the company of $20.2 million and EBITDA of only $10 million. As you can see in the chart above, this would result in shares of the company trading at very lofty multiples on a forward basis. We would have to see business stabilize at levels seen in 2021 or 2022 for the company to be either undervalued or fairly valued. And right now, that seems very unlikely based on the data in front of us.

Takeaway

I understand why the market got excited about this interesting maneuver made by Overstock.com. It probably did justify some optimism from the investment community. But investing is not about short-term wins that are fairly small in the grand scheme of things. Rather, it should be about the long-term picture. And all the data that we have at our disposal today suggests that the long-term outlook for this ecommerce play is less than ideal. Given this view, I would argue that the company warrants a ‘sell’ rating at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here