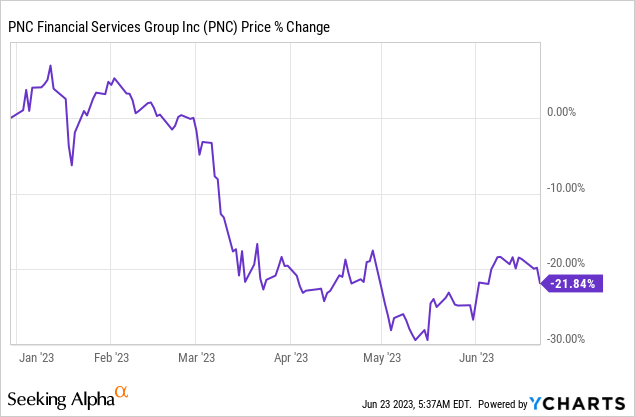

Like so many other regional banks during the first-quarter, PNC Financial Services (NYSE:PNC) has seen a large correction in its market capitalization. With shares still down 22% year-to-date, I believe a lot of PNC Financial’s rebound potential has not yet been realized. Given that the bank’s shares have traded at a solid premium to book value before the March financial crisis and that the bank has actually seen a quarter over quarter increase in its average deposits in Q1’23, I see continual upside and recovery potential for PNC Financial: if shares manage to return to their pre-crisis valuation level, I believe investors could realize up to 27% recovery gains. Additionally, investors get paid a 4.9% yield that is supported by the bank’s earnings!

PNC Financial’s deposit base is growing in a challenging interest rate environment

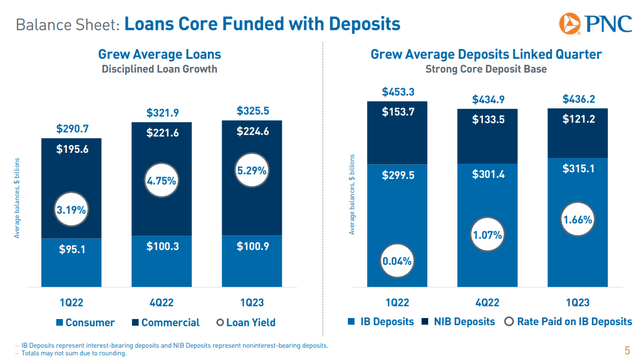

PNC Financial’s deposits declined in Q1’23, year over year: the regional bank had $436.2B in average deposits on its balance sheet in the first-quarter which marks a 4% year over year decline, chiefly because of changing conditions in the interest rate environment. However, PNC Financial as a regional bank did not see deposit outflows during the first-quarter as its average deposits grew $1.3B quarter over quarter.

Source: PNC Financial

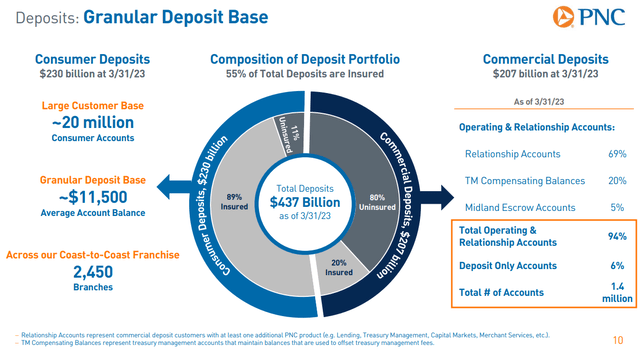

About 53% of deposits are held in the bank’s consumer business ($230B) while 47% of deposits are allocated to the commercial business ($207B). Commercial deposits were especially at risk of getting withdrawn in the first-quarter because the Federal Deposit Insurance Corporation only guarantees deposits up to a value of $250,000. That commercial deposits haven’t fled PNC Financial’s balance sheet is a sign of confidence that depositors don’t view the regional bank as unstable. At the end of the first-quarter, a total of 55% of PNC Financial’s deposits were insured and the majority (89%) of consumer deposits.

Source: PNC Financial

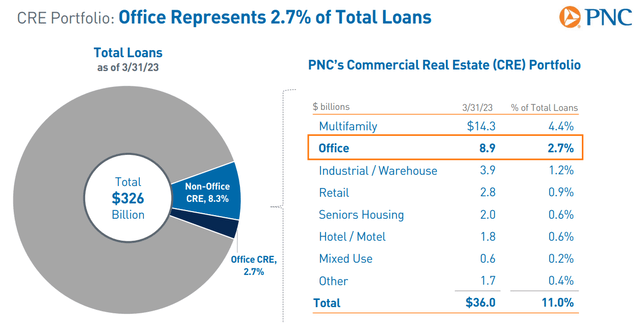

Limited office real estate exposure

Due to the Fed raising interest rates, investors have grown more concerned about the real estate exposure of regional banks, including PNC Financial’s. Dropping valuations, especially in the office and retail sectors, are another cause of concern for bank investors. PNC Financial, however, despite its large loan book, has relatively small exposure to the cyclical office market: only 2.7% of its total loan portfolio was linked to office real estate which limits the potential fall-out from distress potential related to borrowers failing to make payments to lenders.

Source: PNC Financial

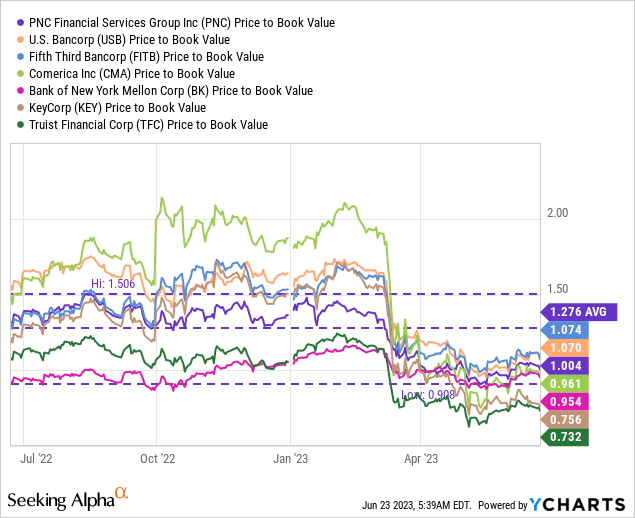

PNC Financial is now a value stock

PNC Financial is currently valued at a price-to-book ratio of 1.0X which is about on the same level as the P/B ratios of other regional banks… with the exception of banks like Western Alliance Bancorporation (WAL) and PacWest Bancorp (PACW) which are perceived as riskier bets due to their dependence on businesses.

Most regional banks have traded at premiums to book value before the financial crisis hit investors unprepared in March, including PNC Financial. The regional bank achieved a 1-year average price-to-book ratio of 1.28X before the financial crisis hit the U.S. financial system caused panic in Q1’23. If PNC Financial returns to its pre-crisis valuation level of 1.28X book value, investors could potentially realize 27% upside potential. Shares are currently trading at $123.44 while the fair value, based off of historical P/B, is possibly closer to $156-157 per-share.

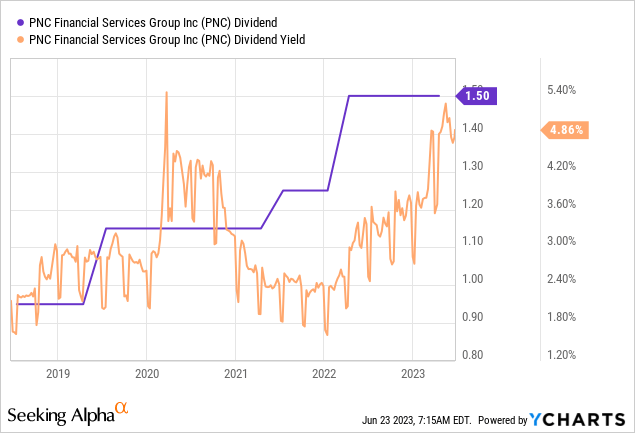

A consequence of the meltdown in the regional banking market, and one attractive feature of an investment in PNC Financial, is that the bank’s shares currently pay a near-5% dividend.

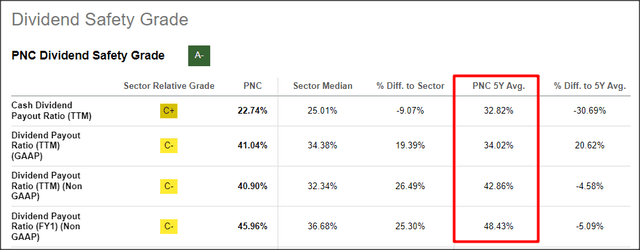

PNC Financial is paying out well less than 50% of its earnings and the regional bank has a dividend safety grade of A- from Seeking Alpha. The payout ratio in the last twelve months was just 41% while the bank’s 5-year average payout ratio was 43% (indicating a stable payout). For me, this means that the dividend is very solidly covered by earnings and the bank has a strong chance growing its dividend going forward.

Source: Seeking Alpha

Risks with PNC Financial

A key risk for PNC Financial is the possibility of new pressure developing on the deposit bases of regional banks. Since the fall of First Republic Bank at the beginning of May, no other major bank has failed, which is good news for PNC Financial as well as for the entire banking industry. However, should another regional bank fail, especially a larger one, then we could see a reboot of the financial panic that rattled investors in March, after the failure of Silicon Valley Bank.

Final thoughts

PNC Financial is an attractive recovery bet in the regional banking market and I see up to 27% recovery potential if the bank’s shares return to their pre-crisis valuation level, based off of book value. PNC Financial traded at a solid premium to book value before the March financial crisis. Since the bank continued to grow its average deposits in the first-quarter, has low exposure to office real estate and a stable dividend payout ratio below 50%, I don’t see why PNC Financial’s valuation could not fully recover to its pre-crisis level. In my opinion, PNC Financial does not only offer recovery potential, but the near-5% dividend yield actually makes the regional bank a value stock!

Read the full article here