By Fawad Razaqzada

Weakness in data and very hawkish central banks have revived investor concerns over a hard landing.

Hawkish Central Banks

Most notably, it has been the European central banks that have been very hawkish – the BoE in particular, with its above-forecast 50 basis point rate hike on Thursday.

But the Fed Chair Jerome Powell was also notably been more hawkish at his testimony this week than he perhaps was at the FOMC press conference last week.

Powell highlighted the greater possibility of further rate hikes compared to last week. He implied that the markets should close the gap with the Dot Plot projections.

So, we have seen global equities, crude oil, and some emerging market currencies like the Turkish lira all selling off. At the same time, the US dollar has rallied against most major currencies, including the Japanese yen and the antipodean dollar.

Gold and silver, offering zero yields, have taken a big fall amid fears of even higher interest rates. The US Dollar Index was higher for the week, snapping a three-week losing run.

Soft European PMIs Raise Recession Worries

The risk aversion deepened on Friday as recession fears grow in Europe following the publication of much weaker-than-expected PMI data from the Eurozone and the UK. US PMI data will be in focus later in the session.

The big worry is the consistent declines seen in the manufacturing activity at the Eurozone’s economic powerhouse, Germany. But the rest of Europe’s manufacturing activity was also very poor in June:

- German Manufacturing PMI 41.0 vs. 43.6 expected and 43.2 last

- Eurozone Manufacturing PMI 43.6 vs. 44.8 expected and 44.8 last

- UK Manufacturing PMI 46.2 vs. 46.9 expected and 47.1 previous

The services sector PMIs were not great either, although in most cases they remained above the expansion threshold of 50.0:

- France flash services PMI 48.0 vs. 52.0 expected

- Germany flash services PMI 54.1 vs. 56.2 expected

- Eurozone flash services PMI 52.4 vs. 54.5 expected

- UK flash services PMI 53.7 vs. 54.8 expected

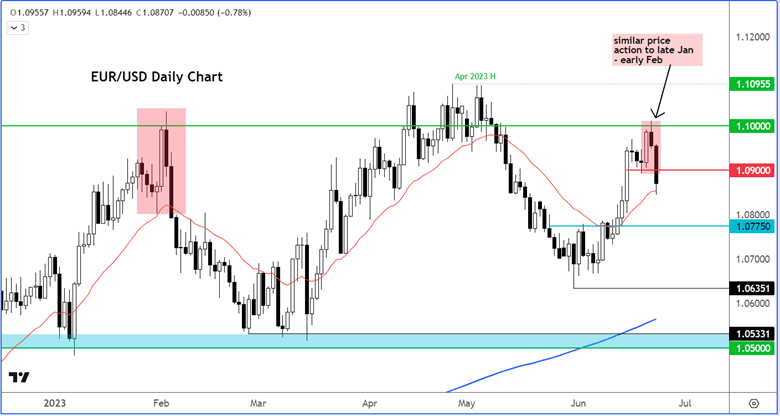

EUR/USD Breaks 1.09 Support

Following the weak PMI data, investors are now more confident that there will be one more ECB rate hike in July, and a long pause after that as inflation is likely to come down with falling economic activity anyway. This could keep the upside limited for the euro.

From a technical viewpoint, the EUR/USD turned sharply lower this morning to print a bearish-looking pattern, similar to the reversal we saw earlier this year – see the chart.

For as long as the price now holds below the 1.09 handle, technical traders may look to punish this pair and push it down sharply in the coming days. The bulls may therefore wish to wait for a confirmed bullish signal to emerge before looking to buy this latest dip.

Source: TradingView.com

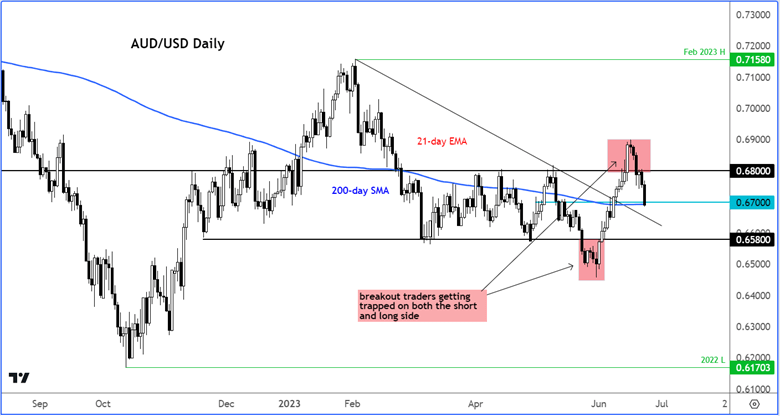

AUD/USD Down 1pc

Among major FX, we have seen a big drop in the risk-sensitive AUD/USD pair, falling further below the key 0.6800 breakout level. As the price has failed to hold the breakout above that old resistance, traders were forced to exit their trades, which has undoubtedly hastened the sell-off.

Similar price action was formed on the upside earlier this month when the breakdown below key support at 0.6580 failed to show any downside follow-through.

At the time of writing, the AUD/USD was testing support just below the 0.6700 handles after falling by 1% on the session. Here, the 200-day average meets with a short-term horizontal level. A close below this level could pave the way for a run-down to that 0.6580 level again.

The bulls will want to see a confirmed bullish reversal first, before potentially looking for long ideas – whether that comes in the form of a hammer or a double bottom, etc. In any case, a move north of 0.6800 would be a significant bullish development.

But right now, the chart is looking quite ugly following the failed breakout, so I favour looking for short ideas on this pair, then long.

Source: TradingView.com

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here