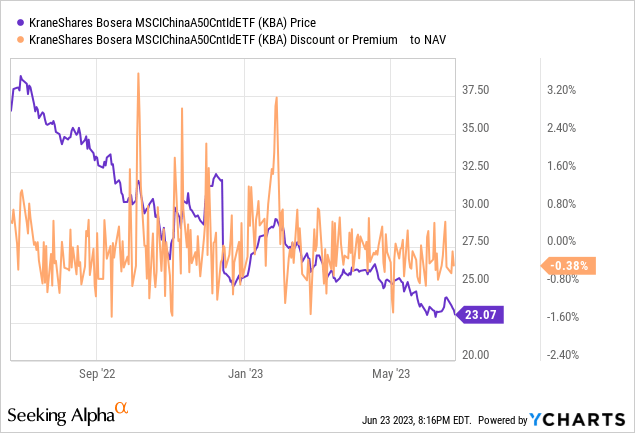

Following an optimistic start to the year, the China reopening theme appears to have fizzled out. While the release of pent-up consumer demand has kept services numbers relatively strong, the rest of the economy has remained surprisingly weak. With the latest batch of economic data (contractionary PMIs, weak industrial production, and deflationary producer prices) indicating falling activity growth, markets have rightly turned bearish on this atypical recovery. Policymakers are stepping in, though, with the recent rate cuts (10bps to the PBoC’s 7-day reverse repo rate and another 10bps to effective lending rates this week) indicating a clear intent to revive credit demand and, by extension, economic growth ahead of July’s Politburo meeting. Yet, I would be cautious about underwriting any potential stimulus announcements (fiscal and monetary) as a silver bullet. Headwinds from the ongoing property market downturn appear to be worse than expected, while the structural impact of geopolitical tensions, particularly on tech, is a material overhang. So even with the KraneShares Bosera MSCI China A 50 Connect Index ETF (NYSEARCA:KBA) down to more palatable valuations following the YTD downturn, it may be time to cash in the chips on the ‘long China’ trade here.

Fund Overview – A Well-Diversified Chinese A-Share Basket

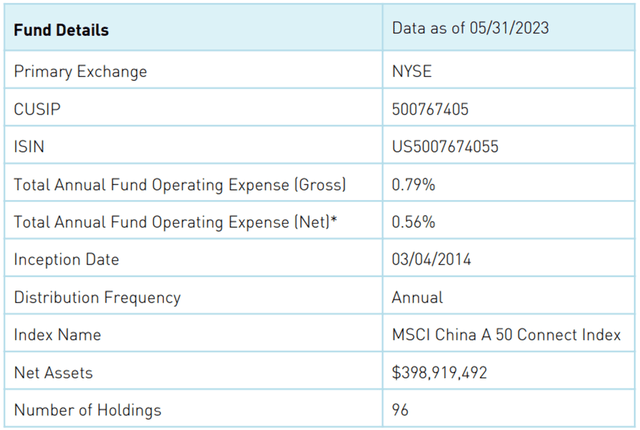

The US-listed KraneShares Bosera MSCI China A 50 Connect Index ETF tracks (pre-expenses) the performance of the MSCI China A 50 Connect Index, comprising fifty Stock Connect-eligible large-cap stocks trading on the Shanghai and Shenzhen exchanges (i.e., A-shares). The ETF held ~$399m of net assets at the time of writing, significantly down from the prior ~$469m amid a combination of investor outflows and underlying performance declines in recent months. The fund has maintained its ~0.8% gross expense ratio, though, with the net ratio also in line at 0.6% (net of contractual fee waivers through August 2023); as one of the few A-share vehicles available to US investors, KBA is reasonably priced. A summary of key facts about the ETF is listed in the graphic below:

KraneShares

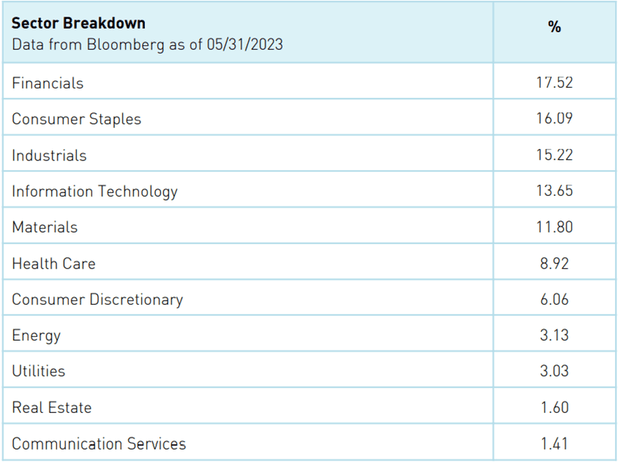

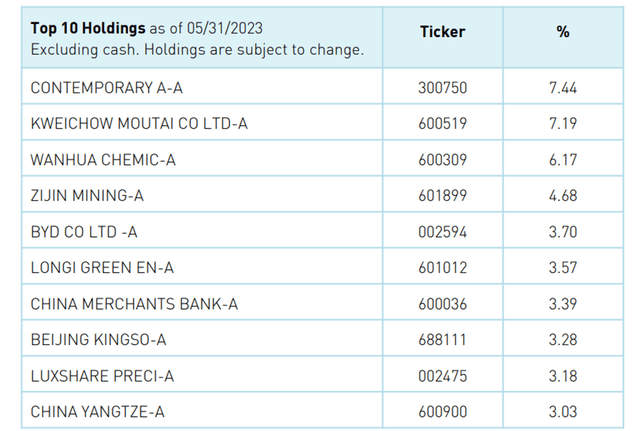

Per the latest KBA factsheet, the fund’s assets are spread out across 96 holdings (broadly unchanged), with no single-stock weightage crossing the 8% threshold. The sector allocation is similarly in line with prior quarters, led by Financials (17.5%). Consumer Staples has seen a modest decline in weightage at 16.1% (vs. 17% prior), along with Materials at 11.8% (vs. ~12% prior); in contrast, Information Technology moves up on the sector breakdown list at 13.7% (up from ~12% prior), while Industrials is broadly unchanged at 15.2%. In total, the top-five sectors contribute to ~74% of the portfolio.

KraneShares

The single-stock allocation has seen some reshuffling over the last quarter, with battery producer Contemporary Amperex Technology now the largest holding at 7.4%, followed by baijiu producer and distributor Kweichow Moutai at 7.2% (down from ~8% prior). Other key holdings include chemical product supplier Wanhua Chemical Group at 6.2% (down from ~7% prior), mining group Zijin Mining (OTCPK:ZIJMF) at 4.7%, along with EV producer BYD (OTCPK:BYDDF) at 3.7%. In total, the top five holdings account for ~29% of the overall portfolio.

KraneShares

Fund Performance – Recent Underperformance Weighs On The Track Record

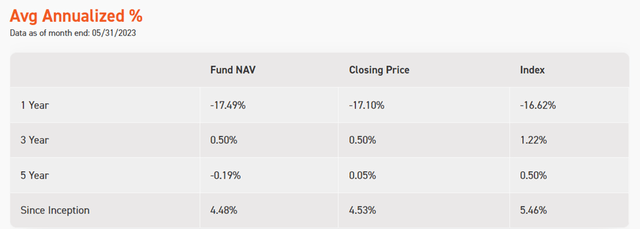

On a YTD basis, the ETF has declined by 9.0%, though since inception in 2014, the fund has compounded at 4.5% in market price and NAV terms. Fund performance has been volatile, though, with much of the outperformance coming in the early years. Last year’s double-digit % drawdown was the steepest in the fund’s history, dragging the annualized three and five-year returns to +0.5% and +0.1%, respectively.

KraneShares

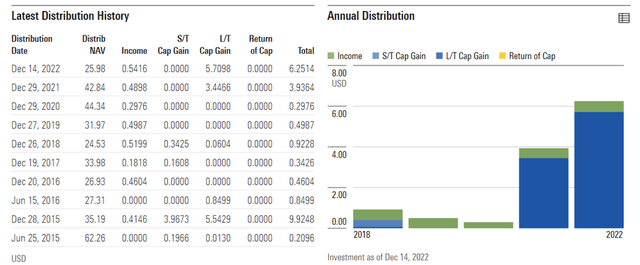

On the flip side, the annual distribution (income and capital gains) has generally been positive, helped by the portfolio’s defensive, cash-generative holdings. With the reopening this year likely to boost earnings as well, expect some upside to the current trailing income yield of ~2%.

Morningstar

Disappointing Ex-Services Data; All Hopes Now Pinned On Stimulus

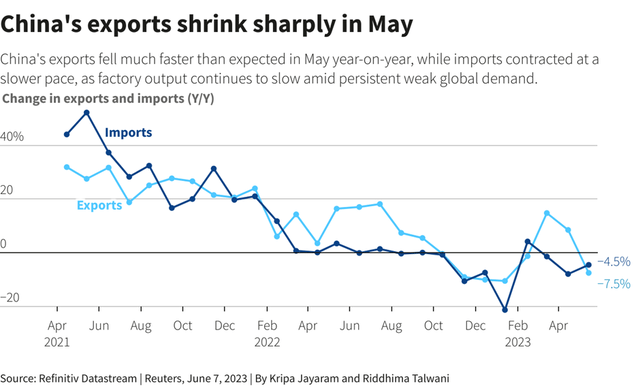

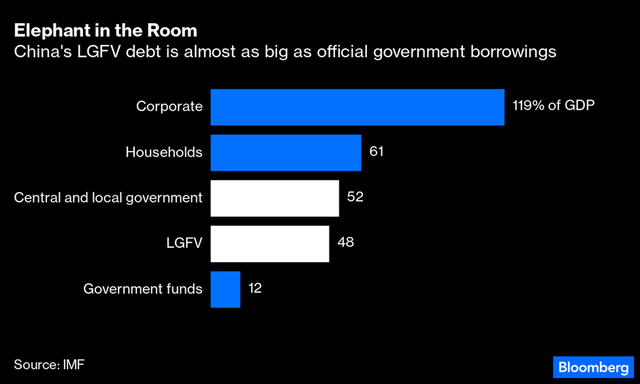

China’s economic data has been disappointing, to say the least. On the one hand, the services economy has rebounded as expected, led by increased consumption post-COVID. Yet, the recovery elsewhere has lagged – despite a brief property sector recovery to start the year, developers have largely been stuck in a deleveraging cycle to ensure their long-term survival. Elsewhere, industrial production has also remained weak, while the contractionary manufacturing PMI at 48.8 in May (down from 49.2 in April) indicates more of the same throughout the year. Perhaps the biggest surprise, though, was the -7.5% YoY decline in May exports (vs. +8.5% in April and 14.8% in March), along with producer prices entering a concerning deflationary spiral at -4.6% (down from -3.6% prior). So even with overall non-financial credit growth screening strongly at ~10% amid improved household loan growth, the prospect of prolonged corporate credit demand weakness and local government debt concerns (mainly property/infrastructure-related) doesn’t bode well for the sizeable ex-consumer portion of the KBA portfolio.

Reuters

Validating these concerns is commentary out of Beijing indicating that policymakers are concerned about the economic growth outlook (recall the +5% target this year), with a comprehensive stimulus package already in the works. Given the crucial role of China’s property sector in driving aggregate demand, any easing will likely be targeted here. Early signs haven’t been too encouraging, though, with the PBoC’s 10bps rate cuts implying limited impact on the monetary side. And given the scale of the local government debt overhang, Beijing’s ability to accelerate infrastructure investment is likely constrained. Hence, investors have rightly kept their expectations low ahead of next month’s Politburo meeting (note KBA’s continued decline in recent weeks), as a below-par growth outlook looks likely to prevail this year.

Bloomberg

Cashing In The Chips On China

Having been bullish on China since the reopening announcement late last year, recent negative economic data points indicate optimism around a consumption-led rebound may have been overestimated vs. the prolonged negative shock elsewhere (most notably from the ongoing property market downturn). Onshore markets have rightly turned bearish again, with a combination of valuation de-ratings and RMB depreciation leading to KBA retracing most of its post-reopening gains. Upcoming policy easing measures will likely help to offset some of the impact, though the scale of recent rate cuts and the unresolved local government debt issues indicate investors shouldn’t pin their hopes on a large-scale fiscal stimulus package anytime soon. With a slew of potentially negative news flow on the horizon from the geopolitical side as well, the risk/reward on KBA doesn’t strike me as attractive here.

Read the full article here