European payment processing firm Adyen’s (OTCPK:ADYEY) growth prospects are stellar, and the company has significant competitive advantages to navigate rising competition.

Brief business overview

Adyen’s payment platform enables eCommerce retailers to seamlessly accept online payments from various payment providers including Apple, Google, PayPal.

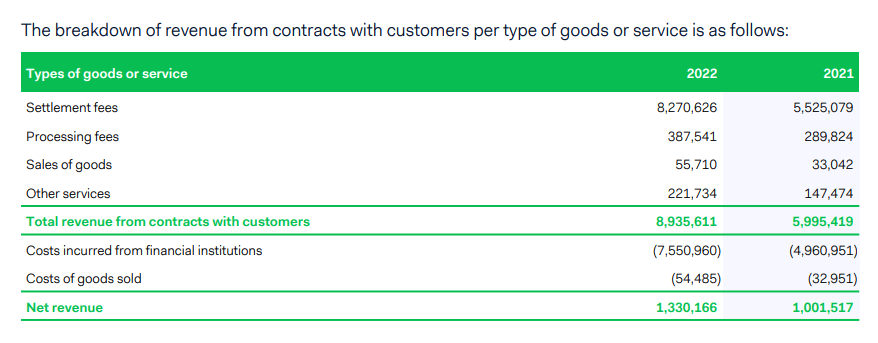

Adyen’s customers include Uber, Netflix, Spotify, Facebook, McDonald’s, Oracle, Etsy. The company generates revenues from settling and processing payments, sales of goods such as the sale of point of sale (POS) terminals, and other payment specific services.

Adyen Annual Report, 2022

FY2022: revenues and processed volumes up, however margins decline

For FY2022 (year ended December 2022), Adyen’s net revenues climbed 33% YoY to EUR1.3 billion, and processed volume rose 49% YoY to EUR767.5 billion. Take rate continued to decline, dropping 10.8% YoY to 17.3 basis points.

EBITDA margin however dropped to 55% in FY2022 from 63% the previous year, due to an increase in employee benefits driven by an increase in hiring. The company’s full-time employees increased to 3,332 in 2022 from 2,180 the previous year.

Although Adyen’s margin contraction and hiring pace didn’t sit well with investors (the stock sank 15% the day results were announced), the stock price has largely recovered. Looking ahead, there are reasons to be optimistic about Adyen’s prospects.

eCommerce has a long runway for growth in Adyen’s biggest markets

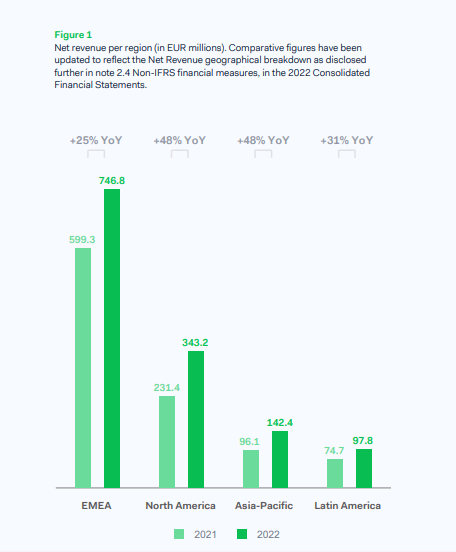

EMEA (Europe, Middle East, and Africa), Adyen’s biggest market, accounts for 56% of Adyen’s net revenues. North America, Adyen’s second-biggest market, accounts for 25% of net revenues.

Adyen Annual Report, 2022

Both regions have plenty of runway for eCommerce growth, benefiting merchant acquirers (a company that processes payments on behalf of a merchant) like Adyen. According to McKinsey, in Northern Europe, where eCommerce penetration is highest in the region, online sales accounts for just 19% of total retail sales. In Western Europe, 13% of retail sales are made online, while in Southern Europe the figure is 10%, and in Eastern Europe it is just 7%, suggesting enormous potential for growth on Adyen’s home turf. For perspective, Europe’s retail market is worth more than EUR 3.2 trillion, according to Statista.

Over in the U.S., the biggest market in North America, 19% of total retail sales are made online, suggesting enormous potential for growth. For perspective, retail sales in North America amounts to around USD 6.5 trillion according to the U.S. Census Bureau.

Increasing focus on the SMB opportunity

It is well-known SMBs are underserved in the financial industry and Adyen, who has historically focused on large enterprise customers, is now turning its attention to the SMB opportunity.

Adyen’s expansion towards the SMB space pits it against American merchant acquirer Stripe, who has typically served SMBs. Stripe is also encroaching on Adyen’s turf with the company looking to expand their enterprise customer base, which suggests rising competitive pressures for both players. There are, however, reasons to be optimistic about Adyen’s SMB ambitions. Given their more ample resources, enterprises are more likely than SMBs to have embraced digitization, which means the untapped opportunity for SMBs is relatively bigger. According to Eurostat, 88% of large enterprises have already reached a basic level of digital intensity, versus 56% for SMEs. The status quo is likely the same elsewhere. Adyen’s management highlighted in their August 2022 earnings call that they “strongly believe” that SMBs are an underserved market.

Moreover, enterprises are relatively sticky customers while SMBs have greater flexibility to switch providers, which means Adyen may lure SMBs away from rivals and into their ecosystem.

Finally, enterprises are more demanding customers unlike SMBs, which may suggest Adyen may have an easier battle capturing market share through SMBs than Stripe capturing share through enterprise customers.

Increasing focus on Asia

Asia accounts for roughly 11% of Adyen’s revenues, suggesting considerable untapped potential for merchant acquirers like Adyen in the world’s biggest eCommerce market. Asia’s flourishing eCommerce space comprises a diverse collection of different countries, regulations, cultures, and online retail players, which means a plethora of widely different payment methods as well. Both Adyen and Stripe are paving their way to capitalize on the opportunity, but Adyen stands out as one of the few (if not only) merchant acquirers that supports a number of local payment methods in Asia and is arguably better positioned to benefit.

Wider support for regional and niche payment methods

Adyen supports numerous regional, niche payment methods some of which Stripe does not, (such as Indonesian mobile wallets GoPay and Dana, Vietnamese mobile wallet Momo, and German mobile wallet Sofort to name just a few). Adyen’s broader payment methods is a tremendous, significant advantage, particularly in the battle for international market share.

Competitive advantages to counter stiff competition

Competition in the payments industry is stiff, notably from American merchant acquirer Stripe and to a lesser extent from payment processors like PayPal (PYPL). Adyen, however, has a number of competitive advantages that could help them remain among the leading merchant acquirers in this competitive but rapidly growing space.

Banking license, a competitive advantage

Unlike Stripe and PayPal which do not have banking licenses, Adyen holds banking licenses in the Netherlands and the U.S. Although this comes with the disadvantage of compliance costs and higher capital requirements, it offers greater flexibility for Adyen in terms of offering banking products and services at considerably more competitive terms. For instance, while Stripe partners with banking partners to offer financing to customers, Adyen’s banking license allows the company to manage this service directly, which means faster credit approval compared to Stripe; Adyen Capital can issue funds within minutes while Stripe takes 1-2 business days, a significant competitive advantage for Adyen.

A banking license could also give Adyen tremendous leeway in its ambition to build an end-to-end integrated financial product suite (encompassing bank accounts, business financing and card issuing) as they could cut off unnecessary intermediaries, potentially enabling them to offer a more competitive offering in terms of product breath, speed, and cost.

Solid financials

Adyen has a solid balance sheet with debt to equity of just 8.42, compared with 58 for PayPal. Adyen has superior profitability metrics as well, with a return on equity of 26.7% compared with 13.4% for PayPal. Stripe is so far loss-making, but expects to turn profitable this year.

Conclusion

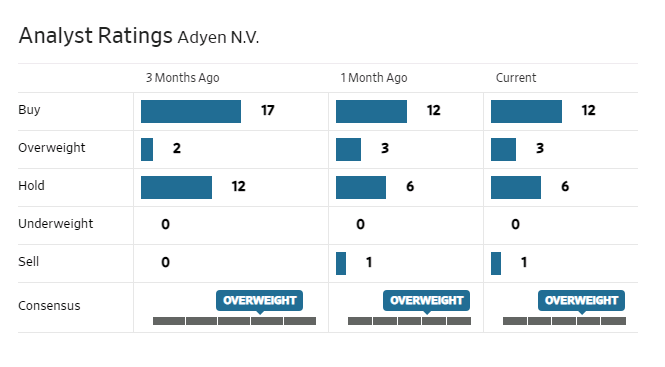

Analysts are mostly bullish on the stock.

WSJ

With a forward P/E of 70, Adyen is trading at an earnings multiple that may seem pricey, although some may argue it is fair considering the company’s solid growth prospects and growing competitive advantages to navigate the fast-growing but highly competitive and relatively commoditized payments industry. A customer churn of below 1% (considerably lower than the 30% churn rate seen by seen merchant acquirers according to some industry estimates) is suggestive of Adyen’s advantages and customer stickiness.

Nevertheless, payments is a relatively commoditized business and a P/E of 70 is considerably higher than rivals like Intuitive Surgical (ISRG) with a forward P/E of 60 (Intuitive Surgical is a market leader in the fast-growing surgical robots space, an industry with high barriers to entry and innovation-driven pricing power), and ASML (ASML) with a forward P/E of 33 (ASML is the undisputed market leader in the fast-growing EUV lithography space, also an industry with extremely high barriers to entry and innovation-driven pricing power).

Adyen could be viewed as a buy for some, while others may prefer to hold and wait for a pull back to add more.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here