By Erik Norland

At a Glance

- Starting in July, Saudi Arabia, a dominant producer in OPEC, plans to reduce how much oil it sends to the global economy

- Concerns over China’s economic rebound continue to weigh on the crude oil market

OPEC has slashed crude oil production twice in the past three months. But despite production cuts, oil prices have continued to slide. Why? It comes down to two words: weak demand.

Global oil demand has been weak for three reasons.

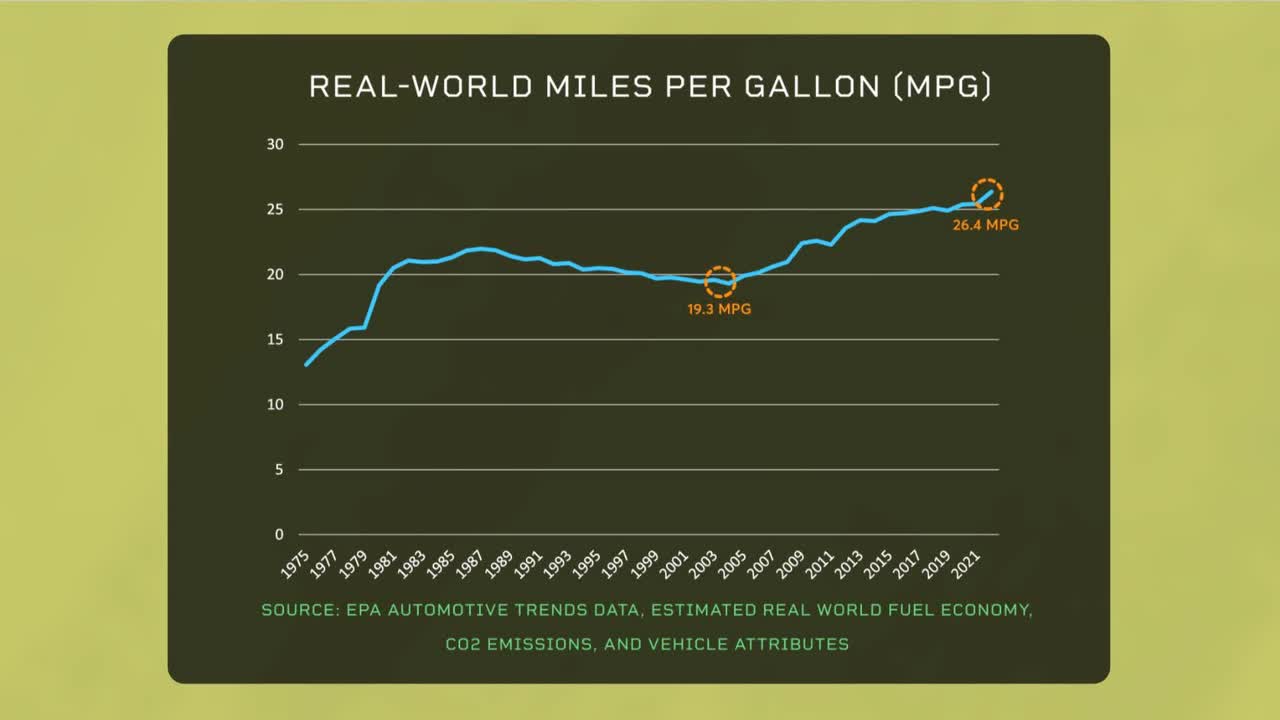

First, cars are becoming more fuel-efficient. The average car in model year 2004 got 19.3 miles per gallon. By contrast, the average car in model year 2022 got 26.4 miles per gallon. Each year, the average car uses 1.75% less fuel than the year before, meaning that, collectively, people would have to drive 1.8% more each year just to keep global demand stable.

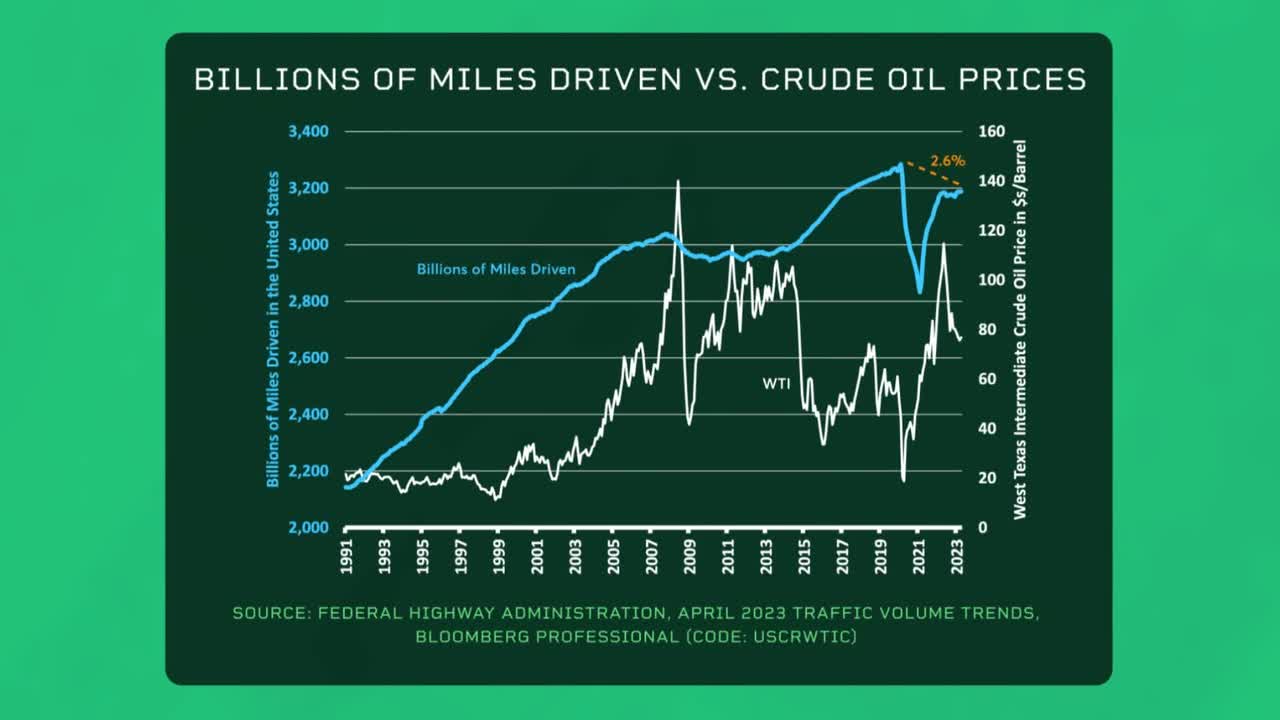

However, rather than driving more, people appear to be driving less. Americans, for example, are still driving 2.6% less than they did before the pandemic.

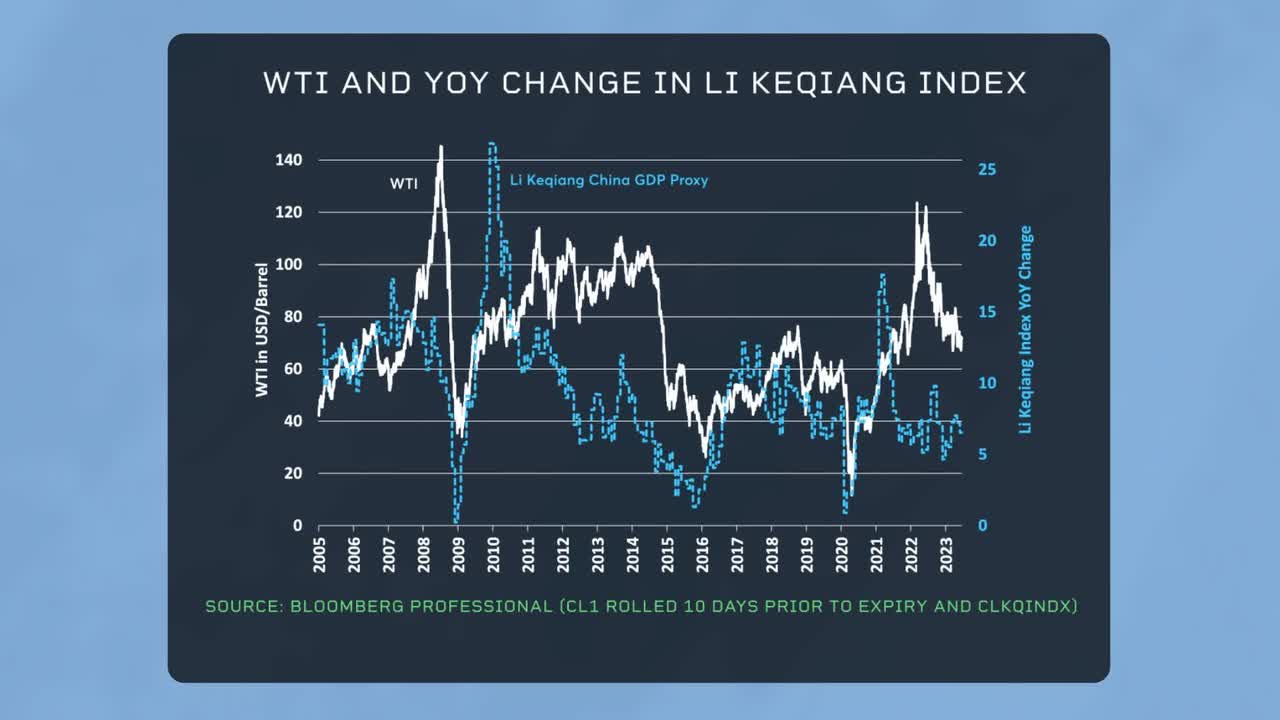

And weak demand isn’t just an American phenomenon. Look at China. From 2000 to 2022, China’s consumption of crude oil grew from 4.7 million to 15.6 million barrels per day, making the oil markets extremely sensitive to fluctuations in the pace of Chinese growth. But so far in 2023, Chinese growth has disappointed expectations, and oil prices tend to follow China’s growth rate with a lag of about one year.

Original Post

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here