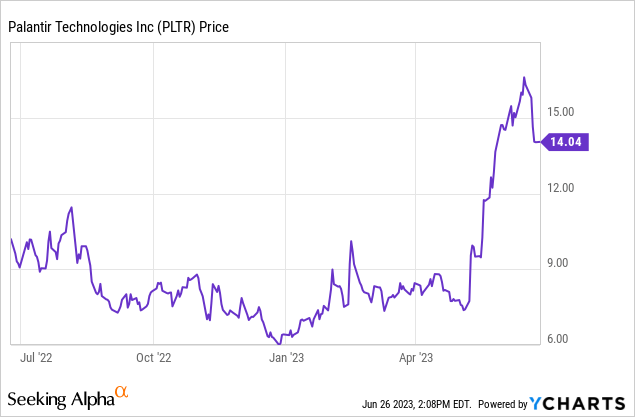

Over the past few months, one factor above all has driven the rebound in tech stocks: enthusiasm for AI. As ChatGPT continues to enjoy rapid early adoption, many tech companies are jumping on the AI bandwagon to demonstrate what generative AI and natural language models can enhance on their tech platforms.

Palantir (NYSE:PLTR), however, is not a mere bandwagoner on this trend. The company’s big data and machine learning software has been built on this foundation for years, and the company is just now starting to monetize AI as its own product separate of Gotham and Foundry. Building off enthusiasm for Palantir’s potential in the AI era as well as the company’s existing strong execution in a tough macro environment, shares of Palantir have more than doubled year to date.

Palantir’s bull case shines with AIP

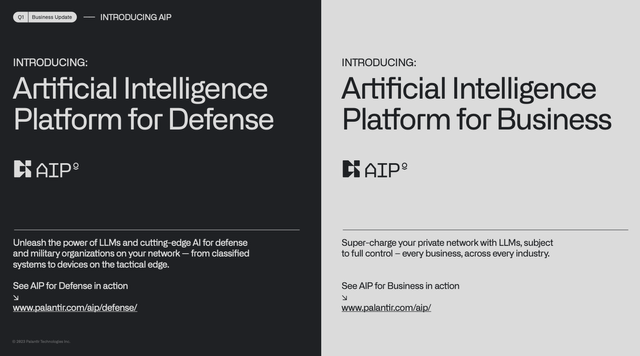

I am still bullish on Palantir stock and continue to hold onto the stock in my portfolio, even after the rapid rebound over the past few months. It’s worth highlighting the company’s early release of its new AIP (Artificial Intelligence Platform), available now to select customers in both the public and private sector segments.

Palantir AIP (Palantir Q1 investor deck)

Writing on the rollout of AIP in the Q1 shareholder letter, CEO Alex Karp wrote as follows:

The first iteration of the platform will be made available to select customers this month. We have already had hundreds of conversations with potential customers about deploying the software and are currently negotiating terms and pricing for access to the components of the platform.”

In short, this technology will allow Palantir’s customers to leverage AI on their own databases – giving them the ability to create AI agents that can automate and trigger business processes.

And as a refresher, on top of AI, here is my full long-term bull case on Palantir:

- Big data is a massive discipline that can be applied in nearly limitless ways, including as AI applications. Palantir isn’t a software company that serves only one or a limited set of use cases. Data and inferences that can be made from data are prevalent in just about everything: which explains why Palantir is such a powerful tool for both public and private sector clients. Big data is also the feeder to AI, as the two work hand in hand.

- Growth at scale. Despite being at a $2+ billion annual revenue scale, Palantir continues to deliver high-teens revenue growth. Few companies are able to achieve this kind of growth at scale, and it’s a testament to the wide applicability of Palantir’s products and the humongous clientele it has drawn (in particular, the U.S. Army). Prior to the recent government spending slowdown, Palantir had forecasted >30% y/y growth through 2025 (which may still be feasible when macro conditions turn around).

- Stepping up go-to-market momentum. Palantir is chasing growth across a wide variety of channels. The company has stepped up its sales hiring, a nod at the broad market opportunity it has and the need for more territory coverage. Palantir also has deepened relationships with ISVs (integrated service vendors) that can resell Palantir’s products without its involvement and offer additional coverage that Palantir’s direct sales force can’t handle.

- One foot in the public sector, one foot in private. Palantir made its name on being a large federal government contractor, but its products are just as compelling to an enterprise segment that is growing ever more obsessed with the value of big data. Most software companies start off as primarily dealing with enterprise buyers, and then hopefully getting FedRAMP certification to sell into public sector clients later. Palantir did the reverse: but now, its momentum with Fortune 100 companies is continuing to grow, and customer adds are continuing to trend at an impressive pace. The latest product rollouts like AI are being sold simultaneously to both government and private sector clients.

- Free cash flow and GAAP profitability. Palantir just crossed the threshold into GAAP profitability and continues to generate healthy free cash flow, which means the business is self-financing (a departure from many other rapid-growth software companies that continue to need to raise capital to finance their losses).

Valuation update

Of course, Palantir’s recent rally has made the stock expensive (again). In spite of this, I continue to see further upside here.

At current share prices near $14 (off from the month’s highs around $16), Palantir trades at a market cap of $29.74 billion. After we net off the $2.91 billion of cash off Palantir’s most recent balance sheet (the company’s has an unused revolver nearing $1 billion in capacity, but is currently undrawn), the company’s resulting enterprise value is $26.83 billion.

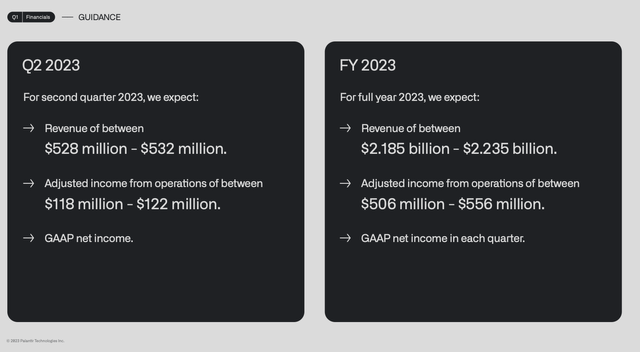

For the current fiscal year, Palantir is guiding to $2.185-$2.235 billion in revenue, representing 15-17% y/y growth:

Palantir outlook (Palantir Q1 investor deck)

And for FY24, Wall Street consensus is pegging Palantir’s revenue at $2.62 billion, representing 19% y/y growth – to me, acceleration is plausible considering macro headwinds in 2023 and potential tailwinds from the rollout of AIP.

This puts Palantir’s valuation multiples at:

- 12.2x EV/FY23 revenue, based on the midpoint of the company’s revenue guidance range

- 10.2x EV/FY24 revenue, based on consensus expectations

I continue to believe in further upside for Palantir through year-end. My December 2023 price target for the company is $17, representing 12.5x EV/FY24 revenue and ~21% upside from current levels.

Q1 download

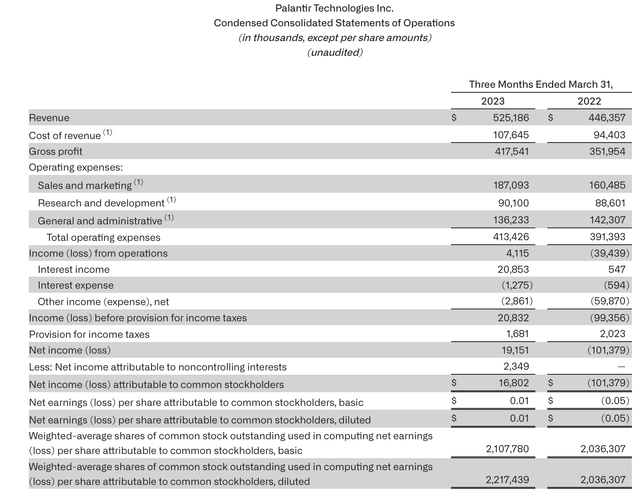

In spite of macro headwinds that have disproportionally impacted large complex software products like Palantir that require lengthy integrations, the company has held up well versus expectations. Take a look at the Q1 earnings summary below:

Palantir Q1 results (Palantir Q1 investor deck)

Palantir’s revenue grew 18% y/y to $525.2 million in the quarter, ahead of Wall Street’s expectations of $506.0 million (+13% y/y) by a meaningful five-point margin, as well as accelerating slightly over Q4’s 17% y/y growth pace. In a quarter where most software companies have reported macro-based slowdowns, this outperformance is truly meaningful.

Commercial/private sector momentum continues to be a major driver for Palantir – and it’s important to note that this business is still quite nascent. The company added 20 net-new customers in the quarter to land at 280 total commercial clients, while commercial revenue grew 15% y/y to $236 million (or 45% of the company’s total). Government revenue at 20% y/y growth outpaced both the company revenue and commercial revenue, as government clients are likely less reactive to cutting spend amid tough times.

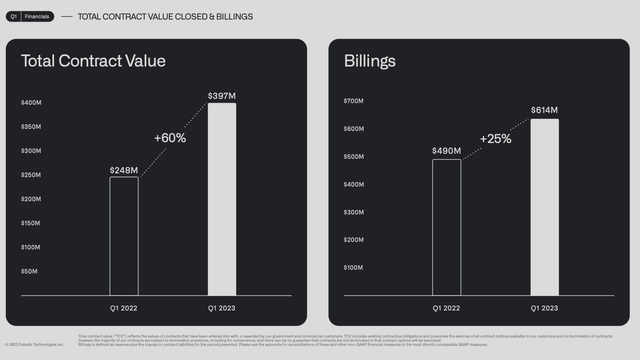

Billings of $614 million, however, is an encouraging metric – adding $89 million of deferred revenue and up 25% y/y, indicating that potential acceleration may be underway.

Palantir billings (Palantir Q1 investor deck)

Here is further commentary on the company’s top-line momentum from Chief Revenue Officer Ryan Taylor’s remarks on the Q1 earnings call:

These strong results were driven primarily by the re-acceleration of our U.S. commercial business, which surpassed the $100 million revenue threshold for the first time with 26% year-over-year growth.

We continue to see robust pilot starts and promising conversions and we’re also beginning to see the realization of our expansion strategy, meaning we’re beginning to see meaningful growth and upsell opportunities with our newer customer base.

Some notable examples include the expansion of our work with Hertz, who is using Foundry to more efficiently manage and operate its fleet of nearly 500,000 vehicles; and Jacobs Engineering, who is doubling down on our partnership to reduce cost and improve performance across plants. We also signed significant expansion agreements with the largest health system in the country for continued acceleration of our hospital operations efforts, and with one of the world’s largest paper and packaging companies.

Our U.S. commercial customer base, which stood at 155 at the end of Q1 2023, a seven-fold increase in customer count over just two years, presents an immense opportunity for continued expansion.”

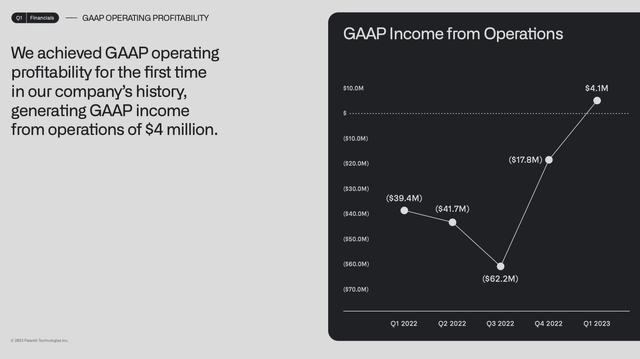

Top-line strength also flowed down into profitability. After breaking through to positive GAAP net income for the first time in Q4 (Q4 was benefited by favorable OI&E to bridge negative operating income into positive GAAP net income), Palantir also generated its first-ever positive GAAP operating income this quarter in Q1:

Palantir GAAP earnings (Palantir Q1 investor deck)

Palantir’s guidance also continues to call for positive GAAP net income in each and every quarter of FY23.

Key takeaways

Palantir is a buy on recent strength. The business has seen incredible momentum in a challenging macro environment, and with potential tailwinds in the wings from its new AI Platform, there are strong drivers in place for re-acceleration in growth in FY24. Stay long here.

Read the full article here