Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company that designs chips for CPUs (Central Processing Units), GPUs (Graphic Processor Units), and other purposes.

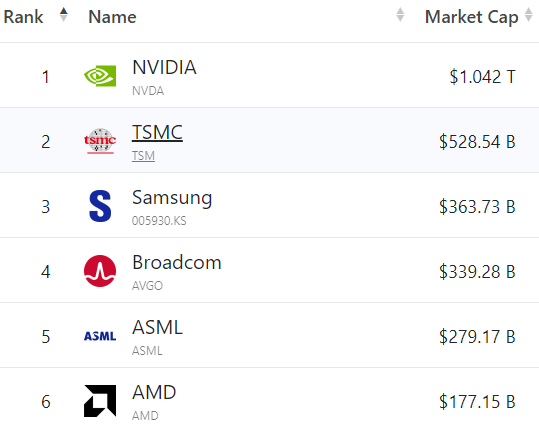

AMD is the 6th largest semiconductor company in the world by market value.

companiesmarketcap.com

In this article, we will look at the reasons why AMD’s price has not continued its spectacular recent climb that seemed apparent before January 2021.

AMD Stock Key Metrics

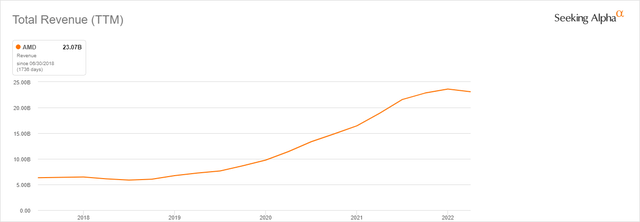

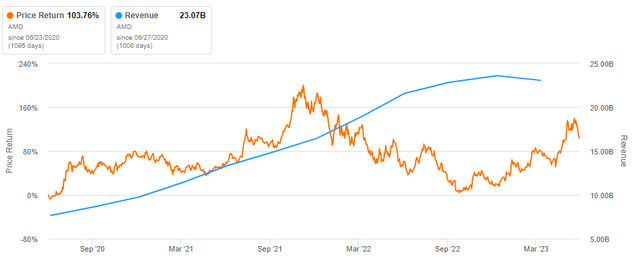

In the last 5 years, AMD has grown its revenue by almost 400 percent, increasing revenue from about $6 billion to $23 billion. This makes them one of the largest and fastest-growing semiconductor companies in the world.

Seeking Alpha

However, if you look at AMD’s growth profile compared to their price over the same period it shows an increase of over 600% and since January 2021 you can see that there has been a significant drop.

Seeking Alpha

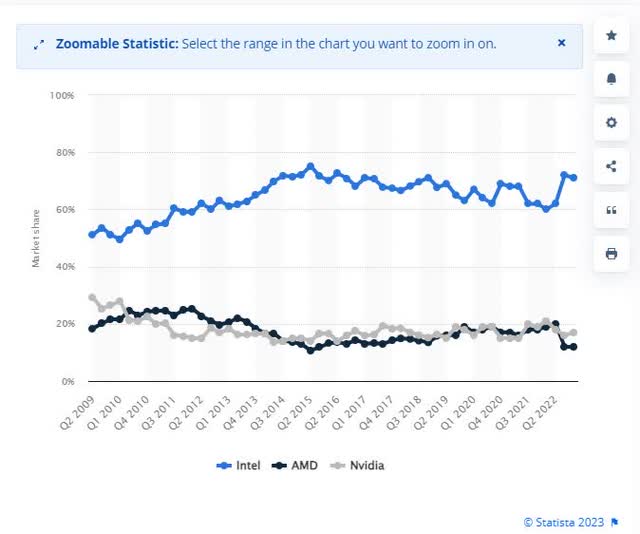

AMD’s two biggest competitors are Intel (INTC) in the CPU market and Nvidia (NVDA) in GPUs.

Here are five things you need to know about AMD.

1. AMD Continues To Gain Market Share From Intel And Will Probably Do So In The Future

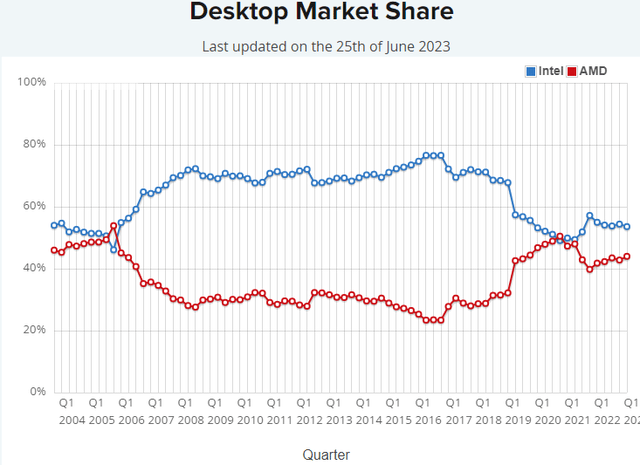

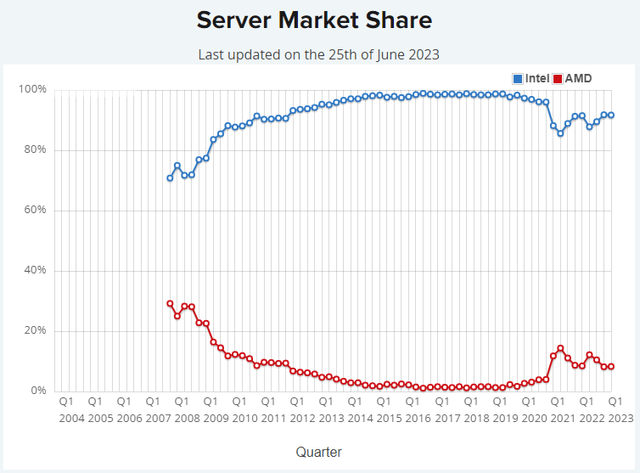

AMD has gained processor share on Intel over the last few years, as can be seen from the following charts, both in desktop CPUs and especially server CPUs.

PassMark Software PassMark Software

Curiously, notice that from 2007 to 2008 AMD actually had a higher market share in server chips than they do now. Of course, the Server Market is much larger now than it was in 2007.

Server chips are very profitable and have contributed to AMD’s rapid revenue and share price gains over the last 3 years.

Seeking Alpha

2. In The GPU Market, AMD Is Not As Dominant As In The CPU market

AMD also competes with Nvidia in the GPU market, although Nvidia has been in the news nonstop since they announced a superior quarter in March. Nvidia chips are the darling of the new AI (Artificial Intelligence) market because they are used in very high-end servers especially cloud servers to manipulate such AI products as chatbots.

Some of these GPU chips used in high-end servers can sell for as much as $10,000 apiece, and since Nvidia has the best ones, at least at the moment AMD is forced to spend more time and research on GPUs.

AMD’s lower-power GPU chips will be used to power not only AI but also graphics, which GPUs were originally designed to do. And AMD Is well aware of the interest in AI devices and in fact, at the recent Advanced Micro Devices, Inc. Bank of America 2023 Global Technology Conference, AI was mentioned 19 times.

In that lower-end market, AMD is very competitive and sells millions of those chips every year.

But interestingly enough, Intel actually manufactures more GPUs than Nvidia or AMD, though not the very high-end ones. Most of Intel’s GPU chips are mated with Intel’s desktop and laptop CPUs.

Statista

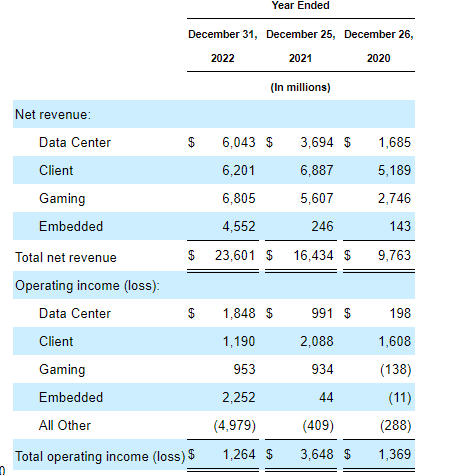

3. AMD’s Most Profitable Segment Is Its Server Chips

As you can see in the chart below, the servers are not only the largest by revenue but also by margin. And AMD also makes chips for game consoles for both Sony Group (SONY) and Microsoft’s (MSFT) Xbox, although those tend to have much lower margins because of the huge volumes and lower technology requirements.

AMD 10-K

Note in 2022, Gaming actually generated more revenue than Data Center

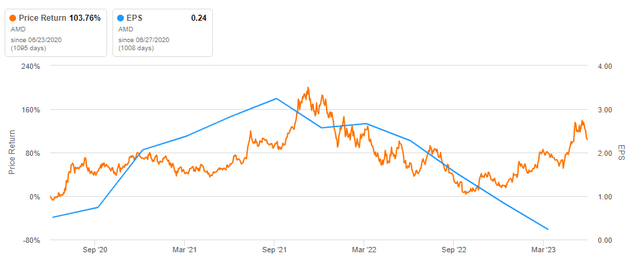

4. AMD’s EPS (Earnings Per Share) Has Dropped 60% Since 2020

AMD has struggled to make consistent profits over the years, which may be part of the reason that the share price has been so volatile.

We can see that in the following chart as we compare earnings per share to the price per share.

Seeking Alpha

5. Despite $3 billion In Share Buybacks, The Share Count Stayed About The Same

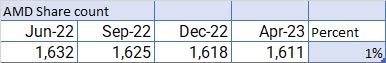

If we look at this chart below, we can see that the share count has gone down by only 1% in the last year, even though they have spent $3 billion on share buybacks and have just authorized another $8 billion on share buybacks.

Seeking Alpha

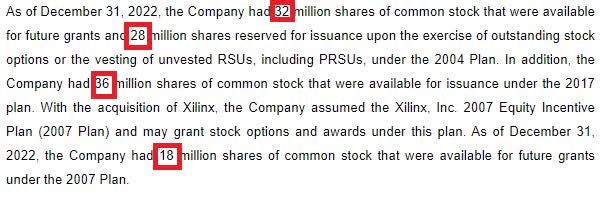

Part of the problem is AMD’s extensive use of SBCs (Stock-Based Compensation), totaling 114 million shares according to the latest 10-K.

AMD

Although I am unable to find anywhere in the 10-K where they say exactly how many shares are being used for SBC, just adding up the numbers in that one paragraph shows well over 100 million shares. So, a legitimate question for investors is why AMD is spending billions of dollars on share buybacks for minuscule share reduction.

Bottom Line

Looking at the above and comparing the numbers for each of the five items, we can see that there are some serious investment questions about AMD, especially recent earnings per share and the substantial SBC cost that is reflected in the share count.

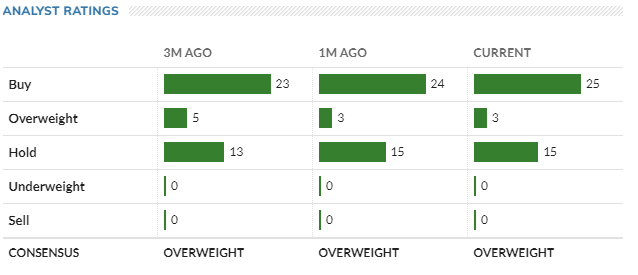

In spite of those apparent issues, AMD’s ratings by Wall Street analysts are extremely high, with the current count being 25 buys 3 overweight, and zero, none, nada Sells.

MarketWatch

Some of this enthusiasm is probably related to the new AMD GPU high-end chip being considered by Amazon’s (AMZN) AWS unit. That GPU chip is called the MI 300 and although no detailed specifications are available, yet the fact that Amazon is considering it is impressive, although apparently no final decision has been made. On that same note, Amazon said they were not working with Nvidia, so this would be a huge plus for AMD’s share price if it turns out to be true.

In the end, it is quite possible that AMD’s share price will continue to rise even though the share count is rising, especially if they get the Amazon contract.

Based upon the price-performance comparison between AMD and Nvidia, the Amazon contract could drive AMD’s price upwards toward Nvidia’s lofty level, even though I doubt it will reach the level of Nvidia. But winning the AWS contract would have a significant positive effect on AMD’s share price.

I rate AMD as a speculative buy at this point in time.

Read the full article here