Investment thesis

This year, Tencent’s (OTCPK:TCEHY) stock significantly underperformed the U.S. stock market and many investors might think that the stock is undervalued. However, my valuation analysis suggests that the current share price looks overvalued. Moreover, the company is in a secular decline in profitability metrics which I consider a red flag. The latest quarter was stronger YoY, but I need a few more quarters of a clear profitability improvement path before I change my “Hold” rating.

Company information

Tencent is a Chinese conglomerate founded in 1998. Since then, the company has grown into one of the world’s largest companies with a diverse portfolio of businesses, including social media, entertainment, gaming, e-commerce, and financial services. Its flagship platform, WeChat, has become an integral part of daily life for millions.

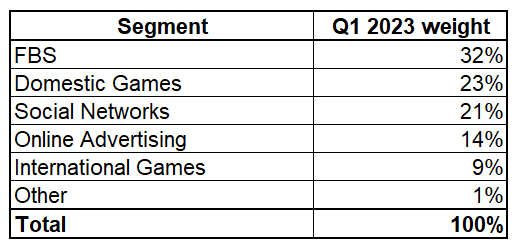

The company operates five segments: Social Networks, Domestic Games, International Games, Online Advertising, and FinTech & Business Services [FBS]. According to the latest earnings presentation, FBS revenue represented almost a third.

Author’s calculations

Financials

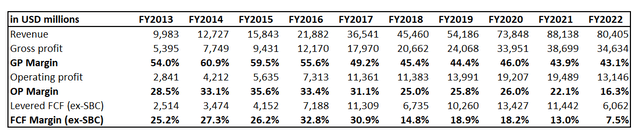

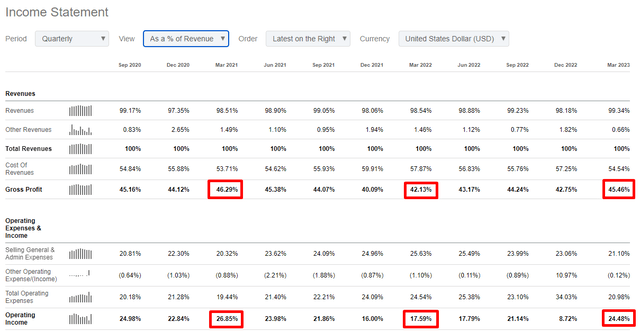

Tencent demonstrated stellar revenue growth over the past decade with a 23% CAGR. The first red flag that I see is that the gross margin deteriorated notably, despite a nine-fold increase in revenue. The operating margin also softened substantially from 29% to 16%. Expanding profitability metrics while the business scales up is crucial for me as a long-term investor.

Author’s calculations

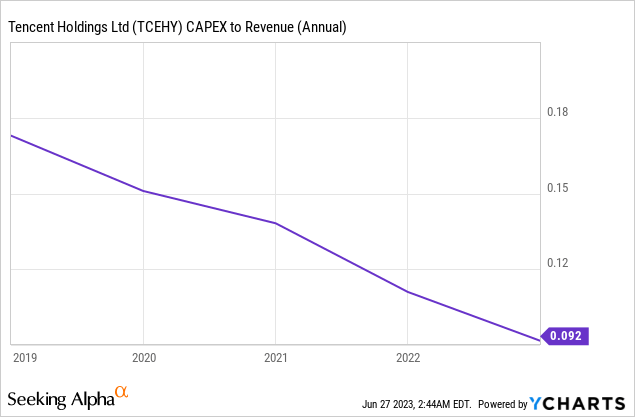

The free cash flow [FCF] margin without stock-based compensation [SBC] also deteriorated significantly over the past decade, which is the second big red flag for me. Some people might argue that the company invests heavily in CAPEX to fuel long-term growth. But CAPEX was decreasing over the past three years while the FCF margin deteriorated from 18% to 8%, which is massive.

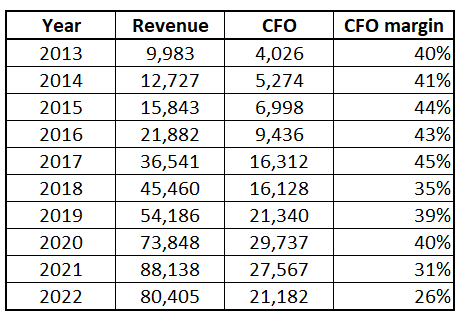

The key to the shrinking FCF margin is in the cash flow from operations [CFO]. In the below table, you can see that the CFO margin deteriorated significantly over the past three years and is currently at the lowest point in the decade. Therefore, I have a high conviction that the company’s operating efficiency is deteriorating rapidly.

Author’s calculations

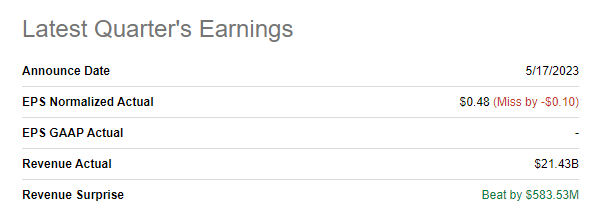

Now let me narrow down my financial analysis to the quarterly level. The latest quarterly earnings were released on May 17. The company delivered higher-than-expected revenue but missed on the EPS.

Seeking Alpha

Revenue grew at about 2% YoY. This can be considered a positive sign because, in the previous three quarters, the company demonstrated a YoY decline in sales. The positive sign is also that profitability metrics improved compared to the Q1 of 2022. On the other hand, profitability ratios are still weaker than the ones demonstrated during the Q1 of 2021.

Seeking Alpha

The positive trend is expected to continue in Q2 of the current fiscal year. Consensus expects revenue at about $21.2 billion, indicating a 7% YoY growth. It is important to note that EPS is expected to expand from $0.43 to $0.61. Tencent’s financial performance is likely to demonstrate strong momentum. However, I need a couple more quarters to have a conviction that the company is on the path to sustainable profitability improvement.

Tencent’s balance sheet looks in good shape, with robust liquidity ratios and a substantial outstanding cash balance. The leverage ratio is conservative, though the company is in a net debt position.

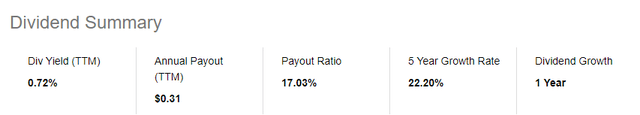

The company returns money to shareholders via stock buybacks and dividends. In FY 2022, the company spent about $4.7 billion on a share repurchase program. On the other hand, the dividend yield is not attractive since the TTM yield is below 1%.

Seeking Alpha

Valuation

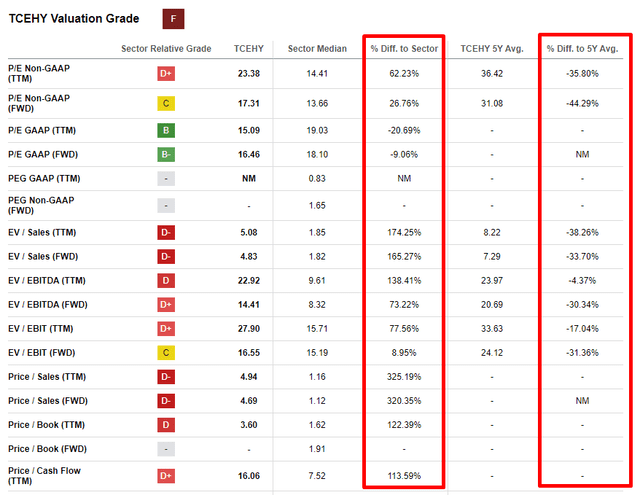

TCEHY stock price demonstrated a 5% year-to-date decline. The stock significantly underperformed both the broader U.S. market. On the other hand, the iShares MSCI China ETF (MCHI) demonstrated weaker performance with a 9% decline. Seeking Alpha Quant assigns TCEHY the lowest possible “F” valuation grade. This is due to the high multiples compared to the sector median. On the other hand, 5-year average valuation ratios are higher than the current multiples.

Seeking Alpha

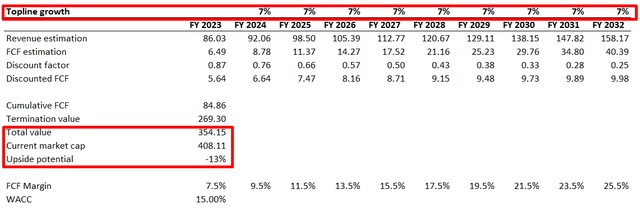

I consider Tencent’s dividend yield low and do not have enough confidence regarding the dividend growth rate. Therefore I will not use a discounted dividend model approach for TCEHY. I implement the discounted cash flow [DCF] approach to cross-check valuation multiples instead. I use a high 15% discount rate for the valuation of Chinese companies due to inherent political risks. For a base case scenario, I expect revenue growth at a 7% CAGR over the next decade. I expect a 7.5% FCF margin for FY 2023 that will expand by two percentage points yearly.

Author’s calculations

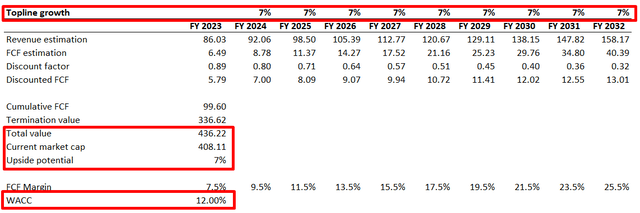

As you can see, based on the above assumptions, the DCF template returns a business’s fair value at about $354 billion. It means the stock is about 13% overvalued. Tencent bulls might argue that the discount rate is unfairly high, so let me simulate a scenario with a lower WACC. For the second scenario, let me use a 12% WACC. Other assumptions are unchanged.

Author’s calculations

I think that even under a much less tight WACC, the stock still does not look attractively valued. I think that a 7% upside potential is unlikely to be worth the risk.

Risks to consider

Tencent is one of the largest Chinese companies, therefore there is a substantial risk related to anti-trust issues. Anti-trust regulations’ goal is to promote fair competition and prevent monopolistic practices. Given Tencent’s dominant position in numerous sectors, including social media, gaming, and fintech, there is a significant risk that regulators may impose restrictions or initiate investigations to ensure a fair game for competitors. Regulatory actions could adversely affect Tencent’s business operations and financial performance.

The company is highly dependent on its key platforms and the closer they are to full saturation, the fewer options to drive sustainable revenue growth the company will have. Yes, the company invests in many new ventures, but there is no guarantee that these investments will ultimately pay off.

Bottom line

To conclude, I do not consider Tencent a good investment option. The main reason is the current valuation, which I consider unattractive. The second important reason is that my financial analysis revealed secular weaknesses the company is experiencing. In companies with strong growth potential, profitability metrics have to improve as the business scales up. Looking back at the company’s financials over the past decade, we can see that it was vice-versa for Tencent. Therefore, I assign TCEHY stock a “Hold” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here