Shenandoah Telecommunications Company (NASDAQ:SHEN), marketed as Shentel, is a telecommunications company that has been providing regulated and unregulated telecommunications services to customers in the Mid-Atlantic region for over 100 years. Shentel offers high-speed internet, cable TV, and broadband services through fiber-optic and cable networks. In addition, Shentel runs a smaller business renting tower space to other wireless carriers.

Shentel has had a challenging few years. The stock price fell from the low-to-mid $30s in 2021 to the end of 2022 at $15.88. Across 2023, the share price has stagnated, bouncing around the $20 mark. However, Q1 2023 earnings painted a very different picture. Not only did earnings of $0.04 beat by $0.12, but revenue of $71.7 million beat by $1.7 million. New customers on the growing Fiber network, called Glo Fiber, drove the positive earnings surprise.

While management was extremely optimistic during the Q1 2023 earnings call, I am not nearly as confident. I believe there is a significant downside risk between stagnant to declining ARPU and diminishing returns on fiber growth and a weak balance sheet. Investors should hold current positions as the stock is fairly valued with balanced upside and downside risk. It will likely be a rocky road, so consider exiting if you have a low-risk or low-volatility tolerance.

Fiber Investments Driving Volume Growth, But Not Pricing

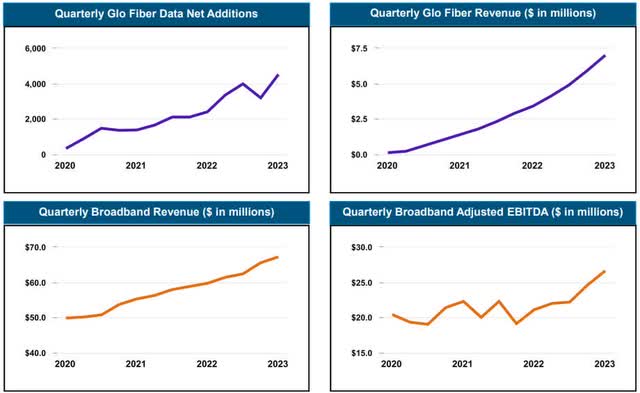

In the Q1 2023 earnings presentation, management looked at the Fiber and Broadband trends, and the growth was strong. The business set records for quarterly net adds, quarterly fiber revenue, quarterly broadband revenue, and quarterly broadband EBITDA.

Q1 2023 Shentel Broadband And Fiber Growth (investor.shentel.com)

In the earnings call, management reiterated the good news and committed to maintaining the trend in net adds and growing broadband EBITDA through scale to 43% by 2025 (up from 37% today). This performance was truly unexpected, as reflected in the earnings surprise discussed above.

I am less impressed by the pricing side, which management tried to gloss over as quickly as possible during the call.

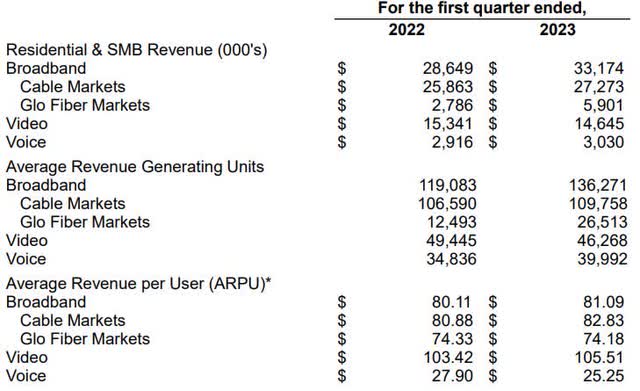

Q1 2023 Shentel Quarterly ARPU Growth/Decline (investor.shentel.com)

Glo Fiber ARPU declined 0.2% year-over-year, which signals that Shentel had to discount or customers selected cheaper plans. Broadband only grew 2.4% year-over-year. That would be fine in normal times, but these are not normal times. With high inflation over the past two years, most telcos have aggressively raised prices to offset cost pressure. The exception is when they are forced to offer promos to maintain market share. Shentel does not seem to have much pricing power in its market.

Maintaining Fiber Growth Rate Will Be Challenging

Early growth following fiber investments is easy as you grab the low-hanging fruit. As your customer base expands, not only does each customer become harder (and more expensive to acquire), but you attract more interest from competitors.

Shentel is up against massive competition from fixed wireless access as Verizon (VZ) and T-Mobile (TMUS) have made this a key strategic priority. Fixed wireless access uses existing wireless networks to deliver home internet, reducing the need for last-mile fiber installation. While both companies cover Shentel’s region, this is Verizon’s turf, and Verizon is in an all-out sprint to grow fixed wireless.

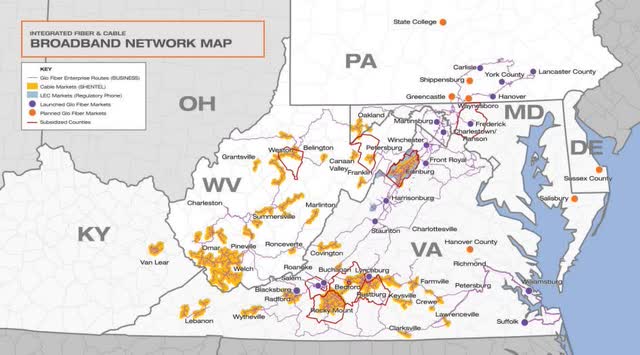

Shentel Service Area (investor.shentel.com)

While Shentel can compete on speed, it can’t compete with Verizon’s scale, ability to discount, and ability to bundle multiple services together. I believe Shentel will continue to grow revenue and OI as they install more miles of fiber, but I think the growth potential has a lower ceiling than management would lead on.

Balance Sheet Weak After Years Of Underperformance

Shentel posted an OI loss from 2018 thru 2020 and only grew to a $6 million profit by 2022. On the investment side, CapEx grew from $57 million in 2018 to $190 million in 2022. Cash flow has been squeezed on both the operations and investment side, with the wireless sale in 2021 and debt issuance in 2022 plugging the gap.

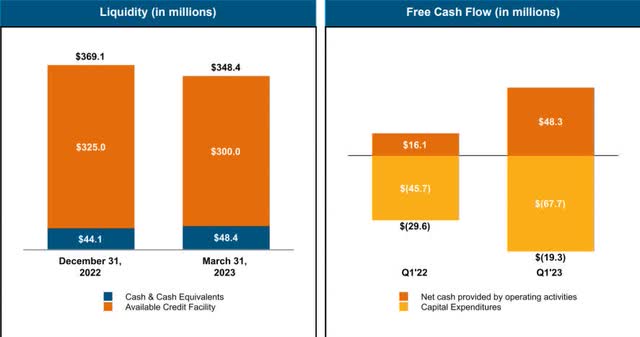

Q1 2023 Shentel Cash Position (investor.shentel.com)

To calm investors’ worries, Shentel points to a $300 million credit facility available to the company. This doesn’t make me feel better. First, I rarely see strong companies lean on credit facilities. Second, even a credit facility needs to be paid back, and Free Cash Flow isn’t ramping up fast enough to maintain this level of growth. To maintain topline growth and Fiber investments, this points to a reduced dividend or increased (and more expensive) debt.

Multiples And Quant Ratings Reflect Balanced Risk

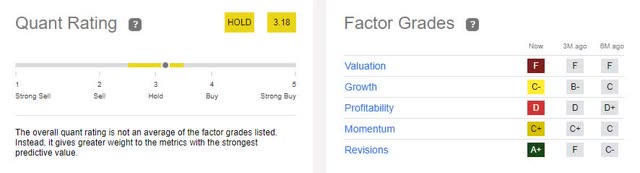

The valuation multiples and the quant ratings show upside and downside ratings.

SHEN Quant Ratings (Seeking Alpha)

Starting with the quant ratings, earnings revisions get an A+ (upside), while valuation gets an F (downside). Growth and momentum are right in the middle (upside and downside). The overall rating is a solid hold. I think this is fair, as the underlying metrics are everywhere.

Valuation multiples are a perfect example that this is a hard company to dissect. P/E is a whopping 4,500% above the sector. EV/EBIT is 700% above the sector. With the exception of dividend yield, which an investor would want to be high, and Price/Book, every multiple is elevated well above the industry. Compared to its 5-year performance, Shentel falls short across every metric except for Price/Cash Flow. The multiples provide both strong buy and strong sell signals. In this situation, I believe the best option is to hold existing positions and hope management’s upside case plays out.

Verdict

Shentel has had a difficult few years, and the stock price reflects it. The recent Q1 2023 earnings report painted a brighter picture, but I am not nearly as confident. It looks as though Shentel is still struggling with ARPU and faces diminishing returns on fiber growth long-term, in addition to an already weak balance sheet. Investors should hold current positions as the stock is fairly valued with balanced upside and downside risk, reflected in the valuation multiples and quant rating. Consider exiting if you have a low-risk or low-volatility tolerance. As always, investors should do their research before making any investment decisions.

Read the full article here