In the midst of the 2023 economic slowdown, opportunities for robust investment can seem elusive. However, one standout contender for consideration is United Parcel Service, Inc. (NYSE:UPS). Despite initial challenges, UPS presents an intriguing investment prospect, leveraging its industry resilience and strategic redirection. In the face of decreased package delivery volumes, the company has demonstrated an ability to pivot effectively towards key sectors such as small and medium-sized businesses and healthcare. Simultaneously, UPS’s attractive P/E ratio and substantial dividend yield offer the potential for significant returns. Coupled with a long-term growth strategy, the company is not only weathering the current economic storm but is also positioning itself for robust future growth. This article offers a comprehensive analysis of UPS’s technical assessment during these unpredictable times, with the goal of forecasting the stock’s forthcoming trajectory. It’s observed that the COVID-19 pandemic has instigated an atypical price surge, surpassing customary thresholds. As a result, a period of price stabilization or potentially a decrease could be anticipated before the next upward trend.

Navigating Investment Opportunities in Economic Turbulence

The economic slowdown of 2023 has created headwinds for many businesses, including UPS, a company whose growth is tightly intertwined with broader economic activity. This is reflected in its core business of package deliveries, which involve transactions from both consumers and businesses. In the first quarter of 2023, UPS’s U.S. delivery volumes fell short of expectations, prompting management to revise full-year revenue and margin forecasts downwards.

While these downward revisions are undoubtedly discouraging, it’s essential to consider the broader context. UPS experienced extraordinarily strong growth during the stay-at-home measures necessitated by the pandemic, with heightened demand for deliveries. Therefore, some degree of retraction is not only natural but expected. UPS is dynamically responding to these challenges by redirecting its focus to key end markets such as small and medium-sized businesses and healthcare. It aims to shift away from lower-margin business-to-consumer deliveries, typified by the likes of Amazon (AMZN). This strategic pivot could see UPS emerge stronger from the economic slowdown, underpinned by a stock valuation offering a high dividend yield—an attractive prospect for patient investors.

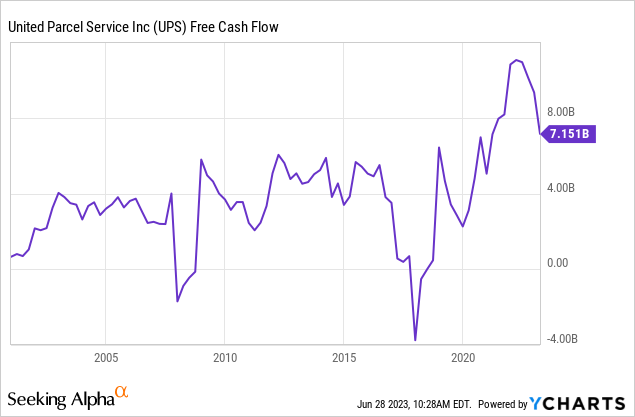

For those seeking an industry leader offering a sound dividend yield and promising long-term growth prospects, UPS is an attractive proposition. The chart below presents the free cash flow for the company which shows a dramatic increase during 2020 and 2021, driven by robust earnings and a surge in delivery demand due to stay-at-home measures, coupled with a decrease in capital expenditures.

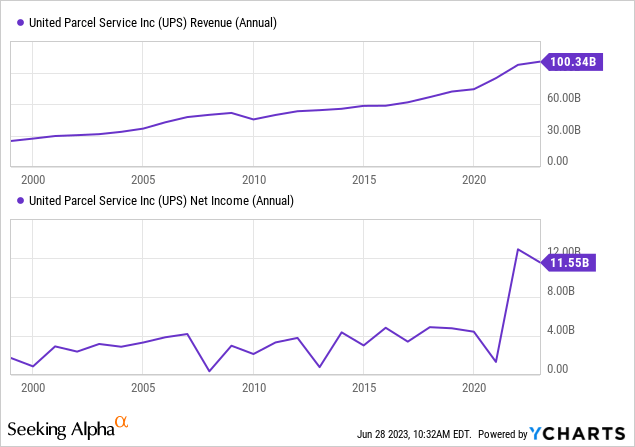

Additionally, UPS’s financial robustness is vividly illustrated in the chart provided below, showcasing annual revenue and net income over the past two decades. A consistent upward trend in revenue generation is observable throughout this period, with total revenue reaching $100.34 billion in 2022. Interestingly, net income experienced a substantial increase in 2022, settling at $11.55 billion. This sustained growth in revenue and a marked surge in net income underscore UPS’s capacity to serve as a reliable avenue for long-term investment. Consequently, any fluctuations in price or potential drops should be viewed as valuable purchasing opportunities by investors.

Exploring the Surge in Market Fluctuations

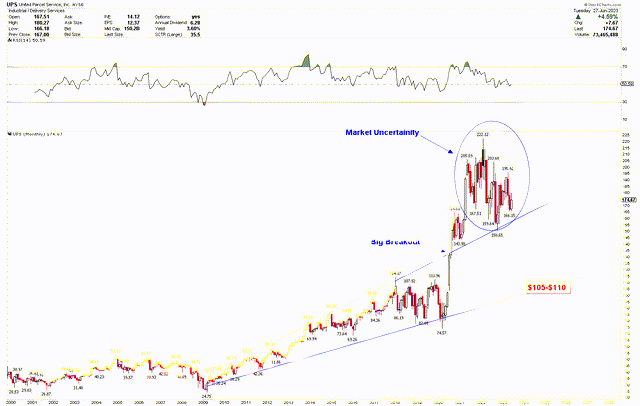

The monthly UPS chart demonstrates a robust bullish trend, characterized by two broadening blue trend lines. These lines also illustrate the formation of an ascending broadening wedge pattern, which was notably breached at the upper trend line, aiming for an all-time high of $222.12. This break above the blue trendline indicates significant market volatility, propelling the price upward, while also causing a sharp market correction. Currently, the price is consolidating between the $222 and $150 range, with a neutral RSI indicating support at the mid-level of 50.

UPS Monthly Chart (stockcharts.com)

Interestingly, the chart above indicates a sharp rise in price, breaking above the trend line following the onset of the Covid-19 pandemic. This pandemic-induced shift is attributed to an extraordinary increase in online shopping worldwide, as stay-at-home measures constrained people to their homes. As a result, UPS experienced a significant surge in package volumes due to the increased demand for e-commerce delivery services.

UPS already had a robust infrastructure in place for handling large-scale deliveries, which gave them an edge during the pandemic. They were able to quickly adapt to the surge in demand, ensuring timely and efficient delivery of goods, which led to increased customer trust and loyalty, in turn boosting their stock prices. Following the pandemic-induced lows of $74.57, the price dramatically climbed to a record high of $222.12. Subsequently, after reaching these peak levels, the price began to experience significant fluctuations within broad ranges. These fluctuations suggest the potential for either a significant market correction or a swift rally. In both scenarios, UPS stock emerges as a strong buy. Should the price drop, investors have an opportunity to purchase at a lower rate, whereas if the price surges, they might consider buying at higher levels.

Interestingly, normal market movements typically remain within the blue lines. However, now that the price has surpassed these lines and is oscillating above them, a potential market drop could target the lower support level of $105-$110, presenting a solid buying opportunity for long-term investors.

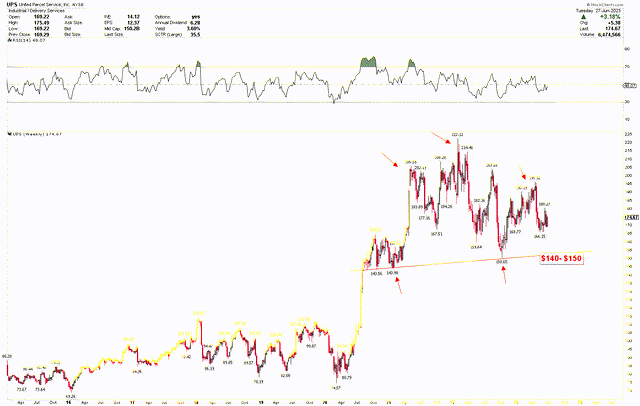

To provide further insight into the wide price ranges of UPS stock, let’s examine the weekly chart below. It depicts market oscillations in the $150 to $222 range. Normally, such fluctuations without any pattern formation result in price drops. Notably, the support line, highlighted by the red trendline, lies at $140-$150. If this support is broken, the price could revert to the $105-$110 support discussed earlier. The weekly chart’s RSI strengthens the possibility of a market drop.

UPS Weekly Chart (stockcharts.com)

Key Actions for Investors?

Predicting market trends amid fluctuating patterns is challenging. Nevertheless, the long-term outlook for UPS remains strongly bullish. Any market corrections should be seen as attractive buying opportunities for long-term investors. It is crucial to closely monitor price levels as increased price volatility could lead to greater price deviations. Should the price fall below $140, it could further slide to $105-$110, a key buying point for long-term investors. On the other hand, if the price surpasses the all-time high of $222, it could continue to climb. Purchasing above $222 is possible, but it comes with increased risk due to the higher price point.

Bottom Line

In conclusion, UPS not only presents a sturdy investment opportunity in the face of the 2023 economic slowdown but also exhibits a promising future growth trajectory. With a history of overcoming adversity and an agile strategy in place, UPS is a compelling investment choice for those seeking robust returns amidst economic uncertainty. Nevertheless, the prevailing market volatility indicates potential for further market adjustments, which could serve as a prime buying opportunity for long-term investors. Crucial points for this downturn lie within the $140 to $150 range, while the solid long-term purchasing zone is between $105 and $110. Should the price recede to around $110, it would strongly warrant consideration from those interested in long-term investments. Conversely, should there be a breakthrough above $222, it could potentially signal the continuation of UPS’s bullish trend, propelling it to significantly higher levels.

Read the full article here