One of the newest Bitcoin (BTC-USD) miners available to investors in the US equity market is Bitdeer Technologies Group (NASDAQ:BTDR). The company has a blended approach that derives revenue from three main sources; self-mining, hosting, and hash-rate sharing. Since my initial coverage of the stock in April, we’ve received Q1-23 earnings and a share repurchase announcement that has helped double the stock from under $7 at the time of publication to just under $13 per share earlier in June.

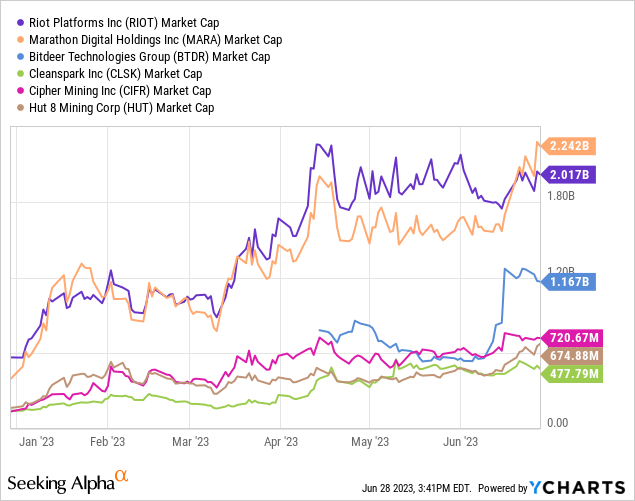

That boost to the stock price has catapulted Bitdeer to a market capitalization of well over $1 billion. BTDR is now the third largest public miner by market cap. In this update, we’ll look at one of the company’s core revenue segments and what might be driving this price action.

Q1 Earnings Breakout

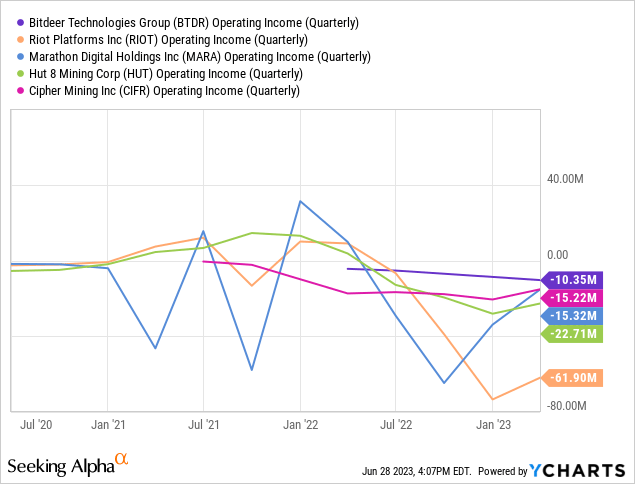

In Bitdeer’s Q1 earnings report, the company reported $72.6 million in revenue for the quarter – a sector revenue figure that is second only to the $73.2 million posted by Riot Platforms (RIOT) in the quarter. However, Bitdeer’s operating loss for the quarter was just $10.4 million, significantly better than Riot’s $66.4 million loss and better than smaller industry peers like Cipher (CIFR) and Hut 8 (HUT) as well:

A $13.5 million gross profit from revenue was nullified by $18.4 million in SG&A, $12.3 million of which was share-based compensation. However, given the company’s operating loss against peers with similar revenue figures, Bitdeer’s performance is clearly better by comparison. The company has seemingly benefited from a more diversified business model that pulls well from each of Bitdeer’s revenue segments.

- $13.2 million from self-mining

- $18.0 million from cloud hash mining

- $22.1 million from general hosting

- $16.5 million from membership hosting

Against Q1-22, total revenue declined by 19.7% year over year. The company attributes this loss to declines in the price of Bitcoin and a reduction in cloud hash mining orders. The biggest individual segment drop was in the cloud hash mining segment. That was down 55% from $40 million a year ago. I suspect that business segment declining more than the others is due to the unprofitability of the agreements for some of the company’s cloud hash customers.

The interesting tell from the Q1 report comes from how the company’s propriety hash figure breaks out. Of the 18.3 operating EH/s as of March 31st, 5.7 is proprietary – or non-hosted. Of the 5.7 proprietary EH/s, 3.9 is used for self-hosting and 1.8 is used for the cloud hash rate business. Which means that 1.8 EH/s in cloud hash generated $18 million in revenue for Bitdeer while 3.9 EH/s in self-mining only generated $13.2 million.

In reading some of the reviews of the service online, I came across many examples of experiences that articulate something similar to this quote from a YouTube review last year:

My first plan I bought was a 30 day plan. It cost me in total, I think about 180-185 US dollars and I got back about $150 US dollars.

That’s not a recipe for success for cloud hash buyers and anyone with a smaller cloud hash plan may be better off simply buying BTC directly rather than gambling on mining returns. It appears somewhat apparent that selling the company’s hash rate is a more profitable business than actually mining with the machines. Given that, I could understand keeping more of the proprietary mining capacity for the company if Bitdeer was actively trying to scale a BTC treasury. However, that doesn’t appear to be the case.

Balance Sheet

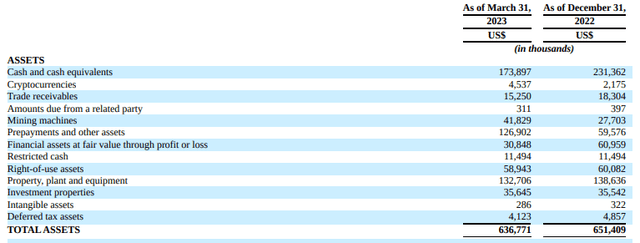

Despite keeping more of the company’s propriety capacity for self-mining even as the cloud hash business is seemingly more profitable, Bitdeer doesn’t have any real cryptocurrency treasury to speak of. Though it has more than doubled crypto holdings since the end of 2022, that doubling is coming from a low starting point:

Assets (Bitdeer)

On the balance sheet, there’s a large cash hoard of $173.9 million. The company holds just $4.5 million in crypto and as far as I can tell a breakout of those holdings was not provided in the Q1 report. Though in the company’s prospectus there was previously a large allocation to FileCoin (FIL-USD) which was recently designated an unregistered security in the SEC’s lawsuit against Binance.

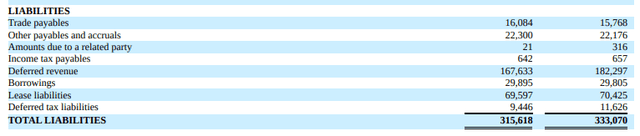

Liabilities (Bitdeer)

On the other side, the company has a $315 million in total liabilities; the majority of which is deferred revenue.

Share Repurchase Plan

On June 16th, Bitdeer announced a $1 million share repurchase program effective through September 15th of this year. The response to that announcement was substantial as the company’s stock rallied from a June 15th close of $7.56 all the way to $11.41 the following day. Given the company’s $841 million market cap on the 15th, this was a rather exuberant response to such a small share repurchase agreement and is likely attributable to BTDR having one of the smaller floats in the sector:

| BTDR | RIOT | MARA | HUT | CIFR | CLSK | |

|---|---|---|---|---|---|---|

| Shares Outstanding | 111.29M | 178.16M | 169.97M | 221.28M | 248.94M | 112.69M |

| Float % | 24.38% | 95.32% | 99.42% | 99.34% | 16.58% | 95.69% |

| Insider Shares | 84.16M | 8.33M | 989.05K | 1.47M | 5.74M | 4.85M |

| Insider % | 75.62% | 4.68% | 0.58% | 0.66% | 2.31% | 4.30% |

Source: Seeking Alpha

With a just a 24.4% float, BTDR’s shares have the potential to be more volatile than many of the other BTC mining stocks. For instance, consider the 50% intraday price move on June 16th following the repurchase plan announcement. That move came on just 712k share volume – or just 2.6% of the float and 0.6% of the shares outstanding. By comparison, RIOT generally trades anywhere between 10-15% of the company’s shares outstanding in a normal session.

Furthermore, the idea that the company would be buying back shares at this juncture is somewhat perplexing. I would understand it more if BTDR shares were trading considerably under book value or if there was a meaningful level of positive earnings that the market wasn’t respecting. Neither of which appear to be the case here.

Investor Takeaways

Bitdeer is a fairly unique mining business in the public equity markets because it does have a fairly well-rounded revenue split from multiple different streams. It has a large amount of insider holdings and a management team that appears to have incentivized higher stock prices. I do question how sustainable the cloud hash rate business is long term, though. Cloud hash appears to be a more profitable use of the company’s proprietary hash rate but it’s coming at the expense of Bitdeer’s customers. I think it’s telling the segment is down more than 50% over the last year.

Churn in that category isn’t unexpected given the very different sentiment in Bitcoin from early 2022 to early 2023. It is possible that cloud hash revenue could rebound if Bitcoin’s price takes another leg higher and retail Bitcoiners try to get in on the mining action again. There is an argument to be made for selling shovels in a gold rush. I’m just not sure I’d chase BTDR shares as an investment given the volatility potential from this low float name.

Read the full article here