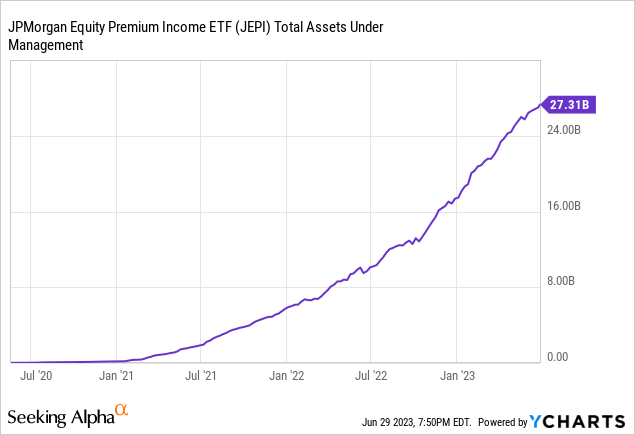

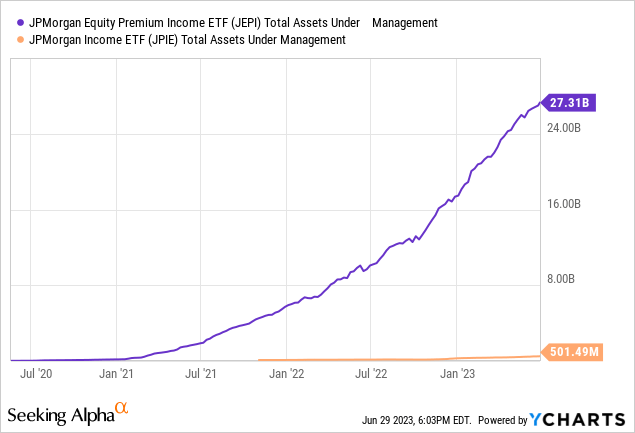

As the US economy draws closer to a recession, many investors, including myself, are looking to limit their equity exposure and reduce their risk. JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), a very popular income ETF, has grown extremely fast.

JEPI has an AUM of about $27B and offers an impressive 30-day SEC yield of about 8.5%. JEPI achieves such a high yield through its strategy of writing covered calls on the S&P 500 Index. It should be mentioned that because of this strategy, JEPI’s yield is rather volatile.

While a high-yield asset is a great thing to own during a recession, covered call ETFs are very vulnerable to market declines. While the premium collected by investors when the market declines will help reduce losses, at the end of the day, JEPI still owns the underlying asset, and if the market decline is bad enough, the premium won’t be enough to offset the losses. This leads to JEPI being relatively volatile. If we enter a recession, I don’t think the yield will be able to make up for the losses that JEPI’s S&P Index holdings will experience. Adding JPMorgan Income ETF (NYSEARCA:JPIE) to complement JPIE, or even in replacement of it, could prove very beneficial in a market downturn.

JPIE

JPIE is an income ETF that currently has a 30-day SEC yield of about 6.4%. While this yield is quite a bit lower than JEPI’s, 6.4% is by no means a low yield. JPIE invests in various fixed-income markets and sectors to achieve this impressive yield. JPIE has a small AUM of a little over $500M. Compared to JEPI’s $27B, I think it’s fair to classify JPIE as a hidden gem among JPMorgan income ETFs.

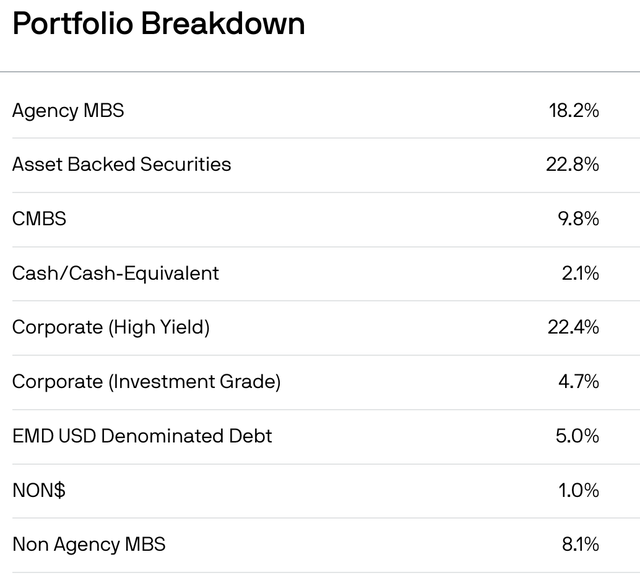

JPIE has over 1000 individual holding across many different fixed-income types.

JPIE’s holdings by fixed-income type (jpmorgan.com)

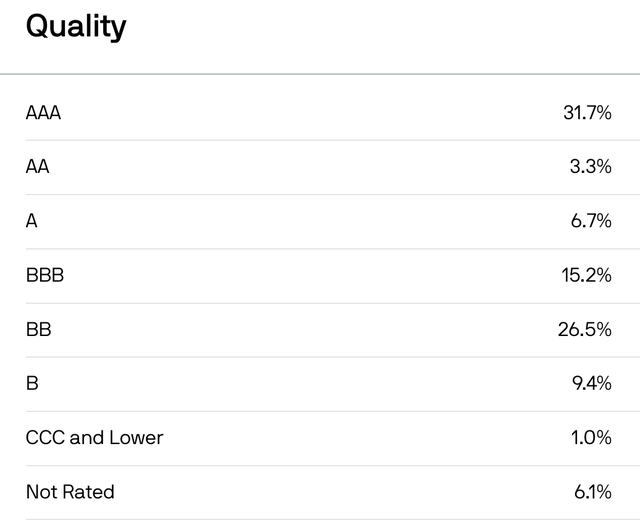

JPIE’s largest holding is asset-backed securities, followed closely by corporate high-yield bonds. Holding over 20% in junk bonds makes JPIE seem very risky, but this ETF aims to offset the added risk by holding a large amount of AAA bonds. In fact, its largest holding by credit rating is AAA.

JPIE’s holdings by credit rating (.jpmorgan.com)

One of JPIE’s goals is to provide low volatility, and so far, it’s been able to do just that.

JPIE’s Volatility

While there isn’t much history to look at, the data we have shown that JPIE has been able to deliver a high yield, while keeping volatility relatively low.

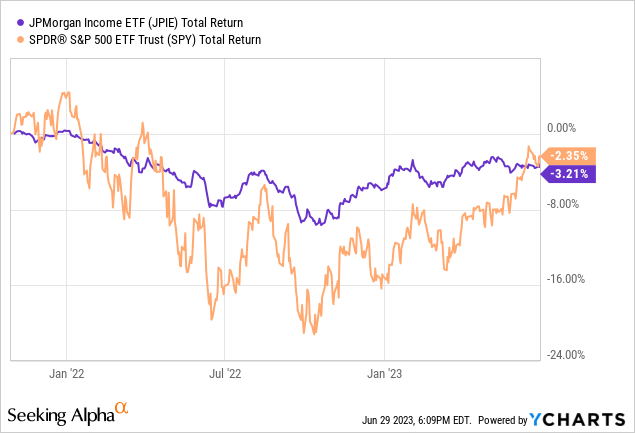

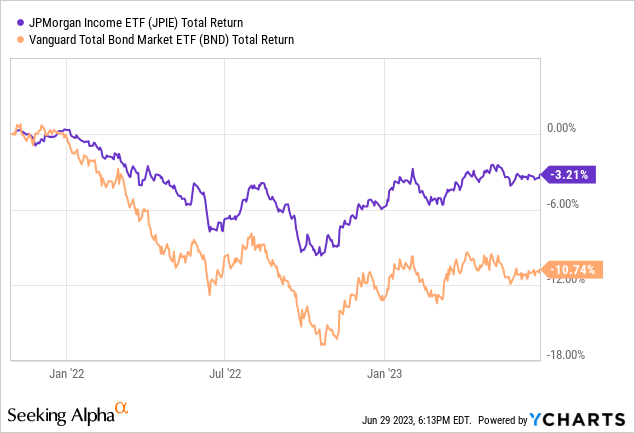

Comparing JPIE’s total return since inception to SPY’s since JPIE’s inception, we see how JPIE isn’t too volatile. In fact, if you compare JPIE to BND Vanguard Total Bond Market Index, which holds only investment-grade bonds and has a current 30-day SEC yield of only about 4.3%, you see that JPIE’s total return performance is much less volatile.

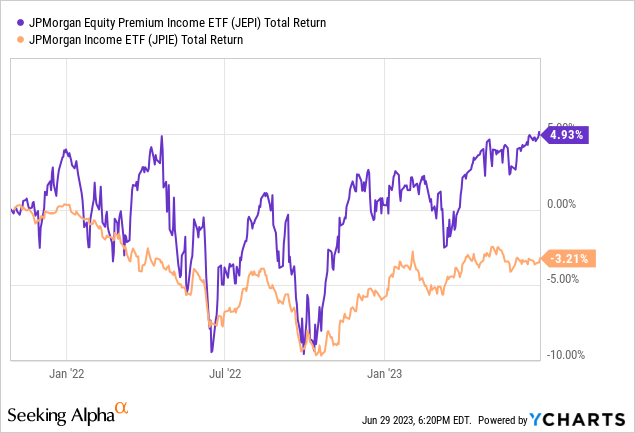

JPIE vs JEPI’s volatility

After the previous 2 comparisons, it should come as no surprise that JPIE is much less volatile than JEPI. Again comparing the total return of JPIE to JEPI since JPIE’s interception, we see how low JPIE’s volatility really is.

The first thing that likely goes into an investor’s mind when they see the chart above is that JEPI is outperforming and it has been most of the time. In my opinion, this only adds to my reasoning for switching partially or entirely to JPIE. Take the profit before we enter a recession, and switch to a low volatility, high yield asset to ride out the recession.

JEPI’s performance during a market downturn

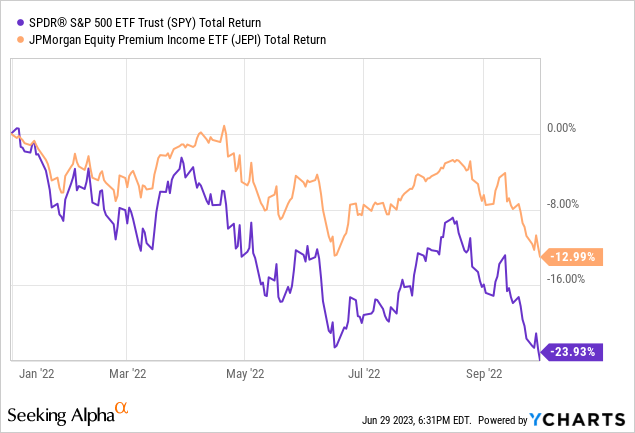

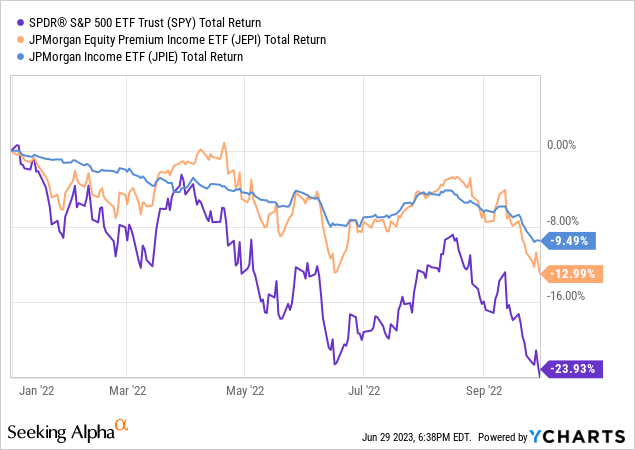

Unfortunately, we haven’t been able to witness JEPI’s performance during a major market downturn. However, the bull market at the beginning of 2022 can help us gain some insight into what may happen to JEPI during a recession. The following chart shows JEPI’s total return compared to SPY’s from January 2022 to October 2022.

While JEPI lost less than SPY, due to the premiums collected by JEPI, losing 13% isn’t much of an accomplishment. Looking at the same data but with JEPI and JPIE, we see that JPIE outperformed both SPY and JPIE, as expected.

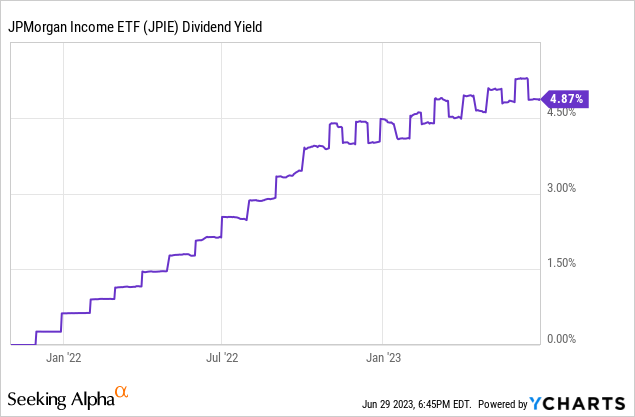

Again, losing about 9.5% instead of losing 13% isn’t anything to brag about, but keep in mind that this was when interest rates were still very low. As the Fed increased rates, the yield of JPIE’s fixed-income holdings has gone up as well (shown below), meaning that JPIE not only offers lower volatility and market downturn protection but now also offers a high yield (the yield below differs from the 6.4% stated earlier due to different dividend calculation methods. According to JPIE’s website, the 30-day SEC yield is 6.4%).

Risks

As mentioned before, JPIE holds over 20% of its AUM in non-investment grade (junk) bonds. If the coming recession isn’t mild as most, including myself, are predicting, JPIE could suffer due to these junk bonds. Junk bonds have a high default risk, but this risk is exacerbated during severe recessions. While JPIE does hold many junk bonds, keep in mind it holds more AAA bonds, potentially providing some stability in severe economic downturns.

Conclusion

I think this small ETF belongs in more portfolios, especially in those that already hold JEPI. JEPI and JPIE are not mutually exclusive, in fact, I think they complement each other. Adding JPIE to a portfolio that already holds JEPI limits risk without sacrificing too much yield. This could prove very valuable as we enter a recession. While I suggest holding JEPI if you already own it, I recommend JPIE as a Buy.

Read the full article here