By Fawad Razaqzada

Gold hit a fresh monthly low near $1,900 before bouncing back slightly on short-side profit-taking.

On Wednesday, investors assessed the main message coming from this week’s Sintra conference – that more policy tightening is on the way – and decided to punish the metal further. Bond yields held firm, and this reduced the appeal of gold, silver, and yen, some of the lowest and zero-yielding assets. But after a slow two-month decline, gold is now near the key $1,900 support level, where we might start to see some bargain hunting again. So, the downside risks could be limited for the precious metal moving forward.

Why Has Gold Struggled?

Just a couple of months ago, the market was pricing in Federal Reserve rate cuts as early as September as economic worries boosted speculation that inflation will fall rapidly. That hasn’t happened. So, gold opponents, arguing that yield-seeking investors would rather invest in government bonds and enjoy the fixed nominal return than hope for a bigger capital appreciation by holding gold, have sold the metal on every rally since. Central bank heads on Wednesday made it clear once again that further tightening is required, and policy will need to remain contractionary longer as the decline in inflation has been frustratingly slow, and the economy is holding its own better than expected. So, in the eyes of gold bears, why tie up capital in something that doesn’t pay any interest or dividends, and cost money to store?

Can Gold Rebound?

Gold proponents would argue that interest rates are near their peak and with signs that inflation is slowly heading back toward the target for most major economies, this should brighten the gold outlook. Still-high inflation around the world means fiat currency is continuing to lose value, and gold could prove to be a good hedge against rising prices.

We tend to favor the bullish gold argument in so far as the longer term is concerned. But the short-term gold outlook continues to remain highly uncertain owing to the reasons stated above and very heavily influenced by central bank speeches and incoming data. Speaking of…

Core PCE in Focus

With the dollar recently bouncing back, all eyes will be on the US core PCE inflation print on Friday. If this shows an above-forecast reading, gold will most likely remain under pressure, further boosting the bearish argument. However, if it surprises the downside, then gold bulls would have more reason to look for dip-buying opportunities. Keep an eye on the Dollar Index as gold tends to move inversely with the greenback.

Gold Technical Analysis

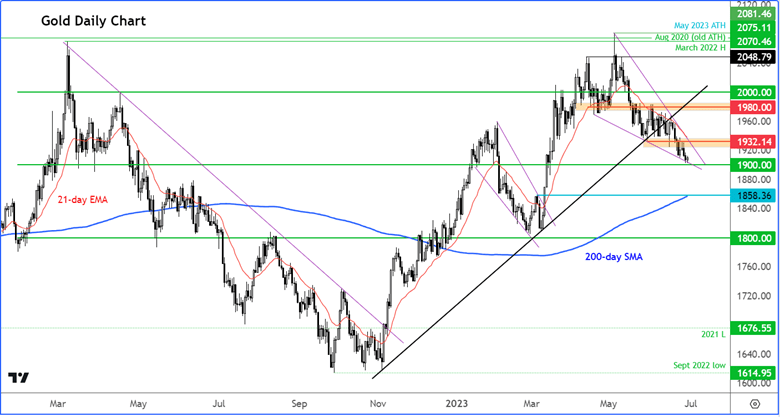

While the macro outlook appears finely balanced, as the focus remains on incoming data, traders will watch price action just as closely to determine whether XAUUSD has bottomed or more losses are on the way.

With that in mind, keep an eye on the falling wedge pattern to see if the buyers will show up or if we simply break through on the downside.

The bullish trend ended in May when the breakout above the August 2020 record high of $2,075 immediately failed. Subsequently, gold went on to break below its 21-day moving average, which is a popular short-term trend indicator. This MA has consistently provided resistance to any gold advance during June.

For now, the short-term gold outlook remains bearish as the price continues to break down short-term support levels and gets offered on any bounces.

Key support levels such as $2,000, $1,980, and now $1,932ish have broken down. The latter is now the most critical short-term level to watch as price tests it from underneath. For as long as gold holds below this $1,932 level, the path of least resistance would remain to the downside towards $1,900. Below $1,900, the next big level is around the $1,850/55 area, which marks the base of the breakout in March and the 200-day average.

Trading View

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here