The Doctor Will See You Now

There are likely few people who haven’t heard of the basic premise of Teladoc’s (NYSE:TDOC) business: instead of physically going to a doctor or therapist’s office, you log into a virtual patient space and have your appointment conducted online. While it may not seem so novel today given the ubiquity of online meetings in general, prior to 2002 (the year Teladoc was founded), on-screen virtual meetings with doctors were still pretty much only found on episodes of The Jetsons.

On paper the concept makes great sense: reduce the friction of in-office visits, increase physician productivity, and cut down on administrative and overhead costs associated with physical visits. The reality, however, has proven not to be so kind to Teladoc, and investors have soured in recent years on the stock.

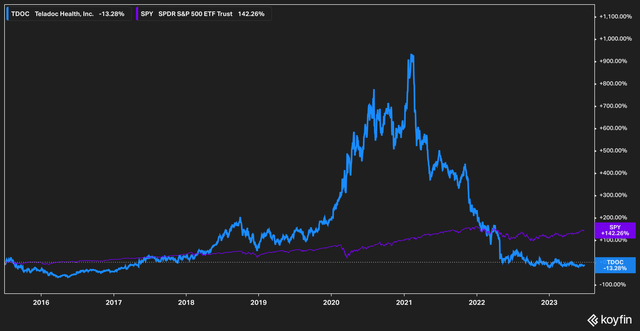

Koyfin

After riding high in the era of low interest rates (where on a ten year basis the stock surged by close to 1,000%), Teladoc has endured a precipitous fall since early 2021. Throughout this time the company has not turned a net profit, and a goodwill impairment charge of $13 billion to end 2022 was not exactly cause for celebration.

However, the dropping of the stock’s price likely has investors wondering whether now is a good time to look at the company. In this article we’ll explore the current state of things as it concerns Teladoc’s stock. Let’s dive in.

The Business

Teladoc operates, on a high level, a relatively easy to understand business with two segments: Health Integrated Care and BetterHelp. Health Integrated Care focuses on physician clients across a wide range of specialties who can pay either through a per-member-per-month basis or a fee per visit conducted. BetterHelp is primarily a mental health and therapy service where individual patients pay Teladoc directly for access to network therapists and psychologists. The company also derives a portion of its revenue from hardware sales (such as tablets) and other fees.

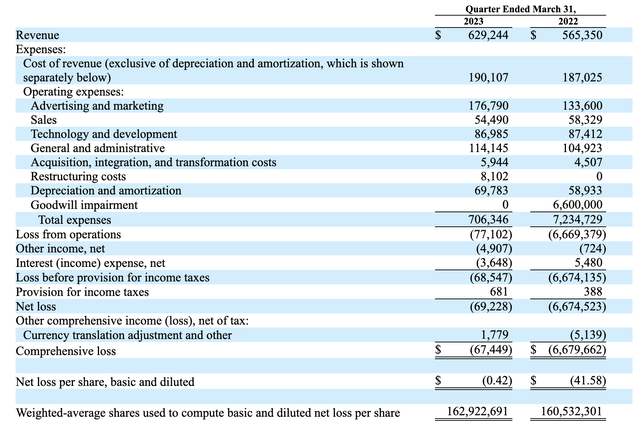

In the latest quarter ending March 2023, the company generated from these segments $629 million in top line revenue and posted a net loss of $69 million.

Company Filings

A few things stand out between the top and bottom line, however. While the company obviously benefitted comp-wise from the massive goodwill impairment charge that was taken in the quarter ending March 2022, in the first quarter 2023 the company expensed $8.1 million of restructuring costs. According to the company’s 10-Q, these costs were “related to lease impairments and the related charges due to the abandonment and/or exit of excess leased office space.” We assume that this cost-cutting measure is a one-time expense, and, frankly, it’s good to see for a company that is currently losing money.

Operating expenses, however, have a different story to tell. While the company’s Sales and Technology and Development line items fell year over year, the Teladoc’s General and Administrative costs rose by 9% and Advertising and Marketing expenses rose by a whopping 32%.

The jump in cost in Advertising and Marketing isn’t a one-time thing, either: per Teladoc’s 10K, 2022 Advertising and Marketing costs were up 50% year over year.

We pay particular attention to this metric because it represents the company’s customer acquisition costs. The more expensive it is to acquire a customer, the longer that customer needs to be retained in order for the company to make a profit. Put another way, a $0.28 of every dollar earned in revenue for Teladoc in the first quarter of 2023 were spent on acquiring customers through marketing. For context, Teladoc spent $0.24 of every dollar earned in revenue in the first quarter of 2022.

We should note that Teladoc states that the first and fourth quarters have a degree of seasonality to them, where they “typically experience the weakest operating income performance during the first quarter as new customer acquisition and revenue growth lags marketing spend.” We do not, however, feel that this seasonality impacts our thesis that the disparity in growth between revenue and marketing is out of synch.

Of course, investors in a business with rising customer acquisition costs would want to know how well the company is retaining the customers it acquires. The good news is that Teladoc’s customer churn rate isn’t growing. The bad news is that it isn’t falling, either. While management did not go into detail on customer retention rates for the Health Integrated Care segment, CFO Mala Murthy noted that, for BetterHelp, customer retention levels were “stable.”

We have to wonder as well whether growth alone will solve Teladoc’s profitability problem, since the depth of the company’s reach is already quite large. On page four of the most recent 10K, Teladoc states that “over 80 million individuals in the United States (“U.S.”) have access to one or more of our products and services.” If this figure is accurate, Teladoc currently has reach to almost 25% of the United States’ population of 330 million. If Teladoc cannot achieve profitability while reaching that many end patients, at what point will it be able to?

The Competitive Landscape

While, as mentioned before, virtual doctor’s visits seemed quite futuristic twenty years ago, the technological barrier to entry today is not exceptionally high. This is evidenced by the growing number of online therapy and medical health providers.

As of now there are at least six other online therapy providers to compete with BetterHelp and multiple sites promoting access to primary care physicians in an online setting. While it can be argued that Teladoc has something of a first mover advantage, the fundamental offerings of its service can be replicated which leads us to believe that whatever advances it makes in the marketplace will likely be at risk of encroachment by competitors.

This competitive problem also highlights the customer acquisition issue outlined earlier. If Teladoc is forced to increase its spend in order to get ads for its services in front of eyeballs more frequently than its competitors, it is difficult to see how the unit economics of the business become profitable.

The Bottom Line

Given the rapid pace of growth in Advertising and Marketing as well as an increasingly competitive landscape, we believe that the risks inherent for investors in Teladoc are numerous. This is a difficult call because, at heart, Teladoc provides a much needed service: making access to medical care easier. For now, however, we’ll be staying away.

Read the full article here