Micron (NASDAQ:MU) reported third quarter earnings on Wednesday, which included an optimistic outlook that signaled that higher margins could potentially be ahead for the battered memory industry due to strong demand for memory chips from the AI industry. Micron solidly beat topline and bottom line forecasts for its fiscal third quarter as well, although the company continued to report negative gross margins.

While average selling prices for Micron’s DRAM and NAND products continued to decline in the double-digits in the last quarter, the company saw a decent uptick in sales volume in both core segments, indicating that demand may be set to rebound. I also expect analysts to upgrade their EPS estimates in reaction to Micron’s optimistic outlook for the fourth fiscal quarter. For those reasons, I am upgrading Micron from sell to hold!

Upgrading from sell to hold

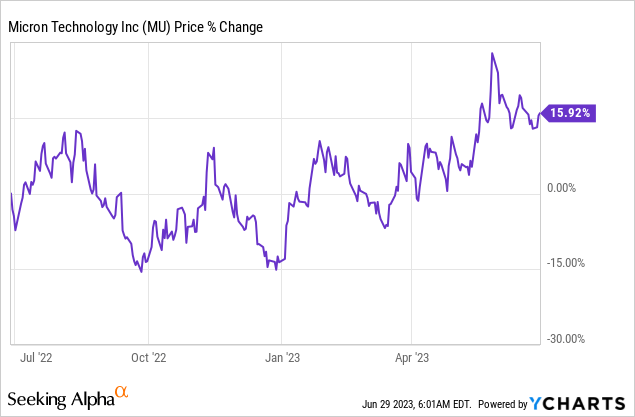

My previous position on Micron was bearish, chiefly because of Micron’s weakening pricing power in the DRAM and NAND segments, decline of gross margins into deeply negative territory and concerns over a prolonged downturn in the memory market. Because of Micron’s optimistic forecast for the upcoming quarter, indicating a sequential improvement in gross margins and strong demand from the AI industry, I am upgrading to a hold recommendation. Since issuing a sell rating on Micron, the company’s share price has declined 4%.

Micron beats top and bottom line estimates

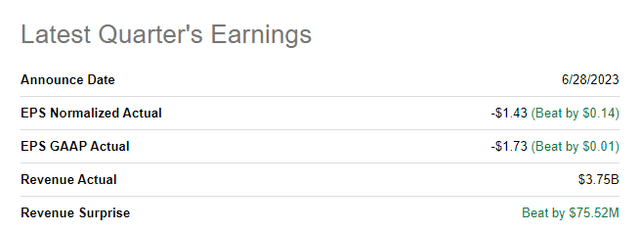

Micron reported much better than expected results for its third fiscal quarter on Wednesday: the memory maker achieved revenues of $3.75B, which was $76M better than the average estimate. Regarding earnings, Micron beat the consensus estimate by $0.14 per share.

Seeking Alpha

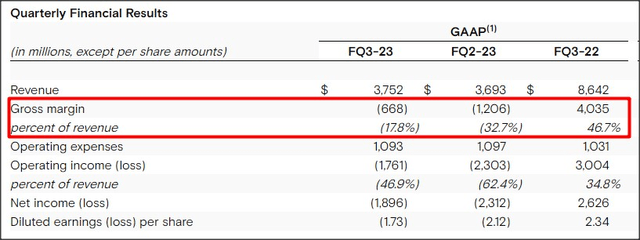

Micron reported $3,752M in total revenues for the third fiscal quarter, showing a 57% year-over-year decline due to slumping demand for memory chips. Revenues were also ahead of the mid-point of Micron’s guidance of $3.7B for FQ3’23. However, on a positive note, Micron’s revenues were up 2% quarter over quarter, indicating that the market situation for memory chip producers like Micron is stabilizing, especially as the AI sector is rushing to the rescue for embattled memory makers. Combined with a more optimistic outlook for the fourth fiscal quarter, there is a strong possibility that analysts are going to upgrade their earnings estimates going forward.

Micron still reported a deeply negative gross margin for FQ3’23, however, indicating that recent cost optimization efforts have had at least some positive effects. Micron reported a gross margin of (17.8%) for its last quarter which sequentially improved by 14.9 PP. However, gross margins are still not anywhere near where they used to be: in the year-earlier period Micron achieved a 46.7% gross margin due to soaring demand for the company’s DRAM and NAND products as well as a strong pricing environment.

Micron

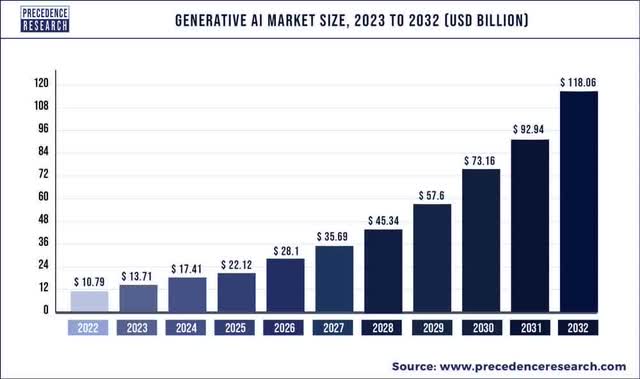

There are signs, however, that the market situation is stabilizing, in part due to accelerating chip demand from the artificial intelligence industry. Generative artificial intelligence is a key growth market for memory makers like Micron and the market is set to experience massive growth over the next decade. The size of the generative AI market, according to Precedence Research, is set to explode by a factor of 11 to $118B over the next decade, boosting the revenue potential of Micron. Generative AI is driving demand for Micron’s memory and storage products, and it could be instrumental in reigniting Micron’s revenue growth going forward.

Precedence Research

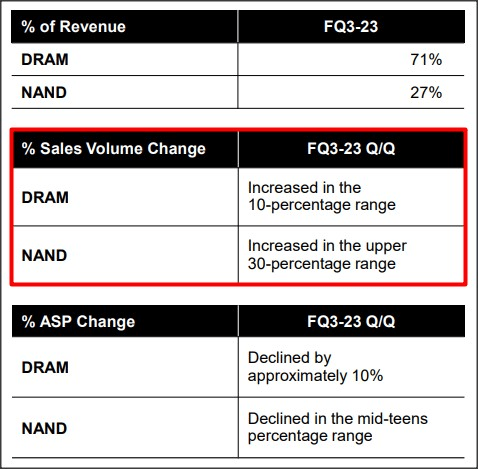

In the last quarter, Micron’s average selling prices for its DRAM and NAND products continued to decline, a result of a very weak device market. However, both DRAM and NAND sales volumes increased materially, indicating that the revenue picture is set to improve going forward. DRAM and NAND sales volumes increased in the 10% and 30%-range in the last quarter, according to Micron’s earnings presentation.

Micron

Outlook for FQ4’23

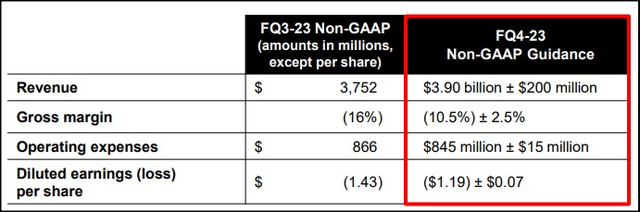

Micron’s outlook for the fourth fiscal quarter calls for $3.9B +/- $200M in revenues while the memory maker continues to expect a negative gross margin of 10.5% +/- 2.5 PP. However, Micron’s gross margin is expected to improve 7.3 PP quarter over quarter. In the best case, Micron could see revenues of $4.1B, which was significantly above the consensus estimate of $3.9B in FQ4’23 revenues. The outlook strongly indicates that Micron expects its revenue picture to stabilize, in part due to growing demand for AI chips. Nvidia (NVDA) also said that the unexpected surge in demand for AI chips is driving a very strong forecast for its upcoming quarter.

Micron

Potential for EPS upside revisions and Micron’s valuation

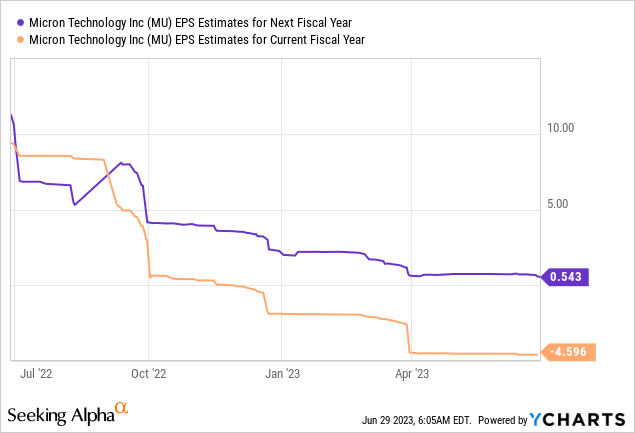

Micron’s outlook for the fourth fiscal quarter strongly suggests that analysts are going to upgrade their EPS predictions, which in itself could be a catalyst for Micron’s shares to revalue to the upside. Analysts revised their EPS estimates sharply to the downside in recent months due to falling consumer demand that led to Micron reporting massive gross margin declines. What added to pressure on Micron’s estimates was that China’s cybersecurity review found that Micron’s memory chips pose a national security risk.

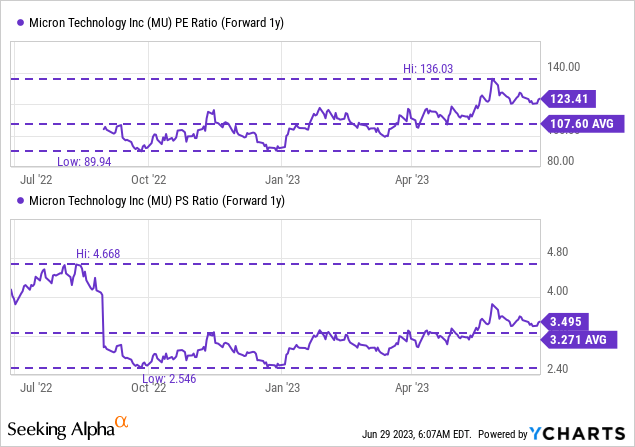

Micron is currently expected to lose $4.60 per share this year before a cyclical recovery drives its EPS back up to $0.54 per share in the following year. Based off of FY 2024 earnings, Micron is trading at a forward P/E ratio of 123X. As estimates are likely to reset higher after Micron presented an optimistic outlook for FQ4’23, shares of Micron may ultimately end up trading at a significantly lower P/E ratio.

I believe Micron could realistically earn $5.00-5.50 per share annually (the annual GAAP EPS average over the last four years was $5.20 per share), if the device market is growing and not going through the kind of drastic correction we have seen in FY 2023. Applying a 12X earnings multiplier puts Micron’s fair value into a range of $60-66. With a price of $64.40, I consider the memory maker’s shares about fairly valued.

Based off of revenues (FY 2024), shares are trading at P/S ratio of 3.5X which is only slightly above Micron’s longer term, average P/S ratio of 3.3X. Purely based off of valuation, I am neutral on Micron.

Risks with Micron

A key commercial risk for Micron remains the chip ban that China instituted in a tit-for-tat action after the U.S. limited China’s ability to import high-performance AI chips. In June, Micron said that it expects the ban of its products to have a low double-digit percentage impact on its revenue base.

I also see continual gross margin risks for Micron as the fourth quarter forecast continues to imply that Micron is going to lose money on its memory products. What would change my mind about Micron (and potentially leading to a buy rating upgrade) is if AI chip demand returned Micron to positive gross margins.

Closing thoughts

Micron delivered much better-than-expected results for the third fiscal quarter, which included both a topline and a bottom line beat. The earnings report also showed that the memory maker saw positive sales volume growth in FQ3’23, especially in the NAND business, although average selling prices continued to slump. The ascent of generative AI could give Micron’s memory and storage products a powerful lift in the near future, but Micron would still have to prove that it can translate this growth into positive gross margins. Micron’s business, at least right now, is not there yet. While I expect EPS estimates to reset to the upside in the coming days and weeks, I am still concerned about Micron’s negative gross margin trend. Still, the potential for an AI-driven demand recovery justifies a rating upgrade from sell to hold!

Read the full article here