There’s no telling where the economy is headed over the next 6 to 12 months, and one cannot rule out the possibility of a recession. This is considering a recent report from JPMorgan (JPM) that they still believe that it is more likely than not that the U.S. will see a recession this year.

Given all the near-term uncertainties, it may not be a bad idea to layer into quality ETFs that are comprised of ‘all-weather’ stocks that are built to not only survive a recession, but thrive over the long run.

This brings me to the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), which may be worth considering at current levels. I last covered SCHD here back in April, highlighting its durable income attributes.

The stock declined by less than 1% since then while speculative growth stocks like C3.ai (AI) have surged in prince. In this article, I discuss why SCHD remains a great value for income and potentially strong gains while the rest of the market is seemingly in full-risk on mode again.

Why SCHD?

SCHD was conceived by leading asset manager Charles Schwab (SCHW) back in 2011, and seeks to track the total return of the Dow Jones U.S. Dividend 100 index. This makes for the passive nature of SCHD’s fund management style, resulting in a low expense ratio of just 0.06%. This means that SCHD’s fees are 88% below the ETF industry median of 0.49%.

Unlike the U.S. Dow Jones Broad Market Index, SCHD does not contain any REITs or Master Limited Partnership. This reduces tax inefficiencies associated with REITs, due to their dividends mostly taxed at ordinary income rates, and tax complexities associated with MLPs (think return of capital).

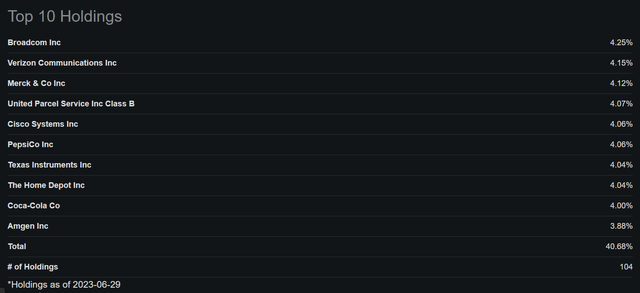

SCHD carries a well-rounded basket of dividend paying and growing stocks in the Industrial, Healthcare, Financials, Consumer Defensive, and Technology sectors, which make up its 5 top asset classes comprising 74% of portfolio total. As shown below, no stock makes up more than 4.3% of the portfolio, and the top 10 holdings are comprised of a list of leading companies in their respective industries with a strong track record of dividend growth, including Broadcom (AVGO), Verizon (VZ), Merck (MRK), UPS (UPS), and Cisco (CSCO).

Seeking Alpha

In fact, SCHD’s portfolio of dividend-paying stocks have grown way faster compared to all ETFs, with a 3-year and 5-year Dividend CAGR of 12% and 14%, respectively, comparing favorably to the 6.5% ETF median for both time periods. This has enabled SCHD to post respectable returns over the past 5 years.

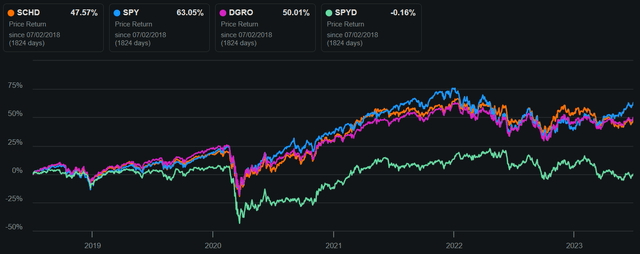

While SCHD has underperformed the S&P 500 (SPY), due to the recent market run-up due to tech stocks, and the more tech-heavy iShares Core Dividend Growth ETF (DGRO), its performance has far-outpaced that of the SPDR S&P 500 High Dividend ETF (SPYD), as shown below. At the same time, due to the relative undervaluation of SCHD’s holdings, its 3.6% yield is far higher than the 1.5% and 2.4% yields of SPY and DGRO.

Seeking Alpha

Risks to SCHD include the potential for recession, which depending on the severity, could impact the stock prices of nearly all of SCHD’s asset classes, especially its financial stocks. A recession could also slow the dividend growth for SCHD as a whole, to below its 3 and 5-year growth rates.

Plus, Broadcom’s share price rose by 36% since the start of May, with its outperformance being why it now stands as SCHD’s top holding. As such, any material weakness in Broadcom’s share price would have an outsized effect on SCHD as a whole.

Nonetheless, I don’t view Broadcom’s share price as being overvalued, as its forward PE of 20.6 is reasonable for company whose been able to grow revenue and EBITDA by 13% and 21% annually over the past 5 years. It’s valuation is also far more reasonable than that of other technology companies such as Apple (AAPL), which doesn’t make SCHD’s Top 10 list and has a slightly lower trailing 5-year revenue and EBITDA CAGR.

Moreover, a recession shouldn’t have a lasting impact on SCHD’s holdings, considering their size and inherent strengths that come along with that. Also, those top holdings such as Verizon and Coca-Cola (KO) should fare better than others considering their recession-resistant nature.

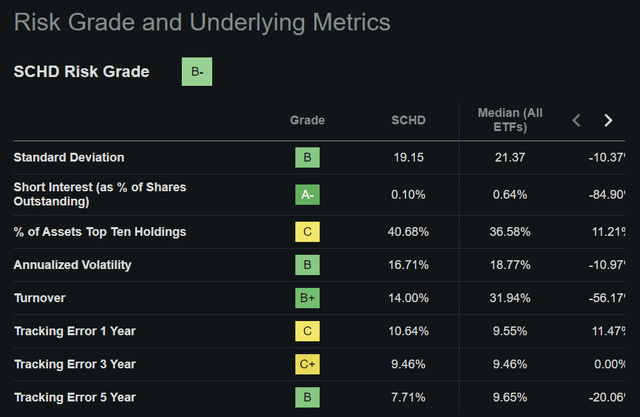

SCHD carries lower risk than the ETF average, with lower standard deviation, short interest, and volatility, as shown below. While it scores a C for having a relatively higher % of assets in Top 10 holdings, I don’t view its top holdings like Broadcom (as mentioned earlier) and Verizon as being overvalued, especially with VZ trading at a forward PE of just 7.9x.

Seeking Alpha

Investor Takeaway

SCHD offers investors great value at present given its high yield and the durable nature of its underlying portfolio of large-cap stocks. Its combination of low fees, diversification, and quality dividend-paying stocks make it an attractive option for those seeking to either invest for the long-term or park capital amidst the potential for a recession.

With a reasonable price of $72.62 (cheaper by 4% since the start of the year) and a respectable 3.6% yield backed by dividend-growth stocks, SCHD may be a solid choice for value investors who are turned off by the run-up in the S&P 500 index.

Read the full article here