AT&T Is Not A Good Business

Warren Buffett is known for saying:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

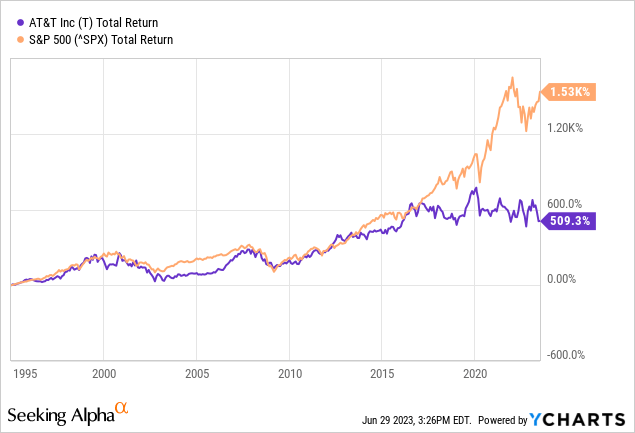

AT&T (NYSE:T) falls into the latter category. And while I think the market has taken Buffett’s thoughts on a “wonderful company” too far, we still need to dig into what has caused AT&T to underperform so substaintially over the past decade:

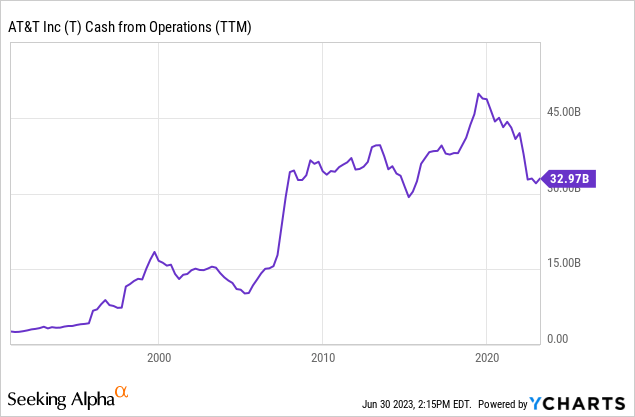

The problem is, AT&T is a very capital-intensive business. At the end of 2022, the company had $127 billion of property, plant, and equipment and $124 billion in licenses on its balance sheet.

In comparison to its $400 billion in assets, AT&T had just $16.2 billion in free cash flow (In 2022). This describes what Warren Buffett would call a terrible business – one that is forced to invest a ton of money and then earns very little returns (Profits).

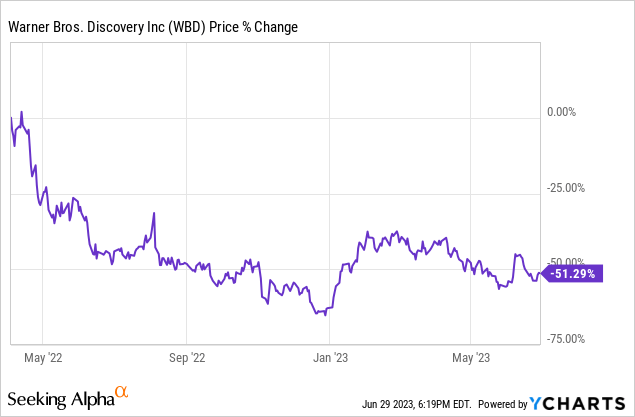

Warner Bros. Spinoff Was The Right Move

Moving over to the debt situation, I think AT&T’s management made a great move spinning off Warner Bros. Discovery (WBD) in 2022. This wiped out a huge chunk of AT&T’s long-term debt. Of course, Warner Bros. was saddled with this debt, but if you sold WBD at the spinoff, you made out alright:

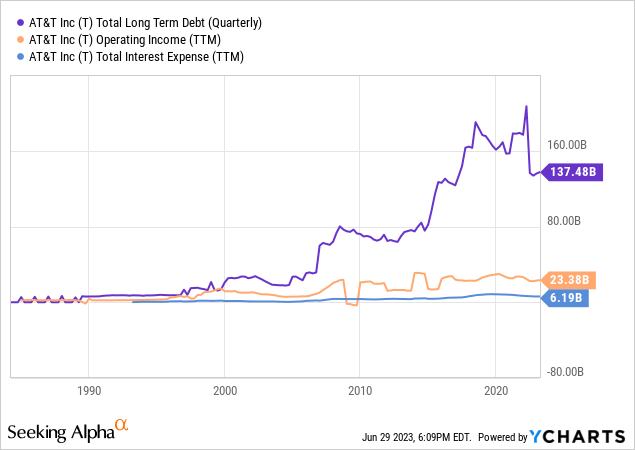

So, AT&T’s debt is down, but is it down enough? No. AT&T’s long-term debt is still 6x larger than its operating income (I like to see this number at less than 3x). AT&T’s debt has grown at a rate faster than income for quite some time:

The interest expense on this debt is already high (at 25% of operating income) and could be headed higher. The longer interest rates remain elevated, the more debt AT&T has to roll over at higher rates.

The Dividend Is Covered

| ___________________ | Trailing 12 Months |

| Operating Cash Flow | $34.9 Billion |

| Capital Expenditures | ($19.4 Billion) |

| Free Cash Flow | $15.5 Billion |

| Dividends Paid | ($8.1 Billion) |

But There’s A Hole In The Balance Sheet

AT&T has a big hole in its balance sheet:

| ______________ | Q1 2023 |

|

Current Assets |

$29.9 Billion |

| Current Liabilities | ($58.1 Billion) |

| Working Capital | ($28.2 Billion) |

I see this $28 billion hole as a detriment to AT&T. Because the company is unlikely to produce enough free cash flow to cover dividends and its working capital hole, it may have to choose among these equally depressing options:

- Sell assets

- Issue shares (dilute shareholders)

- Take on more debt

The Price Is All The Bulls Have

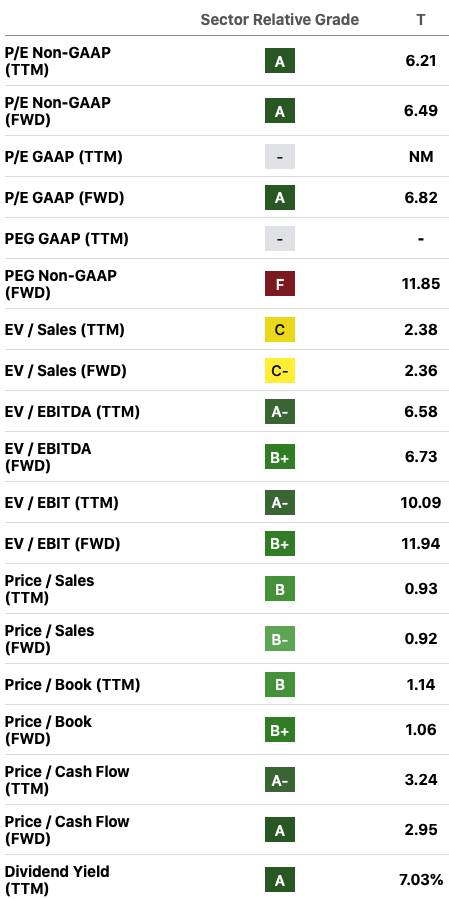

AT&T is cheap, no matter how you look at it:

Valuation Grades (Seeking Alpha)

This is the primary reason to own AT&T.

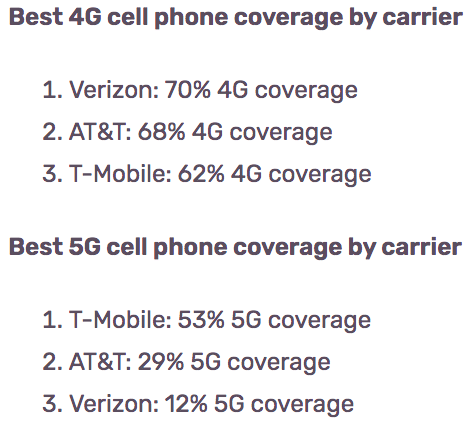

Looking at AT&T’s competitive position, it isn’t exactly a leader. AT&T is in the middle of the pack in 4G and 5G cell phone coverage:

4G And 5G Coverage (Reviews.org)

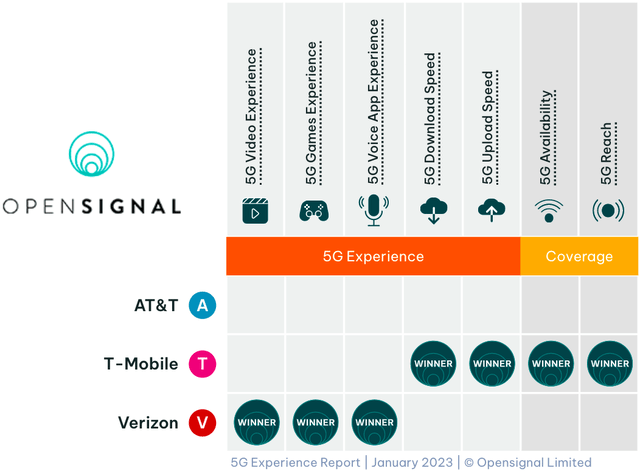

AT&T also struggles to differentiate itself when it comes to mobile 5G speeds, availability, and experience:

5G Awards (OpenSignal)

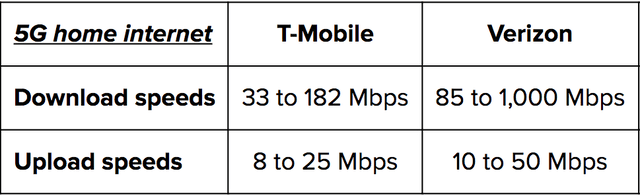

The company just entered the 5G home internet space; but with download speeds between 40 and 140 Mbps and a $55 price that’s higher than competitors, AT&T trails both Verizon (VZ) and T-Mobile (TMUS) in 5G home internet:

5G Home Internet Comparison (9TO5Mac)

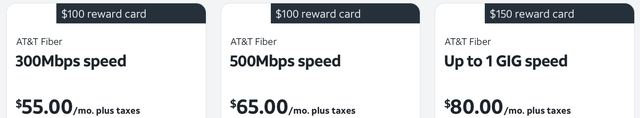

To compensate, AT&T’s CEO John Stankey was talking up the company’s customer service and position in fiber at the company’s 2023 annual meeting. Here are the company’s fiber internet offerings:

AT&T Fiber Offerings (AT&T)

Looking at AT&T’s position in the above categories, I worry about the company’s competitiveness. Saddled with lots of debt, AT&T can’t exactly afford to make the investments necessary to catch up to Verizon and T-Mobile. The company also can’t afford to lower its prices given the holes in its balance sheet. Therefore, AT&T may be forced to lean on its customer service and promotions. This can be costly for shareholders.

AT&T Is Still A Buy

There’s simply too much pessimism around AT&T for it to be a “Hold” or “Sell.” AT&T owns essential infrastructure and licenses. This makes its cash flows more predictable and durable than many of today’s high-flying tech companies.

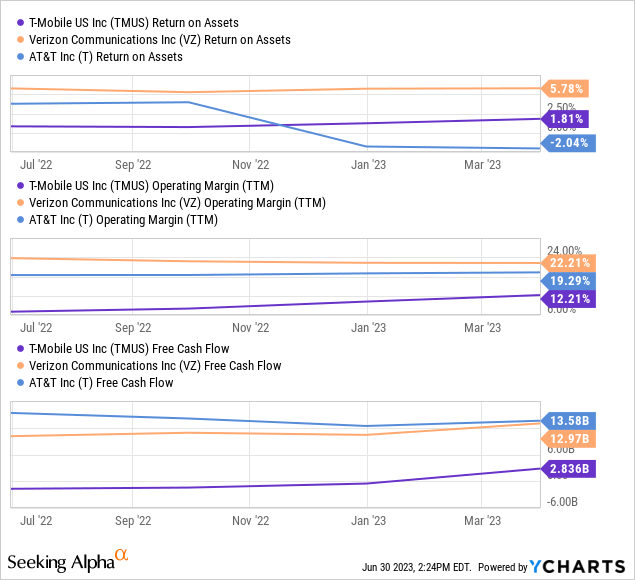

I expect the prices of American phone plans to increase in the decade ahead. I think oligopoly players AT&T, Verizon, and T-Mobile will have no choice but to increase prices in unison. There are three reasons for this. First, share prices have been falling and this should put pressure on these companies to increase profitability. Second, T-Mobile, Verizon, and AT&T have too much debt not to increase their prices. Third, investors have very high expectations for T-Mobile, which earns next to no profits:

A black swan risk to this thesis would be if Amazon (AMZN) decided to join forces with DISH Network Corporation (DISH); having a fourth major player could potentially ruin industry profitability. I think this is unlikely.

AT&T has a normalized PE ratio of just 7x. In the decade ahead, I project total returns of 11% per annum for AT&T:

| Normalized EPS | $2.27 |

| Current Dividend | $1.11 |

| Compound Annual Growth Rate | 1.5% |

| Year 10 EPS | $2.63 |

| Terminal Multiple | 10x |

| Year 10 Price Target | $26.30 |

| Annualized Returns (Dividends Reinvested) | 11% |

Note: This is a base-case scenario estimate. The “compound annual growth rate” is for dividends and earnings. Normalized EPS was calculated using $35 billion of operating cash flow, minus $18 billion of maintenance CapEx (the same as 2022 depreciation), divided by the diluted shares outstanding 7.474 billion.

The low growth rate can be attributed to the amount of earnings AT&T has to burn to improve its balance sheet, the risk of dilution, as well as my view on the company’s competitive position.

Why I Prefer Verizon

My preference for Verizon is very simple. I like Verizon’s products, its balance sheet, and its profitability. Verizon has the mobile 5G edge in major cities, which it recently blanketed with blazing-fast mmWave. If you’re going on a cross-country road trip, Verizon still has the best total coverage because of its 4G network. And, Verizon has the fastest 5G home internet, which it bundles in for just $25 per month. As you saw earlier, Verizon also has industry-leading profitability. Lastly, Verizon has better interest coverage, better debt-to-income ratios, and a better working capital position than AT&T.

Warren Buffett bought VZ stock in 2020 at around $60 per share, and the stock now trades at just $37 per share (Note that Buffett sold out right before the recent decline). Still, I take a little comfort knowing that I paid 40% less than Warren Buffett. As Benjamin Graham once said:

Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto, Margin of Safety.”

In Conclusion

AT&T is cheap, which is why I have a “Buy” rating on the shares. I’m bullish on the industry and expect the oligopoly players will eventually have to increase prices in unison. Still, I don’t like the $28 billion hole in AT&T’s balance sheet, nor am I very fond of its competitive position. I prefer Verizon in this regard. After all, AT&T is last in 5G home internet, last in mobile 5G awards, and middle-of-the-pack in coverage. Improving the balance sheet will be a challenge, which should weigh on growth. But, at a normalized PE of 7, you don’t need it.

For more on my favorite investment in the telecom industry, click here.

Until next time, happy investing!

Read the full article here